From the BBC:

Nursery school teachers should be given the same status and pay as those in primary school, the Pre-School Learning Alliance has said.

It said early-years teachers were being "locked out" of teaching in primary schools, even in reception classes.

Nursery teachers were very disheartened at the government's failure to bring the two sets of teachers' status in line, said the charity.

But the government pointed out that early-years teachers were probably just a bit irritable because of the heat wave.

"Maybe it's time for their glass of milk and afternoon nap," added the spokesman for the DfE. "We'll do some finger painting later on, that usually cheers them up."

Thursday, 31 July 2014

"Call to align nursery and primary school teacher status"

Posted by

Mark Wadsworth

at

16:28

1 comments

![]()

This is how they do it in the US.

Following on from the debate surrounding encouraging local people to allow fracking, the US is held up as a paragon of free market virtue.

Here's what Lynn had to say in The Telegraph.

"To create the kind of vibrant, fast-growing industry that has slashed the cost of energy in the US, and will soon make it self-sufficient again.

It is not just the industry itself that is valuable. In the US, shale has dramatically reduced energy costs, and that has led to a revival of the manufacturing industry.

One reason the industry has developed so fast in the US is that under American law the oil and gas is owned by the people under whose land it is discovered. If a developer finds it under your property, you make a fortune.

If the shale industry gets going, it won’t be the exploration licences that bring in the big money, it will be the tax on the energy produced, on the people working the rigs, and on the far larger number of jobs created by having significantly lower energy costs than our main industrial competitors. That is far more valuable in the medium-term than the revenues generated from exploration licences.

What Lynn conveniently neglects to mention, is the US has, with a few exceptions, an export ban on unrefined oil and gas. See here.

This causes a drop in the price, and by doing so, acts as a defacto land tax/citizen's dividend via lower profits/lower prices.

You can see why this approach is attractive in the US. Firstly, it side steps the whole thorny issue of property rights, and there is no visible taxation. Good Commie free stuff. It also means there is a shortage of refined product abroad, which they can export, presumably at a mark up. Which can be taxed.

Sneaky, but hardly free market.

There is movement to loosen up these rules. In which case prices in the US will rise, landowners won't just be making an unearned fortune, but a bloody great unearned fortune.

Lynn then contradicts himself in the space of the same sentence. If the big money is the upstream taxes, prices would have to rise. Yet he then says prices will fall. Doh!

The truth is, unless we ban exports and produce a significant % of our LPG needs, we will be paying Global prices. Which are still set to rise. Do we want to do it like they do in the US?

I'd say we are best of with a free market approach. And the monopolization of natural resources through exclusive property rights are incompatible (even if they can be somewhat mitigated by tax) with that ideal.

Posted by

benj

at

13:57

4

comments

![]()

Labels: fracking, Free markets, Land Value Tax

Wednesday, 30 July 2014

They own land. Give 'em more land!

Yep, there was a time when dishing out land was the method of rewarding favoured groups. Feudalism basically. See also "selling off the Royal Mail for £1 billion less than its real value" or "Selling off council housing for a massive discount".

Neo-Classical economists agree with this approach. Only by severing our common property rights, and giving them away for free to a select minority, can their value be realised. Presumably, although breathing is currently free, if we could privatise air, those companies would be adding value by charging us to breathe. I digress.

In today's Telegraph, leading the charge to this Feudal Utopia is Matthew Lynn who's article "Want people to back fracking? Let them own land under their property" can be read here.

In a nutshell, his argument is, because people are worried about the impact of fracking, let's re-attach the mineral rights to their freehold. Thus compensating them for any inconvenience caused. Hurrah!

So, because the value of their unearned wealth in land has gone down, let's dissolve the wealth we share in common (unexploited value of shale gas) and give them exclusive rights to it.

The parasite is unwell, let's feed it!

Lynn opines that this simple solution, is the only solution, if we want to get fracking going.

But, there is another simple solution, which is the opposite of his. Land Value Tax.

Under LVT your liabilities change when the economic and spacial environment changes. All externalities are thus internalised. So, those affected by fracking will be compensated by lower bills, at precisely the amount the market judges they are. No bureaucrats, or messy bribes involved.

This sounds like a much fairer and efficient way to run things.

Posted by

benj

at

20:47

22

comments

![]()

Labels: Feudalism, fracking, Land Value Tax

"Wildlife experts said…"

More bovine madness spotted by Julia M in the Evening Standard:

Cows are to be introduced to a London park - in order to save money on the cost of cutting the grass.

The herd of red poll cattle will be munching their way through foliage in Bedfords Park, Having, as part of a biodiversity programme.

Havering Council said the move will cut costs from paying park keepers to cut the grass and using expensive tractors, saving around £300,000.

It is one of the first councils in London to call in a team of ‘expert grazers’ to take over from traditional grass and hay cutting techniques, with similar schemes in Hornchurch Country Park and Rainham Marshes.

Wildlife experts said red poll cattle are known for having a gentle temperament and no horns, making them ideal for grazing in public spaces.

Cattle don't need horns to kill people, weight of numbers, head butting and kicking usually do the trick.

Posted by

Mark Wadsworth

at

11:15

9

comments

![]()

Labels: Cows

Tuesday, 29 July 2014

"There’s room for 10,000 new luxury apartments on spare land in council estates, say London Tories"

From The Evening Standard:

There is enough “redundant” land on London’s council estates to build an extra 10,000 luxury apartments, a report concludes today.

It claims that blocks could be built on swaths of derelict land currently being used for old laundries, garages and housing poor people and calls for “urgent” action to push councils to survey the land and sell it to Middle Eastern sovereign wealth funds.

A spokesman for Mayor Boris Johnson’s office said it had seen the report and was planning to allow the construction of top-end flats for buy-to-leave investors.

The report was released 24 hours after research showed that London’s housing crisis was deepening, with many multi-millionaires locked out of the market, with some oligarchs spending almost half a year's income to snap up a London pad.

Today’s report, Gap In The Top End Of The Market, identifies 4,552 redundant spaces in 13 boroughs. Tory London Assembly members behind the report extrapolated the figures to estimate that 10,000 glittering show homes and penthouses could be built across the city.

Steve O’Connell, report author and Assembly member, said: “We need an urgent, mass-scale, co-ordinated effort to turn the thousands of redundant spaces in blocks and estates into seldom-used housing for our party donors.”

He also highlighted Southwark Council's achievement in rehousing 1,500 social tenants to make way for privately owned flats at Elephant & Castle.

Posted by

Mark Wadsworth

at

16:49

6

comments

![]()

Rebuild costs and land prices

There is one simple statistic which enables us to kill two KLN birds with one stone.

The first is that "I paid for my home out of taxed income.".

The second is a long running argument I have had with various people about the typical rebuild cost/value of an average three-bed semi as distinct from the land value.

We know from Nationwide statistics on the ratio of house prices-to-earnings, that for the period 1953 to 2001, the ratio only went above three (never quite reaching four!) twice: for a couple of years in the early 1970s bubble and for a couple of years in the late 1980s bubble.

But throughout that period, builders were happily building 200,000 - 300,000 new homes a year in all parts of the country, it is NIMBYism and land price speculation which put paid to that, we're now down closer to 100,000.

We can argue over various up or downward adjustments, but we can safely assume that builders did it to make a profit, and that their average costs per new home were less than three times an average year's salary. And we can also assume that building techniques are little changed, it's largely manual labour. The cost of copper has gone up, but the cost of white goods has gone down so it all nets off.

The average full time male annual salary is currently £26,500 (the median is much lower than that), times that by three = £80,000 (which is what I have always said).

Going back to the first KLN, yes, people paid for the bricks and mortar out of taxed income, the same as they pay for anything out of taxed income (glossing over the fact the mortgage was subsidised via MIRAS), but most people who bought before 2001 did not actually pay a penny for the land, they got that for free.

