From The Guardian:

Zac Goldsmith has promised to keep spending on London’s rail and roads while pushing up fares if elected mayor, in a transport manifesto that attempted to paint a choice between Labour’s “experiment” in freezing fares, or delivering new infrastructure.

Launching the manifesto in Ilford on Wednesday morning, the Conservative candidate pledged to “get London building” by pushing ahead with projects including further tube upgrades, Crossrail 2 and a southern extension to the London Overground, which he claimed could be jeopardised by Labour hopeful Sadiq Khan’s proposed fare freeze. Goldsmith said that keeping fares at current levels would create a £1.9bn black hole* in the capital’s investment plans.

While younger Londoners will see fares rise, Goldsmith promised that he would keep the freedom pass, allowing over-60s to travel free, throughout the mayoral term – a pledge also made by Khan.

Goldsmith said 270,000 homes and 250,000 jobs would be unlocked by transport investment, most of which is already planned. He said: “It’s not just vital to keeping London moving, it’s also key to unlocking the land to build the homes London so badly needs.

* The £1.9 bn figure is a wild exaggeration and Goldsmith has already used that for one shock-horror headline, saying that if fares were capped, Council Tax would have to go up. That's the sensible way of doing it, of course, it mean average Council Tax increases of about £30 each year IIRC, so big deal.

But to sum up: Goldsmith expects working age commuters to pay more so that landowners can sell their land for higher prices (now referred to as 'unlocking' for some unfathomable reason). Pensioners are being bought off with their Freedom Passes (Heaven forbid their Council Tax goes up).

Thursday, 31 March 2016

Pity the poor landowners.

Posted by

Mark Wadsworth

at

16:39

1 comments

![]()

Labels: bribery, Greater London Authority, Subsidies, Zac Goldsmith

Wednesday, 30 March 2016

Economic Myths: A richer Africa means fewer migrants

As Flipchart Rick explained last year, the bulk of immigrants (who are all ultimately economic migrants*) to wealthier countries like the UK are from developing countries rather than the very poorest.

So as the poorest countries develop, more people will emigrate from those countries, not fewer and this will not reverse/stabilise until a country is close to Western living standards.

He does some good stuff on immigration, see also this more recent post. Makes you think.

* But what about refugees from Syria? Those who leave Syria are fleeing a war zone and can be considered refugees; those who cross the nearest safe country to get to the nearest wealthy countries (Europe) are economic migrants. End of. That is not a value judgment, I'm an economic migrant myself.

Posted by

Mark Wadsworth

at

18:25

13

comments

![]()

Labels: EM, Immigration

A weak argument against Brexit is an even weaker argument for Bremain.

From the BBC:

Britain would be unable to negotiate its exit from the EU within the two years allowed by European Union rules, the former Cabinet Secretary Lord O'Donnell has said.

The prospect of demanding extra time from other EU nations to complete a leave deal was a "bit scary", he said. Asked how long a negotiation would take, he cited a Cabinet Office paper which said it could be up to a decade...

If the UK failed to get a deal within two years, the country would revert to World Trade Organization rules, which would include significant tariffs, he added.

Richard North is the expert on Flexcit, but why would we need to renegotiate anything on the day the UK ceases to be a Member State?

We could just agree that for the time being everything continues as at present. This is the default assumption for example when Czechoslovakia split into two, the UK swiftly concluded a Double Tax Treaty with the two new countries on exactly the same terms as the old treaty with Czechoslovakia.

The present set of agreement suits all parties reasonably well at the moment, so why would it not suit all parties reasonably well the very next day or the day after that? We'll have to haggle a figure for UK contributions (ransom payments) to the EU and that is the end of that.

By analogy - the rules of the game of football or cricket are the same the world over, that does not mean that each team has to be an official member of some over-arching football or cricket organisation. The rules of the game apply on the pitch between the two opposing teams, end of. It could be a non-affiliated team from Afghanistan playing a friendly against a scratch team from an Australian university; two English schools playing each other; or a Test Match between South Africa and India.

Over time, the UK might do some things a bit differently to remaining Member States, so what? We can apply EU rules 'on the pitch' and make up our domestic rules 'off the pitch' as we go along.

Posted by

Mark Wadsworth

at

11:51

7

comments

![]()

Labels: EU, Logic, Referendum

Tuesday, 29 March 2016

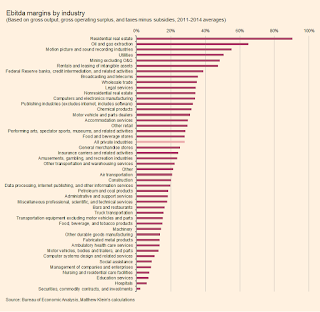

Ranking Americas Industries by Profitability and Tax Rate

Some interesting charts over at FTAlphaville Link

(they might ask you to make one of those free accounts to read it and then mercilessly bombard you with pleas to buy the FT)

Particularly like this one.

Posted by

SumoKing

at

10:58

2

comments

![]()

Labels: Corporation tax, FT, USA

Economic Myths: Taxes on public sector wages

We've done this one often enough, but here we go again.

From the BBC:

More than six million UK workers could find their take-home pay cut from April after the new flat-rate state pension comes into effect.

The move, first announced in the 2013 Budget, will boost the Treasury's coffers by £5.5bn a year. Most of that sum will be raised from public sector employers and employees by higher National Insurance payments…

The whole move to the flat-rate state pension is much to be welcomed of course, it's more like a 'Citizen's Pension'. This has the added bonus of highlighting that National Insurance is just another tax on earnings i.e. a very bad tax indeed, so hopefully we can move away from this bullshit that "National Insurance pays for my pension" or "I've paid for my own state pension, I'm just getting back the National Insurance I paid over a lifetime." This economic myth is so deeply engrained that people get quite angry when you challenge it.

The result being that people can no longer 'contract out' and pay the reduced NI rate if they are in an employer pension scheme…

Employers will now have to pay higher NI, amounting to that 3.4% of their employees' relevant earnings. The government said in 2013 that the new system was fairer for the self-employed and many mothers.

Public sector employers will pay £3.33bn and employees £1.37bn more to the Treasury in 2016-17 as a result of bringing in the pension earlier, according to the Treasury. From the private sector, employers will pay an extra £570m and employees £235m.

If public sector employers have to pay £3.33 bn more to the Treasury, then unless public sector employees reduce their payrolls by one or two percent, doesn't mean that their budgets, paid out by the Treasury, will also have to increase by £3.33 bn?

So this is neither a real boost nor a real cost to the Treasury at all, is it?

Posted by

Mark Wadsworth

at

08:06

3

comments

![]()

Labels: EM, National Insurance, Public sector employees

Monday, 28 March 2016

Yes, I know, the Torygraph again, but it's such fertile ground

Exhibit A

DT Letters

Sherborne, Dorset

Same old, same old.

Posted by

Lola

at

22:35

8

comments

![]()

Fun Online Polls: Cash is still king & Bouncy castles

The results to last week's Fun Online Poll were as follows:

How many times have you paid with cash (coins and notes) in the last week (i.e. not by debit or credit card)?

None - 3%

Once or twice - 22%

Most days - 30%

Every day - 45%

Other, please specify - 1%

The poll was run together with Pub Curmudgeon (hence the high turnout of 183), he has summarised the results on his blog and there's not much more to add.

--------------------------------------------

When you hear that another small child has been killed in a bouncy castle which blew away (this happens every few years), you know as sure as night follows day that the local MP will call for them to be banned.

