From a Georgist forum:

Hello, I have a question. I know this has been addressed before but I forgot and can't solve it on my own.

If the land market price is the capitalization of the annual rent, and a 100% LVT thus makes market price 0, how would rental values be known in the future?

If people knew the rental income will be zero, what is the floor from which to bid for land, and why would the owner sell to the highest bidder, if he knows he will see nothing of that rent bid? He could just give it to the first comer and it would be the same for him.

1. The amount of rent that somebody is willing to pay for exclusive occupation of somewhere is unaffected by how the legal owner has to divvy up the rent payments - he pays some to the government in tax; some to his bank if he bought with a mortgage; maybe he has to pay some to his ex-wife in maintenance payments. The tenant doesn't care.

As it happens, there are plenty of buildings in the UK or any country where the location rent is zero anyway. There is still a functioning market in buying and selling; or owning and renting out homes or business premises. The rent payable, by definition, relates purely to the actual building and other improvements. Introducing LVT would just make all areas of the country like this, but markets would still function.

2. As to buying and selling, it is not difficult to imagine somebody buying an average UK home, worth about £250,000 with a £100,000 cash deposit (equal to the value of the bricks and mortar) and an interest-only mortgage of £150,000 (equal to the value of the land).

On paper, he has borrowed £150,000. The economic reality is, he owns the bricks and mortar outright and is paying £300 a month in land rent (disguised as mortgage interest payments). House prices don't change much and he then sells the house, the mortgage disappears in a puff of smoke and the vendor ends up with his £100,000 back, if he has kept the house in reasonable condition. If he has let it fall derelict, he gets back less than £100,000. If he has made sensible improvements, he gets £100,000 plus value of improvements, and might make a cash profit overall.

Under LVT, the cash position is no different. Our hero buys the house for £100,000 and takes on monthly LVT payments of £300 until he sells. (Sure, if the area becomes more desirable the LVT creeps up; which is the same as the bank's mortgage rate increasing, equally both could go down). When he sells, he gets £100,000 for the house (or more or less, depending on condition) and is no longer liable to pay the LVT in the same way as he would be no longer liable to make monthly mortgage payments.

3. Clearly, the government has to get a reasonable sample of up-to-date rents paid and selling prices in each area, and to update LVT assessments accordingly, in absolute and relative terms, but that is a purely administrative issue and not difficult to deal with.

UK employers have to report tens of millions of wage payments for PAYE purposes every month, and millions or billions of VAT-able transactions every quarter; millions of individuals have to submit tax returns and the tax paid figure has to agree to the PAYE deducted figure.

So keeping tabs on a few million new rental agreements and about one million sales of land and buildings every year (which HM Land Registry and HM Revenue & Customs already do) is a doddle in comparison. Outliers will be easy to spot and investigate; or they can simply be excluded from the averages.

Thursday, 31 October 2019

Killer Arguments Against LVT, Not (472)

Posted by

Mark Wadsworth

at

16:51

5

comments

![]()

Labels: KLN

Wednesday, 30 October 2019

Well played, Metro, well played.

From The Metro:

A MUM couldn’t believe her ears when her satnav started swearing at her... Everything was fine until six months ago when the voice suddenly changed from a woman to a man — and called her an ‘a***hole’...

A TomTom spokesperson said it was likely that Ms Dockerill has an older satnav where you can record your voice. ‘Whether it’s a previous owner, or a cheeky family member, we can assure her that it’s not the satnav shouting obscenities,’ they said.

The company has sent Ms Dockerill a new device — which politely tells her where to go.

Posted by

Mark Wadsworth

at

14:07

0

comments

![]()

Nobody move or your our income gets hurt!

From the BBC:

Boris Johnson's Brexit deal will leave the UK £70bn worse off than if it had remained in the EU, a study by the National Institute of Economic and Social Research (NIESR) has found.

It concluded that GDP would be 3.5% lower in 10 years' time under the deal.The independent forecaster's outlook is one of the first assessments of how the economy will fare under the new deal...

By force of habit (h/t Devil's Kitchen ca. ten years ago), let's have a look at NIESR's most recent accounts and see who funds them.

Page 26:

Income from research work

European Commission Institutions - £112,162

Research Councils - £402,651

Government departments - £1,506,958

Trusts and Foundations - £680,902

Other - £152,444.

In case you are wondering, 'Research Councils' are just yet more quangos.

Posted by

Mark Wadsworth

at

12:37

4

comments

![]()

Labels: Brexit, project fear, Quangocracy

Reader's Letter Of The Day

From today's Metro:

Ms Ahmed's fight for equal pay for BBC presenters is admirable.

The outcome, however, should not be a rise for a woman but a massive reduction in pay for the overpaid male 'talent'.

Peter Brown, Croydon.

Posted by

Mark Wadsworth

at

11:32

0

comments

![]()

Tuesday, 29 October 2019

Yes, that'll work. I wonder why nobody thought of this before?

From City AM:

The UK film regulator will this week roll out a series of new age rating symbols designed for online streaming platforms.

The digital classification symbols, which will launch on Netflix from Thursday, are designed to help young people make more conscious choices about what they watch online...

I've never bothered putting passwords or doing this age-related nonsense on my computers or on our Netflix and Amazon accounts. If my kids are old enough to hack them, they will be old enough to watch whatever they like.

