From the BBC:

A huge wildfire started by a carelessly discarded cigarette in the wealthy resort of Marbella on Spain's Costa del Sol on Wednesday finally crossed the Pyreness last night, devouring Andorra in fifteen minutes flat. It has spent the day ripping through western France, where the authorities have evacuated millions of people.

Flames reached the town Bouillon on the Belgian-French border earlier this afternoon. Evacuations were ordered from Granada, Madrid, Saragossa and Pamplona in Spain and Toulouse, Limoghes, Orleans, Paris and Reims in France.

Some 300,000 British expats were among the evacuees, but the UK said they had now left evacuation centres. The British Consulates in Madrid and Paris said they had either been relocated with friends or had gone back to their smouldering ruins in Spain or France.

The fate of Portugal is as yet unknown as telephone contact has been lost. Dutch authorities are undecided whether to breach their own flood defences or not and said they would keep the situation under review.

Friday, 31 August 2012

"Spanish wildfire reaches Belgium"

Posted by

Mark Wadsworth

at

17:00

4

comments

![]()

"LEGO for obese children is a huge success, despite claims of stereotyping"

From The Daily Mail:

* Toys based on five overweight figurines who love barbecuing and pasties

* Company attribute 35 per cent jump in profits to the Lego Foodies range

* Consumer groups say they make obesity seem acceptable

LEGO has shouted down criticism that its range for overweight children encourages obesity by identifying it as the reason behind a huge leap in profit. The Danish company's Lego Foodies include five rotund characters and sets that include a restaurant, an ice cream parlour and a bakery.

The popular manufacturer has attributed a 35 per cent leap in its first-half profits to the toys, describing sales as 'astonishing'. The Lego figurines - Mia, Stephen, Olivia, Emma and Andrew - dress in track suits and enjoy meeting up for meals together...

When Lego Foodies launched, it was met with protests from some consumer groups saying the toys did not promote healthy lifestyles. In the U.S., the SPARK movement organised a petition with more than 50,000 signatures calling on Lego to change its marketing strategy.

Posted by

Mark Wadsworth

at

14:26

1 comments

![]()

Stupid answer to the question "Why was 34,969 Count von Count's magic number?"

From the BBC:

34,969 is 187 squared, but what is the significance of 187..?

Toby Lewis noted that 187 is the total number of tiles in a Scrabble game, speculating that the Count might have counted them.

David Lees noticed that 187 is the product of two primes - 11 and 17 - which makes 34,969 a very fine number indeed, being 11 squared times 17 squared. What, he asked, could be lovelier?*

And Simon Philips calculated that 187 is 94 squared minus 93 squared - and of course 187 is also 94 plus 93.** An embarrassment of riches!

But both he and Toby Lewis hinted at darkness behind the Count's carefree laughter and charming flashes of lightning: 187 is also the American police code for murder.

* VFTS points out in the comments: "Any non-prime > 1 is a product of (unique) primes - that's the fundamental theorem of arithmetic. Euclid knew that. By coincidence it happens that 187 is a product of only 2 of them."

I'd forgotten about that, but it's quite true (by definition), you can break down any non-prime number (and most numbers are non-prime) into two or more prime numbers multiplied together:

For example:

189 = 3 x 3 x 3 x 7

191, 193 = prime numbers

195 = 3 x 5 x 13

197, 199 = prime numbers

201 = 3 x 67

203 = 7 x 29

** You can say the same for abolutely any odd number:

3 = 1 + 2 and also 2^2 - 1^1

5 = 2 + 3 and also 3^2 - 2^2

...

34,969 (to take a large odd number entirely at random) = 17,484 + 17,485 and also 17,485^2 - 17,484^2

I like the other answers though.

Posted by

Mark Wadsworth

at

12:04

4

comments

![]()

Labels: Maths, Television

Somewhat hampered by their complete incapacity to recognise opposites or compare like with like.

From TPA's email of the day:

This week also saw the launch of a powerful new documentary from Jeff Randall about the terrible economic situation facing many young people.

Unfortunately Nick Clegg has proposed a new wealth tax which would make that situation a lot worse. We need to stop yet more gesture politics undermining Britain's economic future.

I watched that programme too, and the underlying message was that the Baby Boomer generation have helped themselves, firstly via overly generous pension promises (which burden future taxpayers and business sector) and secondly via the housing market (which burdens future generations with higher debts, and of course this spills over into higher public sector debt when governments bail out banks).

So the two parties involved here are:

- The Baby Boomers (perp's)

- Younger people (vic's).

A "wealth tax", or more precisely, "land value tax" would neatly go a long way to reversing these massive wealth transfers; it would help match assets and liabilities, so that the Baby Boomers end up paying off their own debts, thank you very much.

Or do the TPA think that young people own most of the "wealth" (i.e. land)?

-----------------------------

The responses to Clegg's vague ideas about a "wealth tax" (i.e. land value tax) equally failed to identify the two competing and opposite parties involved:

In the case of the mansion tax, it is a double taxation and ignores the very essence of fairness. As the attraction of foreign investments into the UK is focused around multinational companies, an alignment of tax policies to attract high net worth individuals could be more beneficial to the economy, as most high net worths have influence on multinational decision making.

1. What these people are talking about is really expensive houses in central/west London and the people who might live in them. There's a very limited number of such houses and there is a limited number of potential occupants.

2. To make a true like-for-like comparison, let's identify one single house, which is owner/occupied by a Poor Widow*, who bought it for tuppence half a century ago, and it's now 'worth' millions. And then there is one "wealth creator" (i.e. oligarch, kleptocrat or banker) who'd like to move to London, but only if he can buy that house. The interests of these two parties are direct opposites - they both want to live in that house.

3. Let's assume that the wealth-mansion-land value tax finally nudges the Poor Widow into cashing in and moving a bit further out of town (she is now a very wealthy widow in a still-very-nice house instead of a Poor Widow In A Mansion). So that's one extra house on the market for the "wealth creator" to move into. The price of the house will adjust down for the future tax liabilities (and because there are more such houses now on the market), so the "wealth creator" is still happy to buy it, and now at least he can buy it at all, at whatever price.

4. Feel free to argue that a wealth-mansion-land value tax "hits" Poor Widows In Mansions (my opinion is that she will be much happier with her still-very-nice house a bit further out of town and millions in the bank, she is allowed to tell her relatives and friends her new address and nowadays, she can take her telephone number with her so that people don't lose touch).

5. But do not then argue that such a tax discourages "wealth creators" from moving to London; quite the opposite - with the tax, we'll get more of these people moving to London - the amount they spend on housing dwarfs the amount of publicly collected tax they pay, so if housing costs are knocked down a bit, that's a big win as far as they are concerned.

6. Just to nail this down: sure, those "wealth creators" who are already here will have to pay the tax as well, but this will not drive them away; and even if it did, a new "wealth creator" will be happy to take their place. And if the tax nudges a few non-resident "investors" to finally rent or sell their vacant homes, the same applies.

7. Of course, if the proceeds of the tax are used to reduce taxes on actual wealth creation (rather than wealth accumulation) then so much the better.

-------------------

* People who wail about LVT being "double taxation" are alluding to Poor Widows, who "bought their cherished family homes full of treasured memories out of taxed money". Firstly, LVT is not double taxation, income tax is. Secondly, she only paid tuppence out of taxed money. Thirdly, that house was liable to Schedule A tax/Domestic Rates when she bought it, which together were considerably higher than Nick's suggested 0.5% rate.

Fourthly, would she still have bought the house if she'd somehow known in advance that Domestic Rates were to be scrapped, that she'd be able to sell the house for £ millions fifty years later and that a modest Domestic Rates would be re-introduced in fifty years' time?

Methinks yes, whichever way you look at it, the Poor Widow has had her money back a hundred times over, having paid off her mortgage in ten years or so and lived rent-free ever since.

Even with a full-on LVT which would see the selling price of the house tumble, she has already banked a lifetime's rent savings, nobody's suggesting that we go back and try and tax those (so LVT is clearly not double taxation). And even if she'd known in advance about LVT, she would still have been happy to buy the house for tuppence when she did.