And as Land Value Tax is only on the land element, for which any pre-2001 purchaser paid effectively nothing, it is clearly not double taxation for these people.

Agreed, people who were first time buyers after 2001 will have to pay twice for the land, that's as can't be helped, but they are all still of working age and will still pay far less tax overall if we shifted taxes from earnings and output to land values.

Posted by

Mark Wadsworth

at

11:16

14

comments

![]()

Labels: House prices, KLN, Residential Land Values

Fun Online Poll: Planning permission

The responses to last week's Fun Online Poll were as follows:

When considering planning applications, does your local council tend to…

Restrict the amount which somebody can build on any particular site? 12 votes

Force developers to build more than they actually wanted to? 11 votes

Which is about as close to a score draw as you can get.

I know for a fact that rural and suburban authorities set strict upper limits for how much people can build on a particular sized plot, which is often below the optimum density.

And I also happen to know that there is a "London Plan" which also sets upper limits depending on how close the plot is to local transport links, the town centre etc. I was helping a client sell some land ten years ago and part way through the negotiations, the London Plan was amended to allow a 25% higher density in that area, so we promptly increased the asking price by 25% and the developer duly accepted (most of the windfall gains go to the landowner, not the developer). Had the old or new upper limit been higher than what the developer ideally would have liked to build, then the price would not have changed, or would not have increased so much.

And I've never heard a developer complaining that he was given too much planning permission, they're always moaning that they weren't allowed to build enough, but maybe such a thing exists in urban or inner city boroughs? Does anybody have a real life example?

Posted by

Mark Wadsworth

at

07:50

0

comments

![]()

Labels: Town planning

Monday, 28 July 2014

Consolidation.

Posted by

benj

at

22:51

2

comments

![]()

Labels: Gambling

More Ricardo. Is London really that expensive?

From today's Metro "Want to be in London? Pay twice the rent"

"While Londoners typically benefit from higher average incomes than the rest of the UK, affordability is being squeezed," said Martin Totty, chief executive of Barbon Insurance. "For rental property to be affordable, a tenants gross income must be at least two and a half times his or her annual rent. Our data shows that rents in London have pushed beyond that."

Is this really an accurate description of affordability?

If Ricardo's Law of Rent is true, we'd expect the amount of income left after taxes and rent has been paid to be roughly equal. This is what we get.

Greater London £8,382, East Anglia £9,991, Wales £9,273, South West £6,927, South East £9,945, West Midlands £8,178, North West £8,167, Yorks & Humberside £8,009, N Ireland £9,142, East Midlands £8,762, North East £9,125, Scotland £9,278

Given that we are using average wage to average rent ratio, we shouldn't be too surprised about the unevenness. If the survey had used mean wages and rents, this might have looked at lot flatter.

But the point is, discretionary income is a much better measure of affordability. In which case, London certainly isn't the worst. I'm also guessing London gets the lion's share of Housing Benefit, which makes it look more unaffordable than it is, under our current tax system.

Let's see what happens to those figures under a Land Value Tax, even assuming the tenant pays the LVT charge. A tenant on average wages in London would be £10,190 better off in their pocket, and one in Scotland would be £5,600 better off.

So not a tax on London then.

Posted by

benj

at

22:34

22

comments

![]()

Labels: Ricardo's Law of Rent

A solution to the passport problem

From the BBC

Hundreds of passport workers across the UK have gone on strike in a dispute over staff numbers and pay.

The Public and Commercial Services Union (PCS) said the action was a "bid to end staffing shortages that have caused the ongoing backlog crisis".

Home Office data suggests about 360,000 applications are being processed - but it is not clear how many are overdue.

The Home Office said 875 PCS members had walked out and warned the action could jeopardise people's holidays.

Well, of course the PCS wants more (unionised) passport workers. The government would like less of them, but the passport application creates a backlog.

So, here's an idea: have a "summer" price for a passport and a "winter" price for a passport. Make it say, £5-10 cheaper if you buy one between September and March than April to August. Many people don't bother until just before they go and have no incentive to do otherwise. Give them an incentive, they might get a passport earlier and stop the crazy queues. And anyone who suddenly desperately needs a passport in July can easily get one.

Posted by

Tim Almond

at

20:17

3

comments

![]()

Labels: Pricing

"Perils of the English countryside"

You can guess what's top of the list at the BBC.

From 2008 to 2011, there were 269 recorded attacks, of which nine were fatal.

Posted by

Mark Wadsworth

at

10:57

4

comments

![]()

Labels: Cows

Saturday, 26 July 2014

Economic myths: Building more houses will bring down prices, part the umpteenth.

In my local town there is a quite pleasant development of flats with a good view of a spectacular castle, even if the castle does tend to shade the flats somewhat. They are right by the water in the centre of town and even have parking available, after a fashion, yet the majority are unsold. The law of supply and demand says that since the demand is not there, the price will fall until the flats reach a price where the demand is there and they sell. This has not happened.

Today, as I was strolling past the flats along the river, it occurred to me that one reason why so many of the flats are still empty could be that the developer borrowed heavily to finance the development and that the loan is secured against the value of the flats. Reducing a single unsold flat reduces the value of all the unsold flats and thus reduces the value of the collateral against which the money has been borrowed.

In these days, it is "cheaper" to go on paying the interest on the loan than it is to devalue the collateral by reducing the value of the flats, plus there is always the chance that land prices will start to go up again and the flats will sell. Added to which, if the reduced collateral puts the borrower in negative equity, the lender will get nervous that the borrower will simply go bust and so will try and get their money back early, which the developer equally doesn't want.

Posted by

Bayard

at

17:20

20

comments

![]()

Labels: EM, Speculation

Supermarkets and Localism

From the BBC

A group of local councils in England is formally asking the government for new powers to tax large supermarkets.

BBC News has learned that Derby City Council has called for the right to bring in a levy as a "modest" effort to ensure supermarket spending "re-circulates" in local communities.

I don't understand this need for money to stay in the local community. Take 3 products: bacon, watercress and lamb. I happen to know that they're produced in large abundance in Wiltshire, Hampshire and Wales respectively. So, the stores in Swindon are giving money to Hampshire and Wales, the stores in Winchester are giving money to Wiltshire and Wales and the stores in Cardiff are giving money to Wiltshire and Hampshire. Everyone's buying stuff from everyone else, so not much spending stays locally, but arithmetically, each spending money on each other nets off.

Posted by

Tim Almond

at

15:04

2

comments

![]()

Labels: localism, Supermarket

Friday, 25 July 2014

This little piggy went weee weee weee all the way home.

The UK Green Building Council and their fellow subsidy junkies are not happy. They've been shoved off the public teat and they are squealing: “The sudden and immediate closure of this fund is another setback for the energy efficiency industry because companies have specifically geared up to market and deliver through this scheme."

Translated, this means that their business model depended on subsidy capture and now that there is no more subsidy, they are going to either have to sell things to people that they want at a price they can afford or go bust.

Neil Schofield, from boiler manufacturer Worcester, Bosch Group, said “The tragedy is that, for once, Decc has come up with a scheme that works. It’s a body blow and a triumph for short-termism.”

No shit, Sherlock. The government offers to give people money and they accept it. Basically, the Green Deal wasn't working and was an embarrassment to the government so they decided to pay people to accept it and lo and behold, it's suddenly very popular.

All of which goes to show that Big Green is even more insidious than Big Oil, Big Pharma or even Big Land. The latter three can survive without government help, although they make sure they get planty of it, but the former is wholly dependent on subsidies and so has the biggest stake in making sure the public and their politicians believe all the things necessary for that income stream to continue.