Posted by

Mark Wadsworth

at

13:38

4

comments

![]()

Monday, 28 October 2019

"Blue is for a baby boy and spattered in blood is for a baby girl"

Posted by

Mark Wadsworth

at

16:44

3

comments

![]()

Labels: Babies, Health and safety

Sunday, 27 October 2019

Killer Arguments Against LVT, Not (471)

Faced with the incontrovertible assertions that:

a) LVT is not a "tax" but just a user charge for benefits received, like paying a roofer to fix your roof or paying the utility company for the power and water you use, and

b) that is totally unreasonable to make 'everybody else' to pay for the cost of those benfefits,

... the Homeys claim that the circumstances under which current owners acquired their land - or what they intend to do with the proceeds - entitle them to a special exemption.

Here's a selection from the years I've been doing this:

What about somebody who bought decades ago and whose house price has rocketed because of lack of supply/immigration/lax lending standards/gentrification?" (a variant of the Poor Widow Bogey)

What about a recent purchaser with a big mortgage who will be pushed into negative equity? The banking system will collapse!

I bought a semi-derelict house in a run-down area, I have spent tens of thousands on improvements, so it's unfair to tax me on the value I added.

I bought my house out of taxed income!

I inherited this house, it is my family's main asset and I want to leave it to my children who don't have much income or other assets.

I bought additional homes to rent out for security in my old age. (Bonus: I'll just pass on the tax to my tenants, who can't afford it)

I scrimped and saved my whole life, built up and sold a business. I've paid enough tax and I just want to enjoy the rest of my life in my mansion.

My house has shot up in value. I'd like to cash in and downsize, and the surplus cash will be my pension.

I made sacrifices to pay off the mortgage, why do you want to take that away from me?

Pensioners need to be able to release equity in their homes to pay for long-term care, if they can't do that, they'll just be a burden on the taxpayer

And so on and so forth.

1. None of these is an argument against LVT, taken in isolation.

2. Many of the categories are polar opposites.

A pensioner couple who bought their home for a regulated, below market price under Georgism Lite decades ago and paid off the mortgage out of petty cash is the polar opposite of today's FTB couple who have to take out massive mortgages which will take them thirty or forty years to pay off.

The argument that it is unfair to tax somebody on windfall, unearned gains is the polar opposite of the argument that is unfair to tax somebody on the increase in value of their home because they have ploughed so much into improving it. (LVT does neither of course, but that's by-the-by here).

3. The glaring problem, if you look at the whole list...

The categories cover just about everybody, and many - including me - will fall into more than one category.

I might as well accept that income tax is a good idea in principle - but that we should exempt employees (because they have to work hard and need their wages to live off); we should exempt businesses (because they maximise value in an economy); we should exempt business owners (because they are risk-takers and stand to lose everything); we should exempt savings and pension income (because that's return on savings); we should exempt consumers (because without them, businesses would collapse) and so on, in which case there's nobody left.

Posted by

Mark Wadsworth

at

17:57

0

comments

![]()

Labels: KLN

Friday, 25 October 2019

"US hunter killed by deer he thought he had just shot dead"

Posted by

Mark Wadsworth

at

14:57

3

comments

![]()

Enlightenment 2.0

It's as easy as ABC

Arbitrary Authority + Big Bureaucracy = Complete Chaos

Posted by

Lola

at

07:23

2

comments

![]()

Wednesday, 23 October 2019

Nobody move or somebody gets hurt!

From The Metro, an absolute classic of the genre:

KNIFE crime could get ‘considerably worse’ under Boris Johnson’s Brexit deal, a former minister has said.

David Lammy, who represents Tottenham in north London, said the drop in GDP that the deal would cause would ‘mean everything’ to areas with high poverty rates — and have a bigger impact ‘than the 2008 crash’.

The Labour MP (pictured) told the Commons: ‘In my constituency, just the weekend before last, two men were knifed within an inch of their lives. We would see a reduction in GDP, with a Canada-style free trade deal, of 6.7 per cent in our country.

'In a constituency like Tottenham, it means everything. It means that the knife crime I’m worried about could get considerably worse. I don’t want the south side of Chicago in Tottenham.’

I strongly suspect that a lot of people who voted Leave did so to thumb their noses at drivel like this.

'Remain' would probably have won if the Remain campaign had stuck to simply emphasising the positives of being an EU member (of which there are many); glossing over the negatives (of which there are just as many); and not wasting most of their energy on trying to scare people into thinking that the world would come to an end if they voted Leave (when it was quite clear that the world would carry on pretty much as normal, Leave or Remain).

The Leave campaign also have made some pretty outrageous claims, but they weren't so stupid as to claim that we'd all catch super-gonorrhea if we voted Remain.That would just have devalued their more plausible stuff.

Posted by

Mark Wadsworth

at

15:49

5

comments

![]()

Labels: Brexit, David Lammy, project fear

Tuesday, 22 October 2019

The people who run our country don't know what "investment" means.

It's very simple. Businesses 'invest' (in productive assets, tangible or intangible) and individuals (or pension funds on their behalf) 'save' (defer consumption), by either accumulating money in the bank or buying shares (directly or a pension fund does it on their behalf).

