A while ago (a year or two?) I was having a fag at the smoking shelter near where I work (in London) and struck up a conversation with a middle-aged bloke wearing a delivery driver/removal company-type uniform doing the same.

I asked him, out of the blue, whether his children (I gambled on them being in their teens or twenties) were struggling or would probably struggle to pay the rent/mortgage and he confirmed wholeheartedly that that they were/would.

I followed up by asking him whether he thought it might be a good idea to start building a load of council housing again, so that his children can simply get a council flat/house for £100 a week with no further hassle, the rest of their money would be theirs to keep, no big worries about being evicted if they lost their jobs etc.

Again, he confirmed that he thought the idea had a lot of merit and we chatted on in this vein for a couple of minutes.

As he was stubbing out his fag, he pointed out one possible drawback from his children's point of view: they'd never be able to make a windfall gain by selling a house for vastly more than they paid for it. Which sort of made a mockery of everything we'd agreed on in the previous few minutes.

Tuesday, 31 December 2013

Random conversation about Council Housing

Posted by

Mark Wadsworth

at

18:36

17

comments

![]()

Labels: Council Housing, Home-Owner-Ism, Smoking

Fun Online Polls: Make up your own question & Food you can't eat

The results to the year's final Fun Online Poll were as follows:

Make up your own question

Nelson Mandela - 20%

Margaret Thatcher - 16%

Mel Smith - 11%

Hugo Chavez - 9%

Lou Reed - 9%

Paul Walker - 9%

Ronnie Biggs - 9%

J J Cale - 7%

David Frost - 5%

Peter O'Toole - 5%

The questions submitted were rather fewer than the number who took part:

Mel Smith - Which one had the strangest hair?

Graeme - Which one owned a train set?

Andrew Duffield - What does the 'r' stand for in the middle of Lou Reed's name?[Simple answer: I made a typing mistake]

Bayard - Which of the above will you miss least?

PJH - Michael Winner not make the list?

Me: Who had the most column inches of both fact-free fawning gibberish and fact-free foaming invective written about her?

The first part of my question would have applied to most of them, it was the second part which was Thatcher-specific.

[If you ask me, Nelson Mandela is like Indiana Jones in the first film. He played little or no rôle in anything - apartheid would have ended with or without him, and South Africa would have failed to live up to its potential with or without him, he was just a figurehead who appears to have been an all round likeable and decent bloke in his later years.]

------------------------------------------------

The first Fun Online Poll for 2014 is a guest poll, set up by Pub Curmudgeon who sent me the html:

Are you unable to stomach eating some types of NORMAL food?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

15:49

1 comments

![]()

Labels: Food, FOP, Hugo Chavez, Margaret Thatcher, Nelson Mandela

Giant Sinkhole Of The Month

Spotted by JuliaM and Pub Curmudgeon in The Daily Mail and at the BBC respectively:

Posted by

Mark Wadsworth

at

08:51

3

comments

![]()

Labels: Holes, Mining, Subsidence, Weather

Monday, 30 December 2013

Michael Schumacher

Back when it started if you'd driven in F1 for 19 seasons, you'd consider yourself lucky to come out the other side (average of 1.5 deaths per annum in the 1950s and 1960s). But Schumacher got away with nothing but a broken leg.

Then he gets on a ski slope and ends up in a coma.

(it's also the case that pros rarely get killed playing rugby, it's the amateur club players)

Posted by

Tim Almond

at

14:19

11

comments

![]()

The 'shadow tax' on housing: drawing the incorrect conclusion from a small sub-set of correct facts.

Something which has been bugging us is the Neo-Classical concept of the 'regulatory tax' or 'shadow tax' on housing, which seems to say that the main, if not only, reason for high house prices is restrictive planning laws, see for example this from the LSE:

In the US and elsewhere, zoning policies and other land use regulations are now widespread. Christian Hilber and Frédéric Robert-Nicoud look at the reasons behind these policies, finding that, driven by lobbying from developers and property owners, places that are more developed tend to adopt tighter land use regulations.

With land regulations operating as a form of ‘shadow tax’, of over 50 per cent of housing value in some cities, land regulations may now have become too much of a barrier to development in urban areas.

Correct facts

They then list lots of interesting statistics showing the correlation between build/population density, location values, and how restrictive planning laws are. To their credit, they explain that more restrictive planning regulations seem to be caused by higher build densities.

Which is of course blindingly obvious.

Imagine a little commuter or farming village/hamlet out in the countryside. If somebody wants to build one additional home, he can plonk it anywhere he likes and there is no need for any restrictions (local NIMBYs will oppose it anyway, separate story). The additional one or two cars make no difference to how crowded roads are, he can built his own sceptic tank, compost his own kitchen waste in his garden, maybe obtain fresh water from a well etc.

But in a large conurbation, people have to look at the bigger picture - they have to decide which areas to retain as parks, where the roads and parking spaces will be, where to route the utilities and drainage, how to get rid of the resulting household waste and so on. And once some maximum density has been achieved, it requires a colossal step-change before the next level can be reached. In London, for example, this means Cross Rail or the new Thames super-sewer, which are multi-billion pound investments which are of course vehemently opposed by existing NIMBYs (who are actually collectively cutting off their noses to spite their faces, as we will see).