The more obvious alternative is to remind operators to anchor the things properly and close them/deflate them when the wind gets too strong and if something goes badly wrong, sue them for (corporate) manslaughter, but that's too sensible I suppose.

So that's this week's Fun Online Poll.

"Should bouncy castles be banned?"

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

17:18

5

comments

![]()

Labels: Bansturbation, bouncy castles, Cash, Elfin Safety, FOP

Local politics: the huge differences between the Greens and the Conservatives

From their local election leaflets:

GREENS DEFEND GREEN BELT

Councillor Steven Neville has won a concession as a result of the Green Belt Review, which is part of Epping Forest District Council's new Local Plan for Epping Forest.

Buckhurst Hill will now be classed as a large village rather than a town, which gives extra protection for our Green Belt.

And from the Conservatives' leaflet:

Until recently I was chairman of the panel which scrutinised developing our Local Plan and I will continue to ensure that Buckhurst Hill and our Chigwell neighbours receive the best deal possible in any local plan development.

Along with local residents, I spoke directly with the District Councillor in charge of Planning in Epping Forest District, arguing that Buckhurst Hill must not become a town but should remain classified as a village.

I chucked away the Lib Dem leaflet, but I wouldn't be surprised if it had said something similar. And as a matter of fact, Buckhurst Hill is neither a village nor a town, it is a commuter suburb.

Posted by

Mark Wadsworth

at

14:19

1 comments

![]()

Labels: Greens, Local government, NIMBYs, Tories

Aaarrrggghhhh 2 - (but with some comment this time)

And: "Landlords have shown that they are all too willing to sell, as confidence hits its lowest ebb since the banking crisis. Landlords are expected to sell 500,000 properties in the next year, according to research from the National Landlords Association.".

Posted by

Lola

at

12:40

3

comments

![]()

Watership Down

There's a few strange decisions that the BBFC have made. The End of the Affair being rated 18, for example. Or Gremlins as a 15. But none are quite so weird as Watership Down being rated U.

I remember pestering my mother to see it at the age of 9. I mean, this is the trailer:

It's bunnies, on an adventure. Something a bit like The Rescuers, right? Wrong. Watership Down is high octane nightmare fuel for kids. It's not just that it has bloody violence with rabbits tearing lumps off each other, there's a rabbit caught in barbed wire and even a suggestion of rape in there. Oh, and the visions that suggest rabbit Auschwitz on the horizon.

Now, I'm dead against censorship in cinema. But age ratings are a pretty good idea, especially with the younger ones. You want some drama. You need some villainy. You don't want Leporidae Goodfellas, though. And seriously, had no-one at Channel 5 seen this movie before deciding to put it on? I'd rather show Akira to little kids, which is rated 15 (no, don't show Akira to your 5 year old, although at 9, I'd have probably loved it). Akira is at least fantastic and cool, where Watership Down is just grim and depressing.

The BBFC are on record as saying that it wouldn't be a U today, but even when it was originally shown, it wasn't suitable for that rating. It should have been the old A rating (now PG).

Posted by

Tim Almond

at

09:23

5

comments

![]()

Labels: movies

Saturday, 26 March 2016

Tesco Accused of Using Fictional Sounding Farm Names

From the Telegraph

Tesco has drawn criticism for using fictional British-sounding farm names on labelling for a range of meat and fresh produce, some of which is imported.

The made-up names are Woodside, Willow and Boswell farms on labelling for pork, chicken and beef, as well as Nightingale and Redmere on salad and vegetable items, Rosedene on berries, apples and pears and Suntrail Farms on a range of imported fruit.

Posted by

Tim Almond

at

20:11

8

comments

![]()

Executive Pay

To continue with more of "the employer class outlook that is beginning to pervade this blog", here is Merryn Somerset Webb having a go at excessive top management pay.

This isn’t just a UK problem (look to the US and you can find a long, long list of CEOs cleverly extracting $20m a year from the companies they have been appointed to run). But it is an increasingly serious problem for two reasons.

One, it is entirely unnecessary, and therefore wrong (it represents a pointless transfer of wealth from shareholders to managers). And two, because it looks bad......capitalism is amazing. But it only works as long as it keeps making us all better off and – crucially – is seen to be doing so. Stupidly high executive pay packets jeopardise both the reality and the perception of capitalism. That’s a very bad thing indeed."

It could be said that it was inevitable that this would happen as control of companies passed from the owners to managers employed by each other on behalf of the owners and that it is the shareholders who the problem mainly affects who are the ones that have it in their power to put it right, however, in the comments, P Kralj points out:

Shareholders will vote against such pay if they are enfranchised. Most shareholders hold their investments through fund managers and it is the fund managers who vote. The beneficial owners of the shares are not permitted to vote. This is just the same system that the trade unions of old used before Thatcher. It is about time we stopped these commissars voting with our money. If only those with a beneficial interest in the shares were allowed to vote these vast salaries which are unearned and unjustified and are only permitted because of the power in the hands of those who earn them, would not exist.

So in reality something that looks like a necessary problem with capitalism, the better off getting richer at the expense of the worse-off, as railed against by Piketty et al, seems to be more of an unnecessary problem that a few small, but fundamantal changes will go a long way to put right. A bit like LVT, in fact.

Posted by

Bayard

at

14:28

5

comments

![]()

Killer Arguments Against LVT, Not (388)

Via Carol Wilcox, from the FT readers' letters:

Mr Wolf suggests raising “green” taxes and taxes on economic rents (mainly land). These may be efficient or worthy in themselves, but by their very nature they are not particularly “elastic” to economic activity: in rate of revenue increase they are less than proportional to gross domestic product. In this regard they suffer from the same vice as the tax and benefit changes that cut reservation wages, generated the compositional change in employment, and held back revenue growth.

Michael Kuczynski, Pembroke College, Cambridge.

WTF. Rents are actually more than elastic to economic activity, in the absence of government measures to reduce or increase the amounts going to rent, the natural tendency is for rents to increase as a share of GDP when the economy grows and vice versa.

LVT and other taxes on rents do not cut reservation wages by one penny; by stimulating the economy, however slightly, they increase them.

Taxes on output and earnings depress and distort the composition of employment, unlike LVT, which is entirely neutral.

And given that only one-tenth of the UK's total tax revenues are taxes on rents (Council Tax, Business Rates, Fuel Duty) collecting one-quarter of economic rents, there is plenty of scope to increase them, with a double-plus boost if taxes on output and employment are reduced in step.

Posted by

Mark Wadsworth

at

13:37

6

comments

![]()

Academies

From the BBC

The government could be forced to retreat on plans to compel every school in England to become an academy because of an emerging broad-based opposition, the National Union of Teachers claims.

The union's leader Christine Blower said there could be a rapid reversal, as happened with disability payments.

OK, I'm not sure academies make much difference. I think they're a typical bit of New Labour/Cameronite private-but-not-really. I think they're deliberately rigging selection to keep out the "worst" pupils. On the plus side, I think giving schools more power rather than having to deal with local authority bureaucracy is probably a good thing.

But I don't understand what the NAS/UWT have against them. I mean, I would get it if they said that academies are terrible, and we should scrap all of them, but they aren't. They think there's many good academy schools. So, what's the problem? Or is there something that affects the direct interests of teachers (which let's be honest, most union opposition is really about)?

Posted by

Tim Almond

at

12:00

7

comments

![]()

Labels: Education

Thursday, 24 March 2016

Aaarrgghhhhh!

Posted by

Lola

at

14:26

14

comments

![]()

Labels: House prices, infrastructure, Land Value Tax

"Legal services sector costs the UK economy £25bn"

From City AM:

Legal eagles are taking a substantial chunk from the UK's bottom line, as the legal sector is now valued at over £25bn, a report out today has found.