Individuals dissave (accelerate consumption) by cashing in a pension; withdrawing money from the bank and spending it; or selling shares and spending the proceeds. When one individual buys shares, another must have sold them, so the two sides cancel out and it's not even net saving, let alone net investment.

The actual businesses whose shares are bought and sold couldn't care less who buys and sells their shares and are unaffected. They make profits (hopefully), reinvest what is needed to make more profits in future and dish out the rest as dividends to whoever own the shares.

The people who run our country (from MPs to the Governor of the Bank of England) are too stupid to understand this not particularly subtle or difficult point. From City AM:

Three hundred MPs are calling on the trustees of the £700m Parliamentary Pension Fund to end their investments in fossil fuel companies...

The pledge, supporters of which include Labour leader Jeremy Corbyn, Lib Dem leader Jo Swinson, SNP Westminster leader Ian Blackford, and mayor of London Sadiq Khan, stated: “We believe members of parliament have a responsibility to act on climate change, and a unique opportunity to show leadership on climate action, responsible investment and the management of climate risk through addressing the practices of our own pension fund.”

Caroline Lucas MP, the leader of the Green Party, said: “I am encouraged by the huge number of MPs who now agree that we must move our investments away from the polluting industries of the past, and instead support policies that will bring about a clean energy future.”

Bank of England governor Mark Carney and the Environmental Audit Committee have warned that people’s pensions are exposed to overvalued carbon assets as the world moves quickly towards cheaper, greener renewables, and governments legislate for net-zero emissions.

OK, so all "ethical" pension funds simultaneously try to dump their shares in oil or mining companies, what happens? The price falls and they've lost a lot of money anyway - and the yield to future investors goes up. Other pension funds, whose very statutory duty is "getting the best return you can for your pension savers" would be acting entirely unethically if they didn't snap up those cheap, high yielding oil and mining company shares on behalf of their pension savers. Oil companies won't care less either way.

And anybody who drives a car is contributing to oil companies' profits and encouraging them to continue extracting oil; there's no point them being squeamish about owning shares in oil companies and thereby getting a bit of their own money back.

Posted by

Mark Wadsworth

at

15:05

6

comments

![]()

Labels: Caroline Lucas, EM, investment, mark carney, Saving, Twats

"inept and peevish behaviour leaves [our] reputation for honest dealing with our EU partners hanging by a thread"

Our PM is getting the usual grief from the usual self-publicists for not signing that letter to the EU.

This episode was either childish and stupid or hilariously funny, depending on your point of view, and I think it was both (like shouting "Fuck!" in the middle of a school assembly).

But let's not forget that our PMs have a history of such stunts; complying with the letter not the spirit of the law to convey their utter disregard for the whole thing. From Wiki:

Absence of Gordon Brown

British Prime Minister Gordon Brown was the only national representative who was planned to sign the [Lisbon] Treaty in the ceremony but did not take part, leaving Foreign Secretary David Miliband to sign the Treaty alone. Instead, he signed the document at a lunch for heads of state and government later the same day. A requirement to appear before a committee of British MPs was cited as the reason for his absence.

This brought criticism from opposition parties. The Conservatives claimed it made him appear “gutless” and referred to it as a "stunt” which proved Brown was "not very good at international diplomacy". The Liberal Democrats claimed it raised "serious questions" and Chris Huhne said showed "inept and peevish behaviour that leaves Gordon Brown's reputation for honest dealing with our EU partners hanging by a thread".

Parts of British media also criticised Brown for this, suggesting he did it because he was ashamed to sign the Treaty, with Nick Robinson, BBC Political Editor, claiming that Brown was capable of attending the signing but instead chose not to.

I thought fair play when Brown did it, so fair play to Johnson as well, you've got to be even-handed.

Posted by

Mark Wadsworth

at

14:00

0

comments

![]()

Labels: Boris Johnson, EU, Gordon Brown

Sunday, 20 October 2019

Laziness - a driver of, and a brake on, human progress

People use the word 'capital' to mean lots of quite different things, especially in economics.

In its purest sense, I like to define capital as 'labour saving devices'. From stone tools and animal pelts for clothing (or whatever the earliest true labour saving devices were), up to sat nav's superseding maps, which superseded using your own experience and memories (or whatever they invented last week).

The whole idea is that people spend some time inventing or discovering or developing something which enables them to achieve the same results for less effort (or better results for the same effort, or something that was previously impossible). Sooner or later, everybody learns how to do it, and everybody benefits. That's capitalism at its finest.

This is all good stuff, but let's not forget that ultimately, laziness was the driver behind all this.

So 1:0 for laziness!

----------------------

Clearly, there are situations that are not so clear cut.

a) Business see wages as a cost, so newspapers replace type-setting with word processing; supermarkets replace shop assistants with self-checkouts. In the long run, this aids human progress, but in the short term, it's no consolation for people who have, or who'd like to have, a job as a typesetter; shop assistant.

b) People can guard their own trade secrets as jealously as they like. That's human nature, sooner or later, competitors reverse engineer them and we all benefit; the nicer you are to your employees, the less likely the trade secrets get out, so in the medium term at least the employees benefit.

Where it goes too far is government protection of patents and IP rights, especially for things which aren't really a scientific or technological advance. One business' progress is a brake on every other business, but patents lapse and then everybody else can pile in.

That's a contested goal for and against laziness. The one for laziness is given after close scrutiny by the VAR team.