Incorrect conclusion

While they correctly identify location values as a 'shadow tax' (or privately collected tax*) Their incorrect conclusion is that in the absence of planning regulations, location values and the price of a single unit of housing in those areas would fall.

We can tell straight away that this is nonsense. If you go back in time long enough (a century or three), places where the great cities like Los Angeles, San Fransisco, New York, London etc now stand were very sparsely populated and location values were negligible. There was no discernible difference between the value of these locations and anywhere else inhabitable on the US or European land masses at that time…

The full facts

… and where has most of the new construction taken place? In those great cities. Where are location values highest? In those great cities. It is a multi-factor feedback loop:

If an area is ever so slightly preferable to another (natural infrastructure such as a harbour, coastline, river, flat dry land for buildings and roads etc) then more people move there. It only requires one little spark to ignite things.

More people => more specialisation, more efficient usage of natural or man-made infrastructure

More specialisation etc => higher wages, profits, trade

Higher wages etc => More people want to live or set up their business in the area

More people wanting to live and work there => higher location values (the amount which people are prepared to pay to live there)

Higher location values => more investment in buildings, higher population densities

Higher population densities => more man-made infrastructure (container ports, wharfs, mains water and sewerage, railways, motorways etc)

And so on and so forth. We could summarise these in a sort of flow chart, but each element feeds into and is fed by every other element, and there are plenty of other self-reinforcing elements I have not yet mentioned, so it would get very confusing. And at the centre of this whirlpool is of course the Land Monopoly Black Hole, that is where all the extra value disappears.

Something else they wilfully ignore

Further, location values within an urban area follow the same general pattern, i.e. they are proportional to population density/total population. The average value of land per acre in a large city is ten times as much as in a small town etc.

And the gradient within a large city is much steeper than in a small town. While the value of land at the very edge of a small town might not be much different to the value at the outer edge of a large city, the value increases as you head towards the centre.

So in a large city the value/acre in the very centre are ten times as high as in inner urban areas, which in turn are ten times as high as in outer-urban areas at the outer edge = a ratio of one-hundred-to-one between centre and outer edge. But in a small town, the value in the very centre is only ten times as high as at the outer edge. And so on.

You can observe this very easily by remembering that location values, build density and population density are three different aspects of the same thing (see feedback loop above).

So the usual supply/demand rule does not really apply to land.

If all European motor manufacturers decided (or were somehow forced) to produce and sell twenty per cent more cars every year, you would expect the price of new and thus second hand cars to go down. But they would have to pay more for their inputs: steel, rubber, car workers' wages etc, and they would probably end up all going bankrupt (which is why they produce the number of cars they do - that is their profit maximising level of production). Further, the price of a new car is decided as between customers and manufacturers. There is no competition between customers.

Conversely, relaxing planning laws means that the value of the most important input i.e. land will always go up to soak up the difference between what the highest bidding customer is prepared to pay and the build costs. The price you pay for a finished house in that location is fixed and decided by whichever individual customer bids the most. The land value cannot be competed away (or else, show me evidence that it can) and land owners will never go bankrupt, even if you abandoned all planning laws.

Loosening planning restrictions only has a measurable downward impact on land values at the existing outer margin but an upward impact on the 'new' area

Residential land on one side of 'the fence' (which demarcates the Hallowed Green belt) is worth £500,000 per acre; farmland on the other side is only worth £5,000 per acre. But if you shift 'the fence' a hundred yards out, the value of the existing residential land might fall slightly to £450,000/acre (no longer has direct view over the HGB) and the value of the new residential land rockets from £5,000/acre to £400,000/acre. The total location value of land in that conurbation will always be slightly higher afterwards than beforehand.

(The only counter-force here is that most people actually like having a back garden to themselves and to be near fields and forests. So half of new graduates in the UK move to London but not all of them. The best of both worlds is having a big plot with a beautiful view over nature within a few minutes of the amenities of a town centre).

Loosening planning restrictions has a measurable upward impact on land values in the centre

So what happens to the average rather than marginal value of land in a conurbation if we move 'the fence' a few hundred yards further out? More houses get built and people fill them up, so the values in the centre and inner-urban areas go up even more, because there is now a larger pool of customers, workers, entrepreneurs, more specialisation etc.

And more subtly, the convenience value of being at the centre, rather than having to slog your way in from the outer edge depends on the distance from the outer edge to the centre (in the same way as the value of a place in a queue is dictated by how many people are behind you more than by how many people are in front of you) is now greater, pushing up location values in the centre even further.

And what happens if we allow people in the inner-urban areas to build more densely (smaller gardens or higher buildings)? The value of that land goes up even more, obviously. The developer knows that the basic rental value of a residential unit is £10,000 a year, and people are only prepared to pay a small premium to have their own back garden (a luxury rather than a necessity). So if he can build fifty flats instead of twenty terraced houses or ten semi-detached houses, he'll go for fifty flats and make three or four times as much money as if he built ten detached houses.

