This one keeps rearing its ugly head:

"If we pay out a universal Citizen's Income at a flat rate to all adults, this will go straight into higher rents so landlords will be the only beneficiaries"

Clearly not true as it ignores the basic rent setting process (and it ignores the real world, in which UBI would be a straight swap for many existing welfare payments and tax reliefs, a few winners and losers, most households break even to within £10 or £20 a week).

(Clearly, a UBI, like nearly any type of government spending, good or bad, ist best funded out of LVT but that is a side issue.)

--------------------------------------------------------

1. The main driver of rents is the extra income you can earn for a similar amount of effort by moving to a higher wage area. If you do not understand or accept this, go to jail, do not pass Go, do not collect $200. This is easily observable in the real world, what it boils down to is that the net disposable income, after paying rent, is pretty much the same all over the country.

This must be true, or else what's stopping everybody from moving to higher wage areas? Answer: the equal and opposite force of higher rents!

2. In the lowest wage area, the location rent is always nil.* There are vast swathes of land/housing, even in developed countries where the location rent/site premium is £nil i.e. where you can buy a house or flat for less than it would cost to build, or where some homes/shops have been abandoned. This is easily observable in real life.

That is our fixed point, call it Town A, where average wages are £10,000 (or those in work earn £15,000 but one-third of adults are unemployed, for example).

People in Town B have average wages £11,000 (could be higher wages or lower unemployment/more jobs, doesn't matter).

People in Town A would like to earn that extra £1,000, so they are willing to move to Town B, provided the extra rent is no more than £1,000.

People in Town B would like to save rent by moving to Town A, but they know that wages are £1,000 lower, so they expect rents to be at least £1,000 lower in Town A (and at least £1,000 higher in Town B).

So the equilibrium point is where the rent in Town B is £1,000 more than in Town A, the same as the difference in average wages between the two.

This applies to all areas up to Town Z, with the highest average wages in the whole country.

---------------------------------------------------------

OK, so let's imagine the government pays the UBI out of thin air, like some new royalty income (oil, 3G 4G 5G licences etc), so requires no change to taxation which would confuse the discussion.

Town A is still the least desirable area, so location rent is still nil. That is a fixed point.

Average wages (even including UBI) and rents in Town B are still £1,000 higher than in Town A, i.e. unaffected.

The incentive to move from Town A to Town B (higher wages) and to move from Town B to Town A (lower rents) are unchanged and still in the same equilibrium as before.

This applies all the way up the chain to Town Z, the highest wage area in the whole country.

--------------------------------------------------------

* Imagine an outdoor concert with so many rows of seats that there are more seats available than the number of people with even the slightest interest in seeing the show.

The front row seats will go for £100, the second row for £95, the price/value will drop slightly for each row further back, and so on until the seats are so far back that people aren't willing to pay anything for them (not even the price of the bus ticket to the venue) and the promoter can't even give them away.

The marginal location is the last row where people want to sit, even for free. Their location value is £nil. Any further in, and you'd have to pay at least £1. Any further out and there are no takers at all, as the last few people with an interest in the show have already taken a free seat in the back row.

Thursday, 30 May 2019

Killer Arguments Against Citizen's Income, Not (21)

Posted by

Mark Wadsworth

at

12:23

14

comments

![]()

Wednesday, 29 May 2019

Tax haven bleating

From The Mirror:

Big companies are avoiding an estimated £100billion a year in tax thanks to Britain’s “spider’s web” of offshore tax havens.

A damning report says the UK and its network of overseas territories is “by far the world’s greatest enabler of corporate tax avoidance”. Four of the top 10 places branded tax havens by campaign group Tax Justice Network have strong UK links...

The TJN previously estimated that multinationals avoid around £400 billion a year in corporation tax. While it did not put a figure on how much of it was due to UK tax havens, it may be over £100billion annually.

There are growing calls to clamp down on firms that, through clever accounting, deprive countries of tax.

There are two sides to this - the tax havens, and the countries out of which profits are siphoned. Any country out of which profits are siphoned only has itself to blame and is complicit in the whole scam.

A non-tax haven merely has to tweak its tax rules to ensure that a company cannot claim a tax deduction for money paid to a company in a tax haven, in other words, treat such payments as dividend payments, which are paid out of after tax income.

With the really big corporations, the sensible thing to do is to find out (or estimate) their global profits, find out (or estimate) what share of those profits are derived from customers in your own country and then charge them to tax on that element of their global profits derived from your own country.

This is standard practice in countries which have different rates of corporation tax in different regions/states, for example Germany, Switzerland, USA etc. It's not reinventing the wheel.

The EU has a cruder - but equally effective - way of taxing the big corporations, especially American ones. The EU knows perfectly well that they will wriggle out of any tightly defined rules, so it just "fines" them a few hundred million Euros on some trumped-up offence every few years (market rigging, anti-competitive practices, banking fraud, tax evasion, whatever), the big corporations haggle a bit and then pay half or two-thirds of the original sum demanded, it's just a 'market access fee', like an ice cream seller paying for a pitch.

And while £400 billion is clearly a lot of money, it's probably an over-estimate, so let's call it £200 billion. What share of that ought really to have been paid in the UK? Ballpark, the UK is 5% of the global economy, so maybe our tax receipts are down by £10 billion a year, which is barely one per cent of the UK's annual government budget. So nice to have, but not fatal.

Posted by

Mark Wadsworth

at

16:19

7

comments

![]()

Labels: tax evasion, Twats

Oh the irony...

Emailed in by Lola, a video on how Amazon is buying up vacant shopping centres, the ones that went out of business partly because of online shopping ( or 'glorified mail order' as I call it, to put it in context), and using them as warehouses/distribution centres, and presumably collection centres for people in a hurry.

