Spotted by Khards at HPC in The Independent:

THE Government is considering a 'super property tax' for owners of large, expensive homes. Under the proposals, the rate of tax levied would rise with the value of the property, the Irish Independent has learned.

Similar to income tax, the property tax rate would go up in bands linked to the value of the house. That means owners of such houses would pay a higher percentage rate of tax due to its greater value. This 'super tax' would help the Government to sell the property tax to the public as homeowners would clearly see the rich paying more.

So far so good. Here come the "sort of" bits...

It will spark concern among those who already stretched themselves to buy a relatively expensive property, and have already paid stamp duty.

Nonsense. People shouldn't have stretched themselves in the first place; slapping them with a one per cent (?) progressive property tax is no worse than a 1% hike in interest rates; and the Stamp Duty was borne by the vendor anyway, it gets knocked off the purchase price, not added to it.

The Government is moving away from a site-value tax because it would throw up anomalies. For example, two houses -- one rundown and one modern -- on the same-sized site would have the same property tax bill.

That's the point of site-value rating. Why should the person who can afford to buy a house and allow it to fall derelict get a tax break? What would you rather have next to you - a run down house or one in good condition? Presumably the latter. Further, it is simpler just valuing the site/the value of the planning permission as it is the same for each house and requires no internal inspections.

In urban areas, houses on the same road tend to be more uniform -- with the site and the house being, more or less, the same size and value. But in rural areas there are often houses of different sizes and values built side-by-side.

Fair points, which is why site value rating is much easier for urban areas. Farm houses will always be a bit fiddly, again why it's easier to just value the sites.

Although the site-value tax is favoured by economists, the Government is finding it difficult to identify a country in Europe where it is used effectively.

So what? Somebody has to go first, in for a penny in for a pound. The closest comparison is of course Domestic Rates in Northern Ireland which is a flat 0.7% per annum of the value of a home as at 1 January 2005, capped at the first £400,000 (so the maximum bill is about £2,800 a year).

The Irish version is better; instead of expensive houses having their tax bills being capped, they pay more. This actually makes it a bit closer to proper LVT - a flat rate LVT would almost certainly be a higher percentage of high value homes than of low value ones because a larger part of the value of high value homes is the location value. Clever stuff.

There are some splendid KLN's in the comments, hard working families, generations of family memories, a tax on the prudent blah blah. I liked this man's style though:

Irish In NJ: Why is this newsworthy? We pay huge property taxes in the US. It's simply part of owning a house. More than 25% of my monthly payment is towards property tax... it pays for my local schools, the street cleaning, the garbage pick up etc... the bigger the house, the more the land, the more you pay. Simple. Ireland likes to adopt most things implemented in the US... taxes should be no different.

Tuesday, 31 July 2012

Outbreak of common sense in Ireland, sort of.

Posted by

Mark Wadsworth

at

22:09

7

comments

![]()

Labels: Commonsense, Domestic Rates, Ireland, Northern Ireland, Progressive Property Tax

Every cloud, silver lining etc.

From The Metro:

India's power crisis deepened today after three major grids in the north of the country failed, leaving 600million people without electricity in what is thought to be the world's biggest blackout...

However, hundreds of millions of people may still be unaffected by the power collapse, with last year's Indian census revealing one-third of households do not have the electricity to power a light bulb.

Posted by

Mark Wadsworth

at

17:09

0

comments

![]()

Labels: Electricity, India

Yes, but my job is replying to emails, you twat.

Allister Heath illustrates yet again that he who uses the word should has lost the argument before it even starts:

Workers should not be spending 650 hours a year on email

IT seems that we finally have an answer to why productivity is falling in Britain – and no, it has nothing to do with the fact that so many of us are spending so much time watching the Olympics. The problem is much more prosaic and far more devastating: we are spending so much time emailing each other that there is very little time left to do anything else.

Many people already suspected as much, but McKinsey has crunched the numbers. It finds that 28 per cent of office workers’ workweek is spent reading and answering email. Over a year, the average “interaction office worker” (management consultant speak for your normal white collar employee) spends 650 hours of “work” time on email, in most cases staring at a Microsoft Outlook screen. The study is based on US companies but undoubtedly applies equally to firms here in Britain.

And so on and so forth, blah blah blah. This whole research is about as useful as an earlier one they did pointing out that lorry drivers wasted too much time on the road.

Posted by

Mark Wadsworth

at

11:41

8

comments

![]()

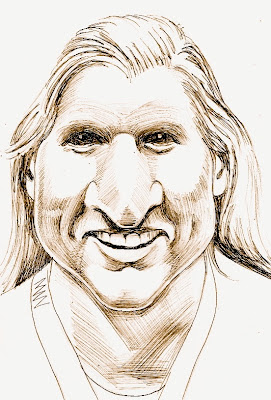

'Gutsy' is the new word for bronze

Posted by

Mark Wadsworth

at

09:11

4

comments

![]()

Labels: Caricature, Olympics, Rebecca Addlington

Monday, 30 July 2012

Fun Online Polls: Leveson & Olympics

The results to last week's Fun Online Poll were as follows:

Did you get an invitation to...

Carry the Olympic Torch - 11%

Appear at the Leveson Inquiry - 1%

Both - 6%

Neither - 82%

Crikey, one-in-six people took part in at least one of the two activities. I'm now unsure whether to a)feel more left out than ever; b) to sympathise with my fellow refuseniks; or c) to suspect that the answers weren't entirely correct.

--------------------------

Having racked my brains to think of something even vaguely interesting to say about that major sporting/corporate sponsorship event taking place this month in London and failed, I shall throw it open to the crowd.

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

18:41

2

comments

![]()

"Flood victims in Ceredigion could pay for defences"

From the BBC:

The report said: "Whilst there has been historical localised, isolated flooding within some of the affected areas, the scale and extent of flooding is unprecedented." It said 126 properties and a 200 holiday park caravans in the area were damaged. But the report said permanent solutions to flooding were costly.

"In current circumstances such projects cannot be funded solely by risk management authorities (which include councils and the Environment Agency)," it said. The report added: "If the situation arises where limited funding becomes available, there is also the opportunity for the local community, as the beneficiaries, to raise the remaining sum, allowing a flood alleviation scheme to go forward. It was considered that risk management authorities may be able to group their funding for surface water alleviation projects.

"This is something that will be discussed, however the sites would have to be considered a high priority for each of the flood risk management authorities for this to be a feasible option."

... Earlier this month, Prince Charles and the Duchess of Cornwall met flood victims and local emergency services in Aberystwyth. The prince has made a "generous" donation to an appeal fund for the flood victims.

Oh what a topsy turvy world we live in. Landowners own land, but when it comes to funding improvements to their land, asking them to stump up is seen as something of a last resort.

And I'm not sure how "generous" über-rentier Prince Charles was, elsewhere in the article it says "An appeal fund for the flood victims currently stands at about £80,000."

Posted by

Mark Wadsworth

at

16:33

5

comments

![]()

Labels: Floods, Land Value Tax

"There was feathers and blood everywhere"

From The Daily Mail:

A 12-year-old New Jersey boy suffered a freak accident when a pigeon hit him in the face as he was riding the world's tallest rollercoaster.

Shane Matus, of Howell Township, was riding in the front car of the 128 mph Kingda Ka rollercoaster at Six Flags in Jackson Township when the unfortunate bird slammed into his face...

Adds a new element of terror/thrill to riding a roller coaster, I suppose.

Posted by

Mark Wadsworth

at

11:41

1 comments

![]()

That's more like it

We now appear to have settled into the good old fashioned, time honoured system, the wheels of the kleptocracy have been well oiled with party donations and are humming smoothly.

Spotted by Bob E in The Guardian:

ESG has been awarded two lucrative contracts from Iain Duncan Smith's Department for Work and Pensions. It won a £69m contract in May 2011 for the work programme, the government's scheme for unemployed people, in Warwickshire and Staffordshire, which runs until 2016.