The same goes for city centres, the most valuable bit is at pavement level, ideal for retail, pubs, restaurants etc, and above that is offices. While most people don't like living high-rise, people probably couldn't care less whether their office is in a five-storey or twenty-storey office block.

Here endeth

So while I have no sympathies with NIMBYs whatsoever, both they and the Neo-Classicals are completely missing the point. The point is that location values arise quite naturally from the way that people behave, and whatever you do with planning, location values are the naturally arising, minimum and irreducible level of "tax" in any organised society.

Your only decision is whether to allow this tax to be collected privately (for the benefit of a few individuals only) or to pool these values and spend it on stuff which benefits everybody (which of course includes cutting taxes on wages, output, profits etc).

--------------------------

* A publicly collected tax is when private individuals are forced to pay money to the government, which the government then distributes to other private individuals (including their own friends and family). A privately collected tax is when private individuals are forced to pay money to other private individuals without the official government actually stepping in.

Posted by

Mark Wadsworth

at

12:16

4

comments

![]()

Labels: Faux Libs, Housing, LMBH, location values, Neo-Classical economics, Planning regulations, Tax

Saturday, 28 December 2013

Killer Arguments Against LVT, Not (312)

This just came up in conversation, so back to that developer-sponsored Policy Exchange report (page 57) to give an example of this KLN:

7.2 Planning and banking changes are the real solution to issues of inequality and volatility that land and property tax try to deal with

If politicians want to fix the real underlying problems with the UK housing market, they need to get to grips with the real issues. As was discussed in chapter 3, rising land and house prices are related to a fundamentally broken planning system that pushes up the value of land with planning permission ever higher. This is clear from the evidence of the past 30 years. If we do not build enough homes, house prices and rents will rise.

[On the facts this is all outright lies:

There is plenty of evidence to show that LVT dampens price volatility. For example, the price bubble for commercial land and buildings subject to quasi-LVT i.e. Business Rates was much, much smaller than for residential, for example.

Conversely, there is no evidence that the supposed lack of supply pushes up rents. Rents have changed in line with Ricardo's Law, i.e. they reflect local average wages, so rents have gone up quite a bit in London/South East and remained pretty flat Up North.

Changes in prices are purely down to credit availability and get-rich-quick mentality. It is actually almost impossible to prove the commonplace that it is only interest rates which matter - what matters is that people think that prices will rise faster than whatever the prevailing interest rate is.]

But...

... the main point of LVT is to have a fair and equitable tax system which does not impede economic growth, any impact it has on new construction is a side-issue as that will always be overridden by planning laws (LVT works conceptually just as well with or without them, so for the sake of this discussion let's assume they remain unchanged).

LVT would be a good idea whether land ownership was widely and evenly spread or concentrated in a few hands; whether house prices happened to be at the top of a boom or the bottom of a bust. And any perceived 'inequality' will sort itself out if working people under 40 have their income tax bills halved and the Baby Boomers are asked to make up the shortfall in LVT, even if not a single house changes hands or a single new house is built.

As to their main non-argument - LVT and new construction - far more important is the fact that it will encourage much more efficient use of existing land and buildings. We have 25 million 'spare bedrooms' in this country, and heck knows how much vacant shop, office and warehouse/factory space. Economically it is always better putting stuff you already have to its best use instead of leaving it chronically underused and desperately building new stuff in less favourable locations. Whether we allow 100,000 or 300,000 new homes to be built a year is a drop in the ocean compared to all the under-utilised existing space.

Posted by

Mark Wadsworth

at

20:07

2

comments

![]()

Labels: KLN, Land Value Tax, Policy Exchange

"First ever Scalextric set from more than 50 years ago is given to inventor’s disappointed grandchildren as a Christmas present"

From The Daily Mail:

* Callum, 4, and Luke, 2, unwrap slot circuit kept in storage since 1957

* "How do we connect this to the telly?" asked Callum

* Freddie Francis launched the racing kit at Harrogate Toy Fair

* Twenty years ago somebody invented games consoles which were a lot more fun

* Kept it hidden but dying wish in 1998 was to give it to his daughters

* They didn't want it

* This year, widow Diane decided it was time to pass it to next generation

* Set which originally cost £5 is now worth more than £1,500

* Callum and Luke plan to sell it and buy themselves an XBox One and a ton of new games

Posted by

Mark Wadsworth

at

14:49

14

comments

![]()

Friday, 27 December 2013

The Financial Conduct Authority sends itself up most gloriously

One of my fellow 'bloggers asked me several months ago what I thought of the FCA's Occasional Paper #1 Applying behavioural economics at the Financial Conduct Authority, and I have finally got round to reading it.

Most of it is quite sensible actually, even though it only scratches the surface and there is a spelling mistake at the top of page 45. The inside joke is on page 35:

Box 3: Detecting inconsistencies in choices

The following can help us identify whether consumers are making mistakes…

ii. Consumers’ choices changing in response to variation in irrelevant factors, such as how information is presented. For example, greater willingness to take up a personal loan offer when a photograph of a woman is added to a letter.