-----------

Also emailed in by Lola, from The Telegraph:

The perilous state of Sir Philip Green’s retail empire has been laid bare in a 312-page tome sent to landlords as the former “king of the high street” pleads with them to help save Arcadia from going bust.

The document reveals that Arcadia’s earnings have crashed from £215m to just £30m in the last five years – a fraction of the £100m of extra costs, including pension contributions and debt interest, it is on the hook for...

Landlords' response: “We are not minded to support Philip Green because he took a perfectly good business and extracted money rather than investing.”

Pots, kettles.

-----------

From the BBC, this morning:

Meanwhile another leadership hopeful, Home Secretary Sajid Javid, has vowed to recruit 20,000 new police officers.

Writing in the Sun, Mr Javid says: "More police on the beat means less crime on our streets. Not exactly rocket science is it?"

BBC Reality Check says, under the Conservative and coalition governments, the number of police offices has fallen by somewhere between 19,000 and 22,000.

I'm not sure why the BBC even bothered to link to the source of the figures for the reduction, this is more or less common knowledge.

Posted by

Mark Wadsworth

at

12:51

2

comments

![]()

Labels: amazon, Hypocrisy, Irony, landlords, Policing, Retail, sajid javid

Tuesday, 28 May 2019

The European Election results - you can spin them any way you like...

From the BBC:

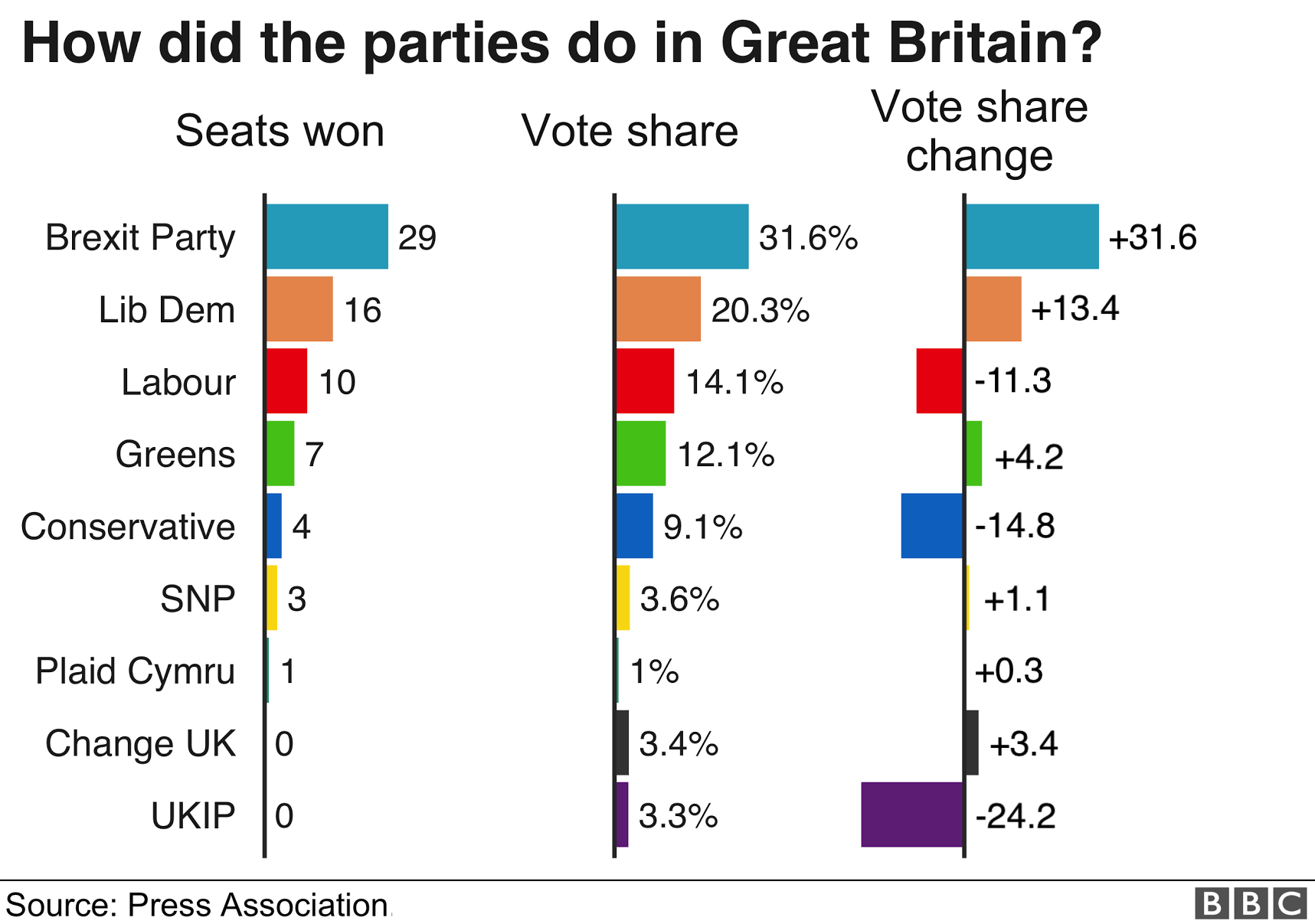

Leavers: Brexit Party got far and away the most votes and seats, so we won.

Remainers: Ah, but if you add the votes of the hard remain parties (Lib Dems, Greens, SNP, Plaid Cymru and Change UK), we won.

[Let's skip the debate about whether votes for the Conservatives or Labour are proxy votes for Leave and Remain respectively, Lord Ashcroft's polls say that the number one reason that people voted for those parties was 'Because I always do.'