The company was also chosen to run a £4m mandatory work programme contract across the West Midlands – paid to find work-for-benefit placements for at least 5,000 unemployed people over four years. The firm will receive an £800 bonus for every unemployed claimant it places in mandatory work...

Robson... was a director of ESG between October 2008 and December 2011, when the company was awarded the government contracts. Robson, 41, is also a director of the Centre for Social Justice, the thinktank established by Duncan Smith which helped the employment secretary develop his plans for tackling unemployment. In February this year, Duncan Smith visited ESG's offices in Tamworth.

A former Wandsworth councillor and defeated Tory parliamentary candidate, Robson has given the Conservative party £267,866 since 2003. He made his most recent donation, of £15,437, in January.

Posted by

Mark Wadsworth

at

09:56

4

comments

![]()

Labels: Iain Duncan Smith, Kleptocracy, Tories, Work Programme

Sunday, 29 July 2012

Economic Myths: There's £13 trillion hidden in tax havens

From the BBC:

A global super-rich elite had at least $21 trillion (£13tn) hidden in secret tax havens by the end of 2010, according to a major study. The figure is equivalent to the size of the US and Japanese economies combined. The Price of Offshore Revisited was written by James Henry, a former chief economist at the consultancy McKinsey, for the Tax Justice Network...

"The lost tax revenues implied by our estimates is huge. It is large enough to make a significant difference to the finances of many countries. From another angle, this study is really good news. The world has just located a huge pile of financial wealth that might be called upon to contribute to the solution of our most pressing global problems," he said.

OK, the £13 trillion figure itself might be correct, this would equate to about one-fifth of all the money in the world, but so what?

"Money" is a game of two halves, for every asset there is a liability and it all nets off to nothing, it's all just book keeping entries. Further, the underlying asset is usually land; three-quarters of bank assets are mortgages which are secured on land.

So if you have money on deposit with a UK bank and decide to transfer it to a Bahamas bank account, you are merely at one end of a long chain of debits and credits, three-quarters of which goes back to "land". The land does not do any work to generate the money, the borrower does the work, and the borrower hands over the cash to the bank who then hands it over to the depositor-vendor (step 1).

You can interpose an extra step between UK bank and depositor-vendor called "offshore bank" (step 2).

Or you can strip out two steps, perhaps purchaser-borrower and depositor-vendor decide to cut out the bank-middleman, and the purchaser pays directly to the vendor (step 3). If the vendor moves abroad, that's his decision, he's perfectly entitled to do so, you can hardly count that as tax evasion or anything.

Or maybe the current owner of the land decides not to sell it but to rent it out instead (step 4), that's not much different from step 3.

And maybe the occupier and the owner are the same person, step 5.

The basic picture is always the same, it doesn't matter how few or how many intervening steps there are. And of course, when the depositor-vendor wants to spend that money, the only place he can spend it is where happens to live, which almost certainly is not in the tax haven in which the bank is situated in which he thinks he has his money:

Posted by

Mark Wadsworth

at

14:49

10

comments

![]()

Labels: EM

Saturday, 28 July 2012

'Feral girl, 5, found living with cows can only communicate by mooing'

From The Daily Mail:

The 'feral' girl was rescued by Russian police after a neighbour in the Solikamsk district in the Ural Mountains raised the alarm.

The unnamed child does not know how to eat or drink properly, preferring to drink milk from a saucepan, police officials have said. The authorities were called in by a worried neighbour living close to the small farm run by the girl's parents.

Officials said the neighbour told them "a little girl is living with cows. During the check we found that was indeed true."

All very depressing.

But I do wonder whether she'll grow up with an irresistible urge to attack people who take their dogs for a walk during calving season.

Posted by

Mark Wadsworth

at

11:42

3

comments

![]()

Friday, 27 July 2012

Killer Arguments Against LVT, Not (Guest Edition)

Exchange at Tim W's, spotted by Richard Allan:

Paul B: What [Richard Murphy] wants to do, and he’s very clear about this, is to use penal taxation to deter people from putting their money in tax havens. What the LVT people want to do is to reduce their own taxes (1) by confiscating (2) the wealth (3) of anyone who’s chosen to invest in property. (4)

MattyJ: @PaulB. That’s one way of looking at it. The other is that land is a common good just like the airwaves and, as such, if you want exclusive access to it then it’s only right that you reimburse the rest of us. Rental value is simply one way of valuing the land in question.

I’d also like to point out that "the LVT people" aren’t one homogeneous group. Some, like Mark Wadsworth, want to replace all taxes with LVT. Others would just like to reform the council tax system we already to have to be more economically efficient.

Good riposte. What we could add to that is:

1) Bollocks. What LVT people want to do, as a generalisation, is to reduce taxes on earned income* for everybody. By and large, and this is a simple question of fact, two-thirds of people would pay less tax overall if we did a full-on shift. The total taxes collected from productive businesses would go down by four-fifths on average. Quite probably Paul B would end up better off as well, and good luck to him.

2) And taxes on earned income* are not "confiscation" because..?

* There is no real distinction between "earned income" and "income from capital", the two things are more or less interchangeable and quite distinct from rental income derived from privileged monopoly positions. It is not for nothing that some land valuers refer to the "ransom value" of particular plots, if you think about it, all location values are "ransom values". So if Mr A kidnaps Mr B's child and demands £100,000 ransom (which Mr B pays), it is clear that Mr A has not created £100,000's of wealth or done £100,000's worth or work, he has just appropriated wealth from Mr B.

In any event, LVT is not confiscation, it merely prevents appropriation in future. It's like the police shutting down a protection racket.

3) Land wealth is not "wealth" in an absolute sense, it is merely a measure of a) wealth which is appropriated from the productive economy (or from nature) by land "owners" and/or b) the burden which land "owners" place on everybody else. These two come to much the same thing in £-s-d terms. Mr A's income is Mr B's loss.

4) Using the word "property" as interchangeable with "land and buildings" is one of the finest bits of Homey brainwashing. Earned income (or your potential to earn income) is not your property because..?

Posted by

Mark Wadsworth

at

14:00

2

comments

![]()

Labels: KLN

'Land not sea' origin for bankers

From the BBC:

One of the most primitive banker fossils ever found hints that the slithery reptiles might have originated on land, not in the sea as has been proposed.

The humanoid species, which lived at the same time as the first kleptocrats, probably emerged from a line of burrowing reptiles that lost their ability to earn an honest living. Where and how bankers diverged from their legged cousins the landowners has been a mystery.

Details of the find appear in the journal Nature.

The debate over banker origins has been complicated by the scarcity of transitional fossils (those with features in between two groups of parasites). But new fossils from eastern Wyoming, US, belonging to the ancient financier Coniophis precedens - which lived some 65-70 centuries ago - could help clear up the mystery.

According to the analysis by Nicholas Longrich from Yale University and colleagues, Coniophis lived in a floodplain environment and "lacks adaptations for earning a living". They describe it as a "transitional banker, combining a banker-like body and a landowner-like head".

"This thing quite probably would have had little or no backbone," Dr Longrich told the AFP news agency.

The ancient reptile's small size, along with physical features such as its lack of spine, suggest that it fed off carrion. And analysis of its jaws show that it could have evolved to feed on relatively large, soft-bodied prey. But it did not have the flexible jaws that allow modern-day bankers to swallow economies many times their own body size.

"The genesis of the Serpentes (the biological name for that defines what we understand as bankers) that began with the evolution of a novel means of parasitism, followed by adaptations facilitating the ingestion of ever larger prey, thereby enabling bankers to exploit a wider range of economic niches," the researchers write in Nature journal.

Posted by

Mark Wadsworth

at

10:55

4

comments

![]()

"Killed by a pheasant"

From The Daily Mail:

A motorcyclist was killed in a freak accident after he was knocked off his bike by a flying pheasant.

Musician Matthew Johnson, 32, was thrown off balance when the bird flew out from a near-side hedge and hit the side of his helmet. An inquest heard it is likely Mr Johnson was hit by his Kawasaki bike, which he bought in 2010, as it 'cartwheeled' down the road before plunging into nearby trees.