Posted by

Bayard

at

18:17

1 comments

![]()

Labels: Subsidies

Killer Arguments Against LVT, Not (332)

From the comments at Landlord-Law Blog:

just saying says:

It’s simple really. Bring in a Land Value Tax.

Jamie says:

Hardly simple!

We’re already committed to a different tax system and there could be massive implications that would dwarf the current problem of a proportion of the 9 million private renters struggling to pay the rent.

How would you deal with the repercussions of potentially wiping trillions off the housing market?

I mean, where do you start with a sweeping moronic comment like that?

Fact is, just about any form of organised society creates land values in the first place, however directly or indirectly, and just about any tax system taxes land values, however directly or indirectly. So "income tax" is in fact a crude and damaging way of taxing land values; land value tax is a sophisticated way of taxing incomes.

It's just a question of replacing the more direct taxes on land and buildings first* and then shifting taxes from the productive economy to land values £ for £.

And those trillions he mentions don't really exist; it's the annual rental values which are real and they would be largely unaffected. If anything, reducing taxes on the productive economy would increase them.

So if you were too timid about the tax shift, selling prices might well go up. There'd be plenty of ill-founded grumbling every year, but by and large, most people wouldn't really notice, they'd just notice that everything is getting a bit better every year.

------------------------------------------------------------

* We could get rid of Council Tax, SDLT, CGT, IHT, Insurance Premium Tax, Stamp Duty and the TV licence fee, as well as income tax on rental income and the non-dom charge (and AFAIC, additional rate income tax) and instead raise/pay the same amount of revenues with annual tax of just under 1% of current selling prices.

[Please note that the UK's private residential landlords pay about £5 billion in income tax but receive about £10 billion a year in housing benefit.]

Three-quarters of households would end up paying much the same as now each year.

The top quarter would pay more on a year-by-year basis but would no longer have to worry about the large one-off hits like SDLT, IHT or CGT (with all the associated complications, expensive tax planning exercises and sub-optimal decision making). Over a lifetime, the total tax they paid would be much the same as well. It's just a smoothing exercise which makes everything much easier to plan for; it's like the difference between the TV licence fee and Inheritance Tax (both of which raise about £3 billion a year).

Posted by

Mark Wadsworth

at

15:47

5

comments

![]()

Guardian of the Galaxy

From Wiki.

Guardian of the Galaxy is a universally available but little read news outlet, founded in 2014.

From today's edition:

Peter Quill: Shocking new statistics reveal that as many as nine in ten children in Missouri in the mid-1980s were abducted by a group of thieves and smugglers called the Ravagers and trafficked as sex slaves.

Gamora: It is time for women to break through the glass ceiling and not just end up as personal assistants to fictional comic book villains.

Groot: For how much longer can Western nations sit idly by and allow the massive deforestation in the Amazon basin when so many species of tree-like humanoids are threatened with exinction?

Nebula: As a cared for child myself, I call on the government to invest more in helping girls to make the transition to adulthood. We cannot tolerate a society which allows so many young women with no stable family background to drift into becoming sadistic and evil lieutenants to Kree radicals.

Posted by

Mark Wadsworth

at

10:37

1 comments

![]()

Thursday, 24 July 2014

A Sci-Fi B Movie if Ever I Saw One

From ITV

A huge nest of rare super ants, known to feast on electric cables, has been found in the UK.

The insects, which have a fatal attraction to electricity, were found at a property in Hendon in north London.

The first sighting of the insects in the UK was at at Hidcote Manor Gloucestershire in 2009. This YouTube video shows their 'super' strength.

I'm not sure which direction you'd go from there. The ants become immune to the power of electricity and mankind gets sent back to the Victorian age as electricity is constantly under threat. Or do the ants feed off the electricity and become like batteries, swarming around humans and destroying them with a static charge before eating us.

Posted by

Tim Almond

at

20:39

10

comments

![]()

Killer Arguments Against LVT, Not (331)

A traditional KLN is that if we collected some tax on the rental value of land and reduced other bad taxes on transactions, output, employment etc, all the wealthy foreigners with their fancy status homes in London would flee the country, leaving economic devastation in their wake.

OK.

From today's Evening Standard:

Foreign “buy to leave” property owners are not preventing ordinary Londoners from affording their own homes and in fact inject millions of pounds into the capital’s economy, a new report claims today.

It says sales of homes worth more than £2 million in central London “have not fuelled a general rise in house prices” and insists that overseas buying at the top end of the market “does not play a major role” in the housing crisis.

The report, commissioned by Westminster council, suggests that owners of trophy mansions pump £2.3 billion a year into the city’s economy through spending in shops and restaurants, work on homes and employing staff.

It found that owners of homes worth more than £15 million spend an average of £4.5 million a year in London while those in the £5 million to £15 million bracket spend £2.75 million annually.

The study follows growing public and political anger over the impact that foreign buying has had on the capital’s property market. The furore has resulted in a raft of new taxes on owners of homes worth more than £2 million and the threat of a further “mansion tax” from Labour and the Liberal Democrats after the election.

Okey doke.

So let's start off with a modest LVT of approx. 1% on current selling prices (25% of the site premium), which would be enough to replace Council Tax, Stamp Duty Land Tax, Capital Gains Tax, the TV licence fee and Insurance Premium Tax, as well as the annual non-dom levy of £30,000 or £50,000 per person.

So our hero in a £15 million home has to pay £150,000 a year in LVT, possibly a smidge more or less than whatever he is currently paying.

If he and his family really spend £4.5 million a year here, are they really going to notice an extra £10,000 or £50,000 a year? About as much as they would notice a tax cut of £10,000 or £50,000 a year, methinks.

I think we can rule out the possibility that Westminster Council are lying for their own nefarious reasons, party political donations from oligarchs and so on.

Posted by

Mark Wadsworth

at

20:22

9

comments

![]()

Labels: KLN

Peace Talks

If you Google the phrase, you get, for example, the following list of combatants/opponents:

Israel v Fatah/Hamas

Afghanistan v Pakistan/Taliban

Colombia v FARC

Ukraine v Russian separatists

Now, we now that these talks are doomed to failure, as the parties will never agree with each other.

But what we ought to try at least, is invite all eight parties to Geneva and choose random pairs to hold talks (like the World Cup draw).

So the Israeli negotiating team ends up sitting down with FARC; Russian separatists go face to face with Colombia; Ukraine meets up with Fatah/Hamas, and so on.

They can have a gay old chat with each other, have a good moan about respective grievances and problems, their aims and goals but will agree they have no actual differences.

So FARC agrees that it will not try to overthrow the Israeli state and Israel agrees that it will not interfere in the Central American drug trafficking and kidnapping business etc, they sign a mutual non-agression and free trade pact and become best mates.

After the first round, lots are drawn again until every team has negotiated with six other teams, each time shaking hands and getting on famously.

In the final round, a few days later once everybody is nice and relaxed and in a conciliatory mood, negotiating teams sit down with their original opponents.

With a bit of luck, in the final round, they'll be so caught up in the mood that they will actually kiss, compromise and make up.

Posted by

Mark Wadsworth

at

14:32

10

comments

![]()

Labels: Afghanistan, Colombia, FARC, Hamas, Israel, Pakistan, Russia, Ukraine

"London workers boost rents in home counties"

More Ricardo's Law of Rent in today's City AM:

IMPROVING job prospects and growing demand from London workers hunting for homes outside of the capital has sent rents in the home counties soaring this year.

Figures released today by Knight Frank show that prime rents jumped 2.6 per cent in the three months to June, a marked increase on the 0.7 per cent growth in the first quarter.

The number of tenancies agreed across the home counties was 50 per cent higher year-on-year, led by demand from people working in London...

“UK tenants are still the largest proportion, with many looking to move out of London to the home counties for a bit more space,” [Knight Frank’s Oliver Knigh] said.