Leavers: Ah, but lots of people would have voted Lib Dem, Green etc anyway, regardless of their EU policies.

Remainers: So let's look at the swing. Total Hard Leave (Brexit Party/UKIP) only up 7.4% compared to the 2014 elections, and the total vote share of Hard Remain parties (list as above) up by 22.4%. The net shift from Conservative/Labour to Hard Leave was 7.4% and from those two to Hard Remain was 22.4%. [Yes, those shifts add up to 29.8% and BBC give combined losses for Lab/Con as 26.1%, not sure where the other 3.7% came from]. That's a significant swing to Hard Remain.

Leavers: Hang on, weren't you moaning after the Referendum that with a 52%/48% result on a 72% turnout, strictly speaking only 37% voted to Leave and 63% didn't. This this time Hard Remain got 40% on a laughably low turnout of 37%, that means only 15% voted to Remain, which is a lot less than 37%.

Remainers: So why are you lauding Brexit Party's votes; they got 32% of 37%, that's only 14$%, hardly a mandate for a No Deal Brexit. Of 17.4 million people who voted Leave back in 2016, only 5.2 million voted Brexit Party, clearly 12 million of them have lost interest.

[And so on, ad infinitum].

Posted by

Mark Wadsworth

at

22:17

9

comments

![]()

Friday, 24 May 2019

I was surprised to see this in The Telegraph

I just stumbled across this, from three years ago:

Business rates are the closest thing we have in the UK to a land value tax (LVT). They're favoured by economists for their property of being "non-distortionary". They don't mess around with incentives, unlike many other forms of taxation.

A higher income tax may be a deterrent to earning more money in the UK, as are corporation tax hikes, but the supply of land is fairly fixed - people aren't going to change their production of it in response to higher taxes...

Business rates have existed for a lot longer than we’ve had evidence in support of them. They were first introduced in their current form in 1990. Their heritage can be traced back further, to the Poor Law of 1572, and later the Poor Law of 1601. They’ve had more than a few facelifts since.

Are they popular? Other than with economists? Not really. Business rates have become the business lobby’s bogeyman. The British Retail Consortium (BRC) is particularly opposed.

“Business rates bills have continued to rise when property values have fallen,” Sir Charlie Mayfield, the BRC’s president has said. “Reforming the rates system would be a welcome boost for retailers and help drive investment in training and technology.”

The opposition from businesses on the grounds of their cost is rather strange, because it's not occupiers that end up taking the financial hit. Rather, it's land owners. This is the so called "incidence" of a tax, who ends up shouldering it.

If business rates rise or fall by a small amount businesses aren't likely to face different costs, just correspondingly higher or lower rents over time. So there would be no more money for investment [as a result of reductions in Business Rates] after all.

It's the landlords who lose out as a result of business rates. Over a period of two to three years, three quarters of the change in business rates is capitalised into rents, according to a report from Regeneris, the consultancy. This has been backed up by work from the London School of Economics which examined properties in London, and a more recent paper using data from enterprise zones, which also came to the conclusion that it is landlords who end up taking the hit.

Posted by

Mark Wadsworth

at

15:22

2

comments

![]()

Labels: Business Rates, daily telegraph, Land Value Tax

Wednesday, 22 May 2019

Surely a ten-year old can see that this is complete and utter nonsense?

From one of my favourite Warmenist Porn sites:

Climate Myth:

Water vapour is the most important greenhouse gas. This is part of the difficulty with the public and the media in understanding that 95% of greenhouse gases are water vapour.

The public understand it, in that if you get a fall evening or spring evening and the sky is clear the heat will escape and the temperature will drop and you get frost.

If there is a cloud cover, the heat is trapped by water vapour as a greenhouse gas and the temperature stays quite warm. If you go to In Salah in southern Algeria, they recorded at one point a daytime or noon high of 52 degrees Celsius – by midnight that night it was -3.6 degree Celsius.

That was caused because there is no, or very little, water vapour in the atmosphere and it is a demonstration of water vapour as the most important greenhouse gas. (Tim Ball)

Basic rebuttal written by James Frank:

When skeptics use this argument, they are trying to imply that an increase in CO2 isn't a major problem. If CO2 isn't as powerful as water vapor, which there's already a lot of, adding a little more CO2 couldn't be that bad, right?

What this argument misses is the fact that water vapor creates what scientists call a 'positive feedback loop' in the atmosphere — making any temperature changes larger than they would be otherwise.

How does this work? The amount of water vapor in the atmosphere exists in direct relation to the temperature. If you increase the temperature, more water evaporates and becomes vapor, and vice versa.

So when something else causes a temperature increase (such as extra CO2 from fossil fuels), more water evaporates. Then, since water vapor is a greenhouse gas, this additional water vapor causes the temperature to go up even further—a positive feedback.

How much does water vapor amplify CO2 warming? Studies show that water vapor feedback roughly doubles the amount of warming caused by CO2. So if there is a 1°C change caused by CO2, the water vapor will cause the temperature to go up another 1°C. When other feedback loops are included, the total warming from a potential 1°C change caused by CO2 is, in reality, as much as 3°C.

Has he not heard of the concept of an equilibrium?

There are two ways of interpreting the rebuttal:

1. There is no equilibrium. So a CO2 induced increase of 1C leads to an overall 3C increase. Which in turn would lead to another 9C increase. Which would lead to a further 27C increase. And then we'd all be boiled alive. Clearly not true.

2. There is an equilibrium, and 3C warmer is the 'new normal'. OK. But the Warmenists insist, with calculations, that the entire 1C increase since the Little Ice Age is down to increases in CO2, with water playing little or no role.

In which case, why isn't it already 3C warmer? That's clearly not true.