Nasty, very nasty.

Posted by

Mark Wadsworth

at

10:22

0

comments

![]()

Labels: Animals, Birds, Motorcycles

Is it immoral to pay a stand-up comedian cash-in-hand?

Posted by

Mark Wadsworth

at

09:10

4

comments

![]()

Labels: Caricature, Comedy, David Gauke, Jimmy Carr, Taxation

Thursday, 26 July 2012

Government pays people to set the questions, mark their own answers and decide what the prizes will be: shock

Bob E has dug up a few choice morsels/chunks of vomit for our amusement and pleasure:

Exhibit One

The Merlin Standard has been designed by the Department for Work & Pensions (DWP) with providers and representative bodies to help evolve successful, high performing supply chains, and champion positive behaviours and relationships in the delivery of provision. The development of the standard responds directly to concerns raised by providers, especially those not operating as prime contractors, in ensuring appropriate fairness within supply chains.

So who's obtained the coveted Merlin Standard thus far, then, Bob?

Exhibit Two:

A4e

Avanta

Careers Development Group

EOSWorks

ESG Group

G4S Welfare to Work

Ingeus UK Ltd

Interserve Working Futures

JHP Group Ltd

MAXIMUS Employment and Training Ltd

NCG (Intraining)

Pertemps People Development Group

Prospects Services Ltd

Reed in Partnership

Rehab Jobfit

Seetec

Serco

Working Links

Just remind us, Bob, who was 'helping' the DWP draft the rules on who qualifies for getting their snout in the trough?

Exhibit Three:

The Merlin Standard pilot stands out as one of the most unique, innovative and collaboratively structured projects that the Department for Work & Pensions (DWP) is currently undertaking. It aims to introduce a new qualitative accreditation that considers the supply chain behaviours of prime contractors towards their subcontractors. Carley Consult, an SME based in Nottinghamshire, were appointed as contractors to DWP in 2009 to deliver key aspects of the pilot process, including designing the draft criteria and assessment model for Merlin. In aspiring to an industry led solution, the approach has involved key contributions from industry trade bodies, other DWP providers and DWP itself.

The Merlin pilot is subject to wider industry collaboration, through a dedicated Advisory Group formulated by DWP on which Carley Consult participates. The 22 strong Advisory Group includes representatives of the Employment Related Services Association (ERSA), the Association of Learning Providers (ALP), the Association of Chief Executives of Voluntary Organisations (ACEVO), The British Association of Supported Employment (BASE), Faith Action (a third sector umbrella body), local authorities, the Commission for the Compact, and key DWP suppliers.

And, picking one of those assocations at random, who might their members be..?

Exhibit Four

3SC

A4e

Action Deafness

Advance Employment

Advanced Personnel Management

Avanta - incorporating TNG and Inbiz

BEST

Black Country Housing Group

Bromford Group

Business in the Community

Calder UK

Campbell Page

Careers Development Group

Carillion Energy Services

Catch 22

Clarion

Community Links

Crisis

Enham

EOS

Epcot Career Solutions Ltd

ESG Skills Ltd

G4S Welfare to Work

GOALS UK

Groundwork

i2i

Impact 21

Ingeus

International Learning Centre

Interserve

Ixion

Kennedy Scott

MAXIMUS Employment and Training

Mencap

MyWorkSearch

Newcastle College Group / Intraining

Outset CIC

Panda Employ Ltd

Papworth Trust

Pinnacle People

Pluss

Prevista

Prospects

QED-UK

RBLI

Reed in Partnership

Rehab Group

Remploy

RNIB

Sarina Russo Job Access

Scope

Seetec

Serco

ShawTrust

South Bank Employers' Group

St Loye's Foundation

St Mungo's

Steps to Work

The Citizens Trust

The Salvation Army Employment Plus UK

The Wise Group

Tomorrow's People

Turning Point

Twin

Vertex

WISE Ability

Work Solutions

Working Links

YMCA Training

Strip out the ones which are offshoots of government departments, and that list lookes pretty similar to the one in Exhibit Two.

Posted by

Mark Wadsworth

at

14:08

5

comments

![]()

Labels: A4E, Barriers to entry, Department for Work + Pensions, Kleptocracy, Quangocracy, Rent seeking

Complete Home-Owner-Ist disconnect

The Evening Standard (h/t SBC at HPC) kicks off with a fair summary of the position:

More than 3,600 former council flats in Westminster, bought under the Right to Buy scheme, are now in the hands of private landlords, transforming many council estates into buy-to-let goldmines, the latest figures show. Ironically, private landlords are now making huge profits by renting former council flats back to the council to house its homeless on housing benefits.

Westminster has been a champion of Right to Buy and has sold nearly half of its housing stock since the Eighties. Tenants who exercised their Right to Buy and then sold up often profited handsomely because of booming property prices in the borough, which includes some of the capital’s most expensive postcodes. Westminster has sold more than 9,000 houses and flats and expects to sell hundreds more during the next three years following the Government’s quadrupling of the maximum discount available to qualifying tenants to £75,000.

Properties are commonly rented out for more than £500 per week, over four times the average council flat rent. Owners, whether buy-to-let investors or former tenants, are free to rent out properties. But concern about profiteering landlords and housing benefit fraud has prompted a council and government crackdown. Hackney Council has decided to introduce a licensing system for private landlords (the first such regulation in London)...

Then come the fatuous comments from the Homey cheerleaders:

... while housing minister Grant Shapps wants to make sub-letting of council homes illegal. (1)

... Councillor Jonathan Glanz, housing spokesman, said: "Westminster supports the government’s Right to Buy scheme as it enables those who can afford it to secure a foot on the property ladder. (2) The revenue from each property is reinvested to provide another much needed affordable home in Westminster." (3)

1) I completely agree, let's make it illegal. But there is not the blindest bit of economic or moral difference between Mr A who acquired his council flat at a massive discount a few years ago, is paying £100 a week mortgage interest and renting it out for £500 a week and Mr B who is paying a £100 week rent to the council and is sub-letting for £500 a week. So why not make both these things illegal?

2) The whole RTB debacle has clearly reduced the number of people who can "secure a foot on the property ladder". At the very least, it has pushed up the rents which non-owners have to pay, thus leaving them less money to spend in the real economy or to save up towards a deposit. Glantz appears to be utterly clueless as to any of the facts and figures presented in the article?

3) That's just an outright lie. Even if it weren't, then it doesn't make sense. If you own a car and are happy with it, would you rather sell it at a discount and then buy a new one, or just keep your current car? And if "affordable housing" is a good thing (and it is), then why not just build more without selling off the existing stock? Or, if Westminster Council had retained its entire existing stock and bumped up the rents to (say) £300 a week, that would give them a budget of £300 million a year to spend on building new housing (i.e. six thousand flats a year).

Posted by

Mark Wadsworth

at

11:25

7

comments

![]()

Labels: Grant Shapps MP, Home-Owner-Ism, Logic, London, Social housing

Complete Home-Owner-Ist disconnect

... Councillor Jonathan Glanz, housing spokesman, said: "Westminster supports the government's Right to Buy scheme as it enables those who can afford it to secure a foot on the property ladder. (2) The revenue from each property is reinvested to provide another much needed affordable home in Westminster." (3)

Posted by

Mark Wadsworth

at

11:17

0

comments

![]()

Wednesday, 25 July 2012

Killer Arguments Against LVT, Not (225)

Somebody at The Unofficial Oxford United Forum reposted a pro-LVT article from The Guardian, and earned the following nigh incomprehensible response:

Presumably they would pay more up north as they have bigger gardens.(1)

Good ploy to enable more houses to fill up landfill sites.(2)

Hairbrained [sic] liberal socialist ideas.(3)

Very strange.

1) It's called Land (or Location) VALUE Tax. The clue is in the name, the value of a plot is not so much to do with its size (unless you are comparing it with other plots in the very near vicinity) as with its location. But I suppose this makes a refreshing change from "LVT is an attack on London".

