From here:

13% leap in releasing equity to repay mortgage

The number of homeowners releasing equity from their property in order to repay a mortgage increased 13% in 2010, new research has shown.

Home reversion provider, Bridgewater Equity Release found that 43% of people used equity release schemes to pay off their mortgage in 2010, compared to 30% in 2009.

Tuesday, 15 February 2011

Daily Mash on top form

Posted by

Mark Wadsworth

at

12:19

8

comments

![]()

Monday, 14 February 2011

Captain Ranty's "Legal Fiction"

Captain Ranty recently posted the following:

Roger [Hayes] decided to not pay his council tax and see where it all ended up. The result is pretty stupendous. He got a judge to agree that he Roger Hayes, the man, was not MR ROGER HAYES, a corporation defined in law.

What does it all mean? In essence, it means that every time you bend a statute, you, the flesh and blood human, is not responsible. Your legal fiction is. I imagine that your legal fiction, like mine, has no money. So the liability for paying your council tax, a parking fine, a speeding fine, your income tax, or corporation tax, falls on your legal fiction, not you, the human.

1. This is what I do for a living, distinguishing between which person (natural or legal) owes what tax and why. It is quite clear, for example, that the legal liability for council tax falls on the occupant; a parking fine falls on the owner of the car; income tax is payable by the individual and corporation tax by the legal fiction known as the limited company.

2. It must also be clear that a liability for a tax is not enforceable against a human being, as such. If somebody turns up at HM Revenue & Customs, cheerfully admits that he has been paid cash in hand all his life and spent it all on wine, women and song and does not have a penny to his name, there is b-gger all that the tax man can do about it. For sure, the man could be declared bankrupt or imprisoned, but that does not recover one penny in tax, does it?

3. Conversely, if somebody else is caught out, having earned the same amount of money cash in hand and has stashed it all in a bank account, then the tax debt is recoverable (whether he gets a prison sentence is by the by).

4. So a liability can only be enforced against assets and not a human being.

5. Now, as it happens, the government upholds another completely artificial legal fiction, to wit the concept of 'land ownership' ('the State' and 'land ownership' are synonymous, of course), which involves matching up a plot of land with a name (which we traditionally assume relates to a human being or other legal entity) and giving that named person special rights and privileges as against all other citizens.

6. But if we follow Captain Ranty's logic through to its obvious conclusion, then surely the name written down at HM Land Registry also relates to the legal fiction MR ROGER HAYES rather than the human being who goes by the name of Roger Hayes? Or does he live in a fantasy world where 'land owners' have rights but no responsibilities and the State (which is all of us obeying these silly little customs, like respecting each other's property and not 'the government' in the narrow sense) does everything out of the goodness of its own heart?

7. If we are to argue that a human being doesn't have to pay tax because they are distinct from the legal fiction bearing a similar name (the tax only being enforceable against that legal fiction), would it not be a reasonable quid pro quo for the State to tell that human being that he has no rights over any land registered in the name of that legal fiction?

8. In summary, while I object to the whole concept of taxation of incomes or the free exchange of goods and services (for a number of tediously pragmatic reasons), I fail to see how any human being can object to the State levying taxes on (i.e. charging money for) the legal fiction of land 'ownership'. Render what is Cæsar's unto Cæsar; make the punishment fit the crime; poetic justice; all that sort of thing.

Just sayin', is all.

Posted by

Mark Wadsworth

at

22:06

53

comments

![]()

Labels: Blogging, Council Tax, Land Value Tax, Logic, Taxation

The New Maths

The Daily Express presents a gold-plated masterpiece of a one-sided equation. See if you can spot the missing figure...

THE taxman is snatching almost £9 billion extra from hard-pressed pensioners every year just because they live longer, research shows. The taxes gobbled up by Her Majesty’s Revenue and Customs has soared by a quarter in the past year thanks to longer life expectancy, leaving pensioners hundreds of pounds worse off.

Currently, the average pensioner household pays out 30 per cent of its income through a combination of direct and indirect taxes... MetLife says the average retired household gets 36 per cent of its gross income from occupational pensions, 50.5 per cent from [taxpayer funded pensions and] benefits and the rest from investments and savings...