If they insisted that of the 1C increase, 0.3C was due directly to CO2 (this is in fact just about plausible) and the rest was due to water vapour "and other feedback loops" (as yet unspecified), well fine, but none of them has ever said that.

--------------

Finally, he does not give a starting point for the CO2 level at which such positive water/CO2 feedback kicks in.

Let's change his wording slightly: "So when something else causes a temperature increase (such as extra CO2 from fossil fuels bright sunlight or atmospheric pressure), more water evaporates. Then, since water vapor is a greenhouse gas, this additional water vapor causes the temperature to go up even further—a positive feedback."

That's clearly nonsense.

Should we assume that up to 'pre-industrial levels' of 280 ppm of CO2, there is no positive feedback, and it starts at 281 ppm? Or current levels of 420 ppm (and rising)? Or does the positive feedback start at 1 ppm?

Posted by

Mark Wadsworth

at

16:28

5

comments

![]()

Classic bit of BBC spitefulness

In their article headed European elections 2019: Where the parties stand on Brexit, the BBC lists parties alphabetically, so first is Change UK, then Conservatives, then Green Party and so on.

"But wait!" shouts the crowd, "Haven't they forgotten The Brexit Party?"

Nope, they are listed second to last, as their name officially begins with the letter "T".

A classic beginner's mistake by whoever registered The Brexit Party with El Comm. Sort of serves them right.

------------------------------------------------------

Funny story: UKIP's official name used to be "UK Independence Party UK I P" with spaces between "UK" and "I" and "P", to get within El Comm's six-word limit. That was my fine work (he said proudly). El Comm didn't follow their own stupid rules and used to write to us without the spaces, which I took great glee in correcting each time. Twats.

Posted by

Mark Wadsworth

at

14:03

0

comments

![]()

Tuesday, 21 May 2019

I am now a Climate Science Believer!

I haven't been posting much over the last few days because I was busy reading lots of articles about Climate Science and watching YouTube videos, most were from Warmenists and a few from Deniers, for balance. No links, for the time being as I have dozens.

The Warmenist articles/videos look to be about 90% correct, but they all contain a couple of logical/mathematical errors, inherent contradictions or over-simplifications, not to mention that they contradict each other. Most of the Denier articles and videos have similar inconsistencies.

What their explanation boils down to, having stripped away the errors and taking the rest at face value, is this:

1. The two main Greenhouse Gases are:

a) water vapour (not to be confused with condensed water droplets, which cool the atmosphere) at an average of 20,000 parts per million (within a wide range between zero and 40,000, that's the assumed average).

b) Carbon dioxide at an average of 420 ppm, up from 280 ppm in pre-industrial era.

Molecule-for-molecule, these have a very similar effect (AFAIAA). Water is self-regulating, as once it hits saturation point, it condenses and falls as rain or snow, removing itself from the atmosphere and cooling things down.

Carbon dioxide is not self-regulating, rain washes some of it out of the atmosphere, but it then most of it re-evaporates and only some goes into the oceans (which is where limestone cliffs come from) or into plants (which eventually die and rot again).

(The Warmenists shift the goal posts here a bit. Up to current CO2 levels, they accept that H20 is self-regulating and can be ignored (most of them do), but magically, if C02 increases, then H20 and C02 will interact and temperature increases due to the H20 element will somehow become self-reinforcing. This seems highly unlikely to me.)

2. The entire additional 33C average temperature of the earth's surface compared to what you'd expect from sunlight alone is down to greenhouses gases.

Apparently nitrogen and oxygen would have no such effect, we'd still get the steady fall in temperature with decreasing pressure/increasing altitude. This is the 'adiabatic lapse rate'. This gradient is much the same for all planets in the solar system, regardless of what kind of gas makes up their atmosphere.

3. If you increase greenhouse gas concentrations from average 20,280 ppm (average H20 plus pre-industrial C02) to 20,420 ppm (average H20 plus current CO2), that's a 0.7% increase in Watts being reflected back to each square metre of the earth's surface. Existing greenhouse effect is 33C, increase that by 0.7% = 33.23 = an extra 0.2C* compared to what it would be at 280 ppm C02, everything else being equal.

* The increase in surface temperature relative to increases in Watts/m2 is logarithmic not linear = 0.1C, so let's round that 0.23C down to 0.2C for sake of argument.

4. It appears to be accepted by both sides that global average temperatures go in lots of overlapping and fairly regular cycles. The most relevant one as at today is a roughly thousand-year cycle i.e. Roman Warm Period, Mediaeval Warm Period and Modern Warm Period.

That explains the rest of any increase since a randomly chosen starting point. Let's not bicker about what a sensible starting point is.

Looking at the increase since the pre-industrial era means you are looking at the increase since the Little Ice Age, however defined, when temperatures were 1 or 2C lower than the very long run average, so of course we're 1C warmer than then.

Posted by

Mark Wadsworth

at

12:24

5

comments

![]()

Labels: climate change, Science

Monday, 20 May 2019

Cargo Cult Improvement

From The Guardian

The article goes into all the normal Guardian favourites like independent shops and god help me, f**king trams. These people think that gentrification is all about putting the independent shops there and that makes everyone richer and they spend money. In reality this is a by-product. You get the fancy, overpriced shops when you get the richer people.

Posted by

Tim Almond

at

22:27

1 comments

![]()

Labels: France, gentrification, Trains

Friday, 17 May 2019

Voices in my head

TV advert: "Adopt a snow leopard to save the species from extinction."

Voice: "What's the point? It's going to know straight away I'm not it's real Dad."

Posted by

Mark Wadsworth

at

15:41

5

comments

![]()

Labels: Humour

Little Ice Age never happened - shock.

From here:

Global mean warming [has] reached 1°C above preindustrial for the first time.