Despite two consecutive quarters of rental growth, rents are still 3.8 per cent down over the 12 months to June. But returning business confidence is expected to further boost rental demand in the UK as companies push ahead with expansion plans.

“I expect that we’ll see further rent increases as the year progresses as demand shows no sign of slowing,” Knight said.

Posted by

Mark Wadsworth

at

11:09

5

comments

![]()

Labels: London, Rents, Ricardo's Law of Rent

An Excellent Example of Bureaucratic Capriciousness.

The retail FS business I co-own has one guiding principle. That is when considering anything the question we ask ourselves is 'is this right for the client?'.

Now, clearly as we are all different some things clients want to do we wouldn't want to do. But, it is not our money or our lives and all our individual motivations are personal. It is not anyone's job to tell someone else what to do, unless specifically asked to do so, and even then - without coercion - you can only 'advise'. Only the state can coerce.

We have recently been working with a number of clients who want, by their own choice and based on their own research and understanding, to invest in an unlisted security through their pension funds. To be clear, we have not 'sold' the investment opportunity to them in any way at all. All we have been asked to do is to facilitate the administration of the purchase. Even then, just because we are Good Chaps we have done a considerable amount of due diligence on the investment opportunity, which FYI is not some mad stupid Bahamian property thingy, or whatever, but a simple capital raising for a straightforward clicks and bricks business.

Mostly this means transferring clients' money from pension manager X to a SIPP manager. This has proved mighty frustration and difficult because, in part, of this piece of abject nonsense and appalling statist nannying from the Financial Catastrophe Authority. At some point I will set out and fisk the bloody thing, but I have to do some money earning work today. If anybody else fancies a go at it, be my guest.

Clearly some people are persuaded to place pensions funds into what are completely unbelievable 'investments' that any sane person would just laugh at. But why do they do this? Well, if you run society as a kindergarten you get juvenile behaviour. The 'it's always someone else's fault' culture creates massive moral hazard and people just disengage their brains. The FCA's lunacy precipitates the failures that they rail against.

Facepalm.

Posted by

Lola

at

10:39

0

comments

![]()

Labels: Financial Conduct Authority

"Women under-represented in"

It's a man's celluloid world: study finds women under-represented in film

Women 'under-represented in world newsrooms'

Women under-represented in academic medicine

Women under-represented in freelancing

Women under-represented in Lords despite new additions

Protestant women under-represented in PSNI

Report finds women under-represented at senior levels in radio

Women under-represented in NHS leadership

Women under represented in fund management

WOMEN UNDER REPRESENTED IN SENIOR POSITIONS IN UK

Why are women under represented in the cannabis community?

Women under-represented in UK boardrooms, says survey

Women under-represented in construction, reveals guide

Women under-represented in senior advertising jobs

Posted by

Mark Wadsworth

at

07:31

16

comments

![]()

Labels: Employment, Feminism, statistics

Wednesday, 23 July 2014

UK Users Shun Porn Filters

From the BBC

The vast majority of new broadband customers in the UK are opting out of "child friendly" filters when prompted to install them by service providers.

The industry watchdog Ofcom found fewer than one in seven households installed the feature, which is offered by BT, Sky, TalkTalk and Virgin Media.

Another whizzo Cameron scheme down the pan.

They were never really going to work because blanket filtering doesn't work. You can filter on PCs quite well. If blocking software stops a child going to a site an adult can easily switch it to be unblocked. With blanket site blocks, if you switch it off then it all gets switched off. Both the site you think the kid should see, and also the freakiest porn around (assuming they go looking for it).

Posted by

Tim Almond

at

23:55

0

comments

![]()

Prefabs sprout

There was mention on the news today of a new answer to the high cost of land in London, the return of the prefab. At first glance it looks like the trend for smaller houses taken an absurd level, with its 280 sq ft of floorspace, but it does make you think, how much space does one person actually need? It is certainly cheap to run, costing under a pound a week to heat and light. Could this be the shape of things to come?

Posted by

Bayard

at

23:28

3

comments

![]()

Fun Online Polls: Budget hotels & planning regulations

The results to last week's Fun Online Polls were as follows:

UK budget and mid-priced hotel chains. Thumbs up, thumbs down, what? Multiple selections allowed.

Premier Inn 20 votes

Travelodge 11 votes

Ibis 7 votes

easyHotel 0 votes

Holiday Inn 5 votes

Mercure 3 votes

Novotel 2 votes

easyHotel 0 votes

Thistle 1 vote

Other, please specify 2 votes

'Others' suggested were Days Inn (have smoking rooms!), Comfort Inn and Big Sleep.

Premier Inn got the most reasonably favourable comments, so that appears to be the winner - but perhaps that is because there are more of them, so people are more likely to have stayed in one?

----------------------------

There appears to be some misunderstanding or disagreement as to planning regulations.

In my experience, local councils restrict the amount of buildings which developers can build on any plot; others (NIMBYs, Faux Libertarians and Homeys generally) appear to think that local councils encourage developers to build more than they really wanted to or more than what is appropriate.

It is possible that both are true: suburban and rural councils try and keep densities as low as possible (even when higher densities would make sense) and turn down more planning applications, and that urban councils ask developers to build as much as possible (more smaller units) and nod everything through.

(I'm not talking about the indirect effect on densities or home sizes of high land prices and taxation of profits rather than land values, I mean in terms of how much building a developer can put on a plot.)

So what's your experience/impression?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

20:20

0

comments

![]()

Labels: FOP, hotels, Planning regulations

"Loving This, Admit Israel And Hamas"

From The Daily Mash, six years ago (but just as valid sixty years ago and will probably still be relevant in sixty years' time):

ISRAEL and Hamas last night admitted the latest wave of deadly violence was one of the best they had seen in years.

As the international community condemned Palestinian rocket attacks against southern Israel and the corresponding Israeli air strikes in the Gaza Strip, both sides agreed it was ‘more fun than a barrel of heavily-armed suicide monkeys’.

Israeli prime minister ... said: “You’ve got to hand it to Hamas, they are the dog’s bollocks when it comes to unrelentingly insane terrorist opponents..."

Land Speculation and Housing Design

In an earlier post our host stated:

It's private, profit maximising developers who bash out the tiny homes because they can get away with it; ...

But why? He then stated that:

...they arise because of the absence of state intervention. If local councils reintroduced minimum room sizes or better insulation requirements, this twat would still be shrieking about state controls and state rationing.

I do not think that this is the full story. I think that the cri de cour for more state intervention is on top of existing failed state intervention, and policy failures. Successive layers of intervention cannot surely be the answer?

It is generally observable in the free market that the magic happens and quality goes up as prices fall. More is done for less every day. Cars are a good example of this. There is no - as far as I can tell - state intervention in space standards or quality standars for cars. (I am of course aware of 'safety' and 'emissions' standards). Competion is pretty fierce between manufacturers. And I will also concede that the car makers are the recipients of an awful lot of government subsidy, notably GM.

In the comments to MW's piece I related how I had known well two spec. house builders, and both were exercised as to how they could build good houses. The one I knew best, each year as part of his business planning sat down and worked out if he could build what he considered to be a suitable First Time Buyer three bedroom house and make a profit. His standards were close the Parker Morris Standards and were based on the analysis that the first house bought by a young couple may have to be suitable for ten years or so, and that this implied the need for at least three bedrooms to give space for children. By the late 1980's he could no longer do this.

You will recall that the Parker Morris Standards were space standards for public housing which were abadoned in 1980 under MW's favourite P.M.

So what is going on? As regards house prices/space standards there are seemingly two factors that mitigate against competion delivering its magic. One, that land is in finite supply and two, state interventions and policy failures.

We on here generally accept that LVT would sort out the unearned scarcity and exclusivity premium enjoyed by landowners. We also know that existing tax policy favours land over production.