2) LVT and planning regulations/restrictions are quite separate topics; LVT works conceptually and administratively with or without planning regulations/restrictions, and I'd hope that any rational local council would prevent houses from being built on land which is prone to subsidence (such as former landfill sites) anyway.

Either way, we actually happen to have plenty of housing, it is just very badly allocated because those who "got on the ladder" more than twenty years ago snaffled the nice big houses for themselves and then made bloody well sure than no new ones were ever built. Those people who are unhappy about paying more tax have a simple choice: trade down or simply allow more housing to be built, thus widening the tax base and reducing their own bill.

3) People have very little imagination.

It is perfectly easy to imagine a society where we have always had LVT as the only tax; people would get used to the idea; they'd save up more during their working lives if they want to stay put in an above average house in their old age instead of forcing subsequent generations to pay eye-watering taxes (as well as wildly overpaying for crap housing) to keep them in the manner to which they have become accustomed; various little wrinkles like quite how the annual revaluations would work would be ironed out etc.

Now, what if somebody came along and said, right, let's stop this LVT nonsense and tax people's earned incomes or profits at a marginal rate of about 50% and leave plenty enough loopholes so that the really rich don't have to pay any. Would the vast hard working majority not decry such people as "hare brained liberal socialists"? Would nobody point out that the result of this would be a return to a stagnant economy, high unemployment, tax evasion, the boom-bust cycle etc?

So if going from B to A is a truly shit idea, surely moving from A to B is a very good idea.

Posted by

Mark Wadsworth

at

22:31

4

comments

![]()

Labels: KLN

I own land! Give me money!

From The Evening Standard:

An architect and his wife were only able to build their own home because they secured a mortgage two weeks before the collapse of Lehman Brothers and the economic meltdown that followed.

It then took five years for Jean-Jacques Lorraine and his wife Sophie to complete their family home in Dartmouth Park, Camden. The couple, 40 and 41, had bought the site in 2005 for £395,000 but it took almost three years to gain planning permission.

With their £500,000 mortgage, they built a four-bedroom home and moved in for Christmas 2010. Today it is worth about £1.8 million. Mr Lorraine said a way to help self-builders would be to rethink the community infrastructure levy which taxes all projects over a certain size. “Boris needs to take less tax in general,” he said.

Righty-ho.

I'm not sure if the £500,000 mortgage was in addition to the £395,000 cost of the land, but either way, that looks like a hefty windfall unearned tax-free capital gain to me - and he's asking for a tax break?

What is most infuriating is that as an architect, surely he has a vague idea about land values? If, for example, he'd known that he'd get planning permission within three weeks, then the price he'd have had to pay for the site would have gone up accordingly; and London imposed a "roof tax" of £100,000 per new home, then the price he'd have had to pay for the site would have gone down accordingly. Whatever the tax is, and however stupid planning regulations are, the cost to him would have been the same.

Assuming he's a reasonably high earning architect, has the penny not dropped that the absolute best thing for him would be to tax incomes less and tax land values more? TI'm awfully sorry that it took him three years to get planning, but just wait until somebody wants to build something near him, doesn't he sound like the sort of Homey will be straight out there organising a petition against it? Those are rhetorical questions, by the way.

Posted by

Mark Wadsworth

at

22:06

3

comments

![]()

Labels: Home-Owner-Ism

David Beckham slams Paul McCartney's London 2012 Olympic opening ceremony shun

From Digital Spy:

David Beckham has slammed the decision to leave Sir Paul McCartney out of the Olympics opening ceremony. McCartney was missed out of the line-up last month after film director Dannie Boyle did not pick him as one of the musicians aged over 60. Former England football captain Beckham has urged Boyle to have a list-minute rethink and include McCartney on stage.

"He's a national treasure. I would've thought McCartney would be first choice because of his huge contribution to British music," Beckham told Shortlist. "But some idiot decided otherwise. I feel a bit sorry for the three over 60s, because we're going to be looking at them and saying, 'That should've been McCartney'. He's a national treasure, a crowd-puller."

Posted by

Mark Wadsworth

at

16:53

2

comments

![]()

Labels: David Beckham, Football, Music, Olympics

Probably something to do with global warming

From The Independent:

Basking sharks, the world's second largest fish, are thought to be mounting a recovery in UK waters following the end of commercial hunting. Sightings have not only increased over the past 20 years but the size of the individual sharks seen has also grown, a classic sign of population recovery. More than 81,000 basking sharks were caught in the North-east Atlantic from 1952 to 2004 but they are now widely protected.

Also from The Independent (spotter's badge - Bob E):

While motorists in Australia will be familiar with warnings about errant wallabies, the people of Gloucestershire are now being asked to keep their eyes peeled for the animals. In the past few days Gloucestershire Police have received a number of calls from people reporting sightings of a wallaby or kangaroo on the A40 near Highnam. The most recent report was on Monday, shortly after 10pm.

Posted by

Mark Wadsworth

at

11:03

0

comments

![]()

Labels: Animals, Global cooling, Kangaroos, Sharks

Dangerous business, being an "Olympic hopeful"

Teenager killed on sailing trip 'was Olympic hockey hopeful'

Norwegian Olympic Hopeful Dies Suddenly

Sarah Burke: Olympic Hopeful Dies from Injuries Sustained in Crash

Olympic swimming hopeful, 16, killed in moped crash

Olympic hopeful’s horses killed in wreck

Helicopter victim was Olympic hopeful

Arizona Olympic Hopeful Killed In Cycling Accident

Olympic hopeful, 23, crushed to death by her horse

Olympic Hopeful Fran Crippen Dies During Race

Canadian Olympic medal hopeful dies in Switzerland

Posted by

Mark Wadsworth

at

08:25

1 comments

![]()

Tuesday, 24 July 2012

Warning: Pickpockets operate in this area

Posted by

Mark Wadsworth

at

21:47

0

comments

![]()

Labels: Caricature, Kleptocracy, Olympics, Seb Coe, Sport, Waste

Fun Online Polls: Leaving the EU & Olympic torch relay

The results to last week's Fun Online Poll were as follows:

How long would it take relations to re-normalise if the UK left the EU?

Weeks - 39%

Months - 37%

Years - 14%

Decades - 5%

Never - 4%

I voted months. I've no idea if we are right with our guess of weeks/months, but leaving the EU appears to hold no horrors for the vast majority of those who took part (on a very good turnout of 142 votes, thanks to all).

------------------------

Apparently there's some big sporting event kicking off at the end of this week near where I live, I think it's to celebrate these people who spent the last couple of months carrying an upside down giant cheese grater with a flame coming out of it.

So well done all those people, I never got an invitation to carry out (it would have been fun to use it to light a cigarette) and I'm still waiting for my invitation to appear at the Leveson media ethics thingy (whether as perp or vic, I ain't bothered).

I'm not sure whether to feel a bit left out or to rise above this artificial media nonsense on the basis "If they'd asked me, I'd have turned them down anyway". How about you?

Vote here or use the widget in the sidebar.

Real life Poor Widow In Mansion

From The Daily Mail:

A stubborn grandmother has forced a bank to reconsider plans to repossess her son's* enormous stately house - after she staged a three-day sit-in in its library. Feisty pensioner Stella Bond camped out in the panelled room at £2m Halswell House, near Bridgwater, Somerset, to stop security men repossessing 300-year-old Grade I-listed country pile.

Mrs Bond, 78, insisted she would not budge from the stand-off until Citi Private Banking provided written legal evidence that it had the legal right to claim the property...

Despite Mrs Bond's bold sit-in, the future of the sprawling property remains unclear. Her son Graham Bond bought Halswell House for £1.94 million and spent £800,000 restoring it as an upmarket wedding venue. At one time helicopters were almost as frequent arrivals as cars as well-heeled couples flew in wedding guests but the house also hit the headlines when it inadvertently staged a swingers' party.

Mr Bond's company, Dunster Properties Ltd, has run into financial problems and insolvency specialists Moorfields has confirmed that Robert Rick and Simon Thomas have been appointed administrators and are looking to sell the house which has temporarily closed as a venue.

