One particularly spurious argument against taxing location values is that a lot of land is not registered, and it is quite true that back in 2005, HM Land Registry's Strategic Plan (which I can no longer track down online) said that half of land by area was as yet unregistered, but that they hoped to have full registration by 2012.

This is all pretty irrelevant, or else they could have opposed the introduction of the national income tax two centuries ago on the basis that there was no official register of how much people earn. Working out who owns (earns) what is part and parcel of any system of taxation of rental values (or incomes).

As it happens...

1. HM Land Registry have now completed registration of over eighty per cent of land by now, and if they keep going at this rate, they will have full registration in four or five years.

2. On an administrative level, this was pretty irrelevant, as the unregistered land was largely agricultural land, the total rental value of which is about £2 billion a year, as against the rental value of residential and commercial land which is over £200 billion a year (and would be much higher than that if earned income, output and profits were not taxed).

3. All this residential and commercial land is already registered for Council Tax or Business Rates purposes, even if it is not registered at HM Land Registry.

4. There is a parallel register for agricultural land called the Rural Land Register:

All land must be registered on the RLR in order to be eligible for payments under the Single Payment Scheme (SPS), the Environmental Stewardship Scheme (ES) or the English Woodland Grant Scheme (EWGS)."

5. So to the extent that we wanted to go to the hassle of collecting a billion or two from agricultural land (as long as they pay the full tax on the areas used for buildings, that is quite enough, actually), we can base it on what the RLR says. The subsidies used to be based on how good the land was, so the payments for owning arable land was much higher than for marginal land used for forestry. It'll be very interesting to see how many landowners start trying to explain that their prime arable land of ten years ago is now so degraded that it can only be used for forestry or for grouse shooting, for which the rental value is £5 or £10 per acre per year.

Sunday, 30 September 2012

Killer Arguments Against LVT, Not (241)

Posted by

Mark Wadsworth

at

12:46

8

comments

![]()

Labels: HM Land Registry, KLN, Subsidies

Saturday, 29 September 2012

Killer Arguments Against LVT, Not (240)

Mr G at HPC:

I am not dismissing the case for LVT but I am still of the opinion that the political elite will simply use it as another means of shafting the majority instead of a means of fairer taxation.

True, but that's just a question of voting for proper pro-LVT party which intends to reduce the total tax burden to its barest minimum, i.e. to only levy taxes on state-protected wealth transfers, so the only publicly collected taxes are taxes on those taxes which are currently collected privately, primarily land rents but also certain specific categories of state-protected monopoly income (patents, airport landing slots, radio frequency etc).

We don't need to re-invent the wheel each time, as Switzerland has a perfectly good working model for such a "tax cap" or "lump sum taxation" based on the rental value of land you occupy:

Non-working foreigners resident in Switzerland may choose to pay a "lump-sum tax" instead of the normal income tax. The tax, which is generally much lower than the normal income tax, is nominally levied on the taxpayer's living expenses, but in practice (which varies from canton to canton), it is common to use the quintuple of the rent paid by the taxpayer as a basis for the lump-sum taxation. This option contributes to Switzerland's status as a tax haven, and has induced many wealthy foreigners to live in Switzerland."

So if wealthy foreigner chooses to live in a house with a rental value of CHF 50,000 a year, his notional income is CHF 250,000 and he pays tax at the normal rates (between 30% and 40%) on that, so he pays CHF 75,000 - CHF 100,000 a year, end of discussion. It matters not whether that foreigner actually earns CHF 1 million or CHF 10 million a year.

There's no reason why any country couldn't do this for everybody, it would be an administrative nightmare, but just as a thought experiment:

a) Each business works out how much PAYE, VAT, corporation tax, Business Rates it would have to pay and compares this with a "lump sum" of (say) double its Business Rates bill (Business Rates being pretty close to LVT) with a full refund of input-VAT incurred. Ninety-nine per cent of businesses would prefer to pay double Business Rates (which would be about ten or twenty per cent of its normal tax bill, that's just a fact) and pay out salaries gross and retain all profits tax-free.

b) Then each employee has the choice of having full PAYE deducted from his salary, or to pay whatever the notional LVT would be on his home. Clearly, low paid people in expensive houses will prefer to just have PAYE deducted, but for most people, the LVT amount would be far less, that's basic maths.

e.g. a couple earns £20,000 each and owns an 'average' house currently worth £200,000 on which the notional LVT is 7% x £200,000 = £14,000 minus two personal allowances of £3,500 each = £7,000. The compare this with two lots of PAYE of £3,868, meaning that they will have to ask their employer to also pay £1,727 in Employer's NIC, who will respond by giving such people lower pay rises in future; and such non-LVT payers will also have to pay normal Council Tax.

c) Tenants own no land, so their notional LVT bill is quite clearly £ nil and they will just be paid gross. No doubt landlords will bump up their rents accordingly, but the landlord will have to pay the tax instead. Or he can quote a lower net rent and agree with the tenants that they pay the LVT, that does not affect the economic incidence of the tax.

d) The Homeys will then counter that "everybody will scramble to sell his house and rent a house with the lowest rental value" which is nonsense of course. That's like saying "If second hand Vauxhalls were cheaper than new Mercedes cars, then all rich people would stop buying Mercedes cars and buy second hand Vauxhalls instead".

e) I can't be bothered to do the calculations for the change in the amount of tax collected, but over time we would observe that people choose to live in houses on which the tax bill is slightly lower than their current PAYE + Council Tax bill. This is exactly the same as observing that housing is a normal good; the mortgage which first time buyers apply for is a fairly fixed multiple of their incomes at any one time, so people are quite voluntarily paying privately collected tax (mortgage repayments) which are a fairly fixed proportion of their net income (about thirty per cent), even though they could reduce this by buying somewhere smaller or in a less desirable area. There's no reason to assume that this will change, just because of the fact that mortgage payments are much lower and the publicly collected tax thereon is higher, especially if people have a lot more pre-tax income to splash around.

f) Hey presto, over the years, paying LVT will become the "new normal" and then all that remains is to sneakily bump up the income tax rate towards 100%, which will affect fewer and fewer people as most people's tax liability will be capped anyway.

Posted by

Mark Wadsworth

at

10:55

8

comments

![]()

Labels: KLN, Switzerland

Friday, 28 September 2012

"What is JK Rowling’s obsession with public transport?"

From The Daily Mail:

•Harry Potter author says writing about it "has made me much less afraid of it"

JK Rowling has admitted she is obsessed with 'buses and trains and "can't understand why they don't obsess everybody".

Her new book The Casual Vacancy starts with a character hopping on the tram and the Harry Potter author says that writing about local bus services and the rail network "has made me much less afraid of it".

Speaking last night, on the day her book was released, she answered questions from 900 assembled fans at London's Queen Elizabeth Hall. Ms Rowling admitted "people took the Tube a lot in my teens" and her obsession was cemented when her mother started taking the 'bus to work when she was 25.

"Funnily enough, flying has never worried me, and neither have tunnels," she continued, "But taxis still give me the creeps. So I'll be going home via the Floo Network."

Posted by

Mark Wadsworth

at

16:35

3

comments

![]()

Labels: Harry Potter, Public transport

Nick Clegg: Utter, utter shit

Factcheck examines Nick Clegg's bold assertion that "One of the things about governing is it forces you to confront the inconvenient truths oppositions choose to ignore. Like the fact that, over the last 50 years, our economy has grown threefold, but our welfare spending is up sevenfold."

Factcheck's quite correct conclusion is that the bulk of the increase is due to people living longer past retirement age:

This isn't actually very surprising: as the DWP itself has discovered, life expectancy has been steadily increasing for the past half century, which for DWP accountants means that state pensions are being claimed for longer...

In fact, when taken as a share of GDP, the sums spent on working age benefits have changed very little. The DWP expenditure tables calculate that in 2011/12, working age benefits cost 3.5% of GDP, approximately the same proportion that was being spent in 1982/83, and actually a smaller share than was being spent throughout most of the 1990s, where it hit 4.6% of GDP at one point.