We also know that planning constraints driven by bureaucratic incompetence and nimbyism further restrict supply.

We also know that bad money and inflation (and that inflation is a function of money) drives asset prices, and specifically land price speculation. (We also know that speculators per se are not a Bad Thing in that in other areas of the economy they act as a form of insurance shouldering risk for others).

And with incipient inflation "honest work and sound production will tend to give way to speculation and gambling. There will be a deterioration in the quality of goods and services and in the real standard of living" [Henry Hazlitt - Man Vs. The Welfare State].

Surely then by removing the interventions and correcting taxation and policy errors developers would not be able to profit from speculation and standards would rise and prices fall.

Discuss.

---------------

MW adds: "By the late 1980's he could no longer do this."

Yes of course, because by then full-on Home-Owner-Ism was taking off, banks and building societies were lending higher and higher multiples; rent controls were being abolished; NIMBYism was becoming rampant; council housing was being sold off.

So from 1945 to the early 1980s, builders lived off volume and 'earned' profits (good design etc) not land price speculation. Selling prices were effectively capped (at approx. half today's unregulated prices), but the builders were still happy to build 200,000 - 300,000 new homes per year.

Posted by

Lola

at

09:11

13

comments

![]()

Labels: house building, Planning regulations, Speculation

George Harrison memorial eaten by beetles

actually spat tea across my screen when I saw this, from the Indy

A pine tree planted in Los Angeles to commemorate the late-Beatles star George Harrison has died – after being consumed by beetles.Planted as a sapling in 2004 near the Griffith Observatory, the tree stood 10-feet high but died recently as a result of an insect infestation.The Griffith Park and its observatory are popular tourist spots in LA, but the trees there have been plagued recently by ladybug and bark beetles, both of which can cause extensive damage.LA councilman Tom LaBonge, who represents the area, told the LA Times that the tree would be replanted. The paper said Harrison, who had a well-developed sense of humour, "likely would have been amused by the irony".

Posted by

SumoKing

at

08:39

3

comments

![]()

Labels: Celebrocracy, Irony, Music

Tuesday, 22 July 2014

Spreadsheet Sex

There's been a lot in the news this week regarding the use of accountancy techniques in order to document sexual activity and the excuses for lack of. Which you can read here for more details.

I think the response to the frustrated spouse should have been based on an economic model. Rather than an internet outing. Something like this perhaps.

Posted by

benj

at

23:27

2

comments

![]()

Labels: Economics, laffer curve

Faux Lib idiot of the day

A comment under this article in City AM was abbreviated and published as a reader's letter today:

Modern homes, as decreed by modern planners and politicians, are too small, too dark, too inflexible, too crowded and too like C19th slums for them to be bought by anyone in their right mind - assuming they had a free choice of houses within their budget and location.

The sad truth is that 'what the State controls, the State rations' and that has never been more true than for housing and infrastructure.

The solution is blindingly obvious - scrap planning controls and let landowners, builders, developers and buyers have a free choice of what, where and how they want to live.

HD2

Bizarre.

It's private, profit maximising developers who bash out the tiny homes because they can get away with it; they arise because of the absence of state intervention. If local councils reintroduced minimum room sizes or better insulation requirements, this twat would still be shrieking about state controls and state rationing.

And who built those C19th slums? Was that not private developers operating without state regulations?

And it's the NIMBYs crying out for planning restrictions, I don't think that the government in the abstract sense could give two hoots how much gets built.

FFS.

Buyers and non-landowning "builders" (i.e. construction workers) will never be on a level playing field with landowners and developers (aka land bankers). They will never have a free choice of where to live or ply their trade

Those land bankers have got plenty of plots with planning, but to maximise their profits, they are just allowing them to trickle onto the market. A load of contsruction workers were laid off back in 2008 so that the land bankers could wait for prices to go back up, so if you are a buyer you have to wait ever so humbly and patiently until they deign to actually build one or an existing homeowner decides to sell one, it's not like you can buy from the competition instead because there isn't any.

Posted by

Mark Wadsworth

at

16:40

17

comments

![]()

Labels: Faux Libs, Fuckwits, Planning regulations

Vehicles-crashing-into-buildings News

From The Evening Standard:

These pictures reveal the devastation wreaked by a runaway bus which rolled backwards down a hill and crashed into the front of a family home.

The images, taken by resident Natasha Ottley, show huge cracks in the brickwork in the now "totally unsafe" property after the empty 174 bus hit it.

Eye witnesses claimed the bus was empty at the time and the driver chased after it to get back at the wheel after apparently leaving the handbrake off but it was travelling too quickly.

I'd say the house looks to be in surprisingly good condition, to say it just got hit by the proverbial bus. Hopefully they can get it patched up again fairly quickly.

Top tip: don't buy a house on a T-junction at the bottom of a hill.

Posted by

Mark Wadsworth

at

14:50

1 comments

![]()

Labels: bus hits bridge, car hits house

Sinkhole News

From The Daily Mail:

It's getting bigger! Massive sinkhole in Florida neighbourhood DOUBLES in size as it becomes tourist attraction

* Crowds are turning up in Spring Hill, Florida, just to peer into the hole

* One resident joked about putting up a lemonade stand to entice visitors

* However it is encroaching on their homes and residents don't feel safe

Posted by

Mark Wadsworth

at

14:38

0

comments

![]()

Labels: Holes, Subsidence

Killer Arguments Against LVT, Not (330)

There are people who don't understand maths who say that because selling prices can fluctuate quite markedly from year to year, and because rents also fluctuate (although nowhere near as much) that the revenues would be too unpredictable.

Well, if you just have low level LVT, fluctuations wouldn't matter, there are just good years and bad years and it all evens out.

If a government relies on LVT as a major source of revenue (or in MMT terms, "a major source of money unprinting"), then the UK already has a perfectly sensible system for dealing with fluctuations/revaluations.

Even if you didn't know that this system existed, you would invent it anyway.

Take it away, Valuation Office Agency:

The rateable value assessed by the VOA and shown in a rating list is broadly the open market rental value (Local Government Finance Act 1988) at a valuation date set by Regulation. This set valuation date (known as the Antecedent Valuation Date or AVD) is normally two years before a rating list comes into force, so 1 April 2008 was the AVD for the current rating lists that came into force on 1 April 2010.

All non-domestic properties (hereditaments) are assessed on this basis, even new properties, so they are valued on a fair and consistent basis. The business rates bill is calculated by multiplying the rateable value of a property with the multiplier (tax rate) set by Government.

A cycle of 5 yearly revaluations has existed since 1990 in England & Wales. The aim of each revaluation is to redistribute the same overall business rates bill to businesses, based on the relative changes in property values since the last valuation date; revaluations do not raise any extra revenue.

So, going by their figures to illustrate the point, in 2008 total rateable values (the amount of rent that could be collected by landlords, assuming tenants pay the tax, which is slightly circular but not even that matters) were £57 billion in England, the government's target receipts from Business Rates in that year were (say) £25 billion, so the multiplier (i.e. the tax rate) was 43.9%.

They guesstimated that total rateable values in 2012 had fallen to £48 billion, so assuming that target receipts are still £25 billion, the multiplier is just nudged up to 52%.

It is only relative changes in value which matter; if the rental value of your building goes up and everybody else's goes down, then your tax bill goes up markedly. If yours goes up but everybody else's goes up even more, your tax bill goes down.

So absolute values don't matter either, as long as the valuation method is consistent, i.e. if all rental values are slightly over- or understated, it cancels itself out and everybody ends up with the "right" tax bill.

And while it is intellecually more sound to base such a tax on rental values than on selling prices (and on site values rather than total values), not even that matters, you can divide the required tax revenues by total selling prices and then apply that smaller percentage to selling prices, it always evens itself out. As long as values are based on averages for similar plots/buildings in any area regardless of the actual condition of each building, then there is no disincentive to improving your own building; your tax bill won't go up if you do.