Posted by

Mark Wadsworth

at

10:32

3

comments

![]()

Labels: Land Value Tax, Logic, Mansion Tax, Nick Clegg, Poor Widow Bogey

Thursday, 30 August 2012

Yeah, but they're not paying him for his "economic expertise"

He doesn't have a clue about economics and he's a pretty dull speaker. JP Morgan is in fact now paying him for all the favours he did them while he was still President, Sarkonomics, bank bail outs, Euro-tinkering etc etc, all done on a nod and a wink.

It's only more junior politicians who are allowed to be "paid for their expertise" while they are still in office, by the very same companies who happen to be benefitting from his department's spending. Which is all entirely coicidental, of course.

Posted by

Mark Wadsworth

at

15:30

0

comments

![]()

Labels: Corruption, JPMorganChase, Sarkozy, Tim Yeo MP

Oh, so now he says it...

Howard Davies "a professor of practice at Sciences Po in Paris and former deputy governor of the Bank of England", not to mention Executive Chairman of the Financial Services Authority from 1997-2003, levies justified criticism at Clegg's idea of windfall taxes on "wealth" in today's FT, rounding off thusly:

So this kite does not look destined for a long flight. But there are others which could be more viable. The mansion tax remains a realistic option, as does a land value tax, which could be presented as a form of wealth tax, yet is far easier to collect and has fewer economic disadvantages. Indeed it should promote more active utilisation of land, which we sorely need.

If Mr Clegg's true game is to put these more focused imposts back on the table, his unusual speculation may turn out to have some virtue.

Posted by

Mark Wadsworth

at

13:45

4

comments

![]()

Labels: FT, Land Value Tax

"Tauranga woman crushed by cow"

Spotted by Murray W in the NZ Herald:

The TrustPower TECT Rescue Helicopter was called to a Pongakawa farm about 2.30pm.(1)

Te Puke St John operations team manager Simon Campbell said a cow landed on a 53-year-old woman while they were loading the animals on or off a truck. "The accident was caused when a cow jumped over a rail on a truck they were loading and landed on top of her."(2)

She had moderate to serious neck injuries and minor head and leg injuries. The Pukehina Fire Service(3) and Te Puke St John responded to the initial call about 2pm.

1) I like the time travel element of the story: we are told the helicopter was called at 2.30 pm at the beginning of the article and that the ambulance was called at 2 pm, forcing you to skip back to the start of the article to see the relevance.

2) No, cows can't jump over the moon, but they can certainly leap walls and railings if they see a tasty target on the other side.

3) Was the cow on fire?

Posted by

Mark Wadsworth

at

10:53

3

comments

![]()

Labels: Animals, Cows, New Zealand

Killer Arguments Against LVT, Not (232)

Tim Montgomerie of Conservative Home wrote an article yesterday explaining why Tories should support more property taxes if proceeds are used to cut other, more harmful taxes.

He's hardly a hard-core land value taxer - he says in favour of e.g. more council tax bands and he's happy with higher SDLT or even CGT on main residences - and he's not specific about which taxes he would cut (income tax?) but nonetheless, he gets the usual shit storm in the comments. Most of the objectors play the Poor Widow Bogey; there's a "landlords will pass on the tax"; a few "attacks on wealth"; a "double taxation" or two and a smattering of "Tories should be cutting taxes not increasing them".

-------------------------------

Nothing new here, all easily dealt with, in fact, we can do all of these in one fell swoop...

... let's not bother collecting Land Value Tax at all. Let's just replace all taxes with a single, flat income/corporation tax at the revenue maximising rate of about 60% (this is hardly more than the current average tax rate on income of about 52% - there are lots of people with a much higher tax rate than that who still go out to work or run a business), no deductions and no tax breaks except the one outlined below. In theory, that would raise about £600 billion a year, much more than the government needs (before we factor in the 'cost' of the tax break).

Poor Widows In Mansions don't have much income so wouldn't pay much tax; landlords can't pass on tax paid by their tenants (and nobody has advanced the thesis that landlords pass on their own income tax, unless they are idiots); it's not an "attack on wealth" in these people's eyes because - apparently - your earning capacity and your earned income is not wealth; and even though in practice taxing incomes is double taxation (and LVT is not), these people don't appear to consider it as such.

-------------------------------

That leaves us with the objection that the government should be cutting taxes on work and enterprise (and rightly so), which requires one simple tax break....

... we cap each business' corporation tax liability at whatever its liability under full-on LVT would be (i.e. double what they currently pay in Business Rates), so three-quarters of businesses would pay nowhere near 60% tax, it would be more like 20%.

... we cap each household's total tax liability at whatever its tax liability would be if we had full-on LVT and an equal and opposite Citizen's Dividend/personal allowance. About three-quarters of households would benefit from the cap* and most of those will end up paying a lot less than all the taxes they currently pay, directly or indirectly.

This would reduce the overall tax take, net of Citizen's Dividend to roughly the right level (£200 billion a year? This is a thought experiment not a maths lesson), and if we have to cut spending to match, then I'm sure all those Poor Widows In Mansions will be only too happy to do without old age care, free NHS treatment, bank bail outs and so on, as long as they can keep their cherished memories etc.

* Let's take a home at the bottom of the top decile by value, which is currently worth about £280,000. The LVT on that at (say) 7% of its current value = £20,000 from which we deduct an 'average' working age household's Citizen's Dividends. 1.9 adults @ £3,500 + 0.7 children @ £1,750 = £7,525, giving this household a net tax bill of £12,500. A household which can afford to buy a house for £280,000 with a mortgage must be earning about £56,000; to be in the top decile by income, a household has to earn something like £80,000. Such households are currently paying massively more than £12,500 in publicly collected taxes (and a shedload more in privately collected taxes, if they bought their house in the last seven or eight years), so they're happy.

If a household in such a home only has taxable income (however defined) of £10,000, then they pay £6,000 tax, of course. The break-even point for being better off under the new improved system is where a household's income is about one-tenth of the current value of the house they live in; so a household earning £28,000 or more in a top decile house will be better off under these rules.

The tax bill for an 'average' working age household in a median home currently worth £150,000 would be capped at about £3,000, which equates to an average tax rate of about ten per cent of their earned income, scarcely worth worrying about.

Posted by

Mark Wadsworth

at

09:02

2

comments

![]()

Labels: ConservativeHome, KLN, Land Value Tax, Simplification

Wednesday, 29 August 2012

"Cow rescued by fire crews after getting stuck in tree"

Steve A spotted this one at the BBC:

A cow had to be rescued by fire crews in Cumbria after falling 30m (100ft) down an embankment and getting stuck in a tree.

Farmer Phillip Armstrong discovered the shorthorn heifer down the steep drop of a quarry after noticing it was missing from the farm in Sheriff Park, Penrith.

The 300kg cow was saved from plunging to the bottom after getting stuck on a sapling, the fire service said. The animal was sedated by a vet and winched to safety using slings.

The 11-month-old bovine was left "sore and bruised" but is now back on its feet after Tuesday's fall. Mr Armstrong's mother Sandra said it was a "happy ending in the end after a very stressful afternoon".

Versatile blokes, those firemen.

"Which service do you require? Police, ambulance or fire brigade?"

"I don't know to be honest. I'm not reporting a crime and unless your ambulance drivers are trained as vets they're not much good to me either."

"Do you wish to report a fire?"

"Well, no not really."

"There's not much we can do to help you then, is there?"

"Hang on then... OK, which service would you send if one of my cows were on fire?"

Posted by

Mark Wadsworth

at

20:14

4

comments

![]()

Man in the pub style energy planning: What would you do with £200 billion?

I'm indebted to Stephen S for sketching this out for me, on the back of an newspaper in a pub, as it happens.