Clegg's comparison with fifty years ago is particularly duplicitous as it implies a slow and steady increase. As the chart in the FT shows, there was a huge leap from 6% to 12% of GDP between 1962 and 1980 (the Boomers feathering their own nest early in life), and since then it has hovered around the 12% mark (plus or minus 2%). So he would have been far more accurate to say that "Total spending on working age welfare has been pretty stable for the last thirty years, costing a modest 3% or 4% of GDP"

And then of course there is a problem of definition:

* Why are only cash welfare payments included and not non-cash welfare such as education or the NHS (of which half is on old age care?).

* Fraud in the welfare system amounts to £5 or £10 billion a year. But the system is made so deliberately complicated that it costs more than £10 billion to administer. Does that count as welfare for civil servants and software companies?

* If they sell off council houses for £15,000 and then pay Housing Benefit of £5,000 a year to rent them back two decades later, is that really an increase in welfare spending or is that just an increase in subsidies to landowners?

* Do artificially low interest rates count as welfare for mortgage borrowers?

* What about netting? There are plenty of pensioners who get a state pension and also a private pension on which they pay tax; and they pay council tax and VAT like anybody else. The net transfer to the pensioner is a lot smaller than his actual old age pension.

* If government tax policies cost somebody his job in which he earned £200 a week and he ends up claiming £100 a week in benefits, then that £100 is welfare spending but why not minus off the £200 which he is being deprived off?

* What about Home-Owner-Ist policies like shifting the tax burden from land ownership to work and enterprise, and pushing up house prices generally through NIMBYism, why is that not welfare for home owners (although difficult to quantify?)

And so on. The whole thing is meaningless guff and the closer you look at it, the more meaningless it becomes.

Posted by

Mark Wadsworth

at

08:42

13

comments

![]()

Labels: Bastards, liars, Nick Clegg, Propaganda, Welfare reform

Thursday, 27 September 2012

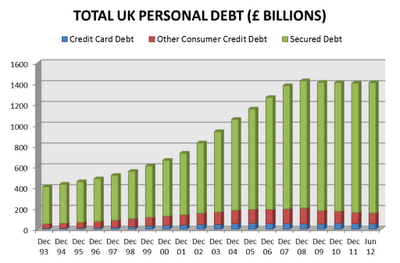

Changes in UK household debt 1993 to 2012

We've all seen plenty of newspaper headlines such as Banks 'significantly' increase mortgage lending and Cash-strapped Brits are paying off debts rather than buying houses.

Clearly, they can't both be right and as it happens they are both wrong. Truth of the matter is that household debts, nearly all of which is house price driven, increased exponentially (by 9.3% a year) between 1993 and 2007, the golden years of Home-Owner-Ism.

In 2007 the whole pyramid scheme reached its upper limit and the opposing forces of "economic reality" and "the government trying to reflate the house price and credit bubble" have been very evenly matched, as Credit Action's September 2012 report shows (from page 4):

Posted by

Mark Wadsworth

at

21:53

6

comments

![]()

Labels: Credit bubble, Home-Owner-Ism, House price bubble

NOW That's what I call complete bollocks

From The Sun:

THE party could be over for pop institution NOW That’s What I Call Music. As part of Universal’s takeover of EMI, the record label must sell EMI’s 50 per cent stake in the classic compilation brand.

Unless someone invests in the 29-year-old album series, it will end with NOW 83 in November..

I think NOW is safe because it still makes so much money. No other compilation brand comes close to its 100million sales. And if NOW were to be taken out of the mix for labels and artists — it would leave a huge hole in their earnings.

The reason why the NOW albums were always so good is because it was a collaboration between several major record labels, who all allowed their most popular hits to go on it. For sure, it was initiated/managed by Virgin/EMI together, but in those days, there were still half a dozen major (of whom EMI were just one) and dozens of minor record labels; it needed somebody to get the ball rolling to everybody's mutual benefit.

But so what, either the NOW series makes money or it doesn't. And it does. Further, NOW is not a business in the traditional sense, it's just a brand name or a boxful of contracts (a bit like Bernie Ecclestone - the entire assets of his Formula One empire would fit in a briefcase as it's all just contracts). NOW has few or no employees, no pressing plant, no assets, no artists under contract, it has nothing other than itself and the fact that people go and buy NOW albums by force of habit (I've got every one from 49 onwards).

So EMI does not actually need to sell its stake to anybody and nobody needs to buy it, and nobody needs to invest in it either (there's nothing to invest in). EMI can just cease involvement and whoever currently owns the other half just gets on with it.

It's then entirely up to Universal-EMI to negotiate how much royalties it wants for allowing hits from its own roster to appear on NOW albums in future. So there's no reason to assume that Universal-EMI will end up worse off for abandoning its stake in NOW - instead of EMI getting half the net profits after paying royalties to all the other record labels (which no doubt includes Universal anyway)for using their songs, Universal-EMI gets the royalties up front and Virgin's residual profit share is correspondingly smaller.

Posted by

Mark Wadsworth

at

14:24

7

comments

![]()

Labels: Corporate structures, Music

"£20bn NHS savings spark care quality fears"

From The Evening Standard:

Quality of care for patients could suffer as the NHS struggles to make £20 billion in efficiency savings, health experts have said.

Two-fifths of NHS finance directors expect patient care to worsen over the coming years, according to a survey. Almost two-thirds think that the NHS as a whole will struggle to achieve the £20 billion "productivity challenge" by 2015, according to The King's Fund research...

So the NHS is supposed to "save" £20 billion over the next three or four years, and when they say "save" what they mean is "spend less than in an alternative scenario where they spend more" (a bit like your wife "saving" £100 off a pair of shoes she didn't need, or indeed your husband "saving" £100 off some whizz bang electronic gadget which he didn't need either).

According to the excellent www.ukpublicspending.co.uk site, NHS spending more than doubled (from £55 billion a year to £120 billion a year) between 2001 and 2010, from which stage spending is expected to flatten off (or only rise gradually).

So a £20 billion saving over 4 years is actually only £5 billion a year, which is like reversing the NHS clock by about six or nine months, surely this is not a thing of impossibility? And if they want a quick win, they can just tear up the PFI contracts on the basis that they were entered into under false pretences, that the awarder of those contracts was acting ultra vires etc etc. Or simply introduce a new Schedule G, and charge tax on profits therefrom at 100% with no deduction for expenses.

Posted by

Mark Wadsworth

at

13:07

2

comments

![]()

Labels: Government spending, NHS

"Half a second"

From City AM:

A TOP European Parliament committee voted unanimously in favour of rules to cut down high frequency trading yesterday, and move forward plans to limit the number of positions market participants can hold.

MEPs claimed the markets in financial instruments directive (Mifid2) will promote market stability by forcing traders to place orders in markets for at least half a second.

Posted by

Mark Wadsworth

at

09:51

11

comments

![]()

Labels: EU, Speculation

Telephone Tips #1 How to leave a message

It's quite simple, you say your name and then your own telephone number, loud and clear and slowly.

It you then want to prattle on brightly for several minutes, that's fine, the person listening to the message can ring you back as soon as he has got the general gist.

If you do the prattling brightly first and then mumble your telephone number right at the end, or even worse, don't mention it at all, that is about as much use as a missing sock.

Posted by

Mark Wadsworth

at

07:58

10

comments

![]()

Labels: Telephones

Wednesday, 26 September 2012

Putting the "fun" into Funding For Lending

Let's assume that City AM has explained the rules correctly:

Q What is the Funding for Lending scheme?

A It is a government scheme to offer banks cheap loans with incentives to lend more to households and businesses. Banks can borrow funds worth up to five per cent of their loan book as of 30 June, at 0.25 per cent. If they increase lending, they get offered more funding; if they lower lending, the interest rate goes up. The loans last for up to four years, and the scheme is open for 18 months.

