From The Guardian:

Zac Goldsmith has promised to keep spending on London’s rail and roads while pushing up fares if elected mayor, in a transport manifesto that attempted to paint a choice between Labour’s “experiment” in freezing fares, or delivering new infrastructure.

Launching the manifesto in Ilford on Wednesday morning, the Conservative candidate pledged to “get London building” by pushing ahead with projects including further tube upgrades, Crossrail 2 and a southern extension to the London Overground, which he claimed could be jeopardised by Labour hopeful Sadiq Khan’s proposed fare freeze. Goldsmith said that keeping fares at current levels would create a £1.9bn black hole* in the capital’s investment plans.

While younger Londoners will see fares rise, Goldsmith promised that he would keep the freedom pass, allowing over-60s to travel free, throughout the mayoral term – a pledge also made by Khan.

Goldsmith said 270,000 homes and 250,000 jobs would be unlocked by transport investment, most of which is already planned. He said: “It’s not just vital to keeping London moving, it’s also key to unlocking the land to build the homes London so badly needs.

* The £1.9 bn figure is a wild exaggeration and Goldsmith has already used that for one shock-horror headline, saying that if fares were capped, Council Tax would have to go up. That's the sensible way of doing it, of course, it mean average Council Tax increases of about £30 each year IIRC, so big deal.

But to sum up: Goldsmith expects working age commuters to pay more so that landowners can sell their land for higher prices (now referred to as 'unlocking' for some unfathomable reason). Pensioners are being bought off with their Freedom Passes (Heaven forbid their Council Tax goes up).

Thursday, 31 March 2016

Pity the poor landowners.

Posted by

Mark Wadsworth

at

16:39

1 comments

![]()

Labels: bribery, Greater London Authority, Subsidies, Zac Goldsmith

Wednesday, 30 March 2016

Economic Myths: A richer Africa means fewer migrants

As Flipchart Rick explained last year, the bulk of immigrants (who are all ultimately economic migrants*) to wealthier countries like the UK are from developing countries rather than the very poorest.

So as the poorest countries develop, more people will emigrate from those countries, not fewer and this will not reverse/stabilise until a country is close to Western living standards.

He does some good stuff on immigration, see also this more recent post. Makes you think.

* But what about refugees from Syria? Those who leave Syria are fleeing a war zone and can be considered refugees; those who cross the nearest safe country to get to the nearest wealthy countries (Europe) are economic migrants. End of. That is not a value judgment, I'm an economic migrant myself.

Posted by

Mark Wadsworth

at

18:25

13

comments

![]()

Labels: EM, Immigration

A weak argument against Brexit is an even weaker argument for Bremain.

From the BBC:

Britain would be unable to negotiate its exit from the EU within the two years allowed by European Union rules, the former Cabinet Secretary Lord O'Donnell has said.

The prospect of demanding extra time from other EU nations to complete a leave deal was a "bit scary", he said. Asked how long a negotiation would take, he cited a Cabinet Office paper which said it could be up to a decade...

If the UK failed to get a deal within two years, the country would revert to World Trade Organization rules, which would include significant tariffs, he added.

Richard North is the expert on Flexcit, but why would we need to renegotiate anything on the day the UK ceases to be a Member State?

We could just agree that for the time being everything continues as at present. This is the default assumption for example when Czechoslovakia split into two, the UK swiftly concluded a Double Tax Treaty with the two new countries on exactly the same terms as the old treaty with Czechoslovakia.

The present set of agreement suits all parties reasonably well at the moment, so why would it not suit all parties reasonably well the very next day or the day after that? We'll have to haggle a figure for UK contributions (ransom payments) to the EU and that is the end of that.

By analogy - the rules of the game of football or cricket are the same the world over, that does not mean that each team has to be an official member of some over-arching football or cricket organisation. The rules of the game apply on the pitch between the two opposing teams, end of. It could be a non-affiliated team from Afghanistan playing a friendly against a scratch team from an Australian university; two English schools playing each other; or a Test Match between South Africa and India.

Over time, the UK might do some things a bit differently to remaining Member States, so what? We can apply EU rules 'on the pitch' and make up our domestic rules 'off the pitch' as we go along.

Posted by

Mark Wadsworth

at

11:51

7

comments

![]()

Labels: EU, Logic, Referendum

Tuesday, 29 March 2016

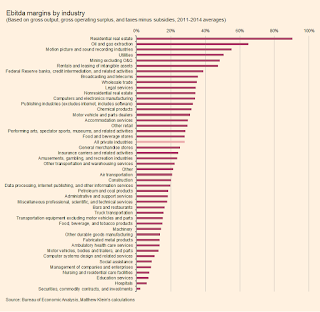

Ranking Americas Industries by Profitability and Tax Rate

Some interesting charts over at FTAlphaville Link

(they might ask you to make one of those free accounts to read it and then mercilessly bombard you with pleas to buy the FT)

Particularly like this one.

Posted by

SumoKing

at

10:58

2

comments

![]()

Labels: Corporation tax, FT, USA

Economic Myths: Taxes on public sector wages

We've done this one often enough, but here we go again.

From the BBC:

More than six million UK workers could find their take-home pay cut from April after the new flat-rate state pension comes into effect.