1. Your budget is the £200 billion, which is the amount of our money which the nutters in charge plan to help themselves to:

The initiative is part of the Government’s commitment to setting the UK firmly on course towards a green and growing economy, while also delivering long-term sustainable growth. This transition to a green economy presents significant growth opportunities for UK-based businesses, both at home and abroad. It will require unprecedented investment in key green sectors - an estimated £200 billion is needed for the energy system alone over the period to 2020.

That's about £7,400 per household, on average, or £1,000 a year for the next seven or eight years. For what, exactly?

2. The United Kingdom uses about 350 million MW-hours of electricity a year. Looks about right: each household has an electricity bill of about £1,000 a year, at 12 pence/kWh, that 8,333 kWh = 8 MW-hours, times 27 million households = 216 million MW-hours plus half again for non-domestic usage.

3. A halfway decent new nuclear power station can produce about 1,000 MW and they cost anywhere between $1.3 and $3.5 billion for a 1,000 MW plant. Given how completely useless the UK is at sticking to the budget, and pencilling in a bit extra for decommissioning a few decades into the future, let's call it £4 billion each. Let's not get bogged down in all the various different reactor types, fission, fusion etc.

4. Sixty such nukes ought to just about provide all of UK's electricity needs. I know that demand fluctuates, but as back-up you can pump water uphill and then have extra hydro electric power when you need it quick. Let's assume we're using most of the electricity in 16 hours each day and the nukes are operating 16 hours a day.

60 nukes x 365 days x 16 hours/day x 1,000 MW = 350 million MW-hours.

5. It would cost (say) £240 billion to build those 60 nukes, which is the money that the kleptocrats intended to siphon off over the next eight years anyway. Clearly, it would take a few decades to get them all finished, but it gets easier as you go along. In theory, the maximum outlay would actually only be about £27 billion - to which see point 7 below.

6. If prices stay at 12p/kWh, that means annual income of £42 billion, which gives us a payback period of six years, after that, it's all "free". So if we the consumers/the taxpayers are paying for them to be built, we can then choose whether to have "free" electricity (the running costs are bugger all) for the next few decades (the oldest nuke in the USA still operating opened in 1969) or more rationally, to stick to 12p or whatever the revenue-maximising figure is and spend the money on repaying the National Debt.

7. Assuming we spend £8 billion a year building two nukes each year for thirty years, and each finished nuke generates £0.7 billion income per year:

i. By year seven, the income from finished nukes (2 x 6 x £0.7 billion = £8.4 billion) is more than enough to pay for the construction of the new ones;

ii. By end of year seven, our cash outlay was 7 x £8 billion = £56 billion minus revenues of £29.4 billion; capping our maximum outlay at £27 billion (nowhere near £240 billion).

iii. After thirteen years, the whole project has broken even in cash terms: we've spent £104 billion on construction and had £109 billion of income.

iv. With such short payback periods, you don't even need to worry about interest payments.

8. A fly in this ointment is of course that people don't like living near nukes and you're not supposed to eat food that was grown near them. Let's give each of them a generous safety zone with a radius of ten miles = 314 sq miles each x 60 = 18,840 sq miles in total. That's about a fifth of the surface area of the UK (94,000 square miles).

But only six per cent of the area is inhabited/developed and The Hallowed Green Belt covers twice as much again. So we could just declare those safety zones to be permanent wildlife reservations, Hallow Greenbelt, national parks, whatever. Nothing helps wildlife and nature more than if humans stay well away. That's the Greenies and NIMBYs dealt with.

8. Yes, we'd lose a bit of farm income - maybe as much as a third, but the total value of UK agricultural output is only £6 billion a year, so if we lose £2 billion a year, that's nothing terrible (it's five per cent of our current electricity bills, for example).

Posted by

Mark Wadsworth

at

13:46

34

comments

![]()

Labels: Maths, Nuclear power

"Stop ignoring me, says older woman"

From The Daily Mail:

One of those former Labour Ministers, either Tessa Jowell or Harriet Harman, has hit out at discrimination against herself, warning it was leading to a generation of ‘passive participants’ in public life. Ms Jowman, who is either shadow Olympics or culture secretary, said that she was a female of a certain age who ‘doesn’t want to be written out of the public domain’.

Speaking to an empty room at the Edinburgh Television Festival at the weekend she said it was ‘offensive and wrong’ that she was made invisible ‘because she is past her reproductive age’. Ms Harwell said the treatment of Ann Widdecombe, the former Strictly Come Dancing contestant, who was dumped off the show in 2010 after ten weeks, was ‘symbolic’, adding ‘something needs to be done about it’.

The Labour MP said the ‘discrimination’ against herself did not apply to older men, such as her husband - either David Mills or Jack Dromey - who kept working and were treated as ‘venerable, experienced, sage and coriander’.

The BBC has been the focus of controversy about the treatment of older women in broadcasting in recent years, with former TV chef Fanny Craddock winning a posthumous ageism case against the corporation last year and the earlier row over ditching Ms Widdecombe from Strictly.

Posted by

Mark Wadsworth

at

09:46

0

comments

![]()

Labels: Ageism, Feminism, Harriet Harman MP

Tuesday, 28 August 2012

Tragic Death Of The Week

From The Daily Mail:

A man who was apparently trying to make passing motorists think that he was Bigfoot paid for the ruse with his life when he was run over by two cars on highway in northwestern Montana Sunday night.

The Montana Highway Patrol said the victim, identified as 44-year-old Randy Lee Tenley, was wearing a military-style ‘Ghillie suit’ and was standing in the right-hand lane of U.S. Highway 93 south of Kalispell when he was hit by the first car Sunday night.

A second car rolled over Tenley as he lay in the roadway. He suffered massive trauma and died at the scene, The Missoulian reported.

Posted by

Mark Wadsworth

at

18:34

4

comments

![]()

Excellent choice of words

From the BBC:

This video is designed to market a vaginal "rejuvenation and tightening" product, which was launched this month in India.

The makers of 18 Again, the Mumbai-based pharmaceutical company Ultratech, say it is the first of its kind in India (similar creams are already available in other parts of the world such as the USA), and fills a gap in the market.

Posted by

Mark Wadsworth

at

17:08

2

comments

![]()

Car park news

I love a good car park story, here's one from the BBC:

An average of just 10 motorists a day are using a £1.3m car park built near Bristol, a council has admitted. The facility, intended as a park-and-ride, opened in June 2011 but will not get a bus service until 2015.

South Gloucestershire Council said it was used by only 139 motorists in its first three months and raised £13,899.74 in revenue last year. The council said it wanted to make local firms more aware of the Stoke Gifford car park, which has 200 spaces... The nearest public transport is Bristol Parkway railway station, which is about five minutes walk away.

I don't see how you can fault the council for this one.

1. If they get the car park full five days a week and half days at weekends, then based on their daily charges listed here, that would be income of nearly £300,000 a year, which is not a bad return on the £1.3 million they spent on tarmac. The site appears to be about two acres, so if the council had built (say) thirty homes on it, it would have to rent them out for at least £10,000 a year each to make the same money (far higher costs, hassle and stress from NIMBYs and tenants). So it's hardly the stupidest decision a council has ever taken.

2. Demand for the car park might not materialise overnight, word has to spread round and people have to adjust, maybe a few people who find taking the bus to the station a bit awkward will take the car in future, for example.

3. And so what if the car park was finished three years before the dedicated bus service? The problem there is lack of bus service, not surplus of car park.

4. If they hadn't built the car park, were they just supposed to leave the land derelict for three years? If the worst comes to the worst, they can always rip up the tarmac and build something else.

5. I'll mark them down for only allowing payment by debit/credit card or mobile phone (wot?) and not accepting good old fashioned cash, and maybe their charges are a little too high, but that's details.

6. Personally, I'd bung in a proper old fashioned car park attendant to sit in a little booth collecting your money on the way in; have a van selling tea and coffee during the rush hour, set up some skateboard/BMX ramps at the far end, encourage the local car enthusiast club to hold their rallies there on a weekend, get a bit of community spirit going etc. That's just more details.