Posted by

Mark Wadsworth

at

12:42

3

comments

![]()

Labels: Business Rates, KLN, Maths

Monday, 21 July 2014

Arming rebels with ground to air missiles. Who thought of that one first?

Putin is a fascist, no doubt. But arming favoured rebels with surface to air missiles is not exactly a new thing.

From wiki

"In late 1985, several groups, such as Free the Eagle, began arguing the CIA was not doing enough to support the Mujahideen in the Russian-Afghan war. Michael Pillsbury, Vincent Cannistraro, and others put enormous bureaucratic pressure on the CIA to begin providing the Stinger to the rebels. The idea was controversial because up to that point, the CIA had been operating with the pretense that the United States was not involved in the war directly, for various reasons. "

" Charlie Wilson, the congressman behind the United States' Operation Cyclone, described the first Stinger Mi-24 shootdowns in 1986 as one of the three crucial moments of his experience in the war, saying "we never really won a set piece battle before September 26, and then we never lost one afterwards".[18][19] He was given the first spent Stinger tube as a gift and kept it on his office wall."

"Wilson later told CBS he "lived in terror" that a civilian airliner would be shot down by a Stinger, but he did not have misgivings about having provided Stingers to defeat the Soviets.[19]"

"Russian officials claimed several times the presence of US-made Stinger missiles in the hands of the Chechen militia and insurgents. They attributed few of their aerial losses to the American MANPADS. The presence of such missiles was confirmed by photo evidence even if it is not clear their actual number nor their origin.[28]

It is believed one Sukhoi Su-24 was shot down by a Stinger missile during the Second Chechen War."

Posted by

benj

at

16:22

5

comments

![]()

Labels: Hypocrisy

Does anyone care about the Commonwealth Games?

It's always struck me as a really weird event, a hangover from empire and the Empire Games, but in reality, the Empire ended 60+ years ago and for most of us we have no more connection with Kenya or Ghana than we do with Morocco and Tunisia.

So, what's left of it is really just like a bad version of the Olympics. Winning a medal in a global contest at Pole Vault without the Russians and Americans there is like winning a national title. And as a viewer, I feel like it's somewhere meaningless.

I didn't really mind it when it was a rustled together event. The Edinburgh games in 1986 cost net about £4m. They found buildings and stadia to use. You could try and break it down and work out if it was worth it, but even back then that was not a lot of money. The Glasgow 2014 games are costing about £523m. I'm not even sure where it's going. They've spent £110m on a new velodrome (so, for some reason, the UK now has 3) but I can't see any other big venues that have been built.

And of course, Scotland has introduced the same sort of fascist laws that the Olympics had in London now about ambush marketing, so local shops and people can't decorate their windows with Commonwealth Games stuff, even though they and everyone else has paid millions towards this happening. It's only official sponsors. I've been to towns after a Tour de France stage and there's none of this. A baker will get someone to paint a cartoon of a rider holding a baguette, the butcher will get one of a pig on a bike. The florist will stick a bike outside the door and cover it in flowers.

Posted by

Tim Almond

at

14:47

7

comments

![]()

Labels: commonwealth games, events, sports

Sunday, 20 July 2014

The Power of Prejudice

Not long ago, Mark wrote a post on the myth that building more houses would bring down prices. However, this is a very persistent meme, one which I've come across twice in the first half of the latest copy of Moneyweek, and the contributors to Moneyweek usually have the right idea about matters to do with land. The second mention was in an abstract of an article by Robin Harding in the Financial Times, which, having started off by identifying the huge transfer of wealth from renters and recent buyers to existing homeowners and sellers, then goes on to attribute entirely to planning restrictions.

Now this may be the same effect as noticing that suddenly, a lot of other drivers seem to have just bought the same model of car as you. However, I think there is more to it than that. There is huge power in getting an idea into the public consciousness, embedded so that it becomes a prejudice, i.e. that it is pre-judged to be correct and no longer exposed to any logical criticism, just accepted as a truth. We can see this process with LVT and the drip, drip, drip of "killer arguments against" spotted and exposed for their utter illogicality in this blog to zero wider effect. The process both is propagated by and propagates the meme, like a sort of fast-breeder reactor. Unsurprisingly, given its effectiveness, this process has been widely used by politicians, pressure groups and vested interests, the demonisation of fat in our diets and the man-made global warming theory being a past and a present example.

Although it is likely that a lot of the commenters on matters to do with land taxes are actually shills for the banks and Big Land generally,there is actually no need for them to do this. The idea that LVT is a bad idea is such a foregone conclusion for many that all the comments could be from people who are who they say they are, just as it is unlikely that Robin Harding is simply trotting out the Homeownerist line, given the thrust of his article.

On the same page in Moneyweek, there is a piece from the Spectator suggesting that wave and tidal power is a waste of time and that the DECC would be better off pointing its subsidies towards solar and wind energy instead of wave and tidal power. This is not an idea I've come across before, but considering that subsidies to solar and wind power benefit landowners and subsidies to wave and tidal power don't, then could we be seeing the birth of another meme?

Posted by

Bayard

at

10:06

12

comments

![]()

Friday, 18 July 2014

Not Often I Agree With Trade Unions, But...

From the Telegraph

Union bosses are to be stopped from holding “rolling” strikes and will only be able to stage walkouts with the support of 50 per cent of the workforce, under Conservative plans.

The Tories will legislate to ban rolling mandates, with a law that a strike must take place within three months of any ballot.

There will also be a legal requirement for a 50 per cent turnout threshold for any strike ballot to be lawful, ministers said.

I don't much like trade unions. I think they're antiquated organisations that came about in a time of limited mobility and our greater mobility has rendered them generally pointless. But I think people have a right to strike and to withdraw their Labour if they're reasonable about it.

And I also think that part of that membership includes a certain degree of being part of things. That you're part of the democratic system, that like parliamentary elections, you'll get what you're given if you don't turn up. We don't nullify elections or parliametary votes because not enough people turned up. If you can't be bothered, you're going to be ignored.

I think most of the reforms of the 80s like laws against secondary picketing and flash strikes are reasonable in terms of balancing the rights of workers and users of their services. It's reasonable that parents have notice of a strike to make arrangements. But from both a position of rights and reducing union power, we should allow strikes to happen.

You see, I like it when public sector employees with power strike because they generally turn the public against them. The tube strikes are making the public much more open to the idea of driverless trains on the Underground network. Point out how often private school teachers go on strike to a parent who's had to take a day off, you've got someone who is more likely to think that voucher schemes are a good idea.

So, trying to stop strikes is not only morally wrong, it's also bad for winning the hearts and minds of the public to accept reform.

Posted by

Tim Almond

at

17:50

13

comments

![]()

Labels: Conservatives, Law, unions

Killer Arguments Against LVT, Not (329)

BenJamin spotted two for the price of one over at the TPA:

Britain already has the highest property taxes in the OECD (see chart), mostly in the form of council tax. Some claim a higher purpose to property taxes than merely soaking the supposed rich – that of putting a lid on property prices.

If that’s the hope, then it is equally misplaced, for such taxes plainly haven’t done much good so far.

That's a good old-fashioned lie.

UK commercial premises have just about the highest annual property taxes in the world (Business Rates) but Council Tax on housing is low by international standards.

If you deduct the £700 per home Poll Tax element, the amount of Council Tax which relates to the value of the home is negligible (about 0.3% of its value up to the first £1 million or so, nothing above that).

Which is why commercial land is cheaper than residential land, and why developers can make windfall gains by getting commercial rezoned as residential - they can get rid of three-quarters of the annual tax at a stroke. And which is why the bubble in commercial prices was much smaller and shorter lived than for residential.