---------------------

And there are situations where laziness is a massive brake on human progress, which is rent seeking in all its forms.

Each individual wants an easy life and something for nothing. So everybody wants to pack in work and be a landlord; home-owners want house prices to go up even if that means their real wages are declining. People play the lottery, even though its a negative sum game and the average player ends up worse off.

Businesses want to take out patents on things purely to stymie and stifle the competition; they want tariffs to protect them from foreign competition. The laziest team member does just enough to not get chucked out and wants their share of the team effort.

Members of mutually owned businesses vote to become shareholders for the one-off, up-front windfall gain of free shares, even though in the long run, they are marginally worse off and everybody else is a lot worse off.

--------------------

That's a clear goal against laziness, making the final result 2:1 for laziness being a driver of progress.

Posted by

Mark Wadsworth

at

18:30

8

comments

![]()

Labels: Economics

Saturday, 19 October 2019

Fun with numbers

This was explained to me a decade ago (by an Indian granddad in the playground when we were picking up kids from school), but I forgot how to do it, so looked it up again a couple of days ago.

Here's how we were taught to do long multiplication at primary school. Makes sense, is methodical, but is difficult to do in your head, remembering the hundreds, tens and units columns:

Vedic multiplication requires far fewer digits in the workings. You start by multiplying the first two (5, 4) and writing 20 so that the last digit 0 lines up with the 5 and the 4. Then you add 5x3 and 4x2 = 23, write the last digit 3 one column to the left of the 20 etc. The only tricky bit is to remember that the last digit of 2 x 3 lines up with the last digit of 5x9 plus 4x1 = 23, because 'tens x tens' is the same order of magnitude as 'hundreds x units':

Not only is it easier on paper, it lends itself to mental arithmetic. You start with 20, it doesn't matter that this actually represents 200,000. Then you multiply it by ten and add 5x3 and 4x2, and so on. You just keep a running tally. Depending on what level of accuracy you want. You could just go as far as 2,279, round it up 'a bit' and then multiply by a hundred (you know that the answer is going to be 'a bit more than' 500 x 400 = 200,000):

Posted by

Mark Wadsworth

at

18:24

2

comments

![]()

Labels: Maths

Great Britain's temperature gradient

From here:

We see that the south coast of England (ignoring the Southampton-Portsmouth urban heat island) is on average 2C warmer than Glasgow or Edinburgh in summer, that's a distance of about 400 miles. Both are at sea level.

We are told that the average global temperature has increased by about 1C over the last 140 years.

To put that in perspective, a 1C increase is like moving about 200 miles further south. Divide that by 140 years; that's about a mile and a half per year.

Posted by

Mark Wadsworth

at

12:32

13

comments

![]()

Labels: global warming

Friday, 18 October 2019

Remoaner who really ought to know better

He's at it again. From The Guardian:

Jolyon Maugham QC, the director of the Good Law Project, who has spearheaded a series of court challenges to the UK government over Brexit, is seeking an interdict from the court of session in Edinburgh that would effectively suspend the deal, which parliament is set to debate in a historic Saturday session tomorrow, as well as a court order so that if MPs do vote on the deal as planned, the full, final text is put before them.

Lawyers for Maugham will tell the court that the deal contravenes section 55 of the Taxation (Cross-border Trade) Act 2018, which states that it is “unlawful for Her Majesty’s government to enter into arrangements under which Northern Ireland forms part of a separate customs territory* to Great Britain”. Maugham’s legal team insist that section 55 is “crystal clear” and that any form of differentiated deal for Northern Ireland will contravene it.

Basic common sense, not to mention high legal theory, tells us that the government/Parliament can pass any statute it likes, even if it directly contradicts a pre-existing statute. That pre-existing statute, however "crystal clear" is then usually repealed or amended accordingly. Sometimes they overlook it and don't bother, in which case you assume that the later statute overrides the earlier one.

So his argument is as mad as saying "They can't pass a statute allowing marriage between two men or between two women, because there is already a statute that says it can only be between a man and woman."

If he really wanted to know how to throw a spanner in the works, he should read Richard North's blog.

* That section in turn says that "customs territory" is as defined in the General Agreement on Tariffs and Trade of 1947. Article XXIV is clear enough: "a customs territory shall be understood to mean any territory with respect to which separate tariffs or other regulations of commerce are maintained for a substantial part of the trade of such territory with other territories", so it's fair to say that NI would no longer be in same "customs territory" as GB.

Posted by

Mark Wadsworth

at

13:47

0

comments

![]()

Labels: Brexit

Killer Arguments Against Citizen's Income, Not (24)

One of the worst I've ever seen, from Mediun.com, a veritable car crash:

Sounds great, right? … it does, until you look under the hood:

How Yang proposes paying for it is by introducing VAT (Value Added Tax) of 10%, that’s a $100 on every $1,000 you spend! The VAT will hit the middle class the hardest, those making and spending $120K per year break even. Those who make and spend $40K per year, will really only be effectively getting $8K per year, $153.85 per week.

His maths is rubbish. Assuming VAT paid is proportional to income/spending, the actual net Freedom Dividend minus VAT for...

- a non-earner would be 'only' $10,800;

- a middle-earner on $40,000 would be $6,800. FD = $12,000; minus 10% VAT on spending $40,000 + $12,000 = $5,200;

- a higher earner earning $120,000 would actually be negative $1,200. FD plus $12,000; minus 10% VAT on spending $120,000 + $12,000 = $13,200.