The study published today by the Law Society discovered that every one per cent of growth in the UK's legal services sector sucks an additional £379m out of the economy and destroys 8,000 jobs.

The report also found that the legal sector, which grew by eight per cent from 2014 to 2015 and currently employs around 370,000 people, shrinks the wider economy by £1.39 for every £1 of extra fees and destroys a further 67 jobs for every 100 roles created within the sector.

"The provision of eye watering invoices is fundamental to the success of legal sector and underpins the very fabric of the Law Society," said Catherine Dixon, chief executive of the Law Society. "From high street solicitors to global law firms, and from in-house solicitors to those who operate in alternative business models, we're all at it, every-bloody-where."

Posted by

Mark Wadsworth

at

10:20

11

comments

![]()

Labels: Lawyers, Rent seeking

Interesting layout.

From The Metro a couple of days ago. On the left is a Tory advert and on the right is a Virgin NTL advert. By whatever coincidence, the Virgin NTL advert matches the bottom half of the Tory advert almost perfectly:

Posted by

Mark Wadsworth

at

08:13

1 comments

![]()

Labels: Advertising

Wednesday, 23 March 2016

"'Scapegoat of Hounslow' can be extradited to the USA"

From The Daily Mail:

The British trader known as the 'Scapegoat of Hounslow' is set to be extradited to the US to face charges of multi-million-dollar fraud perpetrated by major US financial institutions after losing a court appeal today

Navinder Singh Sarao, 37, is accused of helping to cause the 2010 'flash crash', which saw Wall Street shares tumble within a few minutes thanks to a computer glitch. US based firms who did most of the 'helping' have not been accused.

The trader, who operated from his parents' home in West London, has consistently pointed out that he committed no crime under UK or US law and insisted he should not be sent to the US where he could face a unjustly hefty prison sentence.

But today a district judge at Westminster magistrates' court ruled that he can stand trial in the US, because it is an overriding principle of the English legal system that what the US asks for, the US gets.

Posted by

Mark Wadsworth

at

13:30

23

comments

![]()

Labels: Bullying, Speculation, USA

Tuesday, 22 March 2016

The Daily Mash pretty much sums up my childhood.

Posted by

Mark Wadsworth

at

12:33

11

comments

![]()

Labels: Children, Television

Monday, 21 March 2016

Fun Online Polls: Sunday opening hours & Paying in cash

The responses to last week-and-a-half's Fun Online Poll were as follows:

For how many hours should larger stores be allowed to open on Sundays? (The current limit is six in England and Wales) None at all - 21%

Less than six hours - 3%

Six hours is about right - 30%

More than six hours - 31%

Other, please specify - 15%

So there appears to a slight majority in favour of increasing the hours, should we just go to seven i.e. open at 10, shut at 5? They've got all day trading in Scotland and the world hasn't collapsed or anything.

---------------------------------

On the topic of shopping, does anybody use actual cash (coins and notes anymore) to pay for stuff? The only times I've paid in cash this year were at our local Chinese takeaway, where they don't accept debit/credit cards.

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

15:29

18

comments

![]()

A Question?

All anti-Conservatives always use the term 'Tories' for the Conservatives. It is used pejoratively. See here. It isn't really on to describe all members of the Conservatives as having 'Tory' tendencies. But there is a certain arrogance from the likes of Cameron and Osborne that drives everyone nuts. But is it 'Toryism'?

Now that is all very well, I am quite happy with all sorts of political insults - in fact I wholeheartedly approve of them - but where is the similar term to pejoratively describe the Labour Party. I mean (doffing my cap to Godwin's Law) could you justifiably call them 'Nazis'?

Clearly that isn't strictly true. If you've struggled though Mein Kampf you will know why.

What about Polpottists? The Khmer Rouge 'socialism'. (Which is more accurately their own horrible brand of Nazism).

How about 'Castroists'? Just doesn't cut it does it? No pith.

Maybe it just needs to be 'Marxist'. After all that's where Socialism comes from.

But that really doesn't quite work like 'Tory', as many lefties feel quite honoured to be called 'Marxists', despite the fact that Marxism has provided the justification for the murder of possibly a hundred of million of people. Whereas non-communist/socialists haven't really murdered anybody en masse. (Typing Mass Killings Under Capitalist Regimes into Google gets you more stuff on mass killings under socialism / communism, plus this, most of which are no such thing, the regimes quoted generally being totalitarian or authoritarian. It's a highly selective article.)

So come on, where is the equivalent for 'Tory' that could be applied to the Labour Party in the UK?

Declaring Myself. I think I am slightly conservative, with a small, very small 'c'. But I despise the Conservative Party. At least under its current leadership. I take 'Conservative' to mean not being cavalier with the tried and tested institutions handed down to our care. Like the Common Law say. And small government - although that isn't really borne out by recent history, is it?

Posted by

Lola

at

14:17

20

comments

![]()

Charity Parachuting

From Pubmed

All parachute injuries from two local parachute centres over a 5-year period were analysed. Of 174 patients with injuries of varying severity, 94% were first-time charity-parachutists. The injury rate in charity-parachutists was 11% at an average cost of 3751 Pounds per casualty. Sixty-three percent of casualties who were charity-parachutists required hospital admission, representing a serious injury rate of 7%, at an average cost of 5781 Pounds per patient. The amount raised per person for charity was 30 Pounds. Each pound raised for charity cost the NHS 13.75 Pounds in return. Parachuting for charity costs more money than it raises, carries a high risk of serious personal injury and places a significant burden on health resources.

It does have to be said that that isn't exactly the right figure as some of those people would do a parachute jump themselves, but are instead getting their friends to pay for it via a charity donation. But, making it free for them (as their friends and co-workers are paying for it) is more likely to have people doing it.

Posted by

Tim Almond

at

07:01

4

comments

![]()

Sunday, 20 March 2016

Spot the Deliberate Mistake?

Here

At 39 the mother-of-two owns 17 buy-to-let properties on the council estate where she grew up, in Knowsley, Liverpool.

Mrs Haig said: “We take on vulnerable, high risk, homeless, people who can’t get into social housing. We do not exceed the housing benefit allowance. If people’s circumstances change, we drop the rent.”

There's a lot more of this.

Posted by

Lola

at

23:03

6

comments

![]()

Labels: landlords

Why do we pay taxes?

What MW's LLC friend (see below blog), should first do is go back to basics and ask why do we pay taxes in the first place?

There are two separate classes of State spending.

Core spending on those items we cannot provide for ourselves. Defence, foreign affairs, police, justice, transport etc

Re-distributive spending on items many of us could not afford without help. Pensions, welfare, schools, hospitals etc

If most State spending is re-distributive, this must be because there is not a fair distribution of the factors of production to begin with. This is why we pay most of our taxes.

Assuming we have competitive markets, reproducible factors Income and Capital should already be fairly distributed. If they are not then the efficient solution is to reform the market, not higher taxation.

Land is irreproducible and it’s value unevenly distributed. Therefore, even in competitive markets, there will always be an unfair distribution of the value derived from it, unless we all gain an equal share through the tax system.

Failure to equally share the value derived from natural resources leads to excessively high inequality, and a loss of efficiency.

All taxes lower rental income and the selling price of Land.

The fair, efficient way to share the value derived from Land is a direct tax upon it ie a 100% Land Value Tax

The indirect, unfair, inefficient way to share the value derived from Land are taxes on income, capital and transactions.