Posted by

Mark Wadsworth

at

14:05

8

comments

![]()

Labels: Parking, Public transport

Fun Online Polls: Julian Assange and midges

The responses to last week's Fun Online Poll were as follows:

What would you do with Julian Assange?

Allow him to go to Ecuador - 48%

Leave him to sweat in the Ecuadorian Embassy - 27%

Extradite him to Sweden - 11%

Cut out the middleman and hand him over to the Yanks - 7%

Other, please specify - 6%

Good, that's that settled then and I'm with the majority on this one. The turnout was very high at 170 votes, thanks to everybody who responded.

-----------------------

I've noticed a couple of articles saying that there are more midges this summer because of the particularly warm, wet weather.

This week's Fun Online Poll - have you noticed more midges than usual?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

08:29

4

comments

![]()

Labels: Ecuador, Extradition, FOP, Insects, Julian Assange, Weather

Monday, 27 August 2012

Positive Money

A few people have asked me what I think about the proposals put forward by Positive Money:

Positive Money believes that the root cause of many of our current social, economic and environmental problems lies in the way that we allow money to be created. We campaign for fundamental reform of a system that is fueling debt, poverty and our economic and environmental crises.

Good start, agreed so far.

-----------------------------

They have a good page explaining how the banking system works in general, the nub of which is this:

A customer, who we shall call Robert, walks into RBS and asks to borrow £10,000 to buy a new car. Robert signs a contract with the back confirming that he will repay £10,000 over a period of five years, plus interest. This legally enforceable contract represents a future income stream for the bank, and when the bank comes to draw up its balance sheet it will be included as an additional asset worth £10,000.

Robert, having committed to pay the bank £10,000, wants to receive his ‘loan’. So RBS opens up [a deposit] account for him, and types in £10,000. This is recorded as a liability on RBS’s balance.

Notice that no money was transferred or taken from any other account, the bank simply updated a computer database. A bank does not ‘lend money’ – to lend one must have money to lend in the first place. In reality a bank creates credit – money – when it advances loans.

A process which we can refer to as 'splitting the zero'. At least with a car loan, the bank is oiling the wheels of commerce a bit. Robert gets his car earlier than otherwise, the manufacturer can sell an extra car and the bank assumes the risk of non-payment by Robert (instead of the manufacturer having its own leasing-finance division, which many of them do).

Apply the same process to buying land, and the bank isn't actually providing anything (it does nothing to create the land rental values), it's just merrily splitting the zero, paying 2% on the deposit side and collecting 5% on the loan/mortgage side, so ultimately it is collecting land rent. If prices are high enough and interest rates are high enough, the bank is collecting more than the total rental value - from buyers who reckon that it is worth taking a small extra net monthly outlay on the chin (mortgage interest exceeds rental value) in order to make capital gains (and there are hundreds of thousands, if not millions, of such people at the moment).

---------------------------

They point out that the bulk of bank lending is for purely speculative purposes and address the housing bubble:

If you allow banks to create money when they make loans, and you allow them to pump the bulk of this newly money into a housing market with relatively limited supply, then house prices will go up...

A rising house price was treated like an unexpectedly sunny bank holiday; everyone was expected to rush to take advantage of the opportunity before it was over. I don’t recall seeing any decent analysis explaining that overall, constantly rising house prices simply benefit banks and the few individuals who plan to sell up and move into an old folks’ home or a caravan.

Again, completely agreed. If you minus off bricks and mortar from house prices, what you are left with is land speculation. Land prices are the product of about four variables:

+ the actual rental value of any site

- recurring taxes thereon

x availability of credit

+/- bubble/hope/despair element.

To choke this off you just need to bring the end value down to zero. Gross land rental values are A Good Thing of course, but if we taxed away those rental values, there'd be nothing left to speculate on. And the big bonus is that we can then phase out all the bad taxes on earned income, output and profits. Or a government could credibly threaten to do something which would cause land prices to plunge in the near future so that the negative 'despair' element brought selling prices down to nothing.

---------------------------

Positive Money are mildly sympathetic to Land Value Tax, but their preferred method is to reduce the amount of credit which commercial banks can create, which they explain here (pdf).

Briefly and broadly speaking, there will be two kinds of deposit account:

* Transaction accounts, which will be backed 100% by government bonds or deposits at the Bank of England, which will pay little or no interest and which will bear charges. So the government can limit the total amount of money in these accounts by reducing the amount of government bonds in issue or the BoE refusing to accept any more deposits.

* Investment accounts... In order to lend money after the reform is implemented, banks will need to find customers who are willing to give up access to their money for a certain period of time. In practice, this means that the customer will need to invest their money for a defined time period (1 month, 6 months, 2 years, for example) or set a minimum notice period that must be given before the money can be withdrawn (e.g. 7 days, 30 days, 60 days, 6 months).

Banks will then operate in the way that most people think they currently do - by taking money from savers and lending it to borrowers (rather than creating new money (deposits) whenever they make a loan, and walking a tightrope between maximizing profit and becoming insolvent).

---------------------------

Well, no.

On a purely practical level it will be easy to circumvent this and banks will be able to merrily continue splitting the zero so that people can speculate on rising land values.

i. Wadsworth Bank plc holds some spare government bonds, not matched by and in excess of WB's transaction accounts.

ii. Robert wants to take out a mortgage. WB can only make this loan by lending him some bonds. WB records this as a financial asset (it doesn't matter whether WB gives him notes and coins, a cheque or a number on a computer screen, the loan is always recorded as an asset in £-s-d in WB's books).

iii. Robert gives those bonds to the vendor, who turns up a few minutes later at WB (or any other bank, doesn't matter as banks are a closed loop) to deposit his bonds safely.

iv. WB's counter staff explain to the vendor that they are happy to open a transaction account to hold his bonds, but point out that if he leaves his money there, he will earn zero interest. Would the vendor not like to transfer money from his transaction account to an investment account paying a few per cent interest?

v. So the vendor does so. This means that WB no longer has to hold those bonds in a matched account on the vendor's behalf; WB now holds them as spare bonds on its own account again, which is can lend to the next would-be purchaser who walks through the door. Rinse and repeat.

vi. The end result of this is that while the total value of transaction accounts at WB and all other banks is fixed and constant, the total value of its assets (money lent to purchasers) and the total value of its investment accounts (money taken from vendors) is unlimited, and WB is still 'splitting the zero' into ever increasing amounts of mortgages and investment accounts.

vii. So we get the house price bubble going again nicely, until it all goes wrong again, at which stage the government steps in to guarantee investment accounts again.

For sure, we can think up all sorts of extra measures to stop banks from circumventing this, for example by making loans to acquire land (in excess of the rebuild cost/value of buildings thereon) unenforceable, not registering them at HM Land Registry etc.

But the land rents will still be collected privately; if current land owners can't sell to mortgage borrowers then vendors will just sell them to real Estate Investment Trusts in exchange for shares, and then the vendors can sell the shares for cash, or something, and if the REIT wants to sell residential land, it will do so with Islamic mortgages (where the borrower is legally a tenant for a fixed rent for a long fixed period, and ends up repaying exactly the same amount as if he'd taken out a mortgage at interest).

---------------------------

Finally, Positive Money make the assumption that the UK government actually wants to do anything about banking and land speculation. (The idea of taxing the rental value of land instead of taxing earned income faces the same problem, of course, but at least with that you can make it immediately clear that there would be far more winners than losers, hoping to grab the votes of the winners, and that the overall gains to society or to the economy would vastly outweigh any short-term collateral damage.)

The UK government has no intention of doing anything to cut the banking sector down to size or to end the house price bubble. Not only does this ensure them the continuing support of the vested interests and the promise of cushy well-paid jobs once they are booted out of office, in a perverse sort of way, rising house prices have shown themselves to be electoral gold.

---------------------------

And even if we the UK government were entirely benevolent and motivated by the overall interests of its citizens, how will they know what the correct total level of transaction accounts is?