That seems very progressive to me, if that's what you are into. (Yes, VAT is the worst kind of tax, but let's stick to his static calculations).

[Quoting Yang] "We currently spend between $500 and $600 billion a year on welfare programs, food stamps, disability and the like. This reduces the cost of the Freedom Dividend because people already receiving benefits would have a choice between keeping their current benefits and the $1,000, and would not receive both."

So everyone on Welfare, SNAP, Disability or any other government assistance just gets excluded from the “Freedom Dividend” club, unless they give up their “current benefits”. This further widens the income inequality gap, pushing those less fortunate deeper into poverty.

Nonsense.

Yang's whole point is that if his FD is an alternative to existing welfare, to keep the overall additional cost down*. Somebody who is currently entitled to more than $12,000 a year in various welfare payments, they can keep them.

It's hardly "giving up" if you can choose a higher figure. Nobody is "excluded" and everybody with other earnings up to $108,000 would be better off . That narrows income inequality gap and pushes nobody further into poverty (again, glossing over the dead weight costs of VAT), the precise opposite of what he claims.

* Somebody worked out that all the various overlapping state and federal welfare schemes already average out at $7,200 per adult per year, so bumping that up to $12,000 is no biggie.

Posted by

Mark Wadsworth

at

12:38

0

comments

![]()

Labels: KCN

Wednesday, 16 October 2019

Killer Arguments Against LVT, Not (470)

I've seen this one a couple of times and it has been bugging me for years. I can't be bothered finding an example, so I'll paraphrase:

My wife and I are childless, semi-retired but still healthy and live alone in a nice house. There is a family across the road from us in an identical house. They have two kids at school and an older child who is sometimes in trouble with the police. A granny lives with them who constantly needs NHS care.

My wife and I place no pressure on 'local services' and cost the government next to nothing. With LVT, we would be paying the same as the family across the road. They place far more pressure on 'local services' and cost the government a lot of money. So they should be paying far more in tax than we do.

Such people have got the whole tax-spend cycle the wrong way round.

For good reasons (which I won't go into now), governments, on the whole and in general, just do certain things: police and law'n'order; roads; refuse collection; fire brigade; they provide universal education, free-at-point-of use or subsidised and regulated healthcare; welfare systems etc.

Every citizen has an equal entitlement to those things, so they have to be provided 'free-at-point-of-use'. For example, if the government tried to force parents who can't afford private school to send their kids to a state school and pay the full cost for each child, things would rapidly descend into chaos.

No government of a civilised country does this AFAIAA. And trying to make offenders pay for the cost of the criminal justice system is clearly insane. The police are there for the benefit of the law abiding, not for the benefit of criminals.

If the Tooth Fairy paid for all those things (or you had a small population and endless oil reserves), you wouldn't need to collect taxes, and I don't think governments particularly enjoy doing it.

But without a Tooth Fairy or oil reserves, spending without taxation would lead to hyper-inflation and regular collapse, so the money printed by spending has to be un-printed somehow, i.e. by taxation.

Having established that every citizen has an equal entitlement, it makes sense to collect taxes from those who benefit disproportionately. This leaves us with taxes on:

1. Those on really high incomes (annual income over £50,000 or £100,000 or whatever figure, there's no right or wrong answer). Higher earners need a pyramid of reasonably well educated employees under them; higher earners might have been to private school, but they benefit from the fact that their employees had a state education. (So basic rate tax, National Insurance and VAT are straight on the scrap heap of history).

2. Those who own land. In the absence of governments and civilised society (the two go in tandem, one is a symptom of the other), land would be worth precisely nothing.

- There wouldn't be anybody to say who owns which bit, and nobody to protect those rights;

- Some things benefit land values directly (near a good school, in a low crime areas, good transport links); and

- There are also secondary effects. If people only spend 6% of GDP on healthcare (as in the UK) rather than 18% (as in the US) for a similar level of coverage/quality of outcome, they have 12% more money to spend on everything else - goods and services or housing. And higher earners from category 1 bid up land prices.

So a tax on land values seems perfectly reasonable to me.

If our semi-retired complainant thinks he and his wife are being over-charged, he is perfectly entitled to sell up and move somewhere cheaper.

He and his wife will still be getting the same level of services from the government; they will of course be getting a lot less in spillover benefits from society in general, private enterprise etc in a cheaper area, which is why they don't (or wouldn't) move, and it is those spillover benefits that they will be paying for. And if they don't want to, somebody else will.

Posted by

Mark Wadsworth

at

19:18

6

comments

![]()

Labels: KLN

Tuesday, 15 October 2019

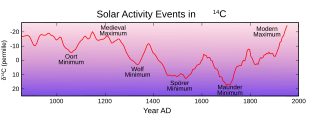

Sun spots

Why are we expected to believe that the correlation between "B" and "C" is causality, but the much closer correlation between "A" and "B" is merely coincidence?

Posted by

Bayard

at

21:13

6

comments

![]()

Labels: global warming, The Sun

Ireland 1: England 0

My heart soared with pride when our PM Mrs T May donned her highest high heels and towered over that French bloke:

In last week's round, Ireland fielded the winning candidate. Is Varadkar surprisingly tall or is Johnson a short-arse? Either way, well played Ireland, a well deserved victory!