Then along comes the ever reliable TPA with the oxymoron of the week:

John O’Connell, research director at the TaxPayers’ Alliance, said: "The taxman doesn’t stop taking when taxpayers stop working and these figures show just how much Treasury coffers are boosted by pensioners. Taxes are too high, the system is way too complex and hard-working taxpayers are the ones that lose out, even when they are trying to enjoy their retirement. We need reforms to ease the burden on taxpayers and leave more of their own money in their pockets."

Posted by

Mark Wadsworth

at

14:55

9

comments

![]()

Labels: Idiots, Logic, Maths, Pensioners, Taxpayers' Alliance

Do you celebrate when your children are mugged?

I'd hope that most people would answer "No" to that question, but allow me to continue the analogy expounded by The Fat Bigot today.

1. Imagine somebody steals £1,000 from your children, or a friend or a colleague. They have become £1,000 poorer and your wealth remains the same. In relative terms however, you are now £1,000 wealthier.

2. Imagine you bought a house for £100,000 ten years ago with a £90,000 mortgage, which you have since paid down to £60,000; and somebody on a similar income buys the identical house next door for £200,000 with a £160,000 mortgage (having paid as much in rent over the last ten years as you paid in mortgage interest).

Are you £100,000 wealthier than he is? Quite clearly yes, but on closer inspection, which is closer to the truth:

a) You have become £100,000 wealthier (your paper capital gain), or

b) You are no better or worse off (you're living in the same house as before) but he is £100,000 poorer than you are?

3. I'd submit that b) is closer to the truth. Now, in example 1, clearly the mugger is £1,000 better off as a result of the mugging and your child (or friend, colleague etc) is £1,000 worse off. If your neighbour is £100,000 worse off (from 2b) then who is £100,000 better off:

a) You? Unlikely, as you only have a paper capital gain.

b) The person who sold him the house? Possibly, depending on how he spent the money (if he merely bought a different house, he has at best broken even).

c) The bank, which can now earn two or three times as much in net interest margin (a larger loan takes longer to pay off, so even at a constant interest rate, the money the bank will earn in mortgage interest minus interest paid to whoever finances the loan, usually the person who sold him the house and pops the money straight back into the banking system)?

d) People who own land with planning permission in the vicinity, who can now make £100,000 more in 'profit' (rent, actually) than they would have done had they built and sold a house ten years ago.

I'd suggest it's a mixture of b), c) and d).

4. Would your answer to question 2) change if you consider yourself and your children (let's assume they are coming up to first-time-buyer age) taken together? Has your family unit become wealthier over the last ten years?

I would submit that your family unit is in fact worse off; although you have a nice £100,000 paper gain (actually, you've avoided a £100,000 loss) but the extra mortgage and mortgage interest that your children will have to pay is about £200,000 each (over the next 25 years); you can extend this maths all the way up and down your family tree and you will see that the hidden losses nearly always far outweigh the capital gains (whether realised or just on paper).

Posted by

Mark Wadsworth

at

13:24

13

comments

![]()

Labels: Blogging, Children, crime, House prices

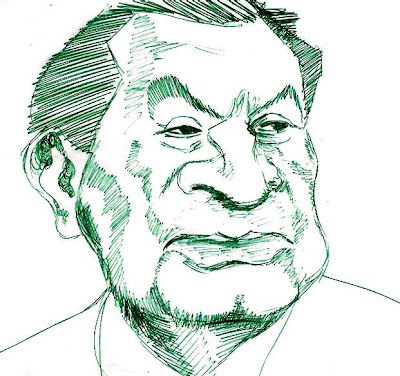

Julian Assange

Posted by

Mark Wadsworth

at

11:42

13

comments

![]()

Labels: Caricature, Conspiracy, Internet, Julian Assange, Wikileaks

Fake Statistics Of The Day

The BBC wheel out their fakecharity template yet again (the clue is at the end where a government spokesman agrees that 'more must be done'):

The number of people admitted to hospital in the UK because of problem drinking could rise to 1.5 million a year by 2015, a charity says. Alcohol Concern estimates that it will cost the NHS £3.7 bn annually [up from £2.7 bn at present] if nothing is done to stop the increase...

The charity says the number of people being treated in hospital for alcohol misuse has gone from 500,000 in 2002-3 to 1.1 million in 2009-10.