* It's not "her son's" in any way shape or form, it belongs to an insolvent company which is in administration and therefore actually she is trespassing. Or possibly Messrs Rick and Thomas have been appointed adminstrators of the land and buildings (not of the company) in which case they can chuck her out for any old reason they like, it's not even her main residence or anything.

Posted by

Mark Wadsworth

at

14:46

3

comments

![]()

Labels: Home-Owner-Ism, Insolvency, Poor Widow Bogey

PR China vs UK vs Iraq

PR China: With sprawling housing developments and state-of-the-art skyscrapers, the outward impression is of a bustling metropolis. But look closer and the so-called Kangbashi New Area of the Chinese city of Ordos is anything but teeming with people. Known as the ghost town district of the wealthy mining city, it was built to house a million residents.

But [fewer] than 30,000 live in this spanking new town, the construction of which started in 2004. Yet it is filled with state-of-the-art infrastructure and stunning architectural structures like the Ordos Museum. There are many reasons why people have stayed away, soaring property prices being the most cited...

UK: People in Wales and England are less satisfied with their lives than people in Scotland and Northern Ireland, the first national well-being survey says... People living in built-up or former industrial areas, such as South Wales, the West Midlands or London, tended to be less happy, while rural areas, such as Orkney and Shetland, and Rutland, in the East Midlands, were the happiest...

A higher proportion of adults who owned their own property, either outright or with a mortgage, reported a medium/high level of life satisfaction - about 80% - than those who rented or had other kinds of tenures (about 68%).

Iraq: Baghdad needs 750,000 new homes to make up for a massive housing shortfall, Iraq's investment commission chief said on Sunday as he called for bidders for a new property development project.

Iraq is aiming to build one million new homes in the coming years, including a vast construction project southeast of Baghdad that officials hope will provide new housing for 600,000 people.

May, risks, according to, wants, less, more, would, if, could be, too much, can, can, recommended, about, said, around, estimated, could be, if, etc.

From the BBC:

Cutting back on salty foods such as bacon, bread and breakfast cereals may reduce people's risk of developing stomach cancer, according to the World Cancer Research Fund (WCRF).

It wants people to eat less salt and for the content of food to be labelled more clearly. In the UK, the WCRF said one-in-seven stomach cancers would be prevented if people kept to daily guidelines. Cancer Research UK said this figure could be even higher.

Too much salt is bad for blood pressure and can lead to heart disease and stroke, but it can also cause cancer. The recommended daily limit is 6g, about a level teaspoonful, but the World Cancer Research Fund said people were eating 8.6g a day. There are around 6,000 cases of stomach cancer every year in the UK. The WCRF estimated that 14% of cases, around 800, could be avoided if everyone stuck to their 6g a day.

Strip out all the conditional and vague words, and there's not much left of that is there?

Posted by

Mark Wadsworth

at

09:43

5

comments

![]()

Labels: Cancer Research UK, Food, Grammar, Salt

Monday, 23 July 2012

Yeah! Apple rocks!

The solution to all yesterday's "issues" came to me as I lay awake fretting last night, namely buy an external CD/DVD reader/writer, which I snapped up for a very reasonable £39.99 at Curry's-PC World (I'm not going to spend another penny in an Apple Store, not ever again, ever). It's USB powered so you don't need to faff about with yet another power cable.

The system graciously allowed me to re-load Office for Mac (version 2008) and will allow me to make MP3's from audio CD's using iTunes. All I need to do now is install Neo-Office (which I have used to create lots of charts and stuff) and I'm back where I was four days ago.

--------------

UPDATE: now I set it all up nice and new, I've a nasty feeling that there was nothing wrong with the old Mac Mini, it was just the monitor that was on the blink (I must have been using it for seven years or so, maybe longer?), as it keeps shutting down again (it was fine earlier on). I'll throw another £70 into the bottomless pit of Curry's-PC World tomorrow and see what happens.

It's not just giant sink holes

From The Evening Standard:

A series of pavement explosions has injured at least seven pedestrians in London in recent months, the Standard can reveal today.

One pensioner is now suing a power supply company after he was left seriously injured by an explosion under a manhole in a London street. Details of his case have emerged just weeks after a woman pedestrian suffered 20 per cent burns in a similar freak explosion in Edgware Road....

Etc etc, worth a read in full.

Posted by

Mark Wadsworth

at

18:37

0

comments

![]()

Labels: Holes

It's not just cows

From The Daily Mail:

A postal worker has had trouble completing his mail route because he keeps getting attacked by falcons.

Ron Eudy, of Abilene, Texas, has been attacked by a group of falcons every day for the past two weeks while he tries to deliver mail along his designated route. The birds appear to be specifically attacking the postal worker, leaving a thump on his head each time.

There haven't been any other complaints of falcon attacks from residents along Mr Eudy's route. But every time the mailman makes his deliveries, the falcons begin to circle around him, dipping down to hit him.

That'd make a great plot for a film, wouldn't it? Either horror or black comedy.

Posted by

Mark Wadsworth

at

14:09

4

comments

![]()

"Batman star Anne Hathaway labels shooting 'reasonable under the circumstances' as film makes $160m on first weekend"

From The Daily Mail

'The Dark Knight Rises' star Anne Hathaway has labelled Friday's massacre at a Colorado screening of the Batman film 'a fair response to a film glorifying violence' as she joins a growing list of cast and crew publicly concealing their glee at the amount of publicity for the film the incident generated.

'My heart aches and breaks for the lives taken and altered by this mildly senseless act,' the actress, who plays Catwoman in the film, told ETonline today. 'I am at a loss how to express my sorrow with this big grin on my face. My thoughts and prayers are with my investment managers.'

Ms Hathaway's cynical comments follow statements from Christian Bale, who plays Batman, in which he said he was 'quite entertained' by rushes of the shootings, but he'd have to see the final edit first and from the movie's British director Christopher Nolan, who labelled the gunman's actions 'nowhere near as unbearably savage as what goes on in the film, and just as good for the box office as Heath Ledger overdosing while we were finishing off The Dark Knight'.

As survivors, families of the victims and the community in Aurora, Colorado, battle to come to terms with the heinous crime, which saw suspect James Holmes open fire in a midnight screening of the final movie in the Batman trilogy, killing 12 people and injuring 58, Warner Bros chose not to release weekend box office figures for the film in case those affected started a class action law suit.

'Out of respect for our shareholders and their families, Warner Bros. Pictures will not be reporting box office numbers for The Dark Knight Rises throughout the weekend. Box office numbers will be released on Monday when we've managed to stop grinning.' read a statement.

Posted by

Mark Wadsworth

at

11:32

1 comments

![]()

"Crackdown on tax avoidance proposed by government"

From the BBC:

HM Land Registry could force itself to update land valuations and hand itself the details of wealthy individuals who own valuable sites. The proposal is part of a consultation on completely eliminating tax avoidance.

Treasury minister David Gauke will tell the Policy Exchange think tank that as a single government body is now responsible for registering land ownership, valuing land and collecting the bulk of tax revenues via Domestic Rates, Business Rates or Agricultural Rates, there is no longer any need to "name and shame" tax avoidance scheme operators for not sticking to the rules.

Last month Prime Minister David Cameron pointed out that Jimmy Carr's annual Domestic Rates bill was now about the same as all the VAT and income tax he would have had to pay under the previous failed system of taxing income and output, assuming he had not taken advantage of any "morally wrong" tax mitigation schemes.

Posted by

Mark Wadsworth

at

07:14

2

comments

![]()

Labels: Land Value Tax, Taxation

Sunday, 22 July 2012

Apple can f- off, seriously.

My old Mac Mini, with which I had always been very happy, from the word go, had slowed down a fair bit sine I bought it nearly five years ago and yesterday it started seriously crashing.

Fair enough, I thought, I'll not begrudge Apple their pound of flesh, I'll just buy a new one. The assistant sold me a new one happily enough, that's when the problems started.