Q Why was it launched?

A It opened on 1 August as politicians and officials feared the funding markets would seize up again, hitting banks hard and cutting the supply of credit. This is a way to guarantee banks cheap funds.

That first bit does not make sense; if a bank declines to take part, then the outrageously low interest rate on the taxpayer funded loans can't be increased. It's like threatening devout Quakers with a hike in alcohol duty. And if it 'works', then what we are looking at is a reinflation of the credit bubble.

The second bit does not make sense either, businesses are being asked to hand over nearly £400 billion a year in VAT, PAYE, corporation tax etc, what's the point in taking their hard earned money and then lending it to banks at a discount in the vague hope that some of it will be recycled back to the businesses which provided the money in the first place?

Posted by

Mark Wadsworth

at

10:32

6

comments

![]()

Killer Arguments Against LVT, Not (239)

From the FT readers' letters:

Private landlords (a majority of whom are individual investors) own 3.7m homes and provide homes for the increasing number of people who cannot afford a home of their own;(1) many of these landlords consider housing investment as a replacement for other forms of pension savings,(2) yet they pay tax on their Schedule A rental income and they pay CGT on profits from the sale of their properties.(3)

Politicians and their advisers need to understand clearly the consequences of introducing a wealth tax on owner-occupied homes (4) and those homes provided by private landlords; investors in housing have provided much of the housing capacity over the past 10 years,(5) yet additional taxes may drive them away from the sector, forcing many tenants (unable to buy their own home) to find homes in a rapidly declining market.(6)

Charles Fairhurst, London W1.

Nope, his statistics are correct but otherwise it's all lies from start to finish.

1) Clearly tenants can afford them, as the rent will always be slightly more than the landlord's costs, some of which would not be incurred with owner-occupation. A large part of the reason why tenants cannot afford to buy them is because by and large, BTL landlords have made net purchases equal to most new housing built in the last ten years, thus driving up the price (the tax and subsidy advantages of this kind of 'investment' goes straight into higher prices).

2) And it's the tenants' job to go out and work and give the already wealthy a handsome pension income? Quite how are tenants supposed to save up for their own pensions..?

3) True. But the landlord bears these taxes, not the tenant.

4) Yes, would lead to more efficient use of land and buildings; would enable tax cuts on the productive economy (primarily benefitting tenants); would dampen boom-bust cycle etc.

5) Wilful distortion - see (1). And those 'investors' haven't provided the most important and expensive element of housing: the land with planning permission. The land is just there and planning permission is an entirely political thing of little relevance in a truly free market.

6) OK, so net income will decline and thus the resale value will decline, although there's no reason to assume that the percentage yield (i.e. net income divided by selling/purchase price will decline), so our BTL landlords will not be able to improve their income by selling up and the effect will be far less marked than he claims. And if they do sell a few of those 3.7 million homes, I'm sure there are plenty of tenants who'll be only too happy to buy them for owner-occupation.

Isn't one of the big Home-Owner-Ist lies that there is a shortage of housing? Has the man managed some leap of Homey DoubleThink and persuaded himself that a tenant under threat of eviction would rather be homeless than buy himself a cheap house, and that all those houses sold for knock-down prices would stand empty? Who in his right mind is going to buy a house with a recurring tax bill and leave it standing empty? Simple observation of existing facts in the real world tells us that the number of vacant buildings goes down if the tax on them increases.

Posted by

Mark Wadsworth

at

09:53

5

comments

![]()

Labels: Housing, KLN, Propaganda

Tuesday, 25 September 2012

Lib Dem crackpot idea of the day

From The Telegraph:

The Deputy Prime Minister said that at a time of economic strain, it was questionable whether it was right to continue making payments to multimillionaires such as Lord Sugar, the Labour peer, businessman and television star.

But the benefits will continue for the rest of the Parliament, due to come to an end in 2015, because a promise to maintain them was included in the Coalition Agreement drawn up between the Conservatives and Liberal Democrats when they came to power in 2010.

Iain Duncan Smith, the Tory Work and Pensions Secretary, is among those who have previously called for the end of universal benefits for the elderly, regardless of income. The winter fuel allowance alone is worth up to £200 for each pensioner – £300 for those over the age of 80.

As ever, it's a bonfire of prejudices here, but I wonder, what is the point of all this? The winter fuel allowance, free bus passes and free TV licence for over-80s "cost the taxpayer" something like £4 billion a year, if you go through the expense and rigamorale of preventing pensioners with assets of more than £1 million (the suggested threshold), which is maybe 1% of pensioners, that "saves" about £40 million a year, which is f- all, compared to the extra £100,000 million they have been spending each year since the "financial crisis" was started.

And seeing as means-testing is just taxation for dishonest politicians or gullible voters, why not hike Band H council tax by a few per cent and get the £40 million in that way?

Do these people not understand maths: reducing somebody's benefits it exactly the same as giving them the benefits but increasing the tax they pay, only the latter is simpler, cheaper to administer and more honest. This is just like the Child Benefit changes: what they boil down to is that higher earners with children will continue to receive Child Benefit but they will pay a much, much higher marginal rate of tax on earned incomes between £50,000 and £60,000 a year.

Posted by

Mark Wadsworth

at

21:33

4

comments

![]()

Labels: Idiots, Lib Dems, Nick Clegg, Pensioners, Welfare reform

"BBC apology to Abu Hamza over Queen disclosure"

From the BBC:

The BBC has apologised for revealing that Abu Hamza raised concerns with his henchmen about why Queen Elizabeth II had not been blown up yet.

The apology comes after security correspondent Frank Gardner told BBC Radio 4 of a private conversation he had with a senior al-Muhajiroun member some years ago. The BBC said it and Gardner were sorry for the "breach of confidence", which both "deeply regret".

On Monday, Abu Hamza lost his latest appeal against extradition to the US. The European Court of Human Rights ruled the extradition could go ahead. The Home Office hopes this can be achieved within three weeks.

Anu Hamza's lawyers have now submitted a further appeal, pointing out that this new disclosure was likely to harm his defence strategy, which was to protest his innocence.

The development was being discussed on Radio 4's Today programme on Tuesday morning when Gardner revealed details of his conversation with a known terrorist on the matter. He said the Islamist had told him, in a private meeting, how Abu Hmza had been upset that the Queen was still alive.

Posted by

Mark Wadsworth

at

18:41

0

comments

![]()

Labels: Abu Hamza, BBC, HM Queen Elizabeth, Terrorism

"CBI says outsourcing services could earn them £22 billion"

From The Evening Standard:

Outsourcing more public services could earn CBI members around £22 billion while adversely affecting quality, according business leaders.

The Confederation of British Industry (CBI) said "inertia" in Whitehall was stopping more state funding being given to the private sector and warned ministers that shunning reform would be a "recipe for disaster for high paid directors".

Its Open Access report, based on a study carried out by Oxford Economics, found improved profitability in businesses and independent organisations would lead to an 11% increase in costs.

John Cridland, CBI director-general, said the private sector was hardly ever best but insisted increasing pressures on his members' end of year bonuses meant the Government must change the way functions like pointless administration and form filling are run. He suggested schools should not waste time running their own lessons or meals service when they could outsource provision and focus on form filling, which they can also outsource.

"Our public services are under pressure as never before with increasing burdens placed on it by PFI schemes and other such disasters, including from an ageing population keen to see a good return on their shares and an urgent need to manage costs," he said.

"Carrying on regardless would be a recipe for disaster. The Government needs to face this tough policy challenge head on. Most public services are still largely state monopolised and it's time to hand them over to my members so that they can monopolise them instead. That is the way to boost out profits by billions of pounds.

"That's isn't to say the private sector should do everything. Not the tricky stuff or the difficult stuff. But, take school lessons - is it really necessary for three quarters of all our schools to be worrying about books and providing teaching staff? We need the Government to set out which services it is prepared to shut down and give us the money instead and when.