It is a signal from the climate system that time is running out if we are to be able to reduce emissions fast enough so as to hold warming below 2°C, and ultimately below 1.5°C by 2100.

This is illustrated with the following chart:

----------------------

According to that chart, the Mediaeval Warm Period was barely a blip, and the Little Ice Age was only 0.3C cooler than the MWP.

That's is not how everybody else remembers it, is it?

From here:

Little Ice Age's Worldwide Effects

Ice cores, cores of lake sediment and coral, and annual growth rings in trees showed that Greenland, Scandinavia, the British Isles, Europe, and North America all experienced cold, with temperatures dropping 1 to 2 °C (1.8 to 3.6 °F) below the average for 1000 to 2000 CE.

During the LIA, mountain glaciers expanded in the European Alps, New Zealand, Alaska, and the southern Andes. In Switzerland and France, the advance of alpine glaciers wiped out farms and villages. Cold winters and cool, wet summers caused crops to fail, and this leads to famines in much of northern and central Europe.

To the west, sea ice expanded around Iceland, cutting off its harbors and access to imported food. Iceland's population fell by half. Icelandic sea ice went from zero average coverage before the year 1200, to eight weeks during the 13th century, and to 40 weeks during the 19th century.

Follow up question, do the Warmenists have an explanation for why it was so warm between six and ten thousand years ago? No, thought not.

Posted by

Mark Wadsworth

at

08:05

6

comments

![]()

Labels: Global cooling

Thursday, 16 May 2019

Fun with numbers - splitting the Remain vote at the MEP elections

The MEP elections in Great Britain, to be next held on 23 May 2019, use the d'Hondt system for allocating seats in each of eleven constituencies/regions.

Whether the Remain parties (Lib Dem, Green and Change UK) have shot themselves in the foot (feet?) by competing over the same small pool of voters is an interesting question.

Let's treat this as an unofficial In-Out Referendum and assume votes cast are in line with current opinion polls and are the same in each constituency, as follows:

Leave

Brexit Party - 31%

UKIP - 4%

Remain

Lib Dem - 10%

Green Party - 10%

Change UK - 10%

Undecided - neutral - ambivalent

Labour - 22%

Tories - 13%

The more seats there are in a constituency, the closer the result is to proportional representation; the fewer seats, the closer the results are to FPTP.

If you crunch the numbers (or use Paul Lockett's fine calculator) for the largest constituency with ten seats (South East), the end result is the same whether the Remain parties had put up a single list or not - Leave 4 seats, Remain 3 seats and Undecided 3 seats.

The difference is that with a single list and 30% of the vote, Remain would win seats 2, 5 and 9; with three competing Remain parties, they will win seats 7, 8 and 9. So they will do relatively worse in smaller constituencies and relatively worse overall.

The reverse is true for Leave, only not as markedly. If Remain had put up a single list, Leave would win seats 1, 4, 8 and 10 of a ten-seat constituency. With the Remain vote split, they will win seats 1, 3, 5 and 10.

-----------------------------------------------

To sum up, for various sizes of constituency with a split Remain vote, seats will be as follows:

3 seats = Leave 2, Undecided 1

4 seats = leave 2, Undecided 2

5 seats = Leave 3, Undecided 2

6 seats = Leave 3, Undecided 3

7 seats = Leave 3, Undecided 3, Remain 1

8 seats = Leave 3, Undecided 3, Remain 2

9 sweats = Leave 3, Undecided 3, Remain 3

10 seats = Leave 4, Undecided 3, Remain 3

As only five constituencies have seven or more seats, Remain have definitely messed up badly. With a single list Remain vote, seats would be as follows:

3 seats = Leave 1, Undecided 1, Remain 1

4 seats = leave 2, Undecided 1, Remain 1

5 seats = Leave 2, Undecided 1, Remain 2

6 seats = Leave 2, Undecided 2, Remain 2

7 seats = Leave 2, Undecided 3, Remain 2

8 seats = Leave 3, Undecided 3, Remain 2

9 sweats = Leave 3, Undecided 3, Remain 3

10 seats = Leave 4, Undecided 3, Remain 3

Just sayin'...

Posted by

Mark Wadsworth

at

15:12

6

comments

![]()

Labels: d'Hondt, Elections, EU, Maths, Proportional representation

Wednesday, 15 May 2019

City AM lets another one slip into its pages...

From City AM Debate:

Is the Tesco boss right to call for slashed business rates and an online tax to save the high street?

Robert Palmer, executive director of Tax Justice UK, says YES [actually he says 'no', but hey]

Since it’s likely that an online sales tax would be passed onto shoppers, what we really need is a proper shake-up of how we tax multinationals to make them pay their fair share, including by making it much harder to stash corporate profits offshore.

Business rates are also a mess. Because the current system is based on rental values, if a landlord improves a property, the value goes up and so does the tax.

The government should replace the current system with a tax based on the underlying value of the land the property sits on.

Sam Dumitriu, research director at The Entrepreneurs Network, says NO:

Online sellers shouldn’t be punished for responding to changing consumer demand by offering goods at a lower price in a more convenient manner. E-commerce platforms such as Amazon have lowered barriers to entry and enabled small and micro-businesses to cater to every obscure taste out there.

Worst of all, the reforms will do little to help struggling bricks and mortar retailers.

The evidence suggests that commercial landlords respond to cuts [in Business Rates] by raising rents, leaving shopkeepers no better off. The only retailers that will benefit are those which own large property portfolios like, er, Tesco.

