From The Telegraph:

George Osborne will this week announce plans to squeeze hundreds of millions of pounds of extra tax revenue to fund giveaways such as cuts in fuel prices, free school meals and married couple's tax breaks.

Much of the money will come from tighter rules applied to people the Chancellor described this week as "not your average taxpayer". But lawyers and accountants said the rules could affect many who could not be described as rich...

Experts last night warned that many British middle-class professionals will be caught up in a Treasury scheme to charge capital gains tax on UK property sold by overseas nationals and expats. The measures, to be announced in the Autumn Statement, are designed to hit wealthy foreigners buying and selling property in the UK.

However, the plan would also apply to British people living abroad and who are classed as non-resident here, but who still own property in the UK. Approximately five million Britons live abroad.

Jeremy Cape, tax partner at Denton, said: "It's impossible to tell how many British citizens abroad will be affected by this possible change. Potentially the largest class will be those who retired a decade or so ago to a warmer climate, but held on to their UK homes.

FFS, why do they assume that expat's are all "middle-class professionals"? In the very next sentence they say that the bulk of those potentially affected are retired, so not "professionals" any more. What do these people want? A tax only payable by working class people?

And if somebody has retired abroad and still owns a home here, then either it is standing vacant for occasional visits or it is rented out.

If it is vacant, then the vendor is not being "squeezed" if he sells it - he ends up with a big pile of cash with or without CGT on it. And if it is rented out, well it's a business asset and so there's no reason not to tax it.

NB, the UK is unusual in that it has hitherto exempted capital gains made on UK land and buildings owned by foreigners.

Wednesday, 4 December 2013

Squeal, piggies, squeal!

Posted by

Mark Wadsworth

at

11:02

6

comments

![]()

Labels: Home-Owner-Ism, Propaganda, Tax

The Median Multiple

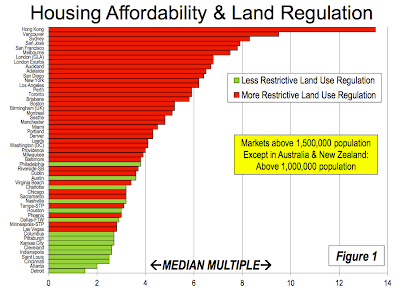

Economists, policy wonks and journalists from all round the World are united in their analysis of the problem of housing affordability. It's all the fault of the Government.

Planning regulations are the cause and location values are the effect. Many economists now call land values "regulation tax" instead.

The tables above are taken from a typical report on the subject by Demographia here .

What the report does is rank 377 cities in USA, Canada, Australia, New Zealand, UK and Ireland by their median multiple, which is the median house price divided by median household income ie affordability.

With this they also give various examples from the USA linking affordability with planning . Dallas being a perennial cherry picked favourite among economists (there are obvious reasons why the largest cities in Texas are outliers, but these are never mentioned in any of the reports).

For arguments sake, let us agree that yes, in general the higher the median multiple, the more restrictive the planning regulations are. But, going down that 377 list from least to most affordable, it's clear there is another differentiating factor that stands out.

I'm sure the sprawling Dallas Fort Worth metroplex (25,000km2) is a good place to find work and bring up a family. Texas as a whole is now doing well with mineral extraction. It also has a competitive tax regime.

But, if you want, beauty, culture, diversity, heritage and the very highest pay you live and work on the east or west coast.

We are told that supply constraints are the problem but there doesn't seem to be a shortage where the MM is highest.

You can make anywhere more "affordable" by trashing the place and making it less economically efficient. In an unregulated land monopoly this is what you'd get. In the absence of LVT, which would automatically prevent urban sprawl, and help efficiency, we need regulations via planning instead.

In the UK we have seen the effects of applying "free-market" solutions to the land monopoly by relaxing building regulations in 1980. The Parker Morris regulations had given us minimum space standards. With those gone, the effects were inevitable. The smallest homes in the developed World and the highest land values. One fed into the other.

Now we are being told to do the same with planning regulations.

Posted by

benj

at

06:15

37

comments

![]()

Labels: Brainwashing, Economics, Median Multiple, Planning

Tuesday, 3 December 2013

A smaller profit is not "a huge loss". You twats.

From The Evening Standard:

Research today revealed how the "Stamp Duty Dilemma" forced 14,000 UK homeowners to sell properties at a huge loss last year. The study also shows current stamp duty rates left a further 10,000 homeowners unable to sell their property at all.

The organisation behind the research says the stamp duty threshold, which hits buyers with a £7,500 tax bill when purchasing a home over £250,000, is massively outdated and should be reformed…

The research concludes that rising prices mean 73 per cent of all properties on the market now sit just under the £250,000 threshold — 50,000 more homes will reach it in the next five years.