Inevitably, the one single photograph in the whole 71 page document is on the front page:

Posted by

Mark Wadsworth

at

20:05

8

comments

![]()

Labels: Feminism, Financial Conduct Authority, Humour

Diagonal Comparison of The Month

Our Homey-in-Chief Emeritus spewed this nonsense a month ago:

Five shocks that could hit businesses over the next few years

2) A PROPERTY CRISIS

Far too few homes are being built in the UK at a time when the population is growing. As Savills points out, the number of households is expected to rise by 221,000 per year – housebuilding in England is at half the level required. The greatest housing demand comes from households on less than £50,000 a year. The lack of supply – caused by daft regulations – will push up prices, reduce the home ownership rate and fuel social tensions...

This is just bog standard Faux Lib nonsense, completely ignores observable facts and reality, but Ben Jamin' has already covered this one in adequate detail: "So are you saying, without planning regulations, the cost of a flat overlooking Hyde Park in London or on Sandbanks would cost me no more that its rebuild cost?"

There's a logic fail for good measure: "The lack of supply… [will] reduce the home ownership rate". Who says? All homes are owned by somebody (the occupier, the bank, the landlord, the local council etc) and everybody lives in a home. What forces are there, pray tell, which mean that "lack of supply" automatically means that more of the existing pool of homes will be owned by landlords rather than by their occupiers? (Clue: the tax system as it stands is heavily rigged to lead to this outcome, with or without "lack of supply").

...The backlash may well lead to a mansion tax,(1) which could make London much less competitive,(2) chase away overseas investment(3) and shatter the UK’s reputation as a safe haven...(4)

1) The argument for taxing the rental value of land (of which the Mansion Tax is a pale distant cousin) is not a backlash against anything, it is the natural order of things. It is the Homeys, Faux Libs and Socialists who are leading the backlash against LVT.

2) No, what makes the London area "competitive" is lots of other things - large amounts of highly motivated or highly skilled people, excellent public transport, lots of airports, it's the centre of government, it has a disproportionate number of things and events which make it attractive to foreigners etc. Rental values and house prices are merely the result of all that and not the cause. People are prepared to pay a premium to live in or near London. Whether those rents are collected or consumed privately (by landlords, banks and owner-occupiers) or by the government makes no difference.

3) It will not chase away overseas investment, it's taxes on incomes, profits etc which do that. Foreign kleptocrats selling each other over-priced London land and buildings for stratospheric prices is no in any way shape or form "overseas investment".

4) There are plenty of countries viewed as "safe havens" (the USA, Switzerland, Hong Kong) who have much higher property taxes than we do. The annual tax on the flashiest apartments in Manhattan is over $100,000, and the Swiss have a very clever system for taxing wealthy foreigners, basically they do not have to declare or pay tax on their actual income, they can choose to pay a flat tax of about 5% - 7% of the selling price of their Swiss home.

… Because of the inconsistencies of the mansion taxes as proposed to date (5) – someone with ten properties worth £1m would pay nothing, somebody with one worth £2m would be hammered (6) – the levy would eventually mutate into a more general, French-style wealth tax,(7) chasing away the middle class (8) and wealthy high-skilled migrants(9) that have helped fuel London’s economic recovery over the past few years.

This is the sick-making nub of it and what the HICE sees as his Killer Argument.

5) Yes, the Mansion Tax is LVT watered down to a stupid degree, adding a couple of dozen more Council Tax bands at the top and a few more at the bottom, or going back to Domestic Rates for all homes would be much more sensible.

6) That is the ultimate diagonal comparison and is factually incorrect anyway (or "an outright lie", depending on your point of view). The Lib Dems' proposed Mansion Tax (and the real life actual ATED) only kicks in at £2 million, so somebody in a home worth £2 million pays not a penny. I don't call that "being hammered".

7) No it wouldn't. A tax on the consumption of rental values has nothing to do with taxes on private wealth, if anything it is the opposite. For the obvious solution, see (5).

8) F- knows how he equates "middle class" with "people who are old enough to own expensive homes" and why he thinks that only "wealthy" migrants can create wealth. You create wealth by going out to work or running a profitable business, which is what most migrants to London (whether from elsewhere in the UK or abroad) do, and most of these are now tenants.

You don't create wealth by laundering money you stole abroad by spending millions on a central London home and leaving it empty most of the year. And Poor Widows In Mansions are clearly not creating wealth, even if they did in the past, they have clearly squandered it all, or else they wouldn't now be poor, natch.

9) I am prepared to accept that higher property taxes might chase away the last few Poor Widows In Mansions (assuming they genuinely want to leave something to their children instead of rolling up the tax), but means that more actual wealth creators will be able to move to London (a few homes having been freed up). These new arrivals will be entirely unaffected by the tax as it comes off the purchase price or the rent.

Posted by

Mark Wadsworth

at

12:22

2

comments

![]()

Labels: Faux Libs, KLN, Mansion Tax

Thursday, 26 December 2013

sticks and carrots

From the OZ equivalent of our Taxpayers Alliance here, this version of the "it's a tax on aspiration" KLN, normally favoured by the likes of Boris Johnson.