Posted by

Mark Wadsworth

at

09:35

9

comments

![]()

Labels: Business Rates, Land Value Tax, Retail

Monday, 13 May 2019

DIY door knob gripe

I learned something new at the weekend, there's a good summary here:

Sprung v Unsprung Door Handles [for 'handles' read 'knobs']

Springs are required to get door handles to return to the horizontal after they have been pushed down. The spring can be located in the handles and or in the latch/lock. Most early handles were unsprung and most modern handles have springing.

You can tell if handles are sprung because they will return to the horizontal without being connected to the latch/lock. If you select unsprung handles then you need to make sure your lock/latch has a heavy duty spring, as this spring has to do all the work.

I had to replace three latches over the weekend which were either too stiff or too wobbly. Easy job, you might think, the old latches were standard size, buy three new ones and pop them in, refix the door knobs, sorted.

The first latch I replaced had old-style door knobs with no spring/return mechanism of their own (the latches have their own spring/return mechanism, so completely unnecessary). That was a ten minute job, line up the grub screws with a hole on the spindle, the new latch clicks into the existing strike plate nicely, job done.

Two of the three pairs of door knobs had their own spring/return mechanism, which were a bloody nightmare. It is nigh impossible to line up both knobs so their spring/return mechanism co-operates with the one in the latch, i.e. still very stiff to turn and you have to turn the knobs back again to get the latch to pop out.

Her Indoors complained that she still couldn't open the bedroom door without using both hands. She had a crack herself and after two or three hours she threw in the towel.

So I bought an unsprung pair from B&Q (the last one in stock), which works a treat and only needs the lightest touch to open and it clicks shut perfectly - provided you don't over-tighten the screws holding them in place (another twenty minutes of trial and error). If you over-tighten them, the mechanism jams or is it 'jambs' in this context?)

Which maniac decided to put springs in door handles/knobs? They are more expensive to make, a bugger to fit and don't work properly. What is the bloody point?

Posted by

Mark Wadsworth

at

14:36

8

comments

![]()

Saturday, 11 May 2019

Before/after of the day

Although I prefer to keep things original*, my final repair/improvement job on the MX-5 Mk2 (which will now run problem-free for the next ten or twenty years, Scouts' honour) was replacing the original arm rest/console, which had a rubbish floppy hinge and no cup holder with one from the later MX-5 version Mk2.5, which has a proper solid hinge, a slightly deeper cubby hole and two cup holders. The rear one is even specially shaped so that it will take a mug with a handle:

* The original one is going in the shed 'in case I ever need it'.

Posted by

Mark Wadsworth

at

12:28

4

comments

![]()

Labels: Cars

I'm not "eating crisps"...

... I'm "staying carbohydrated".

Posted by

Mark Wadsworth

at

08:32

0

comments

![]()

Friday, 10 May 2019

How office twats 'stay hydrated'

Prompted by this fine Daily Mash article...

Where I work, a lot of people carry round those poncey re-fillable water bottles. Twattishness of the highest order, but it's still an improvement on people buying disposable bottles all the time.

Somebody in our office didn't get that memo though. Instead of filling his bottle at one the water coolers which our employer so generously provides, he took a fresh plastic bottle from the fridge, decanted the contents into his refillable bottle, crumpled up the plastic bottle and threw it in the bin.

Posted by

Mark Wadsworth

at

15:50

1 comments

![]()

Thursday, 9 May 2019

Voices in my head

Boss: You forgot to submit the tax return on time and the client has received a £100 late filing penalty!

Me: Hmm... a coincidence? I think not.

Posted by

Mark Wadsworth

at

11:16

1 comments

![]()

Labels: Humour

Daily Mail on top form

From The Daily Mail:

The BBC confirmed [Danny Baker's] tweet, and said in a statement: 'This was a serious error of judgment and goes against the values we as a station aim to embody. Danny's a brilliant broadcaster but will no longer be presenting a weekly show with us.'

Earlier, standing on the doorstep of his £2 million house in a dressing gown, Baker denied he was racist, saying he was 'shocked at my own foolishness.'

Posted by

Mark Wadsworth

at

11:13

0

comments

![]()

Labels: BBC, Daily Mail, House prices, Political correctness

Death of the High Street

Working on a daughter's mountain bike over last weekend. It was daughter A's bike that she had given to daughter B. Needed general clean and oil and the brakes did not work. Worn out brake blocks. Diagnosed at about 16.00 hrs.

To get into the local town to buy new ones and get home, round trip time probably 45 minutes minimum, and it was Sunday so limited choice of shops and the proper bike shop was over the other side of town, maybe an hour plus of driving.

Onto the web. Searched bike brake blocks. Did a bit of reading buyer comments. Ordered a set of new ones (from Amazon as it happens - Amazon fulfilled but sold by a specialist bike part retailer). Delivery said to be next day.

Went off and got on with other things like cutting grass.

Checked emails at about 17.00 - parts had been dispatched.

Next day - parts arrived at about lunch time. And fitted by 14.00.

Why on earth would I want to struggle through traffic and waste about an hour of my life driving to buy them myself from the High Street?

And it must be more 'green' to have them delivered like this as the van had lots of deliveries to make, rather than me making one run.

The High Street is doomed. Or maybe High Street landlords are doomed?

Posted by

Lola

at

11:00

4

comments

![]()

Wednesday, 8 May 2019

What is happening to our once great nation?

From Sky News:

People in the UK are drinking less alcohol, despite an increase in worldwide consumption.

Using World Health Organisation data researchers found UK consumption fell from 12.6 litres of pure alcohol a year per adult in 1990 to 11.4 litres in 2017.

The study, published in the Lancet, predicted the downward trend would continue, falling to 11 litres by 2030.

From the BBC:

British people are having less sex now than in recent years, according to a large national survey.

The findings, published in the British Medical Journal, suggest nearly a third of men and women have not had sex in the past month. That's up from around a quarter in 2001, according to the data from 34,000 people.