Posted by

Mark Wadsworth

at

17:19

13

comments

![]()

Labels: Banking, Central banking, Positive Money

Running the European Central Bank is such a draghi

Posted by

Mark Wadsworth

at

12:28

0

comments

![]()

Labels: Banking, Caricature, ECB, Mario Draghi, Subsidies

Sunday, 26 August 2012

"Hollywood leads tributes to Armstrong, first man on Moon"

From the BBC:

Veteran actor Kirk Douglas has led tributes to Neil Armstrong, the first man on the Moon, who died on Saturday at the age of 82.

Although best known for his one-liner "One small step for a man, one giant leap for mankind", director Steven Spielberg says that his greatest role was as Captain Walker in 1973's "Swallows and Amazons".

His glittering career included small and large screen as well as stage appearances. Samuel Beckett later said that Armstrong was the only actor who did justice to the character of Godot in a 1974 Broadway adaptation. This was followed by an appearance as Charlie in the long-running 1970s US TV series "Charlie's Angels", although for technical reasons his voice was later overdubbed by John Forsythe.

The 1980s were a lean time for Armstrong, and his career did not flower again until the 1990s, when he played Sheridan Bucket in the UK TV series "Keeping Up Appearances" and Keyser Söze in "The Usual Suspects". His final part was the title role in "The Man Who Wasn't There" in 2001.

Armstrong never married, although he had a long relationship with Pru Forrest, famous for her part as Maris in the US TV series "Frasier". He was nominated for a Lifetime Achievement Award at the 2005 Oscars ceremony, but did not appear to collect it in person, his agent citing other commitments.

Armstrong's family confirmed his death in a statement on Saturday, saying he had died from complications after surgery to relieve four blocked coronary arteries. The family statement praised him as a "reluctant American hero" and urged his fans to honour his example of "service, accomplishment and modesty".

Posted by

Mark Wadsworth

at

12:14

10

comments

![]()

Saturday, 25 August 2012

Let's go Greek!

Posted by

Mark Wadsworth

at

17:47

0

comments

![]()

Labels: Anton Samaras, Caricature, Euro-zone, Greece

Killer Arguments Against LVT, Not (231)

I explained yet again why taxing land rents does not take a penny out of the productive economy and Sobers tried yet again to come up with a killer argument against:

Of course LVT is paid out of earned income - where else would the cash come from? Your house doesn't generate any cash just by living in it.

Duh.

As he must know by know by now, two-thirds of LVT revenues will be dished out again as a Citizen's Dividend, so the LVT bill for about half of households will be entirely covered by their Citizen's Dividends, and the Citizen's Dividend will go a good way towards paying the LVT for most of the other half.

The rent for a median house is two-thirds as much as the average, so you can live in anything up to a median home entirely for free (you still have to pay for the bricks and mortar of course). It's only if you want to live somewhere nicer, bigger or in a higher wage area than the median that you have to dip into your earned income. And it is questionable whether the extra income you earn in high wages areas compared to low wage areas (for doing exactly the same job) is truly earned anyway.

All LVT achieves is a mass swap around of people and houses, and at the end of it all, people end up paying the same amount of LVT they would have paid in income (or other) taxes, but most likely living in a bigger or smaller house than before, depending on whether they were a low income/big house or high income/little house person. Everybody lives in a house that has a LVT bill that their income can afford, and that bill is paid out of earned income.

Apart from the lie at the end, that's probably correct. But the mass swap-around (or what I like to call 'right sizing') is just one of many positive impacts. Once the dust had settled, we'd also notice that we've a lot more housing than we thought and not so much need to build new stuff for the next decade or two; the economy will be doing a lot better; inflation will fall; unemployment will be down; credit bubbles will be very much dampened; social cohesion will be better; etc etc.

And as Sobers himself says, the 'ability to pay' nonsense will just melt away, as everybody will choose a home which either their CD will pay for, or where they can easily afford the 'top up' out of their earned income.

Posted by

Mark Wadsworth

at

09:16

16

comments

![]()

Labels: KLN, Land Value Tax

Friday, 24 August 2012

Richard III's remains: Leicester pub car park dug up

From the BBC:

A bid to find the remains of England's King Richard III is starting more than 500 years after his death in a post-match brawl in a Leicestershire pub car park.

A University of Leicester archaeological team is digging in the car park of the 'Grey Friar's Freehouse' where they think he may have been hastily buried.

King Richard III was killed after a drinking bout in a pub near Bosworth in 1485 and his body taken by the supporters of a rival team from the ale house 'The Franciscan Friary'.

Over time, the exact location of the grave has been lost. The project team said their work is "the first ever search for the lost grave of the last anointed King of England to be killed in a dispute over a late disallowed goal in an amateur league play-off".

Posted by

Mark Wadsworth

at

16:23

3

comments

![]()

Labels: Football, History, Pubs, Royal family

"Sinkholes around the world"

I've been posting pictures of sink holes as and when I noticed them, and have now stumbled across this fantastic internet-based resource, which is a gallery of 31 of your favourite sinkholes.

Posted by

Mark Wadsworth

at

15:39

0

comments

![]()

Labels: Holes, Internet, Subsidence

Killer Arguments Against LVT, Not (230)

On my internet trawls, I stumbled across this old post by Adam Collyer again, in which he concedes that replacing taxes on income with taxes on land values has some merit. He plays the Poor Widow Bogey of course, and then this:

The truth is that ultimately, State services can only be financed by taking the fruits of economic activity away from taxpayers. However it is dressed up, whether you tax assets or wealth creation, that is what you are doing.

Nope. By sleight of hand he reclassifies 'land rents' as 'assets', if you unpick this, it must be clear that the claim is simply not true. Taxing the rental value of land does not take a single penny out of the productive economy.

-------------------------

Simple like-for-like comparisons illustrate this. Let's take as our comparisons four similar sites occupied by four similar people. The sites might be farms, business premises or homes, that does not matter. To keep things simple, let's assume a very small government and negligible taxes. These four sites are owned/occupied as follows:

OO = owner-occupied, without a mortgage

LM = owner-occupied by with a large mortgage

RP = rented privately from a private landlord

RS = rented from the government (i.e. Forestry Commission land, Crown Estates office block or shops; council or housing association home).

Let's agree for the sake of this discussion that OO is the optimum position, if everybody were an owner-occupier without a mortgage, this would be the best outcome.

There's no real difference between LM and RP, both occupants are handing over rent to a private landlord/bank. This means that the landlord/bank can enjoy and consume 30% of the economic output of the tenant for nothing in return. At RS, the tenant is handing over 30% of his economic output to the government, but the government is providing services; it guarantees his exclusive possession with land registry and police, it pays for the roads giving access to the site, it collects his rubbish etc.

So the Homeys can either argue that the landlord is part of the productive economy, in which case so is the government, or they can concede that the landlord is doing nothing for the tenant (he is charging the tenant for the value of the services which the government provides him qua landowner virtually for free).

--------------------------

Or let's look at site RS. The tenant is handing over 30% of his output as rent, this is a fixed cost and therefore does not influence his marginal decision making, he will still seek to maximise his income or make best possible use of the site. The rent he pays is not a tax.

What would the difference be if the government changed its policy and said "OK, we're going to stop charging you rent but you have to hand over 30% of your earned income as a tax"? In the very short term, not much, but the tax has deadweight costs, it depresses the size of the economy by a few per cent, it encourages tax-evasion and discourages optimum use of the best sites.

If you're lucky enough to be on a good site, you can just free-ride, or sub-let it or sell it to somebody who is prepared to work harder, at which stage the site becomes effectively an LM or RP site, and so the tenant faces two burdens - rent to the private landlord/bank, who are merely enjoying economic output for nothing in return, as well as the income tax paid to the government. Economic output will go down quite markedly.

--------------------------

A private landlord or bank will take the rent/interest and spend it on stuff which benefits himself, i.e. other people's output. He will not voluntarily plough that money back into the economy by paying for police, building roads, paying for education etc.