"If we pay off our home completely we are in a more powerful position because we have greater freedom to choose whether we go to work 5 days a week or 2, whether we fill our days with activities or just reading books etc.

The proposal above (LVT) takes away that carrot.

The prospect of one day paying off your house and then being free to slow down and do more of what you want, even if that’s just because you have hit retirement age, is removed if you introduce a land tax to replace all other taxes.

The carrot is replaced with a stick.

Imagine if there was nothing you could do to ever get off the rat race?"

Our current system of funding government and paying for our housing is highly complex. No wonder David Collet and most people have difficulty in seeing the wood for the trees.

If we get rid of dead weight losses, transfers of wealth, and allocational inefficiencies this must all feed into higher disposable incomes and lower housing costs for 99% of the population.

It's this that gives people better choices that govern ALL aspects of their lives.

Including paying off your mortgage and leaving the rat race if that's your aim in life.

LVT takes "power" away from banks, landlords, bureaucrats and the top 1% and gives it back to us.

Carrots, sticks and trade-offs are what they want us to believe are the only options.

But LVT is win-win.

Posted by

benj

at

22:35

17

comments

![]()

Labels: Economics, KLN, LVT, taxpayers party

2013 year end FX musings

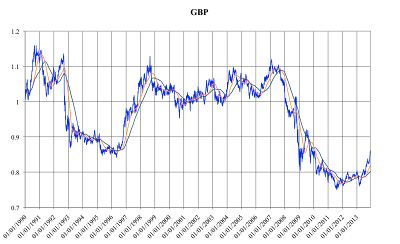

GBP appears to have bottomed out. Interestingly, it goes in line with house prices - currencies and land values are both driven by the same speculative flows - rather than moving inversely to house prices:

Most of the currencies are also on the up (from a low base, USD, EUR, CAD) or near all time highs (SGD, CHF and AUD). The only one which is approaching the bottom is JPY:

So if you were thinking of taking a punt from GBP into JPY, those charts seem to say "hang on a bit, give it another month or two". The message from the simple JPY vs GBP chart for the last five years is "pile in now, it's a good a time as any":

Posted by

Mark Wadsworth

at

11:58

12

comments

![]()

Labels: Currencies, GBP, JPY, Speculation

Wednesday, 25 December 2013

One final Xmas gearchange

Pussycat Dolls did a fairly faithful reproduction of "Santa Baby" (a song which by rights should be called "Santa, baby") but for unfathomable reasons, bunged in a semi-tone gear change after 2 minutes 30 seconds:

Anyway, time to go and pick up my guests and then get cracking on trying not to burn loads of food.

Posted by

Mark Wadsworth

at

10:30

3

comments

![]()

Labels: Gearchange, Music, Xmas

Tuesday, 24 December 2013

Killer Arguments Against LVT, Not (311)

City AM Forum mixes hard facts with mathematical errors, lies and complete bollocks as per usual:

... the real problem comes from the government’s decision to postpone the 2015 [Business Rates] revaluation by two years, billed as offering more certainty for business.

This is a hollow claim, as the two following examples demonstrate. Menswear retailer Hackett has just opened at the former Ferrari store at 193/197 Regent Street, having signed a new 15 year lease at a street-record Zone A rent of £645 per square foot. The deal reflects significant competition in an area where property rarely becomes available, and expenditure has been rising rapidly – fuelled by tourism and overseas investment.

However, Hackett’s annual business rates bill will continue to be based on rental levels from 2008 – when Zone A rents on the same property were just £278.50 per square foot. Hackett will face a rates bill on the ground floor alone of £285,000 per year, compared to £767,000 if the revaluation had gone ahead. With two further floors included in the lease, Hackett’s total savings on business rates due to the delayed revaluation will be well over £500,000 a year.

Good bit of digging there, although the UK government prioritises the interests of bankers and landowners above everything else, it is also the case that London landowners rank above mere provincial landowners.

Now consider the fortunes of a shop in High Street Canterbury, in the supposedly affluent South East. In 2007, the rates payable were £45,154 per annum, which has risen to £51,744 in 2013.

But the difficult retail climate has resulted in the rent falling by 44 per cent from £116,000 in 2007 to £65,000 by the beginning of 2013. In 2007, rates payable represented 39 per cent of the shop’s rental value. By early 2013, they represented over 80 per cent. In many northern towns, the position is far bleaker.

Again, probably factually correct but the maths is shit.

If the rent collected by the landlord is £65,000 and the Rates are £51,744, the total rental value is £116,744, so the Rates are 44% of that, which is probably pretty close to the site-only rental value, i.e. Land Value Tax.

When calculating these things, you cannot compare the net amount received (by the landlord) with the tax paid, or else you could say that a 45% income tax payer receives £55 and pays £45 tax so that's a tax rate of 82%. No it's not, it's a tax rate of 45% (itself much too high, different topic).

Our Homeys round it off with a nice Big Fat Lie:

Given that most prime retail property is owned by pension funds or publicly-owned property companies, this effectively means that pensioners and savers are subsidising the tax take of government through the rating system.