Less than half of men and women aged 16 to 44 have sex at least once a week, responses show. Over-25s and couples who are married or living together account for the biggest falls in sexual activity across the 21-year period.

From the ONS:

Main points

* There were 696,271 live births in England and Wales in 2016, a decrease of 0.2% from 2015.

* In 2016, the total fertility rate (TFR) decreased to 1.81 children per woman, from 1.82 in 2015.

* The average age of mothers in 2016 increased to 30.4 years, compared with 30.3 years in 2015.

* Women aged 40 and over had a higher fertility rate than women aged under 20 for the second time since 1947.

* Over a quarter (28.2%) of live births in 2016 were to mothers born outside the UK, the highest level on record.

(My mother was born abroad, as was my wife, and we have two children, so that last figure does not particularly bother me, here for the record only)

From The Guardian:

Nearly a million more young adults are living with their parents than was the case two decades ago, a study has found.

The figures, in a report by the right-leaning thinktank Civitas, will fuel concerns that too little is being done to protect young people from Britain’s housing crisis.

The proportion of people aged 20 to 34 who live with their parents has risen from 19.48% in 1997, equating to 2.4 million people, to 25.91% in 2017, equating to 3.4 million.

From Public Health England:

The adult smoking rate in England is continuing to decline year on year and is now at a record low. In 2017, 14.9% of people in England aged 18 years and above smoked, accounting for 6.1 million people.

If this trend continues it will reduce to between 8.5% and 11.7% by 2023. PHE is calling for the NHS long-term plan to commit to achieving a smokefree society by 2030 with an adult prevalence of 5% or less.

I'm sure that shifting taxes from production/consumption in the real economy to taxes on land values will help reverse these worrying trends, quite by how much remains to be seen...

Posted by

Mark Wadsworth

at

11:32

10

comments

![]()

Labels: Alcohol, Children, Housing, Sex, Smoking, statistics

I was pleasantly surprised to see this in City AM...

... especially as most of the article is the usual Home-Owner-Ist drivel.

From City AM, the concluding paragraph is:

If politicians want to smooth out this distorted [housing] market, they should make moving house as easy as possible for everyone.

Scrapping stamp duty completely and making up the difference elsewhere – whether with more progressive council tax bands or a new land tax – is the only way to get the market moving again, regardless of Brexit.

Posted by

Mark Wadsworth

at

09:25

2

comments

![]()

Labels: City AM, Land Value Tax

Tuesday, 7 May 2019

More Dark Matter fun...

From Medium.com:

Dark matter has become an object for scientists that is as fascinating as it is mysterious, and whilst many cosmologists and astrophysicists firmly accept its existence there are still groups of scientists that believe that effects attributed to dark matter could be explained by modified theories of gravity.

Jolly good, stick me in the Dark Matter Sceptic Denier corner.

The only evidence for Dark Matter is that some people have tried and failed to work out the correlation between the speed at which galaxies rotate and the amount of observable mass in them, so they invented some extra mass to explain the calculation errors.

The Dark-Matter-Ists then filled their boots with $billions of funding for experiments to try and find out what Dark Matter is.

Fact is, All disk galaxies rotate once every billion years, and I'm surprised it took them until last year to work this out.

Nobody has any idea why - least of all me - but, here's a theory... maybe they just do. If a cloud of black holes, stars, dust etc didn't rotate at that speed, it wouldn't be a galaxy - it would collapse into the central black hole(s) or it would drift apart again.

In other words, there is no correlation between the rotation speed and the size, so there's no need to invent Dark Matter.

Posted by

Mark Wadsworth

at

22:27

3

comments

![]()

Labels: dark matter, Physics

Monday, 6 May 2019

Killer Arguments Against LVT, Not (457)

The Taxpayers' Alliance tweeted this Bastiat quote:

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorises it and a moral code that glorifies it” - Frédéric Bastiat

And added the hashtags #MondayMotivation and #LowerTaxes.

To which I replied: He was referring to landlords and bankers, actually, and many others piled in on similar lines.

Bastiat was a Physiocrat, which is what Georgists used to call themselves before Henry George came along, so he was against Socialism (the milder, pre-Marxist kind) as much as against corporatism, seeing them as two sides of the same coin. For some reason, the right-wingers co-opted the Physiocrats while reviling Georgists. Here's another example, from Wiki Quotes:

It is a rather singular argument to maintain that, because an abuse which has been permitted a temporary existence, cannot be corrected without wounding the interests of those who have profited by it, it ought, therefore, to claim perpetual duration.

Which is Benj's standard reply to the KLN: "But I paid for my home out of taxed income!"

Posted by

Mark Wadsworth

at

19:54

0

comments

![]()

Labels: KLN

Saturday, 4 May 2019

Excellent analogy about "money"

By Tim Youmans on Twitter:

Many years in the future... Earth is now uninhabitable because [reasons]... out of necessity, the people left figured out how to travel light speed, and are heading to a planet orbiting the star Tau Ceti to start over..

(Years into their journey)

Joe: Wait!!! We have to go back!

Kim: Ha! Good one. There is no going back, we only had enough fuel for one trip.

Joe: But we HAVE to!

Kim: What could be so important?

Joe: (mumbling) I forgot the money.

Kim: Huh?

Joe: I forgot the money! OK?

Kim: YOU FORGOT THE MONEY?!

Joe: Yes. I'm sorry..

Kim: You're SORRY? We're heading to a new planet to save our species, and you leave... wait, how much?

Joe: 100 trillion dollars..

Kim: You leave 100 TRILLION DOLLARS(!!) on our old planet with no way for us to get it?!

Joe: Yeah, pretty much.