We have chosen to do more of the later, which creates the double whammy of not fully addressing the issue of inequality caused by unequal land value distribution (still over £200bn pa to go) , while at the same time shrinking the economy by taxing produced factors.

If Land were reproducible like any other factor, the only morally defensible, or indeed necessary way of paying for core services would be a Poll Tax.

My conclusion is that Socialists seek to preserve an unjust distribution of income, capital and land in order to maintain the large State apparatus needed to mitigate all the ill effects that result from such an economic system.

This is why they will never fully embrace a 100% Land Value Tax. They love control more than they love equality and justice.

As for the Tories, I’m sure they cannot believe their luck. They don't even have to try in order to maintain the status quo.

Posted by

benj

at

18:47

6

comments

![]()

Labels: Economics

Saturday, 19 March 2016

Killer Arguments Against LVT, Not (387)

One of my LLC friends emailed in:

Hi Mark,

I have encountered a "Killer argument…", can you turn it into a "… not", please?

"The factory owner of a paper mill will be penalised and might not build another factory while the hedge fund manager with his small office who turnover 5 million will not have to pay for it."

I can argue against it but I know you'd do a better job.

I always find it helpful to look at actual facts and figures to see whether the assumptions are even correct.

Paper mills are a special case, because they need to be near a plentiful water supply, and it helps if they are near a tree supply, i.e. out in the countryside where the land is very, very cheap. So let's just take a generic factory somewhere in England.

According to DCLG, the mean selling price for land with planning for industrial or commercial use across England is £482,000/hectare (£200,000 per acre). (For comparison, The median price for residential land with planning is about £2 million/hectare, i.e. about £80,000 for each plot for a semi-detached house with a reasonable sized garden).

Let's assume the annual rental value is capitalised at 5% = £10,000/acre, so the LVT bill would be £10,000/acre. We don't know how big our hypothetical factory plus parking spaces is, let's say 5 acres @ £10,000 = £50,000 LVT per annum. Unlike Business Rates, the bill would not be triggered when the factory is built or increased when the factory is improved or extended. In all likelihood, the LVT will be pretty similar to the current Business Rates bill (plus or minus 50%, but not huge £ amounts either way).

If our factory owner then decides to buy the five-acre site next door and build another factory on it, instead of paying £482,000 up front and then having to pay Business Rates in future, the land will be more or less free and he will just have the £50,000 LVT bill in future. The current owner of that vacant site, suddenly faced with an annual LVT bill of £50,000 will waste no time selling it or putting up his own buildings to get some money coming in.

According to Findalondonoffice, office rents in St James's and Mayfair, where all the self-respecting hedge funds are based is £98/sq foot per annum, plus £42 Business Rates = £140/sq ft.

How big are our hypothetical hedge fund's offices? They need a grand reception area, a meeting room or two, partners' offices, a trading room. . They might just about squeeze that into two hundred square yards if it's all cubby holes.

So the hedge fund is currently paying £250,000 a year in rent and rates and will continue to pay that much when LVT is phased in. It is his landlord who will pay the LVT which is at least four-fifths of the total value i.e. £200,000.

Like the factory owner, the hedge fund's total tax/rent bill will not change much. Only the hedge fund's landlord's tax bill will increase. There is no reason to assume that the hedge fund will relocate to a small shed in Croydon to save LVT - if they want to minimise occupation costs, they wouldn't be in St James's or Mayfair in the first place, they'd be in a shed in Croydon. And if the hedge fund does relocate, so what? The landlord will still have his £200,000 annual LVT bill, the tax will continue rolling in.

But broadly speaking, the hedge fund will be paying (indirectly) four times as much LVT as the factory owner with his five acre site, not considerably less as the KLN implies

So the Killer Argument fails for lack of evidence. I can't really say much more than that.

If the KLN had been: "Ah, but the landlord who owns office space in central London will end up paying many times more than the owner of a large industrial site in the Midlands." then yes, it would be base on correct assumptions, even thought it still wouldn't be an argument against LVT as such.

Posted by

Mark Wadsworth

at

17:33

9

comments

![]()

Labels: KLN

Daily Mail on superlative form.

Spotted by Chef Dave in The Daily Mail:

It could be a scene from the heart of one of Los Angeles' infamous ganglands - but this chilling video was in fact shot in a north London suburb just yards away from a busy shopping centre.

A gunman who is believed to have been wearing Muslim dress was filmed chasing four teenagers past houses and parked cars before appearing to shoot one of them as they cowered next to a house.

The shocking footage, taken outside Edmonton shopping centre around 2pm, showed the man following the young boys as they desperately tried to flee the scene, which is less than half a mile from a nearby primary school…

As he pulls the trigger, a shot rings out - but the man, who is wearing jeans and a T-shirt, manages to escape. The victim then desperately tries to scramble up the pavement away from his attacker, who appears to give up before running up a nearby busy road. The rest of the group can be seen getting into a car to escape the suburb, where the average house price is £280,000.

Posted by

Mark Wadsworth

at

09:44

1 comments

![]()

Labels: Daily Mail, Gun crime, House prices, Muslims

Friday, 18 March 2016

The Evening Standard channels its inner Daily Mail

From The Evening Standard:

The family of a Mayfair antiques dealer found battered to death outside her Surrey home today spoke of their devastation, saying they were still trying to “get to grips” with the tragedy.

Robyn Mercer, 50, a renowned silverware expert, was found face down on her front lawn in a pool of blood with injuries so severe police at first “thought she had been shot.”

Officers were called to the semi-detached £700,000 house in West Molesey, neart Hampton Court, where she lived with her two teenage children, at 8am yesterday.

Posted by

Mark Wadsworth

at

13:37

3

comments

![]()

Labels: crime, Daily Mail, House prices

Thursday, 17 March 2016

The Electricity Trilemma

From a recent City AM:

Margaret Thatcher’s former energy secretary [Lord Howell] said that with coal stations being phased out by 2025 and nuclear coming online “10 years beyond that”, the UK faces a huge energy gap.

“Wind can come on when the wind is blowing, and we can get up to quite a high percentage of green electricity, but there’s still a big gap.”

He also slammed successive governments’ attempts to address the country’s energy “trilemma” – reconciling affordability, supply security and decarbonisation – dubbing policy on this front a “failure”.

“We’ve got some of the most expensive energy in Europe, even more expensive than Germany. That hurts people, particularly the poorest, and hurts industry and undermines our steel industry. We’ve got the most unreliable system.”

Fair enough, that is the trilemma, those are your three constraints (reliability - cost - "greenness/sustainability"), to which different people attach different importance*.

Minitrue resolves the trilemma by sticking its fingers in its ears and whistling:

A DECC spokesperson told City A.M.: “Our priority is crystal clear – to ensure our families and businesses have access to the secure, affordable and clean energy supplies they can rely on now and in the future.”

* My view is:

1. Security is paramount - which probably means slight overcapacity; which in turn means slightly higher costs and probably prices to consumers. Electricity is so fundamental to so many things, society grinds to a halt without it, but in terms of input costs it is only a tiny percentage unless you are an aluminium smelter or steel forge (which raises the question, why don't they build their own power stations and tell the government/generators to go hang?).

2. Cost - of course, for a given capacity, we should use whatever generation method is cheapest in pence per kWh. Whether that is solar, wind, nuclear, gas, coal or hydro is a separate topic. We have to ascribe monetary values to pollution and potential loss of output and factor them in, this is important albeit difficult/subjective.

3. Greenness/sustainability - is a subset of "cost" IMHO. We could have 100% solar/wind/hydro by tomorrow if we wanted, All we would have to do is shut down everything else, but then you have the add back the cost of economic collapse/sky rocketing electricity prices.