Posted by

Mark Wadsworth

at

12:05

1 comments

![]()

Labels: Boris Johnson, varadkar

Sunday, 13 October 2019

Another piece of the Thomas Cook puzzle

As I mentioned a couple of weeks ago, there were/are lots of groups with an interest in seeing Thomas Cook's operations keeping going. What tourists are paying £1,000 for is to be somewhere nice and hot for a week, the flying there and back - which is what Thomas Cook was in charge of - is a pain in the bum. The marginal/average cost of flying a plane full of UK tourists to their destination in Europe and back is about £100 per passenger, the value/cost to everybody concerned (of the actual holiday, using up limited days' leave from work) is far in excess of that.

The BBC report a good example of such a group, which hadn't occurred to me before:

The sudden collapse last month of one of Europe's biggest travel groups, Thomas Cook, ruined the holidays of 600,000 stranded tourists. Hundreds of thousands more had trips booked when the news was announced.

But for parts of Spain's tourist sector, Thomas Cook's demise is also an existential threat... The Spanish Confederation of Hotels and Tourist Accommodation has said that 1.3 million autumn and winter visitors will be unable to fly into Spanish destinations.

This will result, it says, in the shutting down of at least 500 hotels, generating losses to the tourism sector running into the hundreds of millions of euros.

Spain's government has announced a package of measures worth €300m (£260m; $330m), including emergency credit lines and a reduction in airport fees, particularly for hubs in the Balearic and Canary islands, plus plans to spend €500m in improving tourism infrastructure.

Surely, that €300m (or €800m, or whatever) would have been more than enough to take over Thomas Cook's airline business (plus whatever other bits they need) and keep it going, maybe even turn it round? Stuff like the leases on the planes; staff wages (it's a lot cheaper keeping a team going than assembling a new one); the take-off and landing slots; all the information about who's going where and when.

Thomas Cook's 2018 accounts show that it (they?) had a decent operating profit/positive cash flow from operating activities. What tipped it (them?) into big losses were interest costs and the usual 'cost of intangible assets' nonsense. The new owners of the business don't need to take on the ghastly debts, that's Thomas Cook's old creditors' problem (many of whom will be entirely innocent in the whole mess; some of whom will be complicit and it serves them right).

------------------------------------------

To cut a long story short, the Spanish government could simply run the airline which takes UK tourists to Spain. Everybody wins.

Posted by

Mark Wadsworth

at

18:47

5

comments

![]()

Thursday, 10 October 2019

Sorry, Could you say that again?

Posted by

Lola

at

12:18

5

comments

![]()

Tuesday, 8 October 2019

"Overview of Northern Ireland Trade"

From the BBC:

A No 10 source says a Brexit deal is "essentially impossible" after a call between the PM and Angela Merkel... They also claimed she said a deal would never be possible unless Northern Ireland stayed in a customs union.

I'm all in favour of a (re)united Ireland and NI remaining in the EU customs union is a step in that direction. I'm not sure why the EU is so adamant, but it's not necessarily A Bad Thing.

It depends largely on whether NI trades more with RoI or more with GB? It makes sense to be in a customs union with your largest trading partner.

NISRA says that NI-GB trade is about four times as much as NI-RoI trade (or twice as much as combined NI-RoI and NI-rEU trade). GB is further away, but fifteen times as big as RoI, so that looks about right. Which means that NI would be better off (or less worse off) in the UK customs union and not in the EU customs union (which is not the answer I wanted).

Ho hum.

Posted by

Mark Wadsworth

at

13:35

7

comments

![]()

Labels: Northern Ireland, trade

Well, duh.

From The Guardian:

The drought and water resources minister, David Littleproud, has acknowledged he “totally” accepts that worsening droughts are linked to climate change, as he signalled more taxpayer support for regional communities was coming as Australia’s big dry “escalates”.

Littleproud, who stumbled last month by first telling Guardian Australia he did not know if climate change was manmade, then later clarifying he had always accepted the science on the role humans play in the climate changing, told the ABC on Sunday he understood the link between global warming and drought because “I live it”.

The Guardinistas don't do subtlety or nuance.

Australia as a whole doesn't get much rain, and it appears to have had even less rain in recent years. Which is indisputably a "significant change in weather patterns which might or might not be long-term" or "climate change" for short.

But the article equates "climate change" with "man-made climate change" and so assumes that "minister accepts that climate change exists" to automatically mean "minister accepts that climate change is man-made" (which he was bullied into saying recently, but that's a separate topic), which is one heck of a leap of logic.

Posted by

Mark Wadsworth

at

12:22

1 comments

![]()

Labels: climate change, Logic

Monday, 7 October 2019

Well there's a surprise!

SpareRoom’s Rental Index Q3 2019

Data Summary

- Rents remain steady across the UK, up just 1% over the last year. This indicates that the recent tenancy fees ban hasn’t resulted in rental increases

- Northern Ireland is the cheapest place to rent in the UK, with average rents of £352

- The UK’s cheapest town is Galashiels in Scotland, with average rents coming in at £303 – followed by Northern Ireland’s Bangor (£318) and Craigavon (£320)

- Guernsey continues to outrank London as the most expensive place to live in the UK with rents of £796, compared to London’s average of £782

from here

The surprise is, of course, the last point. All the others are exactly what we would expect, despite all the wailing from letting agents.