"Businesses recognised that there are justified concerns following recent high profile failings. But then we thought, f- it, if we don't ask, we won't get, and that we'll have to work harder to maintain public trust by consistently coming up with new excuses."

The Government published its Open Public Services white paper last year and insists progress on reform is being made.

A Cabinet Office spokesman said: "Improving delivery of taxpayers' money to our friends, family and donors has been a Coalition priority since day one. We have recently made a number of senior appointments, who all have significant commercial experience, to reform the way we subsidise the corporatists with nary a thought to value for money for the taxpayer.

"These appointments include a new Government Chief Operating Officer and will enable us to go even further with our crucial inefficiency and reform agenda and build on the £5.5 billion of corporate subsidies achieved last year.

"This Government recognises the need to distribute taxpayers' money differently in future, in more nuanced and flexible ways, and we are working closely with industry to achieve this. As part of this, we are considering a range of different models.

"While we fully support outsourcing where there is clear evidence that this will boost productivity, we are also toying with the idea of just handing them cash for doing nothing, because 'doing nothing' is almost impossible to f- up, so at least it generates no adverse headlines when the recipient does nothing. As a fig leaf, we are also backing a new wave of employee-owned mutuals which we know can provide a better, more efficient flow of cash to the owner-managers, who will usually be the council and quango fat cats responsible for signing up the contracts in the first place before switching jobs."

Posted by

Mark Wadsworth

at

12:51

0

comments

![]()

Labels: Corporatism, Kleptocracy, Quangocracy, Waste

"German Catholics lose church rights for unpaid tax"

From the BBC:

Germany's Roman Catholics are to be denied the right to Holy Communion or religious burial if they stop paying a special church tax.

A German bishops' decree which has just come into force says anyone failing to pay the tax - an extra 8% of their income tax bill - will no longer be considered a Catholic.

The bishops have been alarmed by the number of Catholics leaving the Church. They say such a step should be seen as a serious act against the community.

This is not really news, as the Kirchensteuer surcharge has been part of the German tax system since the 19th century. You have always been able to opt out, and when I worked there, none of my employers ever asked me whether I wanted to pay it, which saved me the hassle of explaining that a) I'm an atheist and b) I've no interest in paying a Pfennig more in tax than I have to.

The unanswered question always was: what happens if you do opt out? Surprisingly few of my clients ever did. The answer must have been that you are ex-communicated (or whatever the equivalent is for Protestants), meaning you can't go to Heaven, but then of course, the next question would be, what happens if you opt in again for the last few months of your life? Does that buy you a place in Heaven or would you have to pay back tax for the missing years? What if a German Christian were to move abroad for a few years and thus not be able to pay the tax? And so on.

Nobody ever really talked about all this, and as far as I am aware, people who opted out were no more likely to be killed by bolts of lightning or falling trees than anybody else.

Posted by

Mark Wadsworth

at

10:54

13

comments

![]()

Labels: Germany, Income Tax, Religion

"It's a ram-raid!"

From The Daily Mail:

The owners of a shop were left gobsmacked when eighty sheep flocked to their store in an Austrian ski resort.

The ram-raiders drove the owners and perplexed shoppers baa-my when they invaded the shop in St Anton and caused thousands of pounds of damage.

A spokesman for the Intersport shop said: "We think one of them saw its reflection in a mirror and came in to investigate... And being sheep, of course the rest of them decided to follow."

Once the sheep had been ejected, a tourist was enticed back into the shop, and luckily, lots of other tourists followed him in like sheep.

Monday, 24 September 2012

Oi! Get orff my land you fucking plebs! Don't you know I pay your wages?

Posted by

Mark Wadsworth

at

21:37

5

comments

![]()

Labels: Andrew Mitchell, Bastards, Caricature, Policing, Swearing, Tories

Fun Online Polls: E-Bacc & Crackpot Lib-Dem ideas

The results to last week's meaningless rebranding exercise were as follows:

CSE's - 11 votes

GCE's - 10 votes

GCSE's - 12 votes

English Baccalaureate - 21 votes

School leaving age - 14 votes

Participation age - 13 votes

Other such gibberish - 27 votes

Only 47 people took part and no doubt none of us is any the wiser for it.

---------------------------------------------------------

This week it's the Lib Dems' turn, after three days of conference, we've seen plenty of daft ideas. Which is your favourite so far?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

15:02

5

comments

![]()

Labels: Banking, coalition, Education, House price bubble, Idiots, Lib Dems, Pensions, Vince Cable

Vince's crackpot idea of the day

From The Guardian:

George Osborne has agreed to set aside £1bn to establish a British business bank to help small- and medium-sized enterprises, Vince Cable will announce on Monday.

In what Liberal Democrats are hailing as one of the major announcements of their conference, the business secretary will say that the new bank could leverage up to £10bn to help businesses struggling to find funds from high-street banks.

Just like with Nick Clegg's "give your children your pension to help them onto the property ladder" idea, words fail.

FFS, the sub-plot of the most recent episode of The Thick Of It was that two ministers set up exactly such a small business bank, but that was supposed to be satire.

Posted by

Mark Wadsworth

at

10:01

9

comments

![]()

Labels: Banking, Idiots, Satire, Subsidies, Television, Vince Cable

Sunday, 23 September 2012

Killer Arguments Against LVT, Not (238)

I'm not sure whether CityUnslicker meant it as a spoof or not, but here goes:

but I need to rent land from the government by dint of tax obligation I never own any really.(1) What happens when the government decides to raise taxes by 100%? (2)

Taxes always go up, they go up always, forever (3), as politicians know the answer to getting votes is spending other peoples money.(4)

By taxing land you have created the ultimate, never-ending, tax raising machine.

Poverty for all.(5)

1) Do I own my own body? Yes, because nobody else does. I still have to pay for stuff to keep myself alive like food, clothes, warmth and shelter. I own my own car, I still have to pay for petrol, repairs, insurance and so on. If I want to own land, I pay the current owner for the value of the improvements he has added (or which he has paid for) and I pay the 'community' for the value which I derive from them; be it favourable access to other stuff (schools, job, shops, a nice view) and as compensation for them respecting my exclusive possession. It's no different to an interest-only, non-redeemable, variable-rate, non-recourse mortgage (there can never be nequity on it, you can always walk away scot-free), which sounds a more attractive proposition than making people and businesses pay tax on the value of their output, earnings and profits.

2) They wouldn't. You might as well argue against income tax on the basis that the rate could be increased to more than 100%. In fact, if you add together VAT and PAYE, the overall effective rate is sometimes more than 100% of profits which can be made and those businesses go bankrupt. It's just that few people realise this.

Conversely, the government does set the rents on a lot of land (Crown Estate and social housing) and clearly they do not set it above market rates, in fact the Home-Owner-Ists are always wailing that social rents are too low. Similarly, the politicians don't like increasing in-your-face taxes like council tax, Business Rates or LVT, so the chances are that they'd never collect anywhere near 100% LVT.

3) Land rents as a share of GDP tend to go up as the economy becomes more developed, that's a simple fact. So ideally, LVT would go up as land rents go up. History shows that taxes on land rents have always lagged increases in land rents, so if anything the problem is in the other direction, that the government would be too cowardly to raise enough tax.

4) Aha, nice Homey contradiction there: does he seriously claim that the government would piss off 100% of voters by increasing their LVT in order to buy the votes of a far smaller number of voters - who will always wail more about their LVT having gone up than they'll say thanks for the extra handouts? This trick only works with stealth taxes; so the government hikes stealth taxes like VAT and National Insurance in order to be able to freeze a more visible tax like Council Tax.

In any event, LVT does not mean suspension of democracy. The old vested landowning and banking interests in the Tory Party (or behind New Labour) will always agitate for lower land taxes and higher stealth taxes on income; and the diehards in Old Labour will always agitate for higher taxes on income or private wealth (they have perenially missed the point of LVT). It's up to those who are in the productive sector to compaign for low taxes on income, sensible taxes on land values and having as much as possible of the proceeds dished out as a Citizen's Income/Personal Allowance (call it what you will).