Posted by

Mark Wadsworth

at

20:20

9

comments

![]()

Labels: 1984, Electricity

Wednesday, 16 March 2016

Ocado - Fun With Numbers

From The Telegraph:

Ocado has posted a jump in its first quarter sales but failed to provide an update on its renegotiations with Morrisons or its postponed overseas technology deal.

The online grocer, which also sells Waitrose goods, posted a 13.8pc rise in sales to £252m during the 12 weeks to 21 February.

"We are pleased with the steady progress in our business, maintaining double digit sales growth in a retail environment that remains challenging, and post period end we shipped over 250,000 orders in a single week for the first time”, said Tim Steiner, chief executive.

The average number of orders a week also rose by 16.9pc during the quarter to 214,000. However, the cost of an average basket fell for the tenth quarter in a row by 2.9pc to £111.41*.

So what if the average order size fell? Stick those numbers in a spreadsheet and work backwards, you could say that Ocado's retained its existing 191,600 weekly orders @ £115 each, and added another 22,400 @ £83.

This might well be an example of price skimming, i.e. early customers are prepared to place larger orders, so if Ocado then drops its delivery charges, it can gain additional customers for whom it is worthwhile placing slightly smaller orders. As long as the new smaller orders are still profitable, then good for Ocado.

* I'm not sure that's even true. In September 2014, Reuters reported as follows:

British online grocer Ocado reported gross retail sales rose 15.5 percent in its fiscal third quarter but average order size fell as competition increased in the business. Gross sales rose to 218.5 million pounds ($354 million) in the 12 weeks to Aug. 10, compared with a rise of 15.6 percent in the first half, while average order size fell 1.7 percent to 111.64 pounds.

----------------------------------------------

On a related note, Her Indoors mentioned recently that Tesco have higher delivery charges depending for more convenient delivery times. My son (who is good as spotting these things) pointed out that this was just like airline tickets - very early and very late flights are much cheaper. I inevitably added that this was a pure rental charge.

Posted by

Mark Wadsworth

at

18:22

5

comments

![]()

Tuesday, 15 March 2016

Satire copies satire.

Me, last July: Lack of women in London's refuse collection 'disappointing'

Newsthump, today: Feminists demand equal representation in the refuse collection industry

Posted by

Mark Wadsworth

at

20:52

2

comments

![]()

Labels: Feminism

Universal Credit and Support for mortgage interest

From New Policy Institute:

Why is the safety net [Support for Mortgage Interest] less effective for owner-occupiers [than renters]? Firstly, “the Government believes that taxpayers should not in effect be helping people to acquire personal assets through any potential long-term rises in house prices.”

It is not clear whether this still applies when Help to Buy gives support for those acquiring personal assets.

And we might add, when taxpayers help Buy To Let landlords pay off their mortgages by subsiding rents.

Posted by

Mark Wadsworth

at

13:17

5

comments

![]()

Labels: Universal credit, Welfare reform

Monday, 14 March 2016

Nuclear Plan B

Total UK primary energy consumption is the equivalent of around 2200 tw/h per year, of which electricity accounts for around 350 tw/h. This illustrates our reliance on fossil fuels and the mountain we face if we want to reduce and eliminate them.

We have two models in Europe we can already compare on how we might go about trying.

France has low cost (12p kw/h), low CO2 electricity, 75% of which is supplied by nuclear power plants.

Germany on the other hand shows that even a limited penetration of wind and solar (3.5% of total primary energy consumption) leads to high electricity prices. Getting on for double that of France at 23p kw/h. It’s energy companies have also been suffering record losses.

Energy taxes and subsidies more or less cancel themselves out. Graph above taken from Euan Mearns

The system costs incurred by dispersed , intermittent wind and solar rise with market share. So, if fossil fuels are to be reduced in any meaningful way, wind and solar will be a cripplingly expensive way of doing it.

Only nuclear can power a modern economy at reasonable cost free from fossil fuels. But due to the large upfront capital costs it has to be planned and financed in the way the French did. Settle on one design, build lots of them quickly, and finance them from Government bonds.

French nuclear supplies electricity at a wholesale price a third of what Hinkley Point C is being offered. It also exports £3bn a year of it at profit.

There is no reason whatsoever that we should ever pay a penny more for our energy than the French are now. That means a reduction in our current bills.

Areva took an existing design, and added more systems and defence in depth. This has proved difficult to build, and it the reason why EDFs finances are in such bad shape.

As reported recently, the Hitachi ABWR could come in at £70 mw/h, when privately financed. Good, but we can do better.

GE-Hitachi have taken that design and gone in the opposite direction of Areva by simplifying and modularising it. The ESBWR has been approved by the American regulators, and is reported to be the safest reactor to get such approval. Designed to be easier to construct, it also has the lower operating costs.

If the UK built twenty of these, over 15 years, financed by bonds, we can benefit from learning curve cost reductions in exactly the same way the French did.

Having a standardised fleet, rather than the nuclear zoo we are currently on course to build, would have other cost and safety advantages too.

Furthermore, there is new fuel technology currently undergoing regulatory approval that can further cut costs and increase safety. For example Lightbridge all metallic fuel rods can increase power by 30% in a new build reactor, while reducing the fuels operating temperature.

Reactors can make hydrogen from electrolysis or thermochemistry, to power fuel cells or existing gas turbines. High temperature reactors(FHRs), being developed and commercialised in China and the US, can substitute for natural gas using the air Brayton cycle(NACC), thereby reusing existing CCGT infrastructure. This also gives them faster ramping up rates than any current available technology, making them the perfect partner for the limited load following of BWRs.

High temperatures can make CO2 neutral synthetic fuels, using the existing infrastructure for internal combustion engines.

And all nuclear power stations produce lots of hot water as waste, which could instead be used as district heating, making use of the hot water systems most UK households have for gas central heating.

We cannot afford the costly grid and infrastructure upgrades needed in order to accommodate a wind, solar and battery economy.

France has shown us that cheap CO2 free energy is doable. We should copy their example, just don't buy their EPR reactor.

Posted by

benj

at

23:35

19

comments

![]()

Labels: Energy, Nuclear power

European Genocide?

Posted by

Lola

at

22:16

9

comments

![]()

"Holiday costs could soar after Brexit, travel agents warn"

Emailed in by MBK from The Times:

The research details how the EU has benefited UK holidaymakers, including: financial protection for package holidays, compensation for flight delays, free healthcare through the European health insurance card, caps on mobile phone charges and the right to bring home unlimited goods...

Overall, it suggests that a period of uncertainty would almost inevitably follow a vote for Brexit. BTA also claims that a “leave” vote will probably affect sterling, pushing up prices for Britons travelling to the continent.

1. There's nothing to such that financial protection for package holidays (ABTA or ATOL) is restricted to holidays within the EU. In fact, ATOL appears to have been imposed by the UK government.

2. Compensation for flight delays, not sure about this. Firstly, the UK could easily impose the same rules on airlines flying to/from the UK, and secondly, what does relevance does EU membership have on claims against European airlines? Can non-EU citizens not claim under if their flight is delayed?

3. The EHIC card system operates within all EEA countries, not just the EU.

4. The caps on mobile phone charges were one of the few Good Things which the EU pushed through, but AFAIAA, they apply in Switzerland as well. I was there a couple of years ago and am pretty sure I got the same text message as when you go to any other European country.

5. The right to bring unlimited goods? Other EU countries are perfectly happy for us to buy their stuff, it is the UK government which would impose a limited post-Brexit. That would be self-inflicted.