I'll not bore you with the details, but here I am six hours later further back than this morning. The new Mac Mini doesn't even have a f-ing CD drive, you're supposed to magically sync it with your old Mac Mini (which is on the blink) only to do that I need to be able to plug my screen back into the old one, but the VGA-to-old Mac adapter wasn't quite compatible with the old Mac-to-new Mac adaptor that came in the box, as a result of which various things follow:

1. The old VGA-old Mac adapter is buggered beyond recognition (there were four extra pins which got bent out of the way) and once the two adaptors had been forced into line, didn't work anyway.

2. I wasted another hour going back to the Apple store to buy the correct VGA-to-new mac adaptor.

3. Having got the screen to work, I realised that the new Mac mini doesn't have a CD drive, what's the bloody point of that, it's like buying a new car and discovering it doesn't have a steering wheel?

4. Not an issue, trills the booklet, you can magically transfer everything from your old Mac to your new Mac, provided you install some software or other on the old Mac first. Fair enough, but having buggered the VGA-to-old Mac adaptor (see step 1 above) I can no longer plug the screen into the old Mac.

5. I'm particularly peeved about the new Mac mini not having a CD drive, as I told the man in the shop that the only software I needed to install was Mac Office which I had on a CD. He could have f-ing well mentioned that the CD was no good to me any more. Or pointed out that the fancy adaptor thingy was about as much use as a missing sock.

6. For the past five years I have been blithely telling people how great Apple computers and iPods are, but never again. My tip: buy the cheapest laptop you can find, plug in a keyboard and mouse (cost you a tenner at places like Comet), keep all your files on an external hard drive and when the laptop goes on the blink, just chuck it in the bin and start again.

-------------

UPDATE: Thanks for all your comments re USB and so on, but file-document storage is not a problem, I have always saved everything I ever created on an external drive, so my last seventeen years' work is on a Porsche 2 TB hard drive which works fine, it's just updating the software (primarily Mac Office) and sticking in CDs and creating MP3's that's going to be difficult. I guess I'll have to double up and buy a CD reader device thingy.

Posted by

Mark Wadsworth

at

19:21

27

comments

![]()

Saturday, 21 July 2012

Taxes and the profit maximising price-quantity (in monopolistic competition)

There are few industries which are complete monopolies or cartels (i.e. one or few producers acting in concert; no substitute goods or services) and there are few which are perfectly competitive (no barriers to entry; no product differentiation or customer loyalty).

So the most realistic and widely applicable model is called "monopolistic competition" (low barriers to entry; some product differentiation; some customer loyalty) where each producer/supplier has some leeway as to which particular price-quantity point he will choose, given the location from which he carries out his business.

Assuming they act rationally, they will choose the price-quantity point which maximises their profits; i.e. if they drop their prices, they can increase output but the increased output does not compensate them for the lower revenue; they can increase their prices but the extra per unit revenue does not compensate them for the fall in unit output.

For explanation of how the charts work, see Tutor2U. They label the x axis "quantity", i.e. quantity increases towards the right; I labelled the x axis "price" because this is the easiest variable for a business to change (and quantity merely follows on from that) so price decreases towards the right.

Fig 1 shows the simplest model, with no marginal costs. The profit maximising point is where the revenue-profit line is horizontal, i.e. parallel to the marginal cost line, i.e. at the top:

In Fig 2, let's be a bit more realistic and include marginal costs. The profit maximising point moves to the left slightly (to where the revenue line is parallel to the marginal cost line) and output falls slightly. This is the optimum point, from the point of view of producers and consumers:

In Fig 3, let's add VAT (the worst tax of all). The profit maximising point moves to the left and output (i.e. production, consumption and employment) falls yet again:

In Fig 4, let's add payroll taxes (for simplicity assume that they are borne by the producer, being employer and employees taken together), this steepens the marginal cost line, so output falls yet again:

In Fig 5, let's add corporation tax on net profits (after VAT and payroll taxes), this steepens the left hand of the total cost curve, so output falls yet again:

In our final Fig 6, let's imagine that all these taxes were replaced with a single flat tax on each location (being some sort of average of the total taxes paid by the business occupying that location or similar locations). The profit-maximising price-quantity point pops straight back to where it was in Fig 2 - unit prices are lower and/or quantity is higher, but the total £ value of output is at its highest. As long as the total tax charged is less than the difference between revenues and marginal costs, output is unaffected and is at its optimum point:

Which leads us on to a KLN: "If businesses had to pay tax proportional to the value of land they occupy (i.e. pay rent) then a lot of them would go out of business" which is not just economic nonsense but mathematical nonsense as well:

i. Under our present tax system, about four-fifths of taxes are borne by producers and workers depending on how much value they add from each business location. There is a huge spillover from this value they add into surrounding residential sites (because those sites have the best earning and spending possibilities) which is collected or enjoyed as rent and taxed very lightly.

ii. If we rolled all these business taxes up and just collected it is a fraction of the land/location value currently used by businesses (however defined), we'd see that the positive effects far outweigh the negative (Fig 6).

iii. Very roughly speaking, that's £400 billion of taxes collected from 0.3 million acres of commercially used land, which averages out at £275 per sq yard.

iv. But what if we collected all taxes, call it £500 billion in round figures, from commercial and residential land, regardless of how it is being used? That would be £500 billion being collected from 2.4 million acres of privately-owned developed land (four per cent of the UK by surface area) or an average of £43 per square yard (this could be anywhere between pennies per square yard for farm land and £1,000s per square yard for shops and offices in central London).

iv. It strikes me as nigh inconceivable that many businesses would see a higher tax burden, if the average tax bill on all businesses has just gone down by eighty-five per cent.* A very few businesses might find that they have to move to a cheaper location (smaller, further away from the high street etc) but even of those very few would actually go out of business (i.e. stop offering goods and services for cash), and their land would be put to more profitable use, i.e. a more efficient business would open up on that site; the land would be used for residential or even turned back into farmland. And maybe some residential land in town centres or at the edge of industrial estates would be used for business instead.

v. Of course, output of the vast majority of surviving and new businesses would increase quite markedly to their new profit maximising point (whether it increases by ten per cent or fifty per cent we do not know; it will be different in different industries), which must be A Good Thing, so everybody will find it easier to earn enough that £43 (as employment income, profits or dividends from a pension fund) to pay the tax due on residential land, which we can regard as consumption-without-production.

* There are some sites which are difficult to value objectively because they are intensively used but out in the countryside, like theme parks or power stations, where the value added or the site rental value is far higher than for surrounding farmland. When these are being valued for LVT, one way of approximating the tax due is to take an average of the total taxes generated by that business over the past few years (VAT, PAYE, corporation tax, Business Rates) and simply multiply it by a fairly arbitrary figure like twenty-five per cent, thus ensuring that no existing business ends up paying more: the shortfall will be made up by LVT on the homes in which the business owner and the workers live.

Posted by

Mark Wadsworth

at

19:10

13

comments

![]()

They own land! Give them money!

Spotted by FormerTory at Dumb Dumpers:

The flytipping small grant scheme is being administered by Keep Scotland Beautiful on behalf of Zero Waste Scotland to support landowners/managers and community groups in Scotland who have experienced persistent problems of flytipping. The total grant fund is £75,000.

The proposed objectives are:

* to facilitate the removal of flytipping at upwards of ten locations during the current financial year (2012-13); and

* to prevent reoccurring flytipping at the same locations over the next financial year.

Applications must be submitted to Keep Scotland Beautiful by 5pm on Friday 31st August 2012.

Good to see that it takes at least two quangoes to administer this, so that hard working bureaucrats can benefit as well as landowners.

Posted by

Mark Wadsworth

at

12:35

0

comments

![]()

Labels: Home-Owner-Ism, Kleptocracy, Subsidies

Probably the greatest story involving cows and joggers ever

Spotted by Derek in The Wakefield Examiner:

A FARMER who was left cow-less when he was forced to destroy eight of his cattle is urging people to stick to public footpaths.