5) The man doesn't have any grasp of maths.

As a general rule, and you can check the maths in as much detail as you like, this is quite simply true: under a full-on LVT system with a corresponding system of a "Citizen's Income" or "Universal LVT Credits" (one of the main reasons for having LVT is so that every member of society benefits equally from the existence of the nation-state and the resulting land values), the average-size household in a median-value home would pay plus/minus nothing in LVT minus Credits - regardless of how much they earn (income tax etc having been abolished). And neither will they be paying net ground rent or interest on a mortgage into private hands.

You can't make the median household any better off than this. It's mathematically impossible. So if there's no poverty for those in the middle, where exactly is it?

Those people who are happy to pay to live in above average houses would pay - entirely voluntarily - for the core-functions of the state and for the modest net distribution to those households in below-median value housing, i.e. those households whose CI/Credit entitlement exceeds their LVT bill. If they were no LVT, then land prices would be correspondingly higher, and what you save in LVT you just pay in higher mortgage payments. These people are also considerably better off than now (no income tax etc).

That is as close to a tax-free society as you can ever get; if the above-average rents/taxes weren't collected by the government and spent on stuff which benefits us all, then they would be collected privately and spent on consuming stuff created by the productive economy for nothing in return.

Posted by

Mark Wadsworth

at

19:21

9

comments

![]()

Labels: Home-Owner-Ism, KLN

Crackpot idea of the day

From The Daily Mail:

Liberal Democrat leader reveals parents and grandparents can use pension funds to guarantee mortgage deposits for first time buyers...

In an attempt to move on from grumblings about his leadershop, Mr Clegg's hailed a plan to help young people to buy their first home. Mr Clegg said: ‘We have thousands of young people who are desperate to get their feet on the first rung of the property ladder but deposits have doubled and the number of young people asking help from family members has doubled.'

He unveiled a plan being worked on by the Treasury and the Department for Work and Pensions which would allow parents and grandparents to use the lump sum of their pension as a deposit for their children or grandchildren to buy a home.

Liberal Democrat sources said around 250,000 people had a pension pot of £40,000, with a lump sum element of around a quarter - £10,000 - which could be used as a guarantee. They estimate that five per cent of those with a suitable lump sum would take advantage of the scheme, meaning 12,500 people could potentially benefit.

Words fail. All this means is that yet more savings and real wealth will be tied up in leveraged land speculation, so even if it works on an administrative level (which it won't), it will be a disaster economically.

Posted by

Mark Wadsworth

at

18:50

13

comments

![]()

Labels: Home-Owner-Ism, Nick Clegg, Pensions

Saturday, 22 September 2012

'Walkers gave me a Mars bar and saved my life'

From The Westmoreland Gazette

A COAST to coast walker has spoken of his horror after nearly dying during a cow attack in Eden...

He was knocked over by four cows in a field at the edge of Shap. The 48-year-old said if it was not for the help of the Australian walkers and the emergency services he could have died. He was on the third day of his 191-mile walk when the ‘ambush’ happened.

“They were looking at me and I was looking at them but I am always wary of the animals and try to keep my distance," said Mr Gregory. “I saw them coming at me at quite some speed. I let go of my dog's lead – he was panicking. They knocked me down, I lay on my side in a little ball. One cow then stamped on my head; it then stamped on my back.”

The animals went on to kick the experienced walker several times. He was only saved when the cows redirected their attack to Mr Gregory's border collie, Max.

Friday, 21 September 2012

Killer Arguments Against LVT, Not (237)

Form the IEA 'blog:

Paul Perrin: [blah waffle, poor widows, confuses LVT with planning laws, invents numbers out of thin air, doesn't have a clue about anything, whine, moan]

Roy Langston: @ Paul Perrin: Your objections to LVT are unfounded, if not fanciful or dishonest, as already explained -- and as all objections to LVT have always been, and always will be.

If planning permission raises the value of your land, your LVT is not going up "through no fault of your own," but because you have consciously and deliberately decided to deprive others of their liberty to use the land nature put there, and the associated access to the opportunities, amenities, services and infrastructure government and the community have made available there.

It is crucial to understand exactly what a land title is: not rightful ownership of the fruits of one's labor, but merely a legal privilege of depriving others of their liberty to use the land that was already there, ready to use, with no help from the owner or anyone else.

Where a change in planning permission results in a permitted use that no longer matches existing improvements, the assessed land value would be reduced by the cost of buying and demolishing the existing improvements, as any prospective user wanting to engage in the new use would have to shoulder that cost before he could use the land.

All land would be taxed NOT as if it were already improved to the maximum extent possible, but the SAME as if it were to be used in its most profitable permitted use. That is what taxing its "unimproved" value means: taxing the value someone is WILLING TO PAY to use (and normally improve) the land for that purpose.

Or to give a real life example, if a site has a little 2-bed bungalow on it, and the owner knows that if he replaced it with a four-bed detached house, the extra rental value (over and above the cost of demolishing the old house and building and maintaining the new one) would be another £10,000, when he applies for planning permission for his 4-bed, he will of course negotiate with the local council in advance; if they ask for an extra £12,000 a year, he just doesn't develop and stays with the bungalow (losing nothing).

If the council agrees an extra LVT bill on the 4-bed of £10,000 or less, then the owner/developer goes ahead; and as part of the negotiations they might as well agree that for the six-month period during demolition/construction, the LVT is precisely nil; the higher LVT bill does not start until the developer has had a reasonable chance to get the new house built.

Posted by

Mark Wadsworth

at

17:12

20

comments

![]()

Labels: KLN

Daily Mail unearths important background info on Alps Massacre family

From The Daily Mail:

* Family owned crumbing house in village some 30 miles from Bordeaux

* Find proves Mr Al-Hilli had investment interests in the country

* He had been 'planning to create a small apartment in order to rent it'

Until now, French detectives assumed that Mr Al-Hilli’s 1 million pounds plus family home in Clayton, Surrey, was their sole residence.

Because when solving a crime, the number of houses people own, what they are worth and so on is usually vital evidence. No doubt the French police will also be able to build up a profile of the killer or killers, work out what sort of house or flat they own or rent, and that will narrow down the search enormously.

Posted by

Mark Wadsworth

at

11:59

1 comments

![]()

Labels: Daily Mail, Home-Owner-Ism

MPs call on MPs to give up pensions after Olympic failure

MPs should forgo their massive pensions after failing to supply any of the legacies promised by the Olympic Games, a committee of MPs has said.

They should also compensate hotel owners who were promised a boost of tourism from the Olympics but did not get any, the Home Affairs Committee argued in a report on Olympic legacy.

MPs pensions cost £20.5m

But committee chairman Keith Vaz said that MPs had delivered an expensive fiasco after "recklessly boasting" that it could meet the promises to voters.

Tourism chiefs admitted last month that Olympics had cost in tourism revenue after the Olympics reduced the number of visitors to the country.

The hotel owners were forced to turn to their banks for extra loans, which they'll have to pay.

"The government of the 8th largest economy in the world, taking people's money at threat of violence, turned years of people's work to nothing" Labour MP Mr Vaz said.

The government had provided the people with information that was "at best unreliable, at worst downright misleading", he added.

Mr Vaz explained: "Days before they admitted their failure, Jeremy Hunt was telling people that tourism would be boosted, even though all the evidence from years before was that it wouldn't."

The report also suggested that voters should maintain a blacklist of parties to avoid when making future voting decisions.

Posted by

Tim Almond

at

10:14

2

comments

![]()

Labels: MPs' pensions, Olympics

Thursday, 20 September 2012

Why the Conservatives care so deeply about house price inflation

I've cobbled together a chart showing Nationwide's monthly figures for annual house price changes and the Conservatives' lead over Labour in the opinion polls (from here). Positive means the Conservatives are ahead, negative means Labour are/is ahead.