The UK government since 2008 at the latest is openly klepocratic, about a third of government spending is not just wasted, it is actually stolen to line the pockets of insiders. But even then, at least two-thirds of it is spending which actually benefits citizens generally (even if it benefits citizens you don't particularly like, they are still citizens. Perhaps some of them don't like you either).

Even if a government were close to 100% kleptocratic and took nearly all the LVT and spent it on itself, fancy cars, nice houses, big cigars etc. How is that any different from the landlord doing this? At least you can vote out politicians for free. I'm not aware there's a similar mechanism for getting rid of the landowning and banking classes.

--------------------------

So how do we achieve the optimum position where everybody is a mortgage-free owner-occupier but prevent the inevitable concentration of land into ever fewer hands?

Simple: by scrapping taxes on earned income and slapping all land with LVT, dishing out the bulk of it as a Citizen's Dividend (in place of the Welfare State).

By definition, the average citizen or household will be paying plus-minus nothing in LVT minus CD; the OO will be paying LVT instead of income tax, but gets this rebated by the CD. The LM will have a much smaller mortgage, largely rebated by the CD. The RP's and the RS's rent will be largely rebated by the CD.

Thus the average citizen or household will effectively be an owner-occupier as of right just like everybody has the right to vote, or to ring 999, or to write a letter to his MP. And owner-occupation is supposed to be A Good Thing, yes?

So why make people struggle and fight for it half their lives and then free-ride for the rest? Why not keep things constantly at a gentle simmer; nobody is a debt or rent slave and nobody is a free-rider. People can enjoy close to 100% of the value of their economic output for the whole of their lives, it's up to each individual or household how they are going to budget that over a lifetime and how they are going to divvy up their available cash (earned income plus CD) between land rents and other consumption opportunities.

It's hardly my fault if today's Poor Widows In Mansions thought that they could free-ride for the rest of their lives and if they didn't actually defer spending during their lifetimes and save up some cash to see them through retirement.

Posted by

Mark Wadsworth

at

12:17

3

comments

![]()

Labels: KLN

"Pilot keeps a cool head as light airplane flew in to a tomato"

From The Daily Mail:

A businessman has described the moment a pleasure flight over the British countryside in a light aircraft turned into a nightmare after it flew into a tomato.

The Cessna 150 aircraft, piloted by Mark Wagner had taken off from Eaglescott Airfield at Burrington, Devon. Moments before the near-miss, passengers Paul Scantlebury, 48, and Terry Gilbert, 46, had been enjoying views across North Devon. But then the sky turned red with seeds in it and they realised they were in for a rough ride.

Mr Scantlebury said: "Everything was fine for a few minutes. North Devon looked incredible from the air but in a second everything changed. Terry just screamed to the pilot, "Look, look. There is a giant vegetable like in America".'

Paul said the aircraft started shaking violently while he and Terry argued heatedly about whether a tomato is a fruit or a vegetable.

He said that Mr Gilbert started shouting instructions at the pilot: "I clearly remember Terry screaming "Land on it, it's the safest place. We can sail it to New York. I saw it in a film." The pilot very calmly said, "No, no Terry that's wrong. That only works with giant peaches. We just have to stay away from it and land back at Eaglescott."

Posted by

Mark Wadsworth

at

10:25

1 comments

![]()

Labels: Air travel, Food

Thursday, 23 August 2012

Shut up and take your medicine! It'll do us good!

From The Telegraph:

The Bank [of England] has been under attack for months from pensioner groups(1) who have claimed the Bank’s £375bn of money printing has triggered a "death spiral" in pensions, by slashing income from annuity rates.

However, the Bank fought back on Thursday by claiming pensioners have gained from QE and that the effect on those preparing to retire has been “broadly neutral”. Those to have suffered from the Bank’s response to the financial crisis and recession have been the young and the poor,(2) the study found, while the richest 10pc the population are estimated to have seen their wealth rise by more than £120,000 per household.(3)

Pensioner groups have argued that QE has forced down gilt yields and, consequently, reduced the value of annuities bought on retirement. However, the Bank claimed that the lower interest payments had been offset by an increase in the size of the pension pot used to buy the annuity.(4)

In addition, the Bank said that QE had helped “boosted the value of households’ financial wealth held outside pension funds” by about £600bn. More than half of those holdings are held by people aged 55 and over, and roughly 40pc by the richest 5pc of households, the study said.

1) Yes, that means you, Save Our Savers. So what if those pensioners who actually squirrelled away some cash for a rainy day are losing money - house prices are being kept higher than otherwise which makes you richer!

2) Yes, that means you, Priced Out. Paying rent and trying to build up a deposit? Ain't gonna happen, because low interest rates insulate BTL landlords against their bad decisions and the value of your pathetic 'savings' is being eroded. It's your own fault that you weren't born a decade or two earlier,

3) This is the whole foundation and basis of UK government's Home-Owner-ist policies. Rig things to benefit the One Percent but ensure that enough illusory wealth trickles down to enough people to trick them into voting for you again at the next election, it's worked perfectly for decades.

4) That's sort-of true, actually, if you are on the verge of retirement and your tax-favoured pension fund is largely invested in gilts, which is what you are traditionally supposed to do, then the two effects more or less cancel out in the short term.

Spotted by Stillthinking at HPC.

Posted by

Mark Wadsworth

at

20:21

2

comments

![]()

Labels: Bank of England, Home-Owner-Ism, Inflation, Interest rates, Pensions, Quantitative easing

We own land, give us money: Masterclass

This article in City AM reads like a spoof but appears to be genuine:

THE GOVERNMENT has today launched a long-awaited review of the private-rented housing market that calls for councils to waive affordable housing requirements on private rented schemes and for financial incentives to encourage investment into the sector.

The review, conducted by 3i chairman Sir Adrian Montague, makes five recommendations to the government for encouraging large institutions (1) to invest in privately rented homes to help meet demand.

As well as waiving affordable housing requirements,(2) these include making more public sector land available(3) for private rented schemes and setting up a “task-force” of developers to advise the government and set standards.(4)

The report also recommends the government provide equity or debt funding(5) to share the risk and help kickstart investment.

Residential landlord Grainger today described the proposals as “a critical step forward for the faltering UK housing market”.(6)

Harry Downes, the founder of Fizzy Living, which has raised £30m to build rented flats in London said: “ It is very difficult to get funding for a development that isn’t going to be sold off. What we need is for banks to understand that the sector is a viable investment class.”(7)

1) Such as his own company.

2) The Morbidly Obese One has already set about fixing that little problem.

3) They own land! And even though they aren't using it for anything, let's go on the safe side and give them more land! The thought of building social housing on that public sector land is off the radar.

4) Set your own exam, mark your own answers, decide the prize money.

5) They own land! Give them cheap money!

6) People like Grainger ARE the housing market, do they admit they have failed?

7) Well either it is or it isn't. I suspect that it is, banks seem happy enough to lend to Buy-To-Let landlords, why not lend to Build-To-Let landlords?

Posted by

Mark Wadsworth

at

09:56

6

comments

![]()

Labels: Home-Owner-Ism, Subsidies

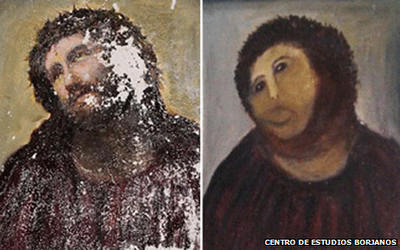

"Spanish fresco restoration botched by amateur"

The story is hilarious enough but the result surpasses all expectations:

Posted by

Mark Wadsworth

at

08:42

6

comments

![]()

Labels: Spain

Wednesday, 22 August 2012

It'd be a great plot for a psychological thriller...

From the BBC:

Actress Natalie Wood's death certificate has been amended to reflect some of the lingering questions surrounding the star's death in 1981. Wood drowned during a boat trip with her husband, TV star Robert Wagner, and actor Christopher Walken. At the time it was ruled to have been an accident.

But police reopened their inquiry last year after receiving new evidence. The death certificate now says she died as a result of "drowning and other undetermined factors". The amended document, obtained by the Associated Press news agency, also says the circumstances of how she ended up in the water are "not clearly established".