Posted by

Bayard

at

16:03

3

comments

![]()

Nobody move or [something extremely yucky] will happen!

From iNews:

Officials preparing Britain for a no-deal Brexit have encountered a new roadblock: a rise in dogging.

A cabinet minister confessed at the Conservative Party conference last week that long tailbacks near the port of Dover could mean lorry drivers visiting voyeuristic sex sites, according to The Sunday Times.

“One of the things we talk about in these no-deal meetings concerns hauliers and their activities,” the minister said. “The main thing is whether they will turn up at the Channel ports with the right paperwork. But there are also dogging hotspots all over the place.”

Good luck to them, consenting adults and all that. As long as local councils clearly sign-post dogging sites (to save embarrassment and misunderstandings) it isn't a problem.

Slightly more concerning is that all those involved will be spreading super-gonorrhoea, a disease which is widespread in non-EU countries such as Norway or Switzerland.

Posted by

Mark Wadsworth

at

11:51

8

comments

![]()

Labels: Brexit, project fear

Sunday, 6 October 2019

Brexit negotiations. Questions, questions...

1. In the pub on Friday, BenJamin' reminded us that the Benn Act is borderline insane. If somebody has no choice but to agree a deal, any deal, then that more or less negates that person's ability to haggle. The almost inevitable outcome of this would be, by default, for the UK to remain in the EU for another few months. Suitably heartened, MPs can then keep doing the same thing over an over forever. He asked, rhetorically, whether he had understood that properly and we all concurred.

2. My follow-up point was, our PM has made a compromise offer re Northern Ireland, which is some sort of fudge whereby Northern Ireland remains part of the EU for regulatory purposes (food and product safety standards etc) but remains part of the UK for customs purposes. I'm not sure if this is even workable, but you do get weird things like this, like the German enclave in Switzerland and they seem to manage somehow.

But never mind, superficially this is a compromise between:

a) the EU demanding that the whole of the UK remain in the EU for regulatory purposes and/or that the regulatory and customs border would be 'in the Irish Sea'.

b) the extreme (on both sides) idea that there should be a 'hard' border between Ireland and Northern Ireland (the EU appear to be pushing for this more than the UK or Ireland itself).

My question is, from the UK negotiators' point of view, this is a compromise (however insincerely meant) - so what compromise did they demand from the EU in return? Nobody talks about that, maybe they didn't ask for anything. Or is the counter-compromise that the EU no longer insists on 'the backstop' (which is too gruesome to even describe)?

Posted by

Mark Wadsworth

at

16:31

9

comments

![]()

Labels: Brexit, Northern Ireland

Nice to see somebody sneak this into City AM...

From City AM/Opinion, :

How business rates reform can thwart the retail apocalypse

... Some have suggested a digital sales tax – in essence penalising tech firms for carving out a more efficient business model, one from which consumers benefit in the form of lower prices and added convenience. Jeremy Corbyn, meanwhile, wants to forcibly seize property from landlords and hand it to community projects and coops. Both are wrong-headed...

Retailers face myriad challenges and we at The Entrepreneurs Network have long called for business rates reform. Blanket cuts will only benefit the biggest landowners like the Duke of Westminster rather than high street shops or their customers. Instead we need to reassess rateable values upon the underlying land value of a commercial site.

As research from Centre for Cities highlights, not all high streets are struggling. In Brighton, vacancy rates are as low as seven per cent.

Online sales currently make up just 17 per cent of the total British retail spend, and tech giants are themselves moving into physical retailing: Apple has stores across the world, and in June Amazon began opening pop-up shops across the UK.

Posted by

Mark Wadsworth

at

16:16

0

comments

![]()

Labels: Land Value Tax

Friday, 4 October 2019

Yay! Go John Lewis!

From the BBC:

John Lewis is seeking discounts from its landlords to cut costs, in a highly unusual move that highlights the huge pressures on retailers.

The BBC has learned that the retail giant has been telling landlords in some locations that it will withhold 20% of this quarter's service charge. These are the fees retailers pay on top of rent for services such as heating and security. John Lewis said the charges had become too high and urged landlords to help...

Debenhams has managed to slash its rent bill with reductions of up to 50% after securing a restructuring deal with its creditors. Struggling retailers have been turning to these so-called company voluntary arrangements as a way to cut costs. House of Fraser was bought out of administration by Mike Ashley's Sports Direct and many of these stores are currently paying little if any rent.

John Lewis are just nibbling at the edges here, the service charge is only a fraction of the rent, and they are only withholding a fraction of the service charge, but it's a start, and hopefully every other tenant will follow suit. And once landlords have reduced their rent expectations, there'll be fewer vacant shops.

--------------------------------

I tweeted this article, some drone from Conservative head office promptly started wailing on about pension funds etc. They are very efficient, it must be said.

Posted by

Mark Wadsworth

at

12:28

8

comments

![]()

Thursday, 3 October 2019

"Everyone suddenly an expert on Northern Ireland"

From Newsthump:

Absolutely everyone on the British mainland is suddenly an expert on Northern Irish politics, it has emerged today.