The co-efficient of correlation is 0.76, which seems pretty high to me.

Posted by

Mark Wadsworth

at

21:01

2

comments

![]()

Labels: Conservatives, Home-Owner-Ism, House prices, Labour

Well done, lads

From Which4U:

Bonus payments for UK workers rose by 3% in the 2011/12 financial year, with those in the finance sector pocketing the most. The amount paid in bonuses reached £37 billion, an average of around £1,400 per worker, said the Office of National Statistics (ONS).

Of this £37 billion, over a third – £13 billion – went to employees in the finance and insurance industry, a 9% fall from the previous year. This equates to roughly £12,000 per employee, from £13,500 the year before.

Though bonuses remain significantly lower than the levels seen before the onset of the financial crisis, employees in finance and insurance continue to do well in a stagnant economy.

I'm not even sure that the last paragraph is true. A third of £37 billion is £12 billion, and before the 'financial crisis', bonuses were running at about £9 billion a year

Posted by

Mark Wadsworth

at

19:03

0

comments

![]()

Labels: Banking, Bonus culture

Well duh!

From IT PRO:

Business focused social networking site LinkedIn claims to have accrued its 10 millionth UK member, and that four out of five professionals now use the site.

The UK cities with the most LinkedIn members include London, Birmingham, Reading, Edinburgh, and Manchester.

No doubt you'd observe that most stamp collectors, fast food outlets or amateur chess clubs are in those places, because that's where most people live.

Posted by

Mark Wadsworth

at

12:47

0

comments

![]()

Labels: Internet, statistics

Burned to a crisp

From the BBC:

Nightshift workers at a factory near Caerphilly that makes potato crisps have been evacuated as fire crews tackle a large blaze.

Firefighters say 75% of the Real Crisps plant on the Penyfan industrial estate at Crumlin was alight as crews arrived just after 03:30 BST on Thursday. More than 50 firefighters and eight engines are at the scene as they try to stop the flames spreading.

Nearby residents are being advised to keep doors and windows closed.

Posted by

Mark Wadsworth

at

08:46

3

comments

![]()

Wednesday, 19 September 2012

Yeah, but has anybody ever read one of his books?

Posted by

Mark Wadsworth

at

21:22

11

comments

![]()

Labels: Books, Caricature, Islamists, Salman Rushdie

"Racism in banking still a significant problem, says report"

From the BBC:

Racism remains a "significant problem" in British banking despite improvements in recent years, according to a House of Commons committee report. MPs also said homophobia may now be the most prevalent form of discrimination.

The report responds to "continuing concerns" following the Kweko Aduboli case. John Whittingdale MP, chair of the inquiry, said: "Recent incidents of coloured bankers being used as scapegoats in the UK highlight that there remain significant problems."

Although LIBOR-fixing, PPI mis-selling and other abuses are rife in the City of London, and all trades are recorded in real time on computer systems, when it comes to making a token sacrifice, it is usually non-white bankers who are singled out, even when the bank concerned had been aware of, and tolerated, his activities for some considerable time.

Outside of the commercial banks, senior members of the Bank of England and the Financial Services Authority are overwhelmingly "white, male and middle-aged".

The Financial Services Committee report said that behaviour and the atmosphere at trading floors and back offices had "changed hugely" since the 1970s and 80s "when racial and other forms of abuse were common". It added that several initiatives and charities such as Love Finance Hate Racism have helped to reduce racism where it is most prevalent - at the high street banks and online - but more still needs to be done.

Posted by

Mark Wadsworth

at

08:54

0

comments

![]()

Tuesday, 18 September 2012

Post-ironic haiku for the new age of customer service

At Blue Eyes. Truly exquisite.

Posted by

Mark Wadsworth

at

21:10

3

comments

![]()

You Only Live Twice Once

I don't get it.

Has it not been established over the past thirty years that doing the theme song to a James Bond film signals an end to your career as a pop star?

Nobody has ever recovered from it, AFAIAA, for whatever reason, once you've done one you lose all credibility, drive, creativeness; whatever that magic spark or unique selling point is you had, it's extinguished.

Posted by

Mark Wadsworth

at

19:40

7

comments

![]()

Labels: Films, James Bond, Music

Fun With Numbers

From the BBC:

The government is considering ending the automatic annual increase in benefits in line with inflation, sources have told BBC Newsnight. If implemented, the move would see many benefits frozen for two years, then rising only in line with average pay...

Ah... why's that then?

In recent years inflation has risen at a far higher rate than average earnings - Whitehall officials say a switch since 2008/9 would have saved £14bn.

If and when the depression is ever over and the normal pattern re-established, i.e. wage increases are higher then inflation, the Tories (and probably Labour) will change tack and say that benefits should be increased with inflation again, so there's no logic to this other than choosing whichever figure is lower.

What about pensions then?

One benefit that will not be affected is the state pension. Pensions are now protected by a "triple lock" which means they will go up annually by either inflation, earnings, or 2.5%, whichever is higher. Having introduced this measure, the coalition will not touch it. But all other benefits are not protected in this way.

Which illustrates my general point: you can have anything you want, provided enough of you are prepared to go out and vote for it.

Posted by

Mark Wadsworth

at

07:33

8

comments

![]()

Labels: Democracy, Inflation, Pensions, Welfare reform

Monday, 17 September 2012

Fun Online Polls: Mazda drivers and Baccalaureates

The results to last week's Fun Online Poll were inline with my own perception:

How old is the typical Mazda MX5 driver?

Under 39 - 14%

40 to 49 - 21%

50 to 59 - 41%

60 or over - 16%

Other, please specify - 7%

Suggestions for "Other" included "female", which is a fair point, actually.

---------------------------------------

This week, let's do a bit of rebranding, just for the heck of it.

Cast as many votes as you like for some meaningless gibberish here or use the widget in the side bar.

Feel free to scrawl some more gibberish in the comments. Who knows? If it's as inane as changing it from "school leaving age" to "participation age", you might get offered a job in the Department For Education.

Posted by

Mark Wadsworth

at

17:25

1 comments

![]()

Labels: Cars, Education, Exams, FOP, Michael Gove MP

Money can't buy you happiness

Not if you are a miserable bastard to begin with.

The Guardian did a small survey to find out if people felt rich or poor, and the ensuing article is well worth a read.

There are some interesting insights into how people view their housing, like the PR from Surrey who says "Considering my husband works 6.30am - 0pm, and I'm also working three days a week, you'd expect to have your own home." A nice piece of Home-Owner-Ist propaganda there, that a rented house is not your home.

A great comment also from a London PA "Somebody did a study and the conclusion was, if you live in the best house in a shit street, you feel much happier than if you live in an objectively much nicer house but it's the smallest one in a nice area. That's something I think about a lot. It may be part of why I feel happy with my life."

It's also interesting how many of the responders are mortgaged to the hilt - Ricardo's law in action. Generally, though, it does show that richness or poverty tend to have as much to do with attitude of mind as it does with actual income, although not living beyond your means has a lot to do with not feeling poor.

Posted by

Bayard

at

07:19

14

comments

![]()

Labels: Poverty

Sunday, 16 September 2012

"Photographer and rugby player tumble through window to their deaths in slurry pit"

From The Daily Mail and The Daily Mail:

A photographer and a professional rugby player fell through an open third-floor window to their deaths at a glamorous party celebrating London Fashion Week.

Guests were horrified when Peter Alexander, 28, and Martin Spence, 22, both stumbled through the window, which was covered by a blind. They fell into a slurry pit on Martin's father's farm in Co. Down, Northern Ireland. Spence's sister Emma, who also tried to help, got into difficulty herself and was taken to be cleaned up...

The pair were said to be ‘messing around’ at Thursday night’s party, which was hosted by fashion PR company Blow to showcase designers and stylists. It was attended by drag queens in glitter and high heels, models and artists. The Northern Ireland Ambulance Service (NIAS) said it responded to a 999 call at about 12.15am following reports that up to three people had fallen into a slurry tank.