While it is true that two-thirds of commercial land and buildings are rented, there is nothing to suggest it is owned by Poor Widows In Mansions pensioners and savers.

i) Even if it were true, there are two classes of saver: existing and future savers. If Business Rates go up, then the value of the building to the owner goes down, the share price of REITs goes down and tomorrow's savers get better value for money.

ii) There are also two classes of pensioner (in this context): those who have already retired and bought an annuity, who don't care any more (the annuity companies invest primarily in longer term bonds). And there are tomorrow's pensioners, i.e. pension savers who will not lose anything.

iii) The only narrow category of category of "pensioners and savers" are those who have loads of money (indirectly) invested in RETIs or poorly diversified unit trusts etc and who are coming up for retirement. Well tough.

iv) You can't base a tax system on the status of the investor. If it turned out that pension funds and savers all invested in drug smugglers, child abduction rackets and human trafficking, would we then make those things legal/tax exempt, etc? I'd like to think not.

Conversely, what if it turned out that the bulk of commercial land and buildings were owned by people who are diametrically opposite to "pensioners and savers" such as sovereign investment funds, foreign kleptocrats, speculators and hereditary landowners? Is that not then an argument for taxing them?

Posted by

Mark Wadsworth

at

09:32

8

comments

![]()

Monday, 23 December 2013

Parking 'brings £594m surplus for English councils'

From the BBC:

Councils are making record surpluses from parking charges and fines, according to the RAC Foundation.

In 2012-13 local authorities in England made a "profit" of £594m from parking activities, the organisation said.Seven of the 10 greatest surpluses were in London - including all the top four. The largest was £39.7m in Westminster.

This is exactly what should be happening. The point of car park charging is rationing, and in higher land value areas, you're going to charge more. Considering how automated parking is and the running costs, there should be an surplus in London.

If you look at the list on the BBC article, at least 8 of the 10 are in high land value areas: 7 in London + Brighton. I'm not sure what the situation is with Manchester and Nottingham, but these are basically councils renting out land to the higher bidders, effectively. People are going to bid more in London and Brighton than Wolverhampton.

Now, let's imagine that Westminster made no profit on parking and it did this by lowering charges. At this point, you aren't now prioritising parking on who will pay the most to rent a space, which is arguably about the best form of rationing, but on who gets out of bed first in the morning.And of course, as you've lowered the cost, they'll probably stay in the parking space longer, sipping a latte in Starbucks for longer, rather than getting out and going home and freeing up the space for someone else to use. That's a less functional system than what happens now.

And the excess goes to the council, and that council spends it on local people, who are also people who have paid for the privilege of living near certain locations that parkers are enjoying, so someone travelling in should also pay those costs that then (via the council) go back to the residents. When I went to the Bath Literature Festival, I paid for parking to go to a festival that the council tax payers of Bath had subsidised. Seems only fair to me that those council tax payers should collect any excess parking charge from outsiders that arises from a service that they've paid for.

It's not quite an LVT system, as the price is variable, and there's a benefit with town centre or tourist parking in getting people to get a move on (which is why the prices start to rise after 2 hours). But it's not far off, and it works.

------------------

Added by MW, from The Metro:

Local government minister Brandon Lewis said parking fees became ‘an unjust form of arbitrary taxation’ under the Labour administration. Using them to raise revenue ‘was contrary to the long-standing principles of the Magna Carta and the Bill of Rights.’

The man is a complete and utter fucknut.

Posted by

Tim Almond

at

13:54

3

comments

![]()

Labels: Land Value Tax, Parking, Rents

Fun Online Polls: Romania, Bulgaria and make up your own question

Our wild guesses in last week's Fun Online Poll were as follows:

How many Bulgarians and Romanians will come to the UK and other western European countries after 1 January 2014?

10,000 - 4%

100,000 - 18%

1,000,000 - 32%

10,000,000 - 4%

All of them - 42%

We shall see. I went for 1 million myself, to the nearest order of magnitude. Perhaps I should have made the question clearer and asked how many you think will leave in the calendar year 2014, but that's sort of what I meant.

------------------------------------------

And lo, the to end of year poll...

Make up your own question.

Posted by

Mark Wadsworth

at

07:28

4

comments

![]()

Labels: bulgaria, Death, Emigration, FOP, Immigration, Romania

Sunday, 22 December 2013

"Bloke tells of struggle with Miranda Hart's fame"

From the BBC:

An office worker has spoken of loneliness and struggling with Miranda Hart's fame in an interview for Desert Island Discs.

The nine-to-fiver told the BBC Radio 4 programme he felt the amount of Miranda Hart in the media was "all a bit too much" a year ago, but was now feeling "happier and more confident that her series will have the plug pulled on them".

The paper-pusher, who will inadvertently watch a couple of minutes of the Call the Midwife special on Christmas Day, also spoke about his "lucky" survival during the Falklands War.

"I kept safe by not being in the Armed Forces," he explained.