Irish politics have proven a nigh-intractable problem for centuries, but all of a sudden everyone on the Internet has a depth of knowledge on the best possible solution for Brexit and the Irish border, which has eluded the world’s finest minds to date.

As one of the UK's top experts on Irish politics (definitely in the top 60 or 70 million or so), all I can say is, stop fannying about.

Just hand Northern Ireland back to the Republic of Ireland. Don't bother with a referendum (as vaguely planned in Good Friday Agreement), that's asking for trouble, just do it, schedule it for midnight 31 October/1 November 2019 for simplicity.

Withdraw any UK troops we might still have there, shut the Northern Ireland department, cancel all government payments to Northern Ireland, tell Westminster MPs from Northern Ireland that they are sacked, the lot.

The DUP and their ilk will be pretty miffed... but what are they going to do about it after the event? Then tell the EU they can shove their back stop up their collective arses.

Posted by

Mark Wadsworth

at

14:45

12

comments

![]()

Labels: Northern Ireland

Wednesday, 2 October 2019

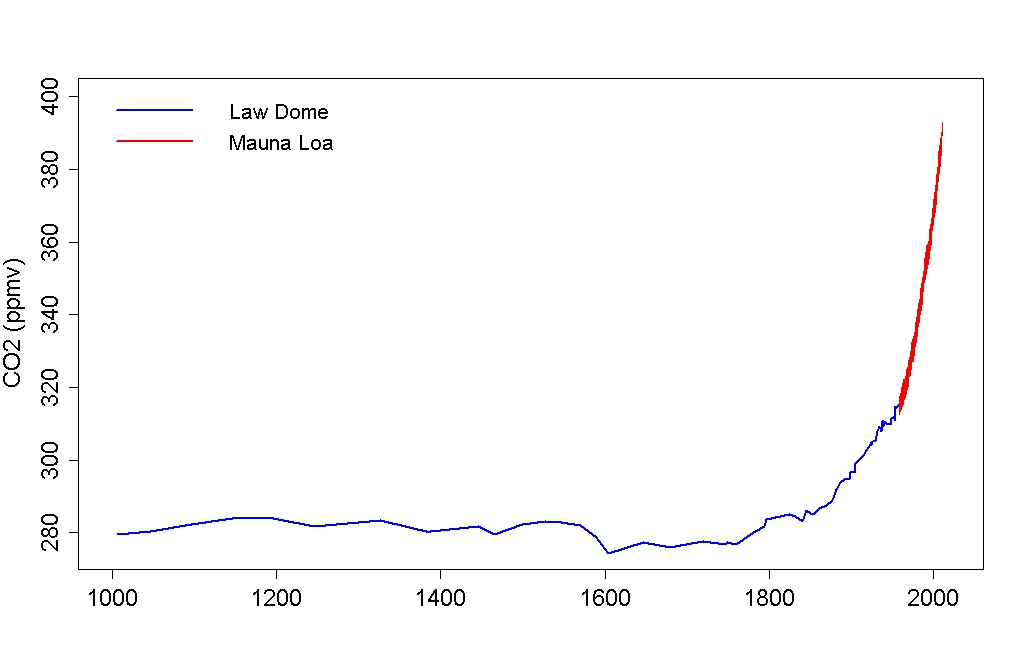

Climate change solely due to CO2 changes. Unless we say it isn't.

From Watts Up With That:

The relative proportions of carbon dioxide and oxygen have varied very widely over the geological ages. It will be seen that there is no correlation whatsoever between carbon dioxide concentration and the temperature at the earth’s surface.

The alarmist rebuttal from Skeptical Science does not appear to dispute the actual facts from the first article, but:

Atmospheric CO2 levels have reached spectacular values in the deep past, possibly topping over 5000 ppm in the late Ordovician around 440 million years ago. However, solar activity also falls as you go further back. In the early Phanerozoic, solar output was about 4% less than current levels...

What about times closer to home? The last time CO2 was similar to current levels was around 3 million years ago, during the Pliocene. Back then, CO2 levels remained at around 365 to 410 ppm for thousands of years. Arctic temperatures were 11 to 16°C warmer (Csank 2011). Global temperatures over this period is estimated to be 3 to 4°C warmer than pre-industrial temperatures. Sea levels were around 25 metres higher than current sea level (Dwyer 2008).

If anything, that disproves a CO2-temperature link. If there were one, then it would be 3C warmer than it actually is. And why was there no 'runaway global warming caused by feedback effects' last time CO2 levels were this high? Because there is no such thing, it is a physical impossibility, like a perpetual motion machine.

If climate scientists were claiming CO2 was the only driver of climate, then high CO2 during glacial periods would be problematic.

That is exactly what they are claiming and it is problematic.

But any climate scientist will tell you CO2 is not the only driver of climate... Past periods of higher CO2 do not contradict the notion that CO2 warms global temperatures. On the contrary, they confirm the close coupling between CO2 and climate.

DoubleThink at its best. CO2 is main driver unless it's something else. Lack of correlation confirms correlation. There is a close coupling unless there isn't. They are truly making it up as they go along.

Read the articles, the first one might well be all lies and propaganda funded by Big Oil, but it is internally consistent, coherent and plausible. The second article ties itself in knots, leaving the reader none the wiser but with the impression that it's a load of rubbish.

Posted by

Mark Wadsworth

at

13:36

6

comments

![]()

Labels: climate change