Posted by

Mark Wadsworth

at

09:51

3

comments

![]()

Labels: Death, Fashion, Northern Ireland, Rugby

Saturday, 15 September 2012

Three for the price of two

These special offers are particularly common with toiletries, which is the sort of thing you don't buy every time you are at the supermarket (toothpaste, soap, deodorant etc) because they last for weeks or months. You note when something is running out and buy another one when it does.

These offers still make good sense for the retailer, because the biggest single item of cost is the storage/display. While stuff is on the shelves (or in the warehouse ready to go on the shelf), it costs money in terms of cash tied up, rent and rates, heat and light, insurance, pilferage. Food goes off quite quickly, so if a bag of carrots costs 30p wholesale and is no longer saleable after a week, the holding cost of that bag of carrots is 4p per day, but let's stick to toiletries.

To illustrate the principle and using arbitrary figures (this is primarily a maths problem), let's assume something retails for £1 (net of all taxes), costs 30p wholesale and that the retailer has to make a minimum margin of 20p per unit to cover all fixed costs (head office, computer system, advertising, red tape, net profit/return on capital etc).

Let's further assume that storage/display cost of the item is 2p per day and it normally stands on the shelf for 25 days. The retailer's margin is selling price £1 - wholesale 30p - [25 days @ 2p storage] = 20p, by the time you have bought three of them, he has made 60p margin.

If he does a 3-for-2 offer, people will think great, it wasn't really time to buy another bar of soap or tube of toothpaste yet, but I've enough space for three in stock in my bathroom cupboard, and people will buy them in advance. As long as the items now only stay on the shelf for eight days, the retailer is home free:

Selling price £2 - 90p wholesale - [3 x 8 days @ 2p storage] = 62p margin.

Obviously, the retailer can achieve one of two things: he might sell more stuff from the same retail square footage; or he might require less square footage to sell the same amount of stuff, it comes to much the same thing in the end.

The calculation is quite marginal. If the item is never sold singly for £1, only in batches of 3 for £2, then that becomes the new normal, and the eight-day turnaround period for the special offers will creep back up to a much longer period (no more impulse buying). Even if the period only goes up from eight to ten days, that 62p margin turns into only 50p margin.

So that is why the retailer does this sporadically and seemingly at random. This week it's toothpaste on 3-for-2 and he shifts enough toothpaste for everybody for the next ten weeks. And next week it's 3-for-2 on toilet rolls, or deodorant, or soap, or vitamin tablets or whatever, so next week everybody buys enough toilet rolls or whatever for ten weeks, each time thinking that they are getting a bargain, which they are for the simple reason that for the next ten weeks they are paying for the storage of those goods.

Posted by

Mark Wadsworth

at

18:57

23

comments

![]()

UK households

Just for completeness, I have compressed the figures from here into a simpler table.

Posted by

Mark Wadsworth

at

10:59

11

comments

![]()

Labels: Children, Population, statistics

"Minister calls for more second rate sport to be shown"

New Culture Secretary Maria Miller has written to broadcasters urging them not to cut their coverage of second rate sport now London 2012 is over.

Mrs Miller said that she had no idea about sport, but the Olympics is the sort of political bandwagon that you have to jump on.

The TV audiences showed that even when you threw £11bn at hosting it, burn another £500m so that people win medals, millions broadcasting it and that it's only on once every four years, nearly as many people opt for Coronation Street on the other side.

The BBC said it had some second rate sport that filled up Grandstand on a Saturday when most people were out shopping, because no bugger wants to watch it.

Mrs Miller is the minister for sexism as well as Culture Media and Sport Secretary.

She said the British media did a fantastic job over the past few weeks hyping the achievements of some second rate sports people in some sports that almost no-one does. And frankly, if Jess Ennis didn't look that good, no-one would care.

But she told broadcasters that outside the Games, second rate sport had been "considerably less interest than first rate sport, with second rate cricket, football and netball "attracting a few couch potatoes and chronic masturbators".

Posted by

Tim Almond

at

09:59

1 comments

![]()

Labels: Olympics

Friday, 14 September 2012

Short List

1. The leader of the Green Party of England & Wales was born in Australia.

2. The leader of the Australian Labour Party was born in Wales.

3. They are both women.

4. The leader of the Welsh independence/nationalist party Plaid Cymru is also a woman, but sadly appears to have no link with Australia at all.

Your challenge is to decide who's on the list and then to name or define it.

Posted by

Mark Wadsworth

at

08:38

3

comments

![]()

Labels: Australia, England, Green Party, Julia Gillard, Lists, Wales

Thursday, 13 September 2012

They own land, give them money

From City AM:

LEADING house builders are exploiting the planning system to boost their profits, according to a paper released today by the think-tank Policy Exchange. It claims that residential development is delayed by an outdated planning system, rather than an inability to access credit.

The organisation says that 2012 is on course to be the year with the second lowest annual level of new homes since World War II, mainly because councils only allow small plots of land to be developed. As a result it is often more profitable for developers to simply sit on land with planning permission, and watch its value rise, rather than build houses.

Yup. There's the problem. We're stuck between the NIMBYs who want no new development to push up land values, and developers who are quite happy not to develop, precisely because of those rising land values. Now, what simple fiscal policy could we adopt to give those land bankers the kick up the arse they need to get on with building houses..?

The Telegraph explains*:

Home owners living in the countryside should be given payments worth thousands of pounds to encourage them to accept major new developments on green belt land, a report recommends.

Righty-ho, this is like negative land value tax and makes things worse; the payment will not be triggered until development starts, and there is still every inventive for NIMBYs to have as little new development as possible because that pushes up their land values, and worst case (from their point of view), pushes up the compensation that a developer can be made to pay if he actually builds a few houses, and no doubt, the more your house is worth, the larger the payment you will get, tenants won't get a bean, will they?

* Via Dill at HPC.

Posted by

Mark Wadsworth

at

12:53

5

comments

![]()

Labels: Construction, Corruption, Land Value Tax, NIMBYs, Planning, Subsidies

The answer is four

From City AM:

A JUMP in loans to home movers outweighed a slip in lending to first-time buyers, data from the Council of Mortgage Lenders revealed yesterday, leading to an overall increase in mortgage market lending...

For existing homeowners the average income multiple declined from 2.91 to 2.88, and the average loan to value (LTV) ratio slipped from 70 per cent to 69 per cent.

But first-time buyers faced a market that opened up in some areas, if they could get hold of credit. One per cent fewer mortgages were agreed, but their value climbed 4.2 per cent on the month, and the average LTV climbed one percentage point to 81 per cent. The main area of tightening was in average income multiples, which slipped from 3.29 in June, to 3.21 in July.

Interesting.

For a home mover (aka 'second-stepper') the house price-to-income multiple is about 4.2 (2.88 divided by 69%) and for first time buyers, it's about 4.0 (3.21 divided by 81%), i.e. there's barely any difference.

(The multiple four is also dramatically lower than the break-even point for who'd be worse off under full-on LVT. Yer typical FTB or second-stepper with a house price-to-income multiple of four would pay about £10,000 a year less in tax and get about £10,000 a year more in Citizen's Dividend.)

Posted by

Mark Wadsworth

at

11:40

4

comments

![]()

Labels: Council of Mortgage Lenders, Maths, Mortgages

Health Scare Story Du Jour

From MSN News:

Bacon is now the second biggest contributor of salt to the UK diet after bread, according to a study.

Two rashers of bacon can contain more than half of the recommended daily amount (RDA) of 6g of salt, while some brands contain three times more salt than others from the same supermarket, the research by Consensus Action on Salt and Health (Cash) found.

The group said bacon contained "huge and unnecessarily high" amounts of salt, with consumers turning to it as a cheaper cut of meat as the recession squeezed family budgets.

Excellent news.

I was always a bit worried that I don't get enough salt, but it turns out that those two rashers of bacon I get with my all day breakfast at lunchtime will get me half way to the daily target.