That "73 per cent... just under... £250,000" suggests they are talking about the London housing market, and nearly everybody selling in London will be selling at a colossal gain. Even if not, the "rising prices" they refer to certainly will*. Not a huge loss.

Naomi Heaton, chief executive of London firm LCP which commissioned the study, said: "When they decide to sell, they will be faced with a very tough decision, the Stamp Duty Dilemma — to sell at up to a £10,000 discount? Or not to sell at all..?"

There's no need for any discount at all, and certainly not one larger than the £7,500 mentioned above - the issue is largely psychological and all the cunning seller has to do is to offer to pay the SDLT for the purchaser, which is perfectly legal and do-able.

So the seller can happily sell for (say) £260,000, and pays the £7,800 SDLT himself, thus netting £252,200 i.e. more than £250,000.

"The first course of action means the homeowner may be treading water when they buy a new property as they are unable to trade up. The second course of action is inaction. Either way, the doors remain firmly closed to first time buyers."

The same logic applies to the next home in the chain; the person who has sold his own home (having paid the SDLT himself) can request the same from the next vendor. Or do his sums properly and take the SDLT on the chin.

As to "the doors remaining firmly closed to first time buyers" this makes naff all difference; if more people were selling houses then they would be an equal increase in the number of people looking to buy houses.

* Of course, there will be some vendors elsewhere in the country who are selling at a loss because prices have fallen - but they get two consolation prizes - the SDLT on their next sale/purchase is smaller and it's cheaper to trade up.

Posted by

Mark Wadsworth

at

16:07

5

comments

![]()

Labels: Maths, Propaganda, Stamp Duty Land Tax, twits

Q: What do Leona Lewis and Dappy have in common?

A: They've both been kicked by a horse, of course!

Leona Lewis

Dappy

PS, I don't know if it was the same horse.

Posted by

Mark Wadsworth

at

11:35

1 comments

![]()

The EU is corporatist (part 94)

As I said a month ago, based on the utterings of small and large business lobby groups, Big Business likes the EU and small businesses/businessmen don't.

Opinium Research have done this a bit more thoroughly and come to the same conclusion, as summarised in City AM:

BRITAIN’S smallest companies are more likely to believe the EU is bad than good, a study showed yesterday.

The study from Opinium Research showed 40 per cent of firms with fewer than nine employees think the EU membership is bad, more than the 38 per cent who favour it. That compares with big businesses, where 57 per cent like membership against 16 per cent who say it is bad.

The general public is also more sceptical than big businesses.

Posted by

Mark Wadsworth

at

10:59

1 comments

![]()

Labels: Corporatism, EU

"Fears someone will die due to rising use of flares in stadiums"

From BBC Sport

Children as young as eight are being used as "mules" to smuggle flares into Premier League matches, according to new research.

A survey found a third of supporters have been directly affected by bad fashion at a stadium and that 86% are concerned for the general level of taste.

Use or possession of 70s clothing in grounds can lead to bans or prison, and an education drive has been launched. Fashion Police Minister Damian Green has said "someone could get killed" by toppling over on 4 inch platform heels.

In the first three months of this season, there were 96 1970s fashion incidents across the Premier League, Football League, Football Conference and domestic cup competitions. For the whole of 2012-13 that figure was 172, a steep increase from 72 during the previous campaign and just eight a year earlier.

Last season saw 71 arrests for 'possession of wide collars/Kevin Keegan perm at a sporting event', an increase of 154% on the 2011-12 season.

The Premier League-commissioned survey of 1,635 supporters found more than half of fans had witnessed glam rock at a match, 24% had had their view obscured by bell bottoms, 10% had suffered from glitter dust inhalation and 2% had been affected by polyester static.

Posted by

Tim Almond

at

09:29

1 comments

![]()

Germany to ban "flat-rate" brothels

From The Telegraph:

Germany's biggest political parties have agreed to ban so-called flat-rate sex offered by some brothels in the country.

The move is part of a clampdown on Germany's booming prostitution industry that critics say has got out of hand since a 2002 law legalised sex work. They view as exploitative the special offers in some brothels where men can have unlimited sex for 100 euros ($136).

There's an old quote by George Carlin about prostitution: "Selling is Legal, Fucking is Legal, so why is it illegal to sell fucking?" I think the German variation here is: "Selling unlimited services is OK. Selling sex is OK. So, why is selling unlimited sex not OK?"

The thing with unlimited services is that they generally they play on how much people value people think they can get. People have an idea that they're getting one over on the business, but in reality, it's generally the other way around.