Kim: I mean... we should just hit the self destruct button! What are we going to do? We get to our new planet full of resources and everything we need to thrive, but HOW ARE WE GOING TO PAY FOR IT?!! My goodness, Joe! You just killed the human species!!

The author concludes that these people would be saved if they understood Modern Monetary Theory, which is besides the point. MMT is just a (very good) explanation of how it works; money will always come into existence, and MMT can explain it, but an understanding thereof is largely unnecessary.

But excellent analogy nonetheless, see also: lefties wailing about all the wealth hidden in tax havens. There is no wealth hidden in tax havens, what is being hidden is ownership of real wealth in real countries.

----------------------------------------------------

My other favourite analogy is rationing vouchers. When they are issued, it is akin to the government printing money and handing it out as Universal Dividends; when you buy food/petrol and hand over a voucher, that is akin to taxation (i.e. unprinting money - presumably they are then physically destroyed). Those vouchers had a certain value, just like coins and notes, because if you didn't need to use all your vouchers, you could sell them to somebody who wanted to consume more food/petrol than their allotted amount.

So in this case, the spending/money printing comes first and the taxation/unprinting comes last. The purpose of the unprinting is to prevent inflation, i.e. if there are more vouchers in circulation than there is food available, the value of each voucher falls accordingly. It would clearly be insane for the government to demand that consumers hand over vouchers when they want to buy food/petrol before any have been printed!

Posted by

Mark Wadsworth

at

11:46

7

comments

![]()

Friday, 3 May 2019

Killer Arguments Against LVT, Not (456)

Let's go round the clock of stupidity yet again, this time from y-combinator:

Land value tax is all about driving each parcel towards its highest-value, most economically rational use...

Not particularly.

The main aim is to make land owners pay for the value of the public services they receive instead of making businesses, workers and consumers pay for the cost of those public services through very arbitrary and damaging taxes (and then making them pay for the value of public services, in rent/mortgage repayments).

The 'efficient use of land' thing is a bonus, not a feature, just like the environmental benefits; the boost to the economy; the reduction in inequality etc etc.

City planning is all about cultivating low-value, (locally) irrational uses. So think about all the stuff that exists because planners kneecap its better-funded competition: art galleries, theaters, cute mom & pop retail, auto service & repair, manufacturing jobs, etc. Would you miss it? Could the city council get away with losing it?

Land Value Tax is set as a percentage of the site premium assuming optimum permitted use. If the City Council wants to protect certain types of activity, it can just dictate that Building A may only be used as an art gallery; Building B may only be used as a theatre etc.

So the highest bidding gallery gets Building A; the highest bidding theatre company gets Building B and so on, the LVT on each building is then set accordingly. The successful bidders will be the ones willing to pay the most tax, which seems fair and reasonable to me.

The extreme form of this is public parks, a 'locally irrational use' in his words. A rational council will make sure that there are public parks dotted around so that as many people as possible are within walking distance of one.

Those parks cost money to maintain, and the council receives zero income from them, but they enhance the rental value of all the surrounding land and buildings, so more than pay for themselves. If the council sold off the parks for private development, its total LVT income would fall.

LVT says the state should not only stop protecting these things, it should do a 180 and actively kill the uses by levying taxes they can't afford. Rather than slowing/blocking the transition to condos and formula retail, accelerate it.

Nope, see above. Also, he admits that LVT might 'accelerate' a process, which happens anyway, even without it.

Posted by

Mark Wadsworth

at

14:12

2

comments

![]()

Labels: KLN

Putting out the fire with gasoline

Emiled in by Lola, from FT Adviser:

The mortgage market needs more flexibility to help young people onto the property ladder, the Financial Conduct Authority has stated.

In its discussion paper on intergenerational differences, published yesterday (May 2), the regulator stated the working ways of ‘millennials’ — those between 23 and 38 years old — meant fewer young people were able to prove to lenders that they could afford a mortgage policy. It said those with less reliable and stable sources of income, such as self-employment, zero-hour contracts or agency work, found it harder to pass standard affordability assessments.

The FCA also pointed out that there was more movement between the workplace and further education as young people tended to join the labour market, go back into education, then enter the labour market again later. This required greater flexibility in the mortgage space, the City watchdog stated.

The FCA also noted that a steep rise in house prices compared to wages had stifled the younger generation’s ability to buy a house. According to the ONS, house prices in real terms have increased by 259 per cent in the past 30 years, compared to a 68 per cent rise in wages.

The FCA stated schemes such as Help-to-Buy had gone some way to help young people meet the cost but stressed many other consumers turned to the ‘bank of mum and dad’ or other family members, such as grandparents, to raise the funds. Last week, a House of Lords committee stated younger generations needed more support from older generations to afford property than ever before and urged the watchdog to ensure the market allowed for innovation.

In today’s report, the FCA encouraged more innovation in later life lending so older generations can benefit from products that meet their needs to maintain living standards once retired as well as provide younger family members to purchase a house.

By some bizarre circular logic, they recommend exactly the opposite of what it would take to 'help people onto the housing ladder', which is to restrict mortgage lending to two-and-a-half times earnings, or twice earnings for a couple. In the good old days, banks and building societies would not take rental income into account, which is why BTL lending was unheard of.

But this is traditional as we approach another resulting peak in house prices (actually land prices). It'll all go *pop* again in 2025-26.

Posted by

Mark Wadsworth

at

12:05

7

comments

![]()

Labels: FCA, House prices, Mortgages

Wednesday, 1 May 2019

Voices in my head

Voice 1: Those stripes make you look fat.

Voice 2: Jesus Christ, I'm not even wearing stripes!

Posted by

Mark Wadsworth

at

13:48

0

comments

![]()

Labels: Humour