The psycho-thriller film noire would involve some old actors sitting around on a yacht at dusk, with the lights of Los Angeles twinkling in the background. They're drinking vast quantities of booze and bickering about what might or might not have happened thirty years ago; there'd be loads of flashbacks to their earlier movies which might or might not be clues to what they know but won't say; all sorts of old jealousies bubbling to the surface etc*.

Meanwhile on the other side of town, some over-ambitious young DA** is feverishly going through all the old transcripts and tapes and so on and trying to nail at least one of the actors concerned (and probably his attractive young assistant*** as well, as a sub-plot). The DA uncovers facts in parallel with the conversation which is taking place on the boat, one is a running commentary on the other.

Question is, would Robert Wagner and Christopher Walken be up for playing themselves?

* A bit like "Rope" by Alfred Hitcock, basically, but on a yacht not in a penthouse. And it's not going to be filmed in one single take because you have to show the sun setting on the other side of the boat.

** Played by somebody who is handsome in a traditional sense, but still a bit creepy, like Billy Zane. So the audience wants to find out the truth, but they don't particularly want him to find out the truth as he would be unbearably smug about it.

*** Natalie Portman, probably. If not, the delightfully goofy Anne Hathaway can do it.

Posted by

Mark Wadsworth

at

14:40

4

comments

![]()

Labels: Films

Pussy Riot

Posted by

Mark Wadsworth

at

09:34

0

comments

![]()

Labels: Caricature, Music, Russia, Totalitarianism, Vladimir Putin

Tuesday, 21 August 2012

Bovine capers

Emailed in by Richard W, from the BBC:

A bull with a feed tray stuck on its head caused traffic tailbacks on a busy South Ayrshire road after escaping from a farmer's field.

Police were alerted to reports that the animal had wandered on to the A77 Ballantrae to Girvan road at about 15:30 on Tuesday.

The incident caused tailbacks for about 45 minutes until the farmer who owned the bull returned it to the field.

The animal had the feed tray removed and the farm fence was secured.

Do you have pictures - still or moving* - of the scene of this incident? Send them to the BBC Scotland news website at newsonlinescotland@bbc.co.uk

* I think most people would be deeply moved by pictures of a bull with a feed tray stuck on its head causing a tailback, it's a very deep metaphor for the contrast between man's inhumanity to man and the unsullied innocence of our four-legged, two-horned friends, or something like that.

Posted by

Mark Wadsworth

at

19:52

1 comments

![]()

Killer Arguments Against LVT, Not (229)

Spotted by MBK at stuff.co.nz:

Councillor Maher said he had "gone on about [LVT] for years" but the Government was in charge of the legislation and did not have the will to change it.

"It's an archaic tax based on land values that has no basis on people's abilities to pay. Just because people own a lot of property doesn't mean they have an ability to pay."

i. That's an equation with two variables isn't it? Like all true Home-Owner-Ists, he assumes that "the amount of land you own" and "your ability to pay, i.e. your income" are both completely fixed and a given, and that the economy has to be based on compensating such people by transferring "income" to them from other people who own "no or not much land and have higher incomes".

ii. In free markets (an anathema for Home-Owner-Ists), very little is fixed or a given and governments do not go round making cash transfers to favoured groups, it's just a question of allowing things to find their own equilibrium. In the instant case, one does wonder why or how people with low incomes managed to amass all this land.

iii. When taxes on earned income are replaced with taxes on land values, such worthy people (i.e. Poor Widows In Mansions and/or people who put farmland to inefficient use) will either reduce the amount of land they wish to occupy or try to increase their incomes, which are exactly the same market forces facing all tenants and first time buyers: if you want to live somewhere nice, either cut back on your other expenditure or try and earn more money (or some combination of the two).

iv. Once the dust has settled, we will magically find that for most people, the amount/value of land they occupy (and hence their tax bills after deducting personal allowances or Citizen's Income) will have been adjusted to what they can realistically afford, i.e. some proportion of their income, and henceforth "ability to pay" will not be a big issue.

v. Yes, of course there will be a few hardship cases - death, dole, disability, divorce etc, and under full-on LVT there would have to be a system of discounts/deferments for older people and/or a much higher Citizen's Pension. Details, details.

vi. How long would it take for everybody to downsize, upsize or rightsize? Five or ten years, tops.

Posted by

Mark Wadsworth

at

12:34

16

comments

![]()

Labels: Free markets, KLN, Land Value Tax, New Zealand

Slavery is freedom! Debt is wealth!

From The Telegraph:

A sharp increase in mortgage lending last month, following rate cuts from some of Britain’s biggest banks has prompted speculation about the end of the mortgage famine and fresh support for house prices.

Spotted by Dill at HPC.

Posted by

Mark Wadsworth

at

08:46

0

comments

![]()

Labels: Home-Owner-Ism

Monday, 20 August 2012

Bloody asylum seekers, coming over here, occupying our embassies...

Posted by

Mark Wadsworth

at

21:23

2

comments

![]()

Labels: Asylum, Caricature, Ecuador, Julian Assange

Fun Online Polls: Olympics bandwagons & Julian Assange

Your responses to last week's Fun Online Polls were as follows:

Which is your favourite Olympic bandwagon?

Michael Gove - Sell off the school playing fields - 29%

Jessica Ennis - One hour's sport a day for school children - 22%

Mo Farah - End child hunger in the Horn of Africa - 19%

Bradley Wiggins - All cyclists must wear helmets - 9%

None of the above/other, please specify - 21%

Bob E submitted a good one: @Chris Hoy/Gordon Brown: Team GB's medal success is an argument against independence for Scotland." If you think along those lines, it also strikes me that Team GB's success is a good argument in favour of immigration, seeing as of how certain sports seem to be dominated by people of certain races/ethnic origins. We Brits are definitely world class at sitting down stuff like rowing, cycling, sailing etc.

Yippee, I chose the most popular one this week. I thought school sports was a complete and utter waste of time myself, it's the sort of thing which ought to be voluntary/extra-curricular like playing in the school orchestra or joining the drama club etc.

----------------------------------

This week's Fun Online Poll, what would you do with Julian Assange?

Vote here or use the widget in the side bar. Because of the EU Arrest Warrant system, I'm afraid that "allow him to stay in the UK" isn't a realistic option, not that William Hague is too keen to mention this.

Posted by

Mark Wadsworth

at

18:42

0

comments

![]()

Labels: Asylum, Ecuador, FOP, Julian Assange, Olympics

HM Government proposes something with which I agree: Shock

From The Metro:

Owners of dangerous dogs which attack members of the public will receive tougher penalties. This could include up to 18 months in prison, as the government sets out new guidelines to clamp down on irresponsible animal owners...

Good stuff.

It strikes me that there's no reason why dog owners are not vicariously liable for absolutely everything their dogs do: if the dog bites someone, the owner should be charged and sentenced as if he had bitten that person; if the dog behaves in such a manner as to make people scared for their safety, the owner should be charged with assault; if a dog kills someone, the owner should be tried for murder, and so on. This saves us the faff of deciding which breeds of dogs are inherently "dangerous" or not (itself a nonsensical exercise as all dogs are the same species).

It's no different to treating somebody's car as an extension of the owner/driver, if you knock somebody down, there's not much point pleading that it wasn't you, it was the car etc.

Posted by

Mark Wadsworth

at

15:57

12

comments

![]()

"76 people rescued from tour boat after it hits rock star"

From The Daily Mail:

A cruise ship raced to save the lives of scores of passengers stranded on a sightseeing boat which began flooding after it struck a rock star off the coast of Alaska.

It has been reported that as many as 76 people had to be rescued when the Baranof Wind collided with "Bat out of Hell" singer Meat Loaf who was taking his early morning dip in the Gulk of Alaska, and started taking on water at 11am yesterday.

Coast Guard David Mosley said the majority of the passengers and crew members aboard the 79ft boat were transferred to a large Holland America cruise ship called the Vollendam which was the closest vessel to the scene.