There's a restaurant near me that sells unlimited deserts as part of their 4 course menu. You can just keep on asking for deserts. So, people think "bargain". Reality is that most people get through desert one quite easily, get desert two, and half way through, they hit the wall. So, the restaurant attracts customers thinking they'll get lots of deserts, but actually, they get one more. A few might scoff down half a dozen, and the restaurant probably loses money on them, but they're so rare that overall profitability is hardly dented.

What I'd imagine is that a lot of men turn up, pay for the unlimited option, then after they've had sex once, are well, done. A lot of guys probably get dressed and leave. Some will hang around, but most won't.

Posted by

Tim Almond

at

07:35

1 comments

![]()

Labels: business, Germany, Prostitution, Sex

Monday, 2 December 2013

The price elasticity of demand for rented accommodation

From The Evening Standard:

Charlie, 23, is studying for a masters in public policy at UCL. He spent his first year in London living in a poky two-bedroom flat in Battersea with two friends; they converted the living room into a third bedroom. “It meant we could live somewhere far closer to the centre,” he explains, “but it was horribly cramped. The flat was small anyway but it meant that when we had people around, we didn’t have anywhere to host them. There was always a queue for the shower and it was particularly busy when all our girlfriends stayed on the same evening.”

Charlie is part of Generation Rent —twentysomethings who bounce from lease to lease, squishing extra housemates into box rooms and sacrificing communal space for a Zone 2 postcode. It’s called “hutching up” and it’s exploding in the capital as young graduates flock to London to work but find starting salaries stretched to cover astronomical rents…

“Our surveys of tenants found that affordability is a key consideration but second to that is proximity to place of work or education,” explains Hudson. “So they’ll move down the line or bus route.”

The article is a long list of similar anecdotal evidence, but big picture wise it is true and this is how it works.

It is tenants competing against each other for the more convenient locations who dictate rent levels, the landlords just sit there and collect what they can get.

And tenants are very price sensitive. Price sensitivity is dictated by various factors, particularly relevant are items 5 to 9 on this list, all of which indicate that the demand for rented accommodation is price elastic.

So we observe that tenants respond to high rents by occupying less and less space, so the proportion of income spent on rent is not directly related to local rents in absolute terms - i.e. if the rent for a flat in London is twice as high as in Birmingham, London tenants do not spend twice as much per head - the tenant on a reasonable wage in Birmingham will rent the whole flat for himself or share with one other; the London tenant on a reasonable wage will share with two or three others.

All of which leads us to the conclusion that landlords cannot just "pass on" an increase in their costs or taxes on their income; they bear those entirely out of the rent, over which they have no influence whatsoever.

Posted by

Mark Wadsworth

at

16:07

0

comments

![]()

Labels: Economics, Elasticity, KLN, London, Rents, Ricardo's Law of Rent

Christmas Suggestions - My Little Pony Knackers Yard

Available from El Reg.

Forget the games consoles, TV-spin offs and all the other crap on the £10k Xmas wish-list, the My Little Pony Knacker's Yard is what your daughter needs!

Posted by

SumoKing

at

13:21

2

comments

![]()

Labels: Children, Christmas, Horsey, My Little Pony

Movie Ratings

Always one of my favourite things, picking up on where professional journalists with their oh-so-high standards who don't do their research. From the Daily Mail on 50 Shades of Grey:-

If the first version of the film gets an R or restricted rating in America it could be seen by anyone aged 17 or over. A more explicit version may get the much rarer NC-17 certificate, which is reserved for films depicting rape or drug use.

… ah, no. Look, this stuff is on the MPAA website and takes about 1 minute to look it up.

The R rating in America is not for anyone aged 17 or over. It's 17, or for anyone accompanied by a parent or guardian.

The NC-17 isn't reserved for rape or drug use. It's for films that most parents would not consider to be suitable for their children.

The NC-17 is really like our 18 rating, only not many film makers go for it, generally preferring the R rating, which we don't have an equivalent of.

If the clever marketing strategy was followed in Britain the film could seek an 18 certificate for the more vanilla version and an R18 rating for the explicit cut, meaning it could be shown only in cinemas with a special license cinemas, revealed the Sunday Times.

But cinemas could legally change themselves into sex-film venues for 'special events' such as midnight screenings, as long as they get local authority approval, said a former adviser to the British Board of Film Classification.

Again... no.

The NC-17 certificate goes to films like Henry and June, A Serbian Film and Last Tango in Paris. Films that were given an 18 certificate by the BBFC.

The R18 certificate in the UK is almost exclusively (and I can find no exception) about hardcore pornography. You've pretty much got to go hammer and tongs on film to get one (and even then, if it's considered essential to the plot rather than just for titilation you can get an 18). And I can't quite imagine an upcoming, reasonably successful actress like Dakota Johnson doing that.

Posted by

Tim Almond

at

10:26

0

comments

![]()