6. Period of uncertainty, fair enough, difficult to quantify one way or another.

7. Sterling might rise or it might fall. Nobody likes paying more for their holidays when sterling falls, but it would be good for exporters and our own tourism industry. So that's a break even.

Posted by

Mark Wadsworth

at

15:31

1 comments

![]()

Labels: Brexit, Climate of fear, EU, Referendum, Tourism

Subsidies for childcare costs.

My article is now up at the Citizen's Income Trust's new look website.

Posted by

Mark Wadsworth

at

13:03

0

comments

![]()

Labels: childcare, Simplification, Subsidies

Sunday, 13 March 2016

Good article about demand-priced parking.

From Xerox.com:

Why does parking matter so much? What’s the impact of parking on city architecture and quality of life?

In most cities, the footprint of parking is bigger than that of any other land use. Parking spaces are also the most uniform and most frequently rented pieces of land on earth…

Cities should charge the right prices for on-street parking because charging either too little or too much can do great harm.

If the price is too low and no on-street spaces are vacant, drivers searching for a place to park will congest traffic, waste fuel, and pollute the air. If the price is too high and many on-street spaces are vacant, adjacent businesses will lose customers, employees will lose their jobs, and cities will lose tax revenue.

Consequently, the right price for on-street parking is the lowest price that can keep a few spaces open to allow convenient access for motorists. This is the Goldilocks principle of parking prices.

Posted by

Mark Wadsworth

at

13:19

1 comments

![]()

Saturday, 12 March 2016

Joined up government.

1. Although Stamp Duty Land Tax is a tax on land values, it is not Land Value Tax because it is only triggered when somebody does something positive and is not an annual tax. It is therefore a bad tax.

2. The government's subsidy for land values, Help to Buy, is a very bad subsidy, firstly because it is a subsidy, and secondly because it is a subsidy to the main thing the government should be taxing i.e. land values.

So we have two bad things, which actually cancel out. We could get rid of both.

Let's look at one individual purchaser:

a) Buys a new build for £400,000 (approximately double the UK average excl. London).

b) Gets a Help To Buy loan of 20% of the price = £80,000

c) Pays SDLT of £10,000 up front.

d) That loan is interest free for five years, so the notional interest saving @ 2.5% per year = £2,000 x 5 years = £10,000.

He wins £10,000 on the Help To Buy swing and loses £10,000 on the SDLT roundabout.

This works out slightly 'progressive' relative to house prices/land values (or sellers thereof), i.e. at prices below £400,000, the subsidy is worth more than the tax and vice versa.

The Tories don't like 'progressive', of course, so they introduced a special Help To Buy for London, where the interest free loan can be 40% of the price paid. Helicopter money for people selling land in London! The break even point for that works out at £500,000, which is approximately the average price paid for a home in London.

Posted by

Mark Wadsworth

at

20:54

3

comments

![]()

Labels: Commonsense, Subsidies, Tax

Friday, 11 March 2016

A Sternly Worded Letter

From the Guardian

The Sports Direct founder, Mike Ashley, has been warned he could be found in contempt of parliament after failing to give MPs a date to answer questions about his company’s treatment of workers.

The move represents the latest setback to the tycoon and owner of Premier League strugglers Newcastle United. Ashley has seen almost £1bn wiped from his personal fortune after a downturn in trading at the store chain and a Guardian investigation which revealed that thousands of the retailer’s temporary warehouse workers were receiving effective hourly rates of pay below the minimum wage.

In a strongly worded letter to the billionaire, Iain Wright MP, the chairman of the business, innovation and skills (BIS) committee, said: “A number of alternative dates have been offered to you by the committee clerk, but as yet you have not accepted any of them, nor agreed in principle to attend. As you will be aware, select committees do not normally need to have recourse to our formal powers to summon witnesses in order to secure attendance; refusal to attend without good reason may be considered a contempt of the house.

“Should you fail in your reply to agree to attend on one of the dates offered to you, or a mutually convenient alternative before 1 June, the committee reserves the right to take the matter further, including seeking the support of the House of Commons in respect of any complaint of contempt.”

Wright has given Ashley, who owns 55% of Sports Direct, until 21 March to reply.

And Ashley will probably do nothing. Because he knows exactly what's intended, which is for Iain Wright to make a grandstanding public spectacle, much like Margaret Hodge does, and he sees no benefit from doing so. So, he's politely telling Iain Wright to go fuck himself.

Posted by

Tim Almond

at

00:50

18

comments

![]()

Labels: parliament, sports direct

Thursday, 10 March 2016

Economic Myths: Debt free money

Lots of people who refuse to accept basic principles believe there is such a thing as "debt free money". If you Google it and follow a couple of links you end in a sea of raving gibberish like this from zerohedge:

This organization (Committee On Monetary/Economic Reform) is demanding that our corrupt government and the nefarious central bank which rules above it return Canada’s monetary system to the issuance of debt-free money.

In turn, the phrase “debt-free money” is relatively easy to define: issuing currency from our central bank, into the economy, without (literally) “borrowing it” into existence – i.e. attaching debt to every unit of currency.

Again, some readers not familiar with our current monetary system may require some additional clarification (as they discover the horror/insanity of our present system)… However, at roughly the same time our (now) now corrupt governments began corrupting our economies, they also totally corrupted our monetary system.

The gold standard was abolished (assassinated by Paul Volcker), and our governments began creating their so-called “money” from debt – i.e. our governments forced themselves to “borrow” our own currencies, from these corrupt central banks, as the mechanism for our money-printing.

As an aside, this person doesn't understand that the government doesn't and can't borrow from the central bank because the central bank is part of the government. You can't borrow from yourself or lend yourself money. He contrasts this with the central bank issuing currency without borrowing it. That is impossible. Whoever issues currency, be that coins and notes, money, bonds, IOUs or numbers on a computer screen is borrowing. He contrasts two scenarios which are exactly the same.

"But it's not borrowing!" squeal the nutters, "The government doesn't ever have to repay its debts, they can just mount up for ever."

Yes, fair point, in practice, governments don't ever repay most of their debts, they just get rolled forward again and again. But if interest is payable on those debts, that't a teeny tiny bit of a bit of a hint of a cluesy-woozy that it's borrowing.

Next argument, "But in today's world, government don't need to pay interest any more, or are even paying negative interest" (which is like a bank charging you an account fee even when your deposit account is in credit, which is not that unusual). That is also true, although this is an unusual situation and we don't know how long it will continue.

Nonetheless, even if the debts are interest-free and will never be repaid, it is still borrowing and that borrowing is debt. The flip side of money is always debt (physical gold is not money for these purposes).

Consider the simple question, everything else being equal, which government is "richer", Government A which has absolutely no public debt or Government B which is drowning in debt (or has issued endless paper money with nothing to back it up like Zimbabwe or Weimar Germany)?

It's not difficult is it? Government A is 'richer'. Why? Because it has no liabilities. Even if Government B never pays interest on its debts or repays those debts, then it has less scope for manoeuvre. If Government A were temporarily strapped for cash, it could issue extra coins and notes, or bonds or whatever and people would accept those as valid, so Government A can procure the services it needs.

Government B no longer has this option, it has already used up its credit line by, er, borrowing. If the absence of something makes Government A richer, the something that is absent is debt or borrowings or liabilities.

Here endeth.

Golden rule: the first person to use the meaningless word 'reserves' has lost the argument. I will delete all comments which include that word.