None of those aboard were seriously hurt although some suffered minor hearing damage after Meat Loaf performed an impromptu sixty minute set on the Vollendam featuring all his major hits including "Bat ouf of Hell".

A spokesman for the Al-Aqsa Martyrs Brigade denied any involvement with the disaster, although he admitted that he could see how the initial confusion might have arisen.

Posted by

Mark Wadsworth

at

10:45

0

comments

![]()

Policy Exchange: half right. Grant Shapps: reliably wrong.

Spotted by Lola in The Telegraph:

In the South East, almost 100,000 council homes are worth more than the average privately-owned property, according to Policy Exchange.

The think tank estimated that selling social housing in expensive areas could raise at least £4.5 billion a year. The proceeds could be used to build houses in cheaper areas to tackle Britain’s housing shortage as part of the biggest building programme for decades.

Yippee, hooray, for more social housing. The problem is that councils will be much better at the 'selling off' bit and not so good at the 'building more social housing' bit.

Here are the numbers:

The Policy Exchange report found that almost four million houses and flats are let out to social tenants in England. However, 22 per cent are worth more than comparable houses in the same area — a total of 818,000 properties throughout the country.

Up to £159 billion could be raised in total if all social and council housing worth more than similar-sized properties nearby were sold across the country, the report suggested.

The think tank said properties should be sold off gradually, as they became vacant. At average vacancy rates that would enable the Government to sell 28,500 homes a year to private buyers, raising £4.5 billion a year, when debts have been paid down.

That could then pay for between 80,000 and 170,000 new social houses to be built a year, creating up to 340,000 jobs, the report argues.

£159 billion ÷ 818,000 = £194,000 each, seems about right.

£4.5 billion ÷ 80,000 = £56,000, seems about right (that's the build cost of a modest house/flat excl. land). Using 170,000 gives us £26,000 which seems on the unrealistically low side.

However, if £4.5 billion is our target figure which we want to raise from social housing in more desirable areas, the other approach would be to bump up the rents on those 818,000 homes by about £105 a week on average (this primarily affects central London and parts of the south east, which would solve the sub-letting issue to a large extent).

---------------------------------

Our Housing Minister responded thusly:

Mr Shapps said he was keen to study the report in detail and urged councils to consider following the key recommendation to sell their most valuable properties.

“It clearly makes sense to use housing stock as efficiently as possible,” he said. “Where you have houses which are worth millions, you could sell them and build a lot more homes to help sometimes vulnerable people come off the waiting list.

“It is blindingly obvious. And only a perverse kind of Left-wing dogma that appears indifferent to the suffering of those languishing on record waiting lists prevents this kind of common sense from prevailing.”

Fascinating. He supports the idea of selling off council housing for top whack. Funny that, it doesn't seem like five minutes ago that he supported selling it off for massive discounts:

The revamped Right to Buy, which will give 2.5 million social tenants the opportunity to buy their home with discounts of up to £75,000 was launched last month.

Mr Shapps has said his ambition is that, for the first time, every extra Right to Buy home sold will be replaced by a new affordable home to rent nationally. He said he had listened to views raised by councils on how they would deliver this ambition, and has agreed to extend their timeframe for spending the receipts from two years to three.

Ho hum. If you can build a new home for £56,000 and he's offering discounts of up to £75,000, doesn't that mean one-and-a-half fewer new homes for each old one sold?

Posted by

Mark Wadsworth

at

10:02

0

comments

![]()

Labels: Grant Shapps MP, Maths, Policy Exchange, Propaganda, Social housing

Sunday, 19 August 2012

Town Planning

Like any kind of central planning, it usually seems to go wrong, but never mind. Over the years, I have become fairly convinced by a theory about optimal layout that works just as well at the small scale (a few dozen houses in a village) as at a large scale (cities of millions). That theory is quite simply that it is far better having towns or villages stretched out along "branches" than to have them as a single "blob".

I've done these pictures using Excel, so of necessity they are squares, and it is quite true that at a micro level, having land divided up at right angles is better than higgedly-piggeldy. But you can imagine the cross as a Y shape or a many pointed star, and the square might be a circle or an oval or anything else.

1. Let's start by looking at a blob of nine square units - these might be a hundred yards or a mile across:

2. The "branches" layout is also nine square units:

3. What is the first big advantage of the "branches"? It's that everybody is closer to the countryside. In a village of a few dozen houses, everybody's back garden backs onto fields; in a town of nine square miles (a town of about 150,000 people), nobody is more than half a mile from the countryside.

With the "blob", nearly half the gardens in the village do not overlook the countryside and nearly half the area of the town is more than half a mile from the countryside:

4. The other big advantage is that - rather counter-intuitively - you need to use less land for roads and journeys are shorter. With the "branches", the total length of the streets/urban motorway is ten units. There is a natural centre, which is where you end up with the pub-post office-church hall in the village, or the secondary schools-offices-shops in the town.

As people will live along the branches, nobody in the town has to travel more than half a mile to get onto a trunk road and then travel more than two-and-a-half miles into the centre. You can drop off your kids at school, go to work and then pop into the supermarket on the way home:

If we criss-cross the "blob" with roads so that every house in the village is on a road, or as few people as possible in the town are more than half a mile from the nearest trunk road, we need twelve units of roads:

Even with twelve units of roads a few people in the town are still more than half a mile from the nearest trunk road:

The other downside of this is that instead of the centre being at the cross hairs, it will spread around the roads forming the inner square with no particular focus, so people all get in each others way in the morning and the evening getting from kids' school to work; or from the office to the shops etc.

----------------------

The moral of the story is that small villages tend to grow organically in the right way ("ribbon development"). They usually start with a few houses next to each other along a road, and if the village is at the junction of two or more roads, we end up with "branches", and the pub-post office-church hall are in the middle.

But once they are big enough, the temptation for the newcomer is to try and fill in the gaps, so that you end up with a "blob". I suppose that's the key to this; if we decide to build more buildings in any urban centre, by all means build upwards in the centre and fill in all the derelict sites first, but if the built-up area is to be expanded, it is better to keep adding bits right at the end of the branches, and if a branch gets too long, then you can split it out into two "twigs" and so on.

Greater London, for example, is a "blob" with a radius of about fourteen miles or about twenty-eight miles across. If it were divided into "branches" about 5 miles across which then split into two "twigs" about eleven miles from the centre, and the "twigs" are also five miles across and about eleven miles long (so the map looks like four capital Y letters joined at the base), we get the same surface area, but...

- the longest journey from edge to centre - taking the trunk roads which run along each "branch" or "twig" would be about twenty-two miles, which is longer than fourteen, but...

- we only need 132 miles of trunk road. If we criss-cross the "blob" with trunk roads five miles apart, we need (about) 200 miles length. So we can have 132 miles of three-lane motorways using the same area as 200 miles of dual carriageways, and in urban areas, it's not the distance you travel which matters but the speed. It's the same for urban railways, it's the number of stops which dictates journey time more than absolute distance.

- nobody is more than two-and-a-half miles from the nearest bit of countryside, instead of only a third being two-and-a-half miles or less from the countryside. All of which means that air quality is much better as there's always fresh air blowing in from somewhere.

- assuming the Y's are at a sensible angle, the tips of the Y's are only about twenty miles from the centre, so the overall footprint is not massively larger than a "blob" with a radius of fourteen miles.

Posted by

Mark Wadsworth

at

15:12

23

comments

![]()

Labels: Maths, Town planning

Saturday, 18 August 2012

GBP, EUR, AUD

GBP is still scraping along the bottom of the chart, and hasn't really changed much in the last two years:

The EURocrats are playing the same game as the British government but there appears to be some way to go yet (another few per cent down?):

The only major currency which looks possible a bit toppy is AUD:

Usual rules apply: the charts from 1990 to date, except AUD which starts a couple of years later and you can click to enlarge.

Posted by

Mark Wadsworth

at

12:20

3

comments

![]()