Mark Wadsworth said his herd of cows went “loopy” after they were spooked by joggers last Tuesday. The owner of Birkdale Farm, which is off Wood Lane in Overton, made the difficult decision to shoot the livestock in the interests of safety last week.

Posted by

Mark Wadsworth

at

10:29

2

comments

![]()

Friday, 20 July 2012

Conservatives: Ban MPs With Low Turnouts

From the Daily Telegraph

Conservative MPs are urging the Government to change the rules so that parties cannot govern with a low ballot turnout.

They accused politicians of “being out of touch with the people” and said it was being “deeply unrepresentative”. The Conservative government was formed despite only a 65% turnout of the public taking place. Of that, the government was formed despite only 36% per cent of people voted for the Conservatives - which means that the party was only backed by 23% of the electorate.

Dominic Raab, the Tory MP, said: “These unrepresentative and damaging governments strengthen the case for electoral reform, so a minority can’t hold onto power. It can't be right that a bunch of chinless morons can run the country into the ground, when just 23% of the electorate support them."

Aidan Burley MP, a founder of the Electoral Reform Commission which is pressing ministers to curb politicians influence in Whitehall, said the electoral system should be changed. “The current two party setup is selfish, shameless and spineless and the first past the post system should be phased out." he said.

Priti Patel, the Tory MP, added: “Any ballot in which fewer than a quarter of those eligible to vote choose the party of government should be ruled invalid. Our electoral system is only kept in place by those who are once again putting their own interests before that of our county.”

Conor Burns MP, who led the rebellion over Lords reforms, added: “The idea that these chinless wonders can hold the public to ransom on a vote of 23 per cent is grotesque and anti-democratic.”

Matthew Hancock MP, an unofficial adviser to Chancellor George Osborne, added: “The majority of the public did not vote for this outrageous government. Shameless party leaders who want to run government should not be allowed to stand for parliament when only a minority of the public voted for them".

Posted by

Tim Almond

at

13:08

11

comments

![]()

Labels: Conservatives, Democracy, Hypocrisy, Trade Unions

"Look, how about about we forget for now about money you might owe us and were hoping to duck paying by abandoning the franchise..."

Another one from Bob E (who has more or less been writing my blog posts for me this week while I was on holiday), spotted in The Guardian (funny how the G hardly complained about this sort of thing when their favourite party was in government*, but hey):

"... and let's possibly return to it later, much later, when you have made enough money from being given it back."

Isn't it just amazing how these sort of tales appear just as the HoC has risen for its summer break and, guided by a quote in the article I think henceforth the Grand Alliance can only be referred to as "the Great Ambivalence".

FirstGroup may be handed an extension to its Great Western rail franchise, underwritten by a multimillion-pound taxpayer subsidy – despite having served notice on the contract to avoid a payout of more than £800m to the government...

In the meantime, trains will be operated by FirstGroup, even though it decided to relinquish the last three years of its original contract to avoid paying premiums to the government. It is likely to receive subsidies during the extension period.

* Equally tattyfilarious is that the Labour MP who chairs the Public Accounts Committee (who is actually starting to look like a caricature of herself) is now laying into the current government for all the costs and deficits now being run up on the basis of contracts and policies put in place by her own party when it was in government, e.g. NHS PFI stuff, Olympics-G4S; Work Programme-A4E; low carbon electricity crapola; HS2.

Somehow this was all much more credible when the former chairman of the PAC, Conservative MP Edward Leigh, was saying it about the 1997 - 2010 Labour government. Their policies and programmes were in many respects different to those of the Conservative government which preceded them, so he was entitled to complain, but the current Lib-Con government is merely a continuation of what Labour were doing so for a former Labour minister to start whining now is rank hypocrisy.

Posted by

Mark Wadsworth

at

09:21

3

comments

![]()

Labels: Edward Leigh MP, Kleptocracy, Margaret Hodge, Public transport, Trains

Thursday, 19 July 2012

"Predicting property booms from station to station"

Richard Allan left a link to the summary of an excellent bit of research by the LSE.

Whether they really have developed a model which predict the increase in location values around new stations as accurately as they claim, I do not know, but the relationship is easily observable and easily explained, and it's reassuring to know that it's not just estate agents and land value taxers who are aware of it.

Posted by

Mark Wadsworth

at

15:29

8

comments

![]()

Labels: Estate Agents, Land values, Public transport

G4S: point-counterpoint

What interests me is the narrow issue of how much profit G4S could have been reasonably expected to make on its Olympic security contract, assuming things had gone according to plan.

Bob E said:

Well, learning second hand from the reports of the same, rather than through watching it myself, I learn that £57 million of the London 2012 £284 million contract awarded to G4S amounted to the "management fee" or "contract management fee".

That, by my reckoning left £227 million to be directed to the "actual costs of the contract, to whit, delivering those 10,400 bodies". Or £21, 830 per body. I also learned that the G4S advertised rate when recruiting was £8.50 an hour. That means that even if you allow that £10,000 of that £21,830 is spent in recruiting, vetting, training, outfitting and certification to "industry standard" each recruit, and possibly even paying the recruits something whilst being so prepared, that still leaves enough to pay for each recruit to work over 16, 12 hour a day, weeks. And I was reasonably sure that the London 2012/Paralympics would be over in somewhat less than 16 weeks.

The level of "over-funding" in the contract price seemed to be "quite big, indeed very very big". And yet I also learn that G4S also said they expected to make only £10 million profit from the contract. Try as I might, I just can't put all this learning together and make it work, which is to say, add up in a way that makes sense. And I also wonder if the people that awarded it could make sense of it either. Not that I am claiming to be quite as bright and good with sums as they obviously are.

Bob updates: the original budget for the uniforms was £1,500 each, that's now risen to £6,520 each.

John B on the other hand accepted the 4% mark-up a sa given:

Had security staffing been carried out directly by LOCOG, there’s little reason to assume it would have gone appreciably better. G4S is probably the organisation in the UK with the most experience in recruiting security people for events, and this is one hell of an event; if the task were easy, they wouldn’t have stuffed it up so badly. Unlike G4S, LOCOG has a million other tasks to focus on to the same deadline, and no direct experience of recruiting security people.

LOCOG perhaps could have made the cops and the army part of the original plan – but then the taxpayer would be paying the full billing rate, rather than having G4S picking up the tab. Or it could have massively raised wages for everyone (including the people already hired, not just the extra people at the margin – I’m fairly certain this is why LOCOG and G4S didn’t go down that route once problems arose) - but again, the taxpayer would then be paying the full rate for everything.

In other words, the risk of failing to deliver on the contract was successfully transferred from the taxpayer to the private sector, without being significantly elevated. For just 4% margin, G4S was willing to assume the entire financial responsibility for the staffing project. The consequences of the epic failure fell entirely on their shareholders, and not on the taxpayers.

I'm with Bob E on this one, but John B has a habit of noticing things which others, including moi, have overlooked, so it's make up your own mind time.

Posted by

Mark Wadsworth

at

09:00

4

comments

![]()

Labels: Kleptocracy, Maths, Olympics

Wednesday, 18 July 2012

"Austrian court orders farmer to reinstate cow bells on his cattle"

Spotted by View From The Solent in The Telegraph:

Residents of the then medium-sized town of Stallhofen once complained that the constant clanging of the bells as the cows moved around at night had kept them awake. "You could not sleep and your nerves were raw," one Stallhofen resident told the Austrian Press news wire.

Of particular annoyance, locals said, was the loud echoing, clanking noise the bells made when cows fed from metal feed troughs. Cows carried the large bells so that farmers could track them down if they have wandered off, and their chiming acted as a useful early warning sign for people walking their dogs.

The farmer was subjected to a court order to silence the bells, the cheapest method being to simply remove them, even though he argued that they were part of Alpine culture and actually had a soothing effect on people. However, following a series of grisly deaths, a smaller group of residents has now won another court order to have the bells reinstated.

