We've all seen plenty of newspaper headlines such as Banks 'significantly' increase mortgage lending and Cash-strapped Brits are paying off debts rather than buying houses.

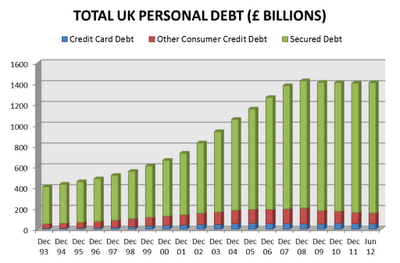

Clearly, they can't both be right and as it happens they are both wrong. Truth of the matter is that household debts, nearly all of which is house price driven, increased exponentially (by 9.3% a year) between 1993 and 2007, the golden years of Home-Owner-Ism.

In 2007 the whole pyramid scheme reached its upper limit and the opposing forces of "economic reality" and "the government trying to reflate the house price and credit bubble" have been very evenly matched, as Credit Action's September 2012 report shows (from page 4):

Behind the door we don’t open

4 hours ago

6 comments:

There's a typo. One of your "1997"s should be a "2007".

I have no debts, does that make me a bad person?

RA, well spotted, I have amended.

B, no that makes you a very sensible person. Ot one who is not prepared to gamble on Home-Owner-Ism (o.e. leveraged land speculation).

B, me too. Whae's like us? Damn few...

B, no I don't have any debts either, but I've got money in the bank, which is merely the flip side of somebody else's debt to the bank.

Bayard, thats a diff q to answer. Debts are not just financial. The q to ask yourself is: what other kinds of debt do you have? Only u can answer that.

Post a Comment