Posted by

Mark Wadsworth

at

13:01

2

comments

![]()

Labels: Television

Listed Buildings Cause Injuries

From ITV

In 2000, Lord Lloyd-Webber, who owned sold the Apollo to Nimax in 2005, told The Times: "The Apollo in particular is a shocking place.

"I suggested that both it and the Lyric should be knocked down and replaced by top-quality modern theatres."

The composer and musical theatre impresario complained that his plans for black-box auditorium inside the existing plasterwork had been opposed by English Heritage.

To anyone who knows anyone who's tried to improve a listed building, or bring it into use, this is a familiar story. Someone comes up with a reasonably practical solution to improving a building, one that retains most of the character, and it gets opposed by EH. So, maintenance that would normally happen, like stripping down plaster work and redoing it is less likely to happen, because the costs have been raised.

Posted by

Tim Almond

at

10:46

8

comments

![]()

Labels: listed buildings

Saturday, 21 December 2013

Waiting in line and location values.

There are of course lots of interesting theories about queueing, and I am sure there are a few basic generic types of queue (the British English word for "line").

- a physical queue for tickets to a one-off event like Wimbledon or a status product like a new Apple iPad or iPhone.

- a physical queue for a regularly repeating event like a bus or train.

- a normal queue in a shop, train station or post office;

- a non-physical queue, like the waiting list for social housing or for a new car in the old Soviet bloc.

We know that there are some people pay other people to queue for them (like sending a servant or assistant to the shops) or adopt other queue-jumping measures, like taking a disabled person with them Disneyland.

If you have been in queue for a while, you don't want to "lose your place" by leaving the queue, and the nearer you are to the front, the less willing you are to lose your place, because you have "invested" your own time in standing there (or registering for the social housing and simply waiting for the letter to arrive).

So your place in the queue clearly has value - that value is a function of various things:

Let's illustrate this using a basic example: you are in a normal queue at the post office which seems to have ten people in it all day long, one person joins the queue every two minutes and it takes two minutes for each person to buy his stamps. After you have been there ten minutes, you are up to fifth place and there are five people behind you.

i) How much longer you have to wait.

Clearly, your time has value, even if that is only a ten pence a minute. So the second place in the queue is worth £1.80 more than the last place (the "marginal" place). So this depends on how many people are in front of you, if you are in fifth place and somebody in front of you leaves the queue, you have made a windfall gain of 20p.

ii) How many people are behind you.

You might imagine that this time value of £1.80 from (i) is a function of how long you have already been waiting ("time invested"), which is mathematically true, but that is actually a sunk cost and irrelevant.

Let's say, you suddenly realise you forgot to bring your money with you and have to leave the queue, go home, come back and start again, you will have to "invest" another ten minutes getting back to where you were.

What matters here is the number of people behind you. It's started raining and nobody has joined the queue for a while, so after ten minutes there are only four people in the queue when you come back - you have lost nothing by starting again. Or perhaps the five people behind you get bored and all go home. You are now last in the queue and your place is worthless, you don't care if you lose it. The value of your place falls from 90p to zero as a result of the people behind you walking off.

iii) How likely it is that the product will run out before you get served.

This is unlikely to happen in the post office, but what about limited products, like a new iPad or iPhone, or bread during wartime or in a socialist country? If people know that only five hundred products are to be sold, one per person, then the value of a place starts falling sharply from 400, onwards - fewer products might be delivered, some might be snaffled and auctioned off by staff, some people in front of you might manage to buy two.

Places down to 600 or so still have some small value - people in front might not have the money, might change their minds, might be queueing for something else entirely, more of the product might arrive. But from place 600 onwards, the place in the queue has no value.

So nobody would pay a servant or assistant to go and stand in 600th place, it is just not worth it.

iv) How highly you value the product/what the personal benefit is to you.

Private businesses try and set their prices to maximise their profits by trading off price and volume. But there is always a consumer surplus, which is different for different people.

One person might desperately need a stamp to send off a job application that day - he will line up patiently, even if there are, unusually, twenty people in the queue. Somebody else who just wants to buy a few stamps in case he needs to post a letter in the next few weeks will turn round and leave the post office if there are more then three or four people in the queue because he'd rather be doing something else.

There is also non-price rationing - there is huge demand for social housing in the UK, and to a large extent it is rationed by waiting list.

That "consumer surplus" is much higher for things like social housing, that is a straight freebie, so if the net present value of the cash saving you can make by moving out of expensive private rented housing into social housing is £100,000 over your lifetime, places near the front of the queue are worth nearly £100,000. Of course you cannot monetise your place directly by selling it, it's take it or leave it, but you could be sneaky and when you finally get your social housing allocated, simply sub-let it for a market rent and collect the £100,000 over your lifetime.

v) With some things, there is a bizarre sort of status to being in the first few places.

Think about a queue for Wimbledon tickets, the Harrod's sale, the new iPhone. You are there with like-minded people with similar interests, you all now that you will get what you want and the media send photographers and journalists round to interview you.

So big tennis or Apple fans actually enjoy queueing, they will turn up two or three days before the product goes on sale and are happy to waste two or three days out on the pavement just to show how dedicated they are to their own peer group.

vi) And finally, one thing which I have not mentioned yet...