As for so-called “granny” clauses, allowing the elderly to roll up their liability until death, this hardly solves the problem. The eventual fire sale of baby boomer homes would only further undermine house prices down the line.

He appears to assume that lower house prices is A Bad Thing, which is not true. And as Ben points out in the comments, the author of the piece himself says that the best way to get prices down is to build more; assuming this to be true (it isn't really), this would imply that he thinks lower prices are A Good Thing.

Either way, when houses are inherited, they are usually sold. So the number of such houses being sold depends on how many widows or widowers die each year, which is a fairly fixed figure, about three hundred thousand a year.

In the absence of a crystallised LVT bill, presumably slightly more of those houses would be kept and rented out by the heirs; but they would be rented to the people who would otherwise have bought them.

Posted by

Mark Wadsworth

at

11:02

5

comments

![]()

Labels: KLN, Taxpayers' Alliance

Thursday, 17 July 2014

On the road again

I'm doing a talk on LVT at a venue near Cardiff at 3.30 on Saturday afternoon:

If you'd like to attend, please send me an email (widget in the sidebar) and I will forward it to the organiser.

Posted by

Mark Wadsworth

at

21:43

6

comments

![]()

Labels: ALTER, Land Value Tax, Wales

More on "Human Rights"

The previous post about the EHCR reminded me of the recent fuss on the intertubes about the CEO of Nestle saying that human beings do not have a right to water. Predictably, he's been called all sorts of names, of which "sociopath" is probably one of the milder ones.

However, sadly, he's right. Humans don't have God-given rights, they only have the rights that an authority grants them. If you were in anarchist utopia and you started explaining to the man taking away your water supply that he was infringing your human rights, he would simply continue on his job, unless you were bigger and better armed than him. To have rights of any sort, you need some sort of authority to enforce them. That authority in turn will be powerless to either enforce or deny your rights if faced with a more powerful authority which has a different idea of the rights of its citizens.

So all talk of universal human rights will remain nonsense until there is a universal authority, which is unlikely to happen any time soon.

Posted by

Bayard

at

20:35

6

comments

![]()

Labels: Human rights, Water

The EU and the ECHR

From the BBC

BBC Political Editor Nick Robinson said Downing Street had rejected any suggestion that the purpose of Mr Cameron's reshuffle was "to clear the decks for an assault on the European Court of Human Rights and says no final decision has been taken on what will be in the Conservative manifesto".

Under the Conservative proposals, the UK Parliament will decide what constitutes a breach of human rights.

BBC political editor Nick Robinson said a report written by a working group of Conservative lawyers predicts the so-called British Bill of Rights could force changes in the way the Strasbourg court operates.

But it also acknowledges that it could lead to the UK being expelled from the 47-member Council of Europe, which aims to uphold human rights across the continent.

Mr Grieve had warned his colleagues that the idea was a plan for "a legal car crash with a built-in time delay", Nick Robinson said.

The former Attorney General argued that it was an "incoherent" policy to remain a signatory to the European Convention of Human Rights but to refuse to recognise the rulings of the court which enforces it.

Anyone who thinks the Strasbourg court is going to change for us is frankly talking out of their arse.

But more importantly, this ignores the reality that we won't just get expelled from the Council of Europe, but probably kicked out of the EU as the Commission has a very clear viewpoint of the ECHR and the EU.

And it looks like the reason Grieve got the boot is that he knew it was unworkable, grade A bullshit. If you tear up the ECHR, you have to leave the EU, and Cameron isn't going to want to do that, so who knows what the hell he thinks was going to happen. It's just stupid get-the-kippers-back policy making that can't be delivered.

Prime Minister on top form

From the BBC:

Having made an unfair diagonal comparison...

... the PM continued: "That is [Labour's] policy. The squeezed middle will be squeezed more. Now you need to tell us which people are going to pay which taxes because on this side of the House, we have cut council tax, we have cut petrol duty, we have cut the jobs tax, we have increased the married couples allowance."

OK.

They have not "cut" Council Tax, they have capped increases to +/- normal price inflation, and they only achieved this by increasing central grants to councils funded out of general taxation.

They have not "cut" petrol duty either, they have just increased it slightly less than originally planned.

They did not cut "the jobs tax" (National Insurance), they increased it by 2% (1% on Employer's, 1% on Employee's). There is a silly gimmick about knocking off the first £2,000 a year from the Employer's National Insurance. Whoopee do. The value of the allowance to small firms is about one-tenth as much as the overall extra tax from the extra 2%.

The married couples allowance has indeed been increased by £250, so the value of this is a maximum of £50 a year. But only married couples where the older partner was over 65 on 5 April 2000 can claim it.

Posted by

Mark Wadsworth

at

08:56

4

comments

![]()

Labels: David Cameron MP, liars, Taxation

Wednesday, 16 July 2014

Tee hee

From the BBC:

Labelling people as having pre-diabetes is "unhelpful and unnecessary", researchers claim. The definition, given to people on the "cusp" of type 2 diabetes, has no clinical worth, a joint UK-US team argues.

There is no proven benefit of prescribing drugs as many will not develop diabetes, the researchers write in the British Medical Journal.

But a charity said being identified as being at high risk was helpful. It offered the chance to reduce risk by eating a healthy diet and being physically active, said Diabetes UK.

People with pre-diabetes have no symptoms of ill health, but their blood sugar levels are at the high end of the normal range.

The term is not recognised by the World Health Organization but has been used in many scientific papers.

Posted by

Mark Wadsworth

at

11:50

3

comments

![]()

Labels: Commonsense, diabetes

Tuesday, 15 July 2014

The Business of Musicals (In Venn Diagrams)

From Time

Holler if Ya Hear Me, the Broadway musical inspired by the music and lyrics of the late rapper Tupac Shakur, will close July 20 following weeks of poor ticket sales and mixed reviews.

This can be explained with the following venn diagrams:-

Posted by

Tim Almond

at

14:30

5

comments

![]()

Worst A-Level Results Photos Ever

Posted by

Tim Almond

at

11:38

0

comments

![]()

Labels: totty, women's bishops

"London criminal gangs to hire former police officers"

From The Evening Standard:

London's crime gangs are set to hire more recruits from the ranks of former police officers in a new drive to bring in 5,000 extra members.

Organised crime is relaxing strict rules on recruitment to allow people to join who have worked as police officers or PCSOs in their past. The existing policy of restricting entry to those who have never worked for the police or only in civilian roles or as informants will be relaxed. A panel is conducting monthly reviews of new applicants who have been rejected because of frontline service.

Crime bosses say the current vetting policy for new recruits is “very restrictive” and they want to bring in a “more balanced and nuanced view.” In future, if ex-officers are considered to have become law breaking citizens they will be allowed to join.

The move comes as the gang bosses announced the first ever ban on new recruits who are not London born and bred. From next month only candidates from families who have lived in a London borough for three of the last four generations will be eligible to join. The new policy is aimed at increasing the number of white gang members to better reflect the ethnic mix of the capital.

Posted by

Mark Wadsworth

at

09:55

2

comments

![]()

Labels: crime, Policing, Political correctness

Monday, 14 July 2014

Fun Online Polls: Penalty shoot-out and budget/mid-priced hotel chains

Now that this football related tomfoolery has ground to its tedious and predictable outcome*, I can announce the results to last fortnights' Fun Online Poll:

Penalty shoot out

Kick it to your left: Keeper dives to his right and saves it! 8 votes

Kick it straight and hard, Psycho style: Goal! 47 votes

Kick it to your right: Goal! 14 votes

I hope nobody cheated, but well done either way.

Best (and only) comment:

Al Trewyst: Goooooooaaaaaaaaaaaallllllllllll !!!!!!!!!!!!!!!!!!!!!!!