I try and keep track of the constant doubling of chocolate rations alcohol-related admissions, so here's a quick summary:

Daily Telegraph, 22 July 2008:

Alcohol is thought to cause about 17,000 cases of cancer a year and £2 bn of NHS money [sic] is spent every year treating patients with alcohol-related diseases...

Office for National Statistics figures showed last month that in 2005/6, hospitals admitted 208,000 people with diseases caused by drink. That was double the figure 10 years before... Officials estimate that the true figure for alcohol-induced admissions last year was 811,000.

BBC, 15 March 2009 (who clearly hadn't read the memo):

The NHS bill for alcohol abuse is an estimated £2.7 bn a year. The most recent figures show hospital admissions linked to alcohol use have more than doubled in England since 1995. Alcohol was the main or secondary cause of 207,800 NHS admissions in 2006/7, compared to 93,500 in 1995/96.

I think that the real giveaway is that they appear to be sticking with the £2.7 bn figure, which if correct would mean that the NHS is now treating twice as many people as it did a few years ago for the same cost*. And Alcohol concern are now going for broke, not only do they claim that the number admissions went up five-fold between 1995-96 and 2002-03 (they never revised up the earlier, lower figure of course) but that it will have trebled yet again between 2002-03 and 2015 (i.e. a fifteen-fold increase in twenty years, a compound annual growth rate of 15% at a time when alcohol sales are flat or falling).

* If you take their entirely made up figures and divide £3.7 bn cost by 1.5 m admissions, that works out at a princely £2,467 cost per admission, which seems a tad over the top for an X-ray, a bandage or whatever.

Posted by

Mark Wadsworth

at

10:22

8

comments

![]()

Labels: 1984, Alcohol, Alcohol Concern, liars, Quangocracy, statistics

Fun Online Polls: Harry Potter & Valentine's Day

Thanks to everybody who took part in last week's Fun Online Poll. The results are:

If you were Harry Potter, with whom would you have liked to get hitched?

I have no idea who any of these people are - 52%

Hermione Grainger - 19%

Luna 'Loony' Lovegood - 13%

Parvati Patel - 5%

Ginny Weasley - 5%

Cho Chang - 4%

Other, please specify - 2%

So well done the 48% of you did have an idea, and well done to fictional characters Hermione Grainger (predictably enough) and Luna (who would be pleasantly surprised by this, if she existed).

-----------------------------------------------

Seeing as today is St Valentine's Day, how about a St Valentine's Day-related Fun Online Poll?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

07:36

0

comments

![]()

Labels: Films, FOP, Harry Potter, Valentine's Day

Sunday, 13 February 2011

"Gay church 'marriages' set to get the go-ahead"

Hey... they could hold these in a Roman Catholic church or an Anglican cathedral*.

The bloke in charge of the ceremony can join in the fun by wearing a dress himself.

* Or indeed in a mosque, where the bloke in charge seems to wear a trouser/dress combo.

Posted by

Mark Wadsworth

at

18:16

10

comments

![]()

Labels: Homosexuality, Religion, Roman Catholics

Which population explosion, exactly?

Changes in the population of England & Wales (from ONS - I chose E&W rather than UK because the UK figures only go back to 1971), banded by age. It's up to you which type of chart you prefer (the first one shows the changes in each age band much more clearly but the second one also shows the increase in the total population):

To cut a long story:

To cut a long story:

* the number of children aged 0 - 17 has declined ever so slightly (by quarter of a million)

* half the increase in population of 13 million between 1961 and 2020 is down to longer life expectancy - there are 6.5 million more people aged 60+ (an increase of two-thirds in that age band, or a compound growth rate of 5% per year).

* the other half of the increase is in people aged 18 - 59 (an increase of a quarter in that age band, a compound growth rate of less than 0.5% per year). You can see it's a fairly straight line from the mid-1970s onwards, so although Labour did open the immigration floodgates in 1997 or thereabouts, this did not lead to a step-change in the pace of growth of the middle age-band.

* So the increase in the number of 18 - 59 year olds is down to a combination of there having been more 0 - 17 year olds earlier on; better health care; and net immigration (let's allocate a third of the increase to each cause, for sake of argument).

Posted by

Mark Wadsworth

at

11:13

3

comments

![]()

Labels: England, Immigration, Population, statistics, Wales