The move, first announced in the 2013 Budget, will boost the Treasury's coffers by £5.5bn a year. Most of that sum will be raised from public sector employers and employees by higher National Insurance payments…

The whole move to the flat-rate state pension is much to be welcomed of course, it's more like a 'Citizen's Pension'. This has the added bonus of highlighting that National Insurance is just another tax on earnings i.e. a very bad tax indeed, so hopefully we can move away from this bullshit that "National Insurance pays for my pension" or "I've paid for my own state pension, I'm just getting back the National Insurance I paid over a lifetime." This economic myth is so deeply engrained that people get quite angry when you challenge it.

The result being that people can no longer 'contract out' and pay the reduced NI rate if they are in an employer pension scheme…

Employers will now have to pay higher NI, amounting to that 3.4% of their employees' relevant earnings. The government said in 2013 that the new system was fairer for the self-employed and many mothers.

Public sector employers will pay £3.33bn and employees £1.37bn more to the Treasury in 2016-17 as a result of bringing in the pension earlier, according to the Treasury. From the private sector, employers will pay an extra £570m and employees £235m.

If public sector employers have to pay £3.33 bn more to the Treasury, then unless public sector employees reduce their payrolls by one or two percent, doesn't mean that their budgets, paid out by the Treasury, will also have to increase by £3.33 bn?

So this is neither a real boost nor a real cost to the Treasury at all, is it?

Posted by

Mark Wadsworth

at

08:06

3

comments

![]()

Labels: EM, National Insurance, Public sector employees

Monday, 28 March 2016

Yes, I know, the Torygraph again, but it's such fertile ground

Exhibit A

DT Letters

Sherborne, Dorset

Same old, same old.

Posted by

Lola

at

22:35

8

comments

![]()

Fun Online Polls: Cash is still king & Bouncy castles

The results to last week's Fun Online Poll were as follows:

How many times have you paid with cash (coins and notes) in the last week (i.e. not by debit or credit card)?

None - 3%

Once or twice - 22%

Most days - 30%

Every day - 45%

Other, please specify - 1%

The poll was run together with Pub Curmudgeon (hence the high turnout of 183), he has summarised the results on his blog and there's not much more to add.

--------------------------------------------

When you hear that another small child has been killed in a bouncy castle which blew away (this happens every few years), you know as sure as night follows day that the local MP will call for them to be banned.

The more obvious alternative is to remind operators to anchor the things properly and close them/deflate them when the wind gets too strong and if something goes badly wrong, sue them for (corporate) manslaughter, but that's too sensible I suppose.

So that's this week's Fun Online Poll.

"Should bouncy castles be banned?"

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

17:18

5

comments

![]()

Labels: Bansturbation, bouncy castles, Cash, Elfin Safety, FOP

Local politics: the huge differences between the Greens and the Conservatives

From their local election leaflets:

GREENS DEFEND GREEN BELT

Councillor Steven Neville has won a concession as a result of the Green Belt Review, which is part of Epping Forest District Council's new Local Plan for Epping Forest.

Buckhurst Hill will now be classed as a large village rather than a town, which gives extra protection for our Green Belt.

And from the Conservatives' leaflet:

Until recently I was chairman of the panel which scrutinised developing our Local Plan and I will continue to ensure that Buckhurst Hill and our Chigwell neighbours receive the best deal possible in any local plan development.

Along with local residents, I spoke directly with the District Councillor in charge of Planning in Epping Forest District, arguing that Buckhurst Hill must not become a town but should remain classified as a village.

I chucked away the Lib Dem leaflet, but I wouldn't be surprised if it had said something similar. And as a matter of fact, Buckhurst Hill is neither a village nor a town, it is a commuter suburb.

Posted by

Mark Wadsworth

at

14:19

1 comments

![]()

Labels: Greens, Local government, NIMBYs, Tories

Aaarrrggghhhh 2 - (but with some comment this time)

And: "Landlords have shown that they are all too willing to sell, as confidence hits its lowest ebb since the banking crisis. Landlords are expected to sell 500,000 properties in the next year, according to research from the National Landlords Association.".

Posted by

Lola

at

12:40

3

comments

![]()

Watership Down

There's a few strange decisions that the BBFC have made. The End of the Affair being rated 18, for example. Or Gremlins as a 15. But none are quite so weird as Watership Down being rated U.

I remember pestering my mother to see it at the age of 9. I mean, this is the trailer:

It's bunnies, on an adventure. Something a bit like The Rescuers, right? Wrong. Watership Down is high octane nightmare fuel for kids. It's not just that it has bloody violence with rabbits tearing lumps off each other, there's a rabbit caught in barbed wire and even a suggestion of rape in there. Oh, and the visions that suggest rabbit Auschwitz on the horizon.

Now, I'm dead against censorship in cinema. But age ratings are a pretty good idea, especially with the younger ones. You want some drama. You need some villainy. You don't want Leporidae Goodfellas, though. And seriously, had no-one at Channel 5 seen this movie before deciding to put it on? I'd rather show Akira to little kids, which is rated 15 (no, don't show Akira to your 5 year old, although at 9, I'd have probably loved it). Akira is at least fantastic and cool, where Watership Down is just grim and depressing.

The BBFC are on record as saying that it wouldn't be a U today, but even when it was originally shown, it wasn't suitable for that rating. It should have been the old A rating (now PG).

Posted by

Tim Almond

at

09:23

5

comments

![]()

Labels: movies