Posted by

Mark Wadsworth

at

20:58

38

comments

![]()

Labels: Central banking, EM

"Attorney General Loretta Lynch has 'considered taking legal action against Santa Claus deniers'"

From The Daily Mail:

The United States' top lawyer told the Senate Judiciary Committee on Wednesday that the Justice Department has 'discussed' the possibility of a civil lawsuit against parents who fail to tell their children that presents are delivered by a kindly old man from the North Pole.

She said any information her office has received has been sent to the FBI in a bid to build a case. Her comments came as she was questioned by Democratic Senator Sheldon Whitehouse from Rhode Island.

He compared the Father Christmas deniers to parents who do not tell their children that the Easter Bunny brought their Easter eggs - the people the Clinton administration won a racketeering case against.

Whitehouse said: "The similarities between the mischief of Santa Claus deniers pretending that Christmas gifts are purchased by parents or other family members or those who pretend that they put the dollar bill under the pillow when a child loses a tooth or hid the Easter eggs in the yard has been remarked on widely, particularly by those who accept the evidence on where toys, dollar bills and Easter eggs really come from."

The US is also to hold talks with EU officials to raise their concerns about European claims that Father Christmas has his base in Lapland.

Posted by

Mark Wadsworth

at

16:15

2

comments

![]()

Labels: Free speech, Global cooling

Wednesday, 9 March 2016

Fun Online Polls: The next US President & Sunday trading hours

The results to last week-and-a-half's Fun Online Poll were as follows:

Who do you think will win the US presidential election in 2016?

Donald Trump (R) - 57%

Hillary Clinton (D) - 40%

Other, please specify - 3%

We'll see… Best comment:

TheViewFromMountRushmore: Other. The money men will win just like they've won every other US election.

A good turnout of 107 voters, thank you everybody who took part.

-----------------------

Unbeknownst to me, the government wanted to grant local councils the power to allow larger stores (that's the modern word for 'shops' despite being a complete misnomer - a store is what's in the warehouse FFS) to open longer than six hours (the current limit in England), but the government motion was defeated today.

Relaxing Sunday trading laws was of course one of John Major's many fine achievements. I remember peering out of my the front window of my flat to see if the Woolworth's up the road was really open on the first Sunday (it was, which cheered me up).

So that's this week's Fun Online Poll: is six hours 'about right', too long or not long enough?

Vote here or use the widget in the sidebar.

(Ever the small 'c' conservative, I'm happy with the status quo of six hours. It's great for shopping, but shop workers need time with their families too and if I get dragged off shopping on a Sunday, I'd like to be home by six.

More bizarrely, the people who oppose this are a mix of hard-left Trade Unionists, hard-right Christians and the self-promoting SNP, who allow larger shops to open for ten hours on Sundays. Go figure.)

Posted by

Mark Wadsworth

at

20:42

9

comments

![]()

Labels: Donald trump, FOP, Hillary Clinton, Pedantry, Retail

Tuesday, 8 March 2016

Crony Corporatist Speaks Out

Here

I fundamentally disagree with Mr Carney. The act of exiting the EU may in the very short term lead to some uncertainty and fluctuations in the price of Sterling and the UK stock and Gilt markets. But once it dawns on the capital markets that we are not paying out lots of money to the EU and are not on the hook for various bailouts and that we are not obliged to do all the mad and expensive interventions that the EU requires and crucially we can set out own banking solvency and capital requirements I think that Sterling will strengthen. This is of course not necessarily good news for UK trade but it will excellent for paying off all those government debts.

And Carney has also said that as a consequence of this uncertainty he will need to flood us with liquidity. Oh really? IMHO the 'real' reason to do this is to have lots of lovely cheap credit land on people in a burst of joyful feel goodness and encourage high spending on toys and stuff. Bread and Circuses.

In any event Mr C has a woeful track record in money and interest rates. Commentators have been saying for years that its interest rate policy has been useless. And it has managed to mis-use quantative easing Deliberately?

Overall markets - that's me and you and bloke on the Clapham Omnibus by the way - hate uncertainty. But they are really pretty quick to sort out the truth once things are clear. (Actually, I love uncertainty. It's opportunity).

Dan Hannan is pretty good on this.

This is just Carney doing his corporatist bit for the global self defined elite. 'Elite' my arse.

Update.

Just came across this little gem. Here (within the extended text). To paraphrase slightly - 'You cannot win an argument with the Bank of England with logic, because they argue by assertion'. That applies to the whole financial regulatory structure.

Posted by

Lola

at

17:57

35

comments

![]()

"Maria Sharapova distances herself from Nike following 'sweat shop' rumours"

From the BBC:

Maria Sharipova has moved quickly to distance herself her sponsor Nike after rumours surfaced that the company's products are made in factories in Asia where child labour is common.

Ms Sharipova said she was "saddened and surprised" at the company's admission that even adult workers in those factories are paid less than $1 a day, meaning it would take them six months to earn enough to buy a pair of the overrated and overpriced shoes.

Nike said that they had been sub-contracting to sweat shops since 1996, on the advice of their accountants.

She is one of the highest paid female athletes with earnings of over $30m last year from winnings and endorsements, meaning she earns more money than every one of Nike's single sweat shop workers put together.

Posted by

Mark Wadsworth

at

14:20

3

comments

![]()

Monday, 7 March 2016

Project Fear: Now it's getting silly.

The results of a 'survey' carried out by rent seekers OfficeBroker:

OfficeBroker ask 18-34 year old Brits their views on ‘Brexit’ and what they would do if the UK leaves the EU.

• 15.4% of young Brits would consider emigration if UK quits EU, which would result in more than 2 million people leaving the UK*.

• Nearly a third (32%) of 18-34 year olds in the North East of England would also consider leaving the UK.

• Northern Irish more likely to give up on UK if Britain votes to leave the EU as 23.8% of 18-34 year olds polled from NI say they would consider emigration

It is not clear whether they asked them "OK, where would you go?"

Surely, if they plan to emigrate to somewhere else in the EU it will be more difficult to do so post-Brexit, and if they think they'd go somewhere else, what difference would Brexit make?

Either way, the obvious follow-up question is "Why are you still here?"

Posted by

Mark Wadsworth

at

16:40

5

comments

![]()

Labels: Emigration, EU, Referendum

Very worrying.

From Farmer's Weekly:

A new campaign aims to raise awareness among dog owners of the devastating effects of livestock worrying, which is on the rise according to official figures.

The three-month campaign, led by Police Scotland in association with NFU Scotland, Scottish Land & Estates and other authorities, has been launched to coincide with the spring lambing period, when sheep are most at risk...

Dog attacks on livestock: The worrying facts

• More than 18,500 livestock were killed or injured in dog attacks in 2015.

• The South West has the highest number of livestock-worrying incidents in each of the past three years where attacks rose by almost 60% in 2015...

The simplest solution is to put cows and sheep in the same field. If the dogs go after the sheep, the cows will go after the dogs (or their owners).

Sorted.

Sunday, 6 March 2016

Economic Myths: Most of them.

To my mind, economics is like astronomy, evolution or geology, first you look at what has happened and what happens and then you work out an explanation or recognise patterns, out of intellectual curiosity as much as anything and whether you can influence outcomes or not.

William Smith and Charles Darwin knew nothing about the finer workings of plate tectonics or DNA but worked out that the most likely explanations for what was actually observed were 'geology' and 'evolution'. There's no point trying to debunk their explanations on the basis that they didn't know about plate tectonics or DNA.

To paraphrase Peter Hitchens, capitalism (i.e. business i.e. micro-economics) is like the weather, it just is, it is a force of nature and the government should try not to meddle too much. Micro-economics is merely the study thereof. I know nothing about the practicalities of oil extraction, but when oil was over $100/barrel, it seemed quite likely to me that it would fall back to $30 or $40 because that is the normal state of affairs. There are simple explanations why, but the the explanations follow the facts and cannot influence them.