* Out of seven teams which have appeared in a World Cup Final since 1970, five were in the quarter finals and four were in the semi-finals. Seven of those finals have featured at least one of this year's two finalists and this was the third final to have featured exactly the same two teams.

------------------------------------

An article in The Daily Mail today prompts this week's Fun Online Poll.

Budget/mid-priced hotel chains.

Vote here or use the widget in the side bar.

Film Review: How to Train Your Dragon 2

How to Train Your Dragon 2 is a really good sequel to the first film. I don't think it's as good as the first one. It's visually more impressive with even more dragons, even more detail, but I think the story isn't quite as strong. And novelty always counts for something. But if you want a good film to keep the kids happy, or just like that sort of films, I thoroughly recommend it.

(note: we saw it in 2D, but I think it might be worth the extra money for 3D for all the flying bits).

Posted by

Tim Almond

at

16:30

5

comments

![]()

Labels: movie reviews

Cow News

From The Evening Standard:

They have been an unusual landmark greeting motorists into west London for nearly four decades. The herd of fibreglass cows on top of the Dairy Crest factory has been described as Hounslow's answer to the "Angel of the North".

But the cattle have disappeared, upsetting local residents and commuters using the A316...

Father-of-four Joachim Jellinek is running a campaign for the cows to be returned to their rooftop. He was alerted to their disappearance by his two-year-old son Cosmo, who pointed at the roof earlier this month and said he was "sad" they had gone.

Mr Jellinek said: "I am determined that this landmark on an otherwise very unremarkable building and stretch of road will not be lost forever..."

A spokeswoman for Dairy Crest said the company feared that after years of exposure, rusting the fittings that secured them, the cows were at risk of falling onto the road.

She added: "We are going to have a close look at them and decide what to do. We understand that they are much loved and brighten up a rather boring bit of road."

Posted by

Mark Wadsworth

at

14:45

3

comments

![]()

Labels: Cows

How do they work that out?

From the BBC:

Untaxed foreign cars 'cost millions'

The RAC says the government is missing out on millions of pounds of revenue every year because there are thousands of untaxed foreign cars on British roads.

About 60,000 foreign vehicles are registered with the Driver and Vehicle Licensing Agency every year. However, the RAC said an estimated 15,000 others are not, which it said amounts to about £3m per year in uncollected tax.

No, uncollected tax is simply not a cost. That's like counting all the goals which I have never scored in a Cup Final as a cost. The notional cost to the UK government is equal and opposite to the tax saving for Johnny Foreigner.

While it's very naughty of these people not to register their vehicles like everybody else, Vehicle Excise Duty is less than a tenth as much as duty and VAT on petrol/diesel, so they are not making much of a saving overall, and the tax they pay on petrol more than covers their share of the cost of road maintenance etc.

This logic does not apply to lorries which fill up on the other side of the Channel and then use British roads without refilling here, although I'm not sure why they would, AFAIAA, fuel prices are pretty much the same in the UK, Belgium and France.

They keep burbling on about some sort of Brit Disc for foreign lorries (which seems like a sensible idea to me), but it never gets off the ground. Maybe the EU doesn't like it or something.

Posted by

Mark Wadsworth

at

13:20

4

comments

![]()

Sunday, 13 July 2014

Green myths: vertical farming

One thing that annoys me, usually by way of articles being shared on facebook, is tales of a Grand New Way of doing things*, called vertical farming. We can finally stop using land for growing stuff, and get it all from a building down the street, no food miles and all that. Before ranting on about this, The Guardian already kills it for me in this feature, probably without reflecting on it at all.

Wheat, maize and rice – these things that provide the bulk of our calories- will be very difficult to grow on a vertical farm because you need to accumulate a massive biomass for those crops - you might expect typically anything between 5 and 12 tonnes per hectare of grain from something like wheat, but to do that you have to accumulate upwards of 20 tonnes per hectare of dry weight of plant. So it's the weight of the plant. The crops that are likely to be grown are high-value nutritious crops – like tomatoes, lettuces, green crops.

The first point is; these are crops growing in greenhouses already, very tried and tested stuff. So why don´t we already stack these crops in storeys and move them into the city? Simple, it´s not worth it to use higher value land, and lots of lots of energy, to grow this stuff in a town centre, even a suburb, when you can grow it out in the sticks and drive it to market. The building of the structures, labour and energy usage, is expensive enough that it is often cheaper (and according to reports, expends less CO2 in the process, for those who are concerned about this), to ship/fly in tomatoes from North Africa instead of growing it in a greenhouse in a temperate country like the UK.

In fact, the primary input to producing these crops is sunlight, and common sense tells us that stacking crop production in storeys, requires the same energy to be retrieved from elsewhere. Hey, maybe we can replace the "saved" land with PV-panels as an educational demonstration of the law of diminishing returns.

The second point is; the savings in land area are minimal. According to these figures, the total amount of "croppable" land in the UK is 6,3 million hectares. Out of these, 163.000 hectares, or 2,6%, is used for horticultural crops. Big whoop. These crops are high value, nice to have, can yield a lot per area, but provides very little in the way of what we actually need in the Maslowian sense. When the G calls it "nutritious crops", this just plays into the idea that we´re somehow beyond needing proteins and calories to live another day, and that humans can subsist on vitamins, antioxidants and fibre.

*I´m not saying that Grand New Ways of doing things can´t happen, it certainly will, but people often mistake visions of "what would be cool" with what works. There is something that could considerably reduce the use of land, energy and other inputs (although not nutrients, as they would have to be fed into the process) from producing food, which is in vitro meats. But I don´t really see that stuff being produced in Islington either.

Posted by

Kj

at

22:52

10

comments

![]()

Benji's Law of Value

Following on from MW's piece below, I'd like to postulate two new laws. For which I expect to receive the Nobel Prize for Economics.

1) What is morally correct is economically efficient.

following on from this

2) The sum of all good State regulation raises aggregate land rents. The sum of all bad State regulation reduces them

By the "State" I mean all of us acting under agreed laws and social norms.

If 1 & 2 are true, there are many instances of policies espoused by economists and the main political parties that run contrary to this.

Posted by

benj

at

17:57

19

comments

![]()

Labels: Economics

Economic myths: Increases in housing supply push down prices

The simplistic view is that if we allowed more houses to be built, prices would come down.

One of the fatal flaws in this theory - apart from there being no real life evidence to back it up - is the assumption that demand is fixed. It is not. High prices in e.g. London could be solved by allowing more homes to be built - but only if there were a complete freeze on migration to the capital (whether from elsewhere in the UK or elsewhere in the world).

So supply - of housing or commercial premises - creates its own demand. There are three million households in London and three million homes. If they built another million homes, another million households would move to London. By and large prices would not change. With agglomeration benefits, they would actually go up slightly, but that is another topic.

The next fatal flaw is the theory assumes that land is uniform and freely interchangeable. For sure, if there was a sudden glut of coffee (and no protectionist intervention, such as price subsidies or deliberate destruction of the excess crop), coffee prices would go down. That is because coffee is freely traded around the world and is homogeneous. A coffee bean in the UK is the same as a coffee bean in New Zealand.

But each and every plot of land is unique and a mini-monopoly in its own right. So each has its own value which cannot be influenced by the owner.

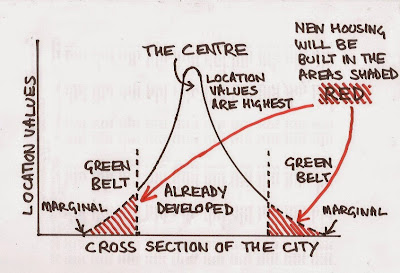

Let's draw a cross section of a typical city; land values are highest in the centre and then tail off towards the margin. In the absence of planning restrictions and the Hallowed Green Belt, builders would build all the way out to the margin where land values are virtually zero.