Posted by

Mark Wadsworth

at

10:07

12

comments

![]()

Labels: Bansturbation, Food, Salt

Wednesday, 12 September 2012

If the numbers in work keeps going up at this rate, well, by this time next year, Rodney …

Entire post emailed in by Bob E.

The publication of the Labour Market Statistics for September 2012 by the ONS has seen the traditional hurried raft of “cut,n’paste the press release” newspaper pieces and the equally traditional politicos currently in power desperate to get their carefully pre-prepared sound bite statement of “the good news, how the numbers in work is rising and how that justifies all the government’s policies and special measures and proves they are working” reported, ideally on the Six O’Clock news. And today the “headline” good news was really really startling … and no it wasn’t “look what hosting the Olympics has delivered” although there was some attempt to try and suggest an immediate positive benefit of that £10 billion (and counting) outlay. The really big news was

The number of people in work increased by 236,000 to 29.6 million, which is the largest quarterly rise for two years.

Well there you go! The number of people in work has gone up, and massively so. Unconfined joy all round. Well not quite all round as a few people found this massive leap in the numbers in work difficult to reconcile when set alongside certain other stats and were left scratching their heads:

The jobless total fell by 7,000 in the quarter to July to 2.59 million, an unemployment rate of 8.1%.

The Office for National Statistics said the number claiming Jobseeker's Allowance last month was 1.57 million, down by 15,000 on July – the largest monthly fall since June 2010.

Other figures revealed the number of part-time workers increased by 134,000 to reach 8.12 million – the highest since records began in 1992.

The number of Britons working part-time because they could not find a full-time job also hit a record high of 1.42 million.

The figures also showed the number of people out of work for over a year was the highest for more than 16 years – at 904,000, up 22,000 on the previous quarter.

And alongside those, we shall call them apparent inconsistencies; there was also other data around on the UK economy which was even more difficult difficult to square with the “massive jump in the numbers in employment”. The Guardian was so confused (Latest UK jobs figures raise the 'productivity puzzle') it opened to the matter up to public debate, by posing the question of its readers If the economy is shrinking, why have firms continued to create jobs, albeit many of them part-time? thus immediately answering its own question – although it required a reader to point out that they had done so :-

... if you take 1 million people in full time employment, sack them, re-employ them on 18 hrs per week at lower wages, recruit another 2 million on the same lower wage, unemployment is decreased by 2 million. Chances are [the] deficit will increase (less taxes and no NI contributions), GDP will fall, yet magically unemployment falls. Simples.

Which explanation would have been evident to anyone bothering to actually read the ONS bulletin rather than just quote the press release as it points out for anyone who cares enough to actually read it that since the last "peak" employment figure was registered the overall increase in part time (which includes "zero hours contracts") jobs doesn't even match the fall in full time jobs since

Between March to May 2008, when the number of people in employment reached a pre-recession peak of 29.57 million, and May to July 2012:

• the number of people in full-time employment fell by 640,000

• the number of people in part-time employment increased by 628,000

• the number of unemployed people increased by 978,000

and better yet that bulletin published today includes a graph illustrating what is actually going on... So, if the numbers ‘in work’ keeps going up at this rate, well, this time next year... ooh nasty but don't expect that to persuade the politicos to drop their obsessive insistence that "the only figure that matters is the number of people 'in work'".

So, if the numbers ‘in work’ keeps going up at this rate, well, this time next year... ooh nasty but don't expect that to persuade the politicos to drop their obsessive insistence that "the only figure that matters is the number of people 'in work'".

Posted by

Mark Wadsworth

at

18:21

0

comments

![]()

Labels: Employment, liars, statistics, Unemployment

"We would rather die once than fear death every day"

A senior sherpa, called Mr Sherpa, on top form. From the BBC:

The Mount Everest region's Sherpas have said they are angry at the way studies of glaciers and glacial lakes have been conducted in recent years. They say the studies do not involve them and that results are often spread through alarmist media reports that cause panic among locals in the area.

"Everytime we begin to forget about the threats from glacial lake outburst, then comes news of yet another study through the radio and television, and this has been happening over and over again for more than 15 years now," said Mr Sherpa.

"Instead of having to fear death like that again and again, we would rather die once if the lake really bursts out one day."

Rumours of glacial lake outburst are also said to be causing panic among the locals. Two months ago, following a television report on the risk of a glacial lake outburst in the region, many families in the lower belt of the Everest region fled their homes overnight.

Mr Sherpa said he and other villagers recently received late-night phone calls from people in a village downstream who were inquiring if the Imja glacial lake had burst.

"We were so scared because they were seeking confirmation from us after they heard rumours that sirens had gone off nearby the Imja lake, and we did not even know if the sirens had already been installed."

Posted by

Mark Wadsworth

at

16:17

3

comments

![]()

Labels: Global cooling, Himalayas, Philosophy

From a Christian non-conformist think-tank...

Since the economic crisis, people have become increasingly aware of the unfairness of our current tax system. Tax avoidance by corporations and the super-rich gives the appearance that paying tax is an optional extra, whilst low-paid workers have no choice in the matter.

There’s a subsequent desire to come up with forms of tax that are fair, asking most from those who have most, providing the resources needed to fund decent public services. Church Action on Poverty is currently bringing the debate to towns and cities up and down the country through its Tax Justice tour.

For Christians, and all people of faith, there could hardly be a fairer tax than a land tax. If we believe that the earth was created for everybody to share equally, it is hard to justify a small elite benefiting exclusively from large parts of it.

In the UK, land ownership is more heavily concentrated in the hands of a wealthy few than it is in many developing countries. 69 per cent of Britain’s land is owned by less than one per cent of the population. Much of that 69 per cent is in the hands of the aristocracy, which means the current owners have inherited it: ownership is not a result of their own endeavours.

(c) Bernadette Meaden has written about religious, political and social issues for some years, and is strongly influenced by Christian Socialism, liberation theology and the Catholic Worker movement. She is a regular contributor to Ekklesia.

Posted by

Mark Wadsworth

at

15:59

24

comments

![]()

Labels: Land Value Tax, Religion

A common misconception

There's an article on 24Dash about possibly improving 'security of tenure' for private tenants by extending the notice period from 6 months to 2 years if the landlord gives them notice to quit, which might or might not be a good idea (seems fair enough to me, I'd also like to reduce the notice period from 6 months to 3 months if the tenant wants to move).

What is striking is this bit:

[The Inquiry] said successive governments have prioritised owner occupation, but it is now in decline.

No they have not, that's exactly what Home-Owner-Ism, an electoral gold mine originally struck by Thatcher but taken to extremes by New Labour, is NOT about. It pretends to be about "prioritising owner-occupation" but actually what it does is "prioritise those people who happen to be owner-occupiers when Home-Owner-Ism kicked off" and shits on all who come after them.

Look at the official stat's from the DCLG (Excel). In England...

- the number of owner-occupier households is only up by 1.4 million since 1991, and is now falling again, we are back down to 2002 levels in absolute terms and back to the mid-1980s if expressed as a percentage of all households.

- the number of social tenant households (council or Housing Association) is down by 0.5 million since 1991. Note: according to those figures, the social housing stock peaked at 5.2 million in 1981 and is now down to 4.0 million, so they 'only' sold off about a quarter of social housing stock.

- the biggest increase is in private renters, up by 2.2 million since 1991, the bulk of that increase was in the last ten years. Some of those will be renting ex-social housing, but by and large, more than half of new homes built in the last twenty years have been acquired by landlords.

It all stands to reason really, the real driving force behind Home-Owner-Ism is the large landowners and banks; the former love collecting rent and the latter would rather lend to BTL landlords than owner-occupiers, it being far less hassle for the bank if a landlord kicks out a tenant who loses his job than the bank having to kick out a mortgage borrower who loses his job.

Posted by

Mark Wadsworth

at

13:01

2

comments

![]()

Labels: Banking, Home-Owner-Ism