No government can predict how much people are prepared to pay for a particular good or service; how much it will cost to produce; whether you can do it profitably and so on. That is up to entrepreneurs to work out by trial, error and a large chunk of luck.

Macro-economics i.e. government policy is different. It is not like the weather, it is entirely man made by politicians who all have their own agenda and marginal voters and who sift through mountains of economic theories to find some which justify what they were going to do anyway.

But government policy can be studied the same as anything else. Over the past century or three, countries have tried implementing just about anything you can dream up - minimum wages; minimum or maximum prices; exchange controls; import and export duties; setting interest rates, NIRP and ZIRP; subsidising banks or any other industry for that matter; taxing this or the other activity or economic variable; means-tested, universal or contributory benefits; jobs guarantees and so on. Some have worked, most have failed.

At any time you will have people focussed on one or the other particular area, usually to the exclusion of all others, claiming that their solution is the Holy Grail, the Silver Bullet, the Panacea etc, despite it has all been tried before and we have good records on all this stuff and whether it led to a favourable outcome or not.

What's wrong with going back to basic principles and looking at what actually happened when a government did X, Y or Z?

And the fact is, that as crazy as these ideas sound to the brainwashed, my few favourite hobby horses (taxing land values and monopolies instead of turnover, wages or profits; replacing means-tested and contributory benefits with universal benefits; having free trade which includes abandoning The War On Drugs etc) have all been tried and tested and have always 'worked', without fail. None of these are the Holy Grail, Silver Bullet or Panacea because they do not seek to improve 'capitalism', which will never be perfect, they just go with the flow and make things better rather than worse. They work whether you understand them or not, whether you agree with some vague set of principles or not.

To sum up, it is far easier addressing the question "what happened when" than twatting about with hypothetical "what would happen if…"s

The only argument worth having is over which outcomes you want - if you actually want high land prices, high unemployment, low wages and profits, depressed growth, rampant inequality, government and trade deficits etc, then by all means, stick with what we've got. But at least be honest about what you want.

Posted by

Mark Wadsworth

at

16:41

14

comments

![]()

Labels: EM

English Wine

Yes I know this is more my thing, but there is a land thing in here, so read on:-

"Champagne sales are going to decline here, and English sparkling wine will eventually take half of champagne’s share.” So predicts Ian Kellett, once managing director at the investment bank Dresdner Kleinwort Benson and now owner of Hambledon Vineyard in Hampshire. He’s convinced that England’s advantage is its lower land costs (Champagne’s are €0.9m to €2.1m a hectare). And he maintains there is no shortage of suitable land in England — “if the farmers will sell it”. He also expects champagne prices to continue to rise along with the debt burden of maturing their stock.

The thing is that the only reason Champagne's land prices are so high is because of demand for the land. You'd think a former banker would get this.

A little background to those not in the know:

To call your wine Champagne, it has to follow the rules of the Appelation d'origine contrôlée of Champagne. That includes a list of rules, like what grape varieties you can use, but more importantly for this, it also defines the geographic area. And that is a rather artificial area. Some land inside of it really isn't much good, some land outside would be better. You can grow a damn' good sparkling wine just outside using the same processes and grapes but you can't call it Champagne.

So as Champagne attracts a premium just on its name (a combination of ignorance and it being a Veblen good), what do we think the effect of that is on land prices inside the Champagne area? Yeah. Also worth noting: there's a similar battle to developers and Homeys with this: people with land just outside want the region expanded, people who own land in the region don't.

See, this guy has it wrong. England's advantage isn't having cheaper lands, it's having lower demand for the product. The land is only more expensive because of higher demand. If more people switch to English wine, the price of Champagne will fall, and with it, the value of the land it's grown on. It's still probably more suitable land for growing sparkling wine on.

The rest of the article is quite interesting if you're into general wine stuff. It seems quite a lot of producers are hobby businesses - people who've made money doing something else and are now pumping money into them. And it's still precarious from a climate perspective. Personally, I've not found one I like yet, but some people do like them.

Posted by

Tim Almond

at

13:23

9

comments

![]()

Saturday, 5 March 2016

Quote of the Day

Here

“We asked him – do you know anything about nuclear issues? And he said no, I majored in economics.”

Posted by

Lola

at

12:30

8

comments

![]()

Sigh. Just where is the Ministry of Truth when you need it..?

Here

Ho Ho.

Posted by

Lola

at

12:26

0

comments

![]()

Friday, 4 March 2016

Shooting the messenger.

The Sunderland manager got hauled over the coals in a press conference for continuing to field a player who by all accounts was a kiddy fiddler, transcript in The Guardian.

Yes, I know that being a football manager is about PR as much as anything, but he'd have been well in his rights to tell the assembled journos to piss off.

I agree that an employer shouldn't employ somebody if that puts customers or the general public at risk. So if a teacher is under suspicion of kiddy fiddling, the head of the school would have little choice but to suspend him.

The manager or owner of a transport business would be advised to suspend a driver being investigated for reckless driving, even if the driver did it on his own time; a bank would be criticised for employing people who are under investigation for defrauding pensioners out of their life savings; a pub would be in the wrong if it employed people with criminal records for GBH as doormen etc.

But I see no link whatsoever between kiddy fiddling and playing football in full view of tens of thousands of people. No spectator was put at risk of anything.

Posted by

Mark Wadsworth

at

13:35

12

comments

![]()

Thursday, 3 March 2016

Lost in translation?

From the BBC:

The agreement between France and the UK that allows the UK to conduct border controls on the French side of the Channel is a bilateral treaty that is not connected to Britain's EU membership.

It is meant to stop people from travelling across the Channel without their immigration status being checked - but has led to the establishment of the so-called Jungle camp in Calais, where about 4,000 migrants are thought to be waiting to cross...

France could opt to end the border treaty any time - but the country's interior minister Bernard Cazeneuve has said to do so would be "foolhardy" and cause "a humanitarian disaster".

His colleague, economy minister Emmanuel Macron, gave a different view in his FT interview, saying of Britain's EU membership: "The day this relationship unravels, migrants will no longer be in Calais."

Say what?

To summarise: if we vote to leave, on the next day, the French will do something which they themselves describe as 'foolhardy' and which would cause 'a humanitarian disaster'?

Go for it lads, go for it.

It's a bit like Cameron's volte face:

November 2015:

The Prime Minister told an audience at the Confederation of British Industry that the EU referendum debate was not about whether exit from the bloc was possible.

“Some people seem to say that really Britain couldn’t survive, couldn’t do okay outside the European Union. I don’t think that is true. Let’s be frank, Britain is an amazing country. We’ve got the fifth biggest economy in the world. We’re a top ten manufacturer. We’ve got incredibly strong financial services. The world wants to come and do business here.

“Look at the record of inward investment. Look at the leaders beating the path to our door to come and see what’s happening with this great country’s economy. The argument isn’t whether Britain could survive outside the EU. Of course it could.”

February 2016:

The Prime Minister said he believes Britain will be "stronger, safer and better off" in a reformed EU.

He also warned of the security challenges facing the West and said it was no time for division.

"The challenges facing the West today are genuinely threatening," Mr Cameron said. "Putin’s aggression in the east, Islamist extremism to the south. In my view this is no time to divide the west."

Posted by

Mark Wadsworth

at

13:47

8

comments

![]()

Labels: Brexit, David Cameron MP, EU, France, Hypocrisy, Immigrants, Logic