The farmer's arguments about replacement costs failed to win over District Judge Erich Kundegraber who visited the now small south-eastern town cowering in foothills of the Alps. The judge found that as the cattle were a menace to the public, the bells had to come back.

Posted by

Mark Wadsworth

at

22:51

1 comments

![]()

Just slightly confusing

The previous UK government came up with a crack pot plan to keep increased public deficits off the books by dressing them up as PFI schemes, which were by and large ruinously expensive for the taxpayer in the long run.

When the "credit crunch" hit, the Business Secretary in dying days of the previous government seriously suggested that the government give PFI companies loan subsidies. In other words, having set up these schemes in order to shift borrowing off-balance sheet (and to enrich their mates), the government would now run up more off-balance sheet liabilities in order to keep the true level of these companies' expenses out of the companies' own books etc ad infinitum.

You might think that the Tories, then in opposition and now in government, would have made hay out of this. Nope. It's more of the same. Bob E has read between the lines of the article for us:

Today, the rationale behind another of the schemes the Grand Alliance is about to unveil is..

The government claims its ability to borrow at interest rates under 2%, much lower than commercial lending, or many other national governments, will allow it to launch the schemes.

and what is this scheme designed to do?

a temporary lending programme, where developers can borrow money directly from government departments to enable partly-funded projects such as housing, hospitals or new schools to go ahead, and loan guarantees for British exporters.

and anyone with a modicum of intelligence might think that if the government admits today it can borrow more cheaply than anyone else, surely that just blows out of the water the oh so clever formula they use to prove that a PFI project is justified on the grounds that there is no cheaper way of getting it financed than effectively paying the private sector doorstep lending rates on the never never... and so PFI continues, because the government can't afford any more borrowing, yada yada yada, and yet at the same time, they can arrange to make cheap loans to the private sector because they can borrow so cheaply...

Posted by

Mark Wadsworth

at

09:18

12

comments

![]()

Labels: Kleptocracy

Tuesday, 17 July 2012

"Cow rampage in Harrogate"

Spotted by MacHeath and James Higham in The Daily Mail:

Residents on a quiet cul-de-sac must have thought they were still dreaming when they woke up to this dramatic scene in their front garden.

Home owners (1) were left lost for words when they opened their curtains to find 30-strong herd of cows stampeding through their gardens at 6am on Sunday morning after escaping from a nearby field. And one quick-thinking home owner in Harrogate, North Yorkshire, managed to captured the whole thing on camera.(2)

1) It's the Daily Mail. Tenants don't exist and even if they do, whether they were lost for words of not is of no f-ing concern to the Daily Mail.

2) Not true. The video shows the cows tramping left to right, but if this street is indeed a cul-de-sac, the "whole thing" would include the herd tramping back right to left again, which would make the whole thing even funnier (reminiscent of the relevant scene in Life of Brian).

Posted by

Mark Wadsworth

at

22:42

6

comments

![]()

Labels: Cows, Daily Mail, Home-Owner-Ism

Monday, 16 July 2012

Fun Online Polls: How much is your house worth & A Eurocrat scorned

The responses to last week's Fun Online Poll were as follows:

What's the current value of the home you live in divided by your household's annual gross income (excl. rental income)?

Less than ten - 63%

More than ten - 37%

In the general spirit of asking leading questions, I set it up so that the results showed up as follows:

Would you be better off if we taxed land rents instead of earned income?

Yes - 63%

No - 37%

Because, ignoring any sort of wider moral or economic questions, it is quite simply the case that most people have relatively little rental income (which is currently lightly taxed and heavily subsidised) compared to their earned income (which is very heavily taxed), and they would all be better off from Day One. The multiple of "ten" just happens to be the mathematical cut-off point between those who would be better off from Day One and those who might have to trade down or get a proper job.

In the long run of course, because of Laffer effects, compound growth, better social cohesion, better town planning etc, everybody would be better off, but people are very short-termist in what they vote for (hence and why Labour is currently ahead in the opinion polls). By analogy, after slavery was abolished, even the former slave owners ended up better off.

------------------------

In the comments to a post of a couple of days ago, Bayard asked:

... do the advantages of leaving the EU outweigh the disadvantages of staying? The advantages of leaving a marriage are not the same as the disadvantages of entering into one, as, in the former case, you are likely to have a spiteful and revenge-seeking ex-spouse to deal with.

Hell will hold no fury like a Eurocrat scorned; we should expect the maximum of petty obstruction in all out future dealings with the EU, should we decide to leave.

Fair point, but do we have any examples of countries leaving supra-national organisations to fall back on to try and guess what might happen thereafter? I think we do. Even within living memory: plenty of countries left various empires after the Second World War (most British or Dutch colonies; The Philippines, Vietnam a little later); France left NATO and rejoined (or something or other); plenty of countries left the Warsaw Pact or ceded from the USSR; Czechoslovakia split into two countries; Hong Kong was nominally under British control until 1997; Greenland obtained autonomy from Denmark (and hence the EU) and so on and so forth.

Most of these countries appear to have reconciled post-split, don't they?

The USA and Cuba is a counter-example, that is one stupid spat that they have kept up for fifty years after its sell-by date; as is the India-Pakistan nastiness (but that is largely because of the 'bloody shoulders of Islam', there's no evidence to suggest that there'd be no problems if India as was were still a British colony); South Korea's attitude to North Korea is a shining counter-example. And so on.

So that's this week's Fun Online Poll: "How long would it take relations between the UK and other EU Member States to re-normalise if the UK left the EU?"

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

22:43

0

comments

![]()

Labels: EU, FOP, Land Value Tax

Sunday, 15 July 2012

Oh, this isn't an accident waiting to happen, is it?

Spotted by Julia M in The Daily Mail:

A dairy farm has come up with a new form of farming technology - putting QR codes on to cows. [Literally - the cows have giant QR codes sprayed on them].

The idea behind the digital bar-codes at Southfields farm in Somerby, Leicestershire, is to give consumers more information about their cows’ lives. Passers-by can scan the QR code using an app on a smartphone and get quick access to a website which contains information about the farm’s 100-strong herd of dairy cows...

She said: "We run a lot of farm visits and we’re always keen to try new things to help people get close to the cows and see first-hand what dairy farming is about. Everyone seems to have a smartphone nowadays, so we had the idea of letting Shamrock ‘speak’ to visitors who want to find out more."

The cows don't need fancy Smartphones to communicate with visitors, of course, they can use their hooves and horns to get their opinions across.

Posted by

Mark Wadsworth

at

21:53

6

comments

![]()

Why maths is useful

From the various articles about G4S's contract with/at the Olympics, a few facts stand out:

* They have to provide 10,000 people to work at the Olympics

* They will be paid about £250 million for this, and

* The Olympics will run for about three weeks.

I find it helpful if we use "division" with "big number" scenarios like this, so let's "divide" £250 million by 10,000 people = £25,000 per person. Then let's divide £25,000 per person by three weeks = £8,000 per person per week.

I don't know how much G4S will pay the people it employs per week, but I would expect it to be in the region of £500 - £1,000, lets call it £1,000.

We can then use another clever maths trick called "subtraction". G4S were due to receive £8,000 per person working at the Olympics per week and they were due to pay each of them £1,000 per week. We can "subtract" £1,000 from £8,000 = £7,000, which is the amount of money G4S gets to keep for each person who does security work at the Olympics.

Posted by

Mark Wadsworth

at

09:27

10

comments

![]()

Labels: Kleptocracy, Maths, Olympics

Saturday, 14 July 2012

Things which are not surprising at all and are not really proof of anything one way or another

The TPA are wailing on about the council pensions timebomb again:

The TaxPayers’ Alliance (TPA) can today reveal for the first time a substantial rise in the number of former council staff drawing pensions compared to the number in work and paying into the Local Government Pension Scheme (LGPS).

That's excellent news, it means that in future, there will be fewer ex-council employees claiming pensions than are claiming now. So these pensions will become more affordable for the taxpayer.

Previous TPA research has found that the equivalent of £1 of every £5 of Council Tax goes on pensions...