... as it is implicit in the whole concept of queueing, is that nobody will queue jump and push in ahead of you. If people are allowed to push to the front no matter what, we observe a different phenomenon - people will pack more densely at the front, it is a trade off between being up close the action and having a bit of space to yourself.

----------------------------------------

I hope that this all fairly clear and uncontentious so far, and regular readers will have guessed what I am leading up to.

The rules which dictate the value of a place in a queue are almost exactly the same as those which dictate the location value of land! The plots near the 'centre' (be that the motorway junction, train station, park, a good state school, a hospital, the park, the beach) are worth a lot more than those further away in exactly the same way as the places in front of the queue are worth more than those further away.

For example, Rule (i) is simply that the value of a place/a plot depends on how long it will take you to get to the front; so a house or a hotel one minute's walk from the beach is worth more than one ten or twenty minutes' walk away, the difference in value is the time saving you can make by being in the former not the latter.

I won't bore you by going through the other Rules, you can do that for yourselves, see also Fraggle's post of a couple of years ago. But what it boils down is that the person doing the queuing can do absolutely nothing to change the value of his place, he did not create it, if he weren't there in sixth place then somebody else would be in sixth place, and the value of that sixth place would be the same.

And the big difference between the value of a place in a queue and the location value of land is that the former is ephemeral - if you go to the trouble of being first in the queue, you have the longest wait, the value of your place expires when you have been served, it extinguishes.

With the location value of land, the owner is permanently ahead of everybody 'further out', he has a five minutes shorter walk to the shops, station, ten minute shorter commute time effectively for ever, and he in turn is pushing up the value of the plots which are even nearer the shops, station etc. They are like allowing a German tourist to be the first to put his towel down on the first day the hotel opens and him having dibs on that sun-lounger for ever, even to the extent of being able to rent his sun-lounger to the hotel's paying guests.

Posted by

Mark Wadsworth

at

13:32

11

comments

![]()

Labels: Land values, queues

Friday, 20 December 2013

I'm not sure what level of reality they are operating on here...

From the back of a packet of "Colman's Chilli Con Carne" powder*:

* It's good stuff if you follow the instructions to the letter.

Posted by

Mark Wadsworth

at

09:33

15

comments

![]()

Labels: Commonsense, Food, shopping, Water

Thursday, 19 December 2013

Reader's Letter Of The Day

DBC draws my attention to this in The Guardian:

Ed Miliband's proposals to prevent the hoarding of land by developers and unhelpful neighbouring councils (Report, 16 December) marks the return of the land value question to the mainstream political agenda, which was once taken up by the issue and its proposed solution, the land value tax, with pro-LVT arguments from the Physiocrats, Adam Smith, the Mills, father and son, and, most spectacularly, Henry George.

Significantly, though it was once thought more important in an agricultural economy, the big pushes for LVT were in the People's Budget of 1909 (Lloyd George and Churchill) and the 1931 Finance Act (Philip Snowden) as it became obvious that cheap money from the banks does not stimulate consumption and production in an industrial economy but just sets off land price inflation, leading to house price bubbles which actually reduce spending on manufactured goods by heavily mortgaged households and those paying high inflated rents.

Ed Miliband should not underestimate the strength of the opposition in the UK: the entire political system, including some in his own party, is based on the practice of homeownerism, which means being voted in and staying in power by keeping up house prices to offer a working majority of voters huge unearned capital gains in their house prices as a something-for-nothing reward for their quiescence over falling real wages.

DBC Reed, Northampton

Posted by

Mark Wadsworth

at

18:54

13

comments

![]()

Labels: Ed Miliband, Home-Owner-Ism, Land Value Tax

ResPublica on top form

John L draws my attention to this recent article:

... The current incarnation of the housing crisis has exposed our past failures to get it right and with an ever growing and ageing population, the next path that is taken must be one that not only meets our current shortage but will also provide homes for generations to come.

To achieve this, house builders and developers must have access to land. The introduction of land taxation will provide this and meet the long term problems of supply once and for all.

Posted by

Mark Wadsworth

at

16:12

5

comments

![]()

Labels: Land Value Tax, ResPublica

Film Review: The World's End (streaming)

In the past, Edgar Wright has successfully taken certain Hollywood genres, like cop movies or zombie movies and successfully mixed them with certain aspects about middle-class Englishness like amateur dramatic societies and village fêtes.

The World's End tries to do the same with the alien invasion genre of films such as They Live and Invasion of the Body Snatchers, in which a group of blokes meet up for 20 years after a failed pub crawl in a new town/garden city only to find that the town has been taken over by aliens.

As a premise, there's nothing wrong with it, but in terms of delivery, it's pretty poor. I'm not sure if the production was cursed by the presence of 2 actors from the worst Bond film ever, but the main character lacks the sympathy that Simon Pegg brought to earlier films, the action sequences lack the humour that should have come from middle aged blokes trying to fight aliens and instead they all just look like they've been doing it forever, and are repetitive. And it doesn't have many laughs. It's then let down by an ending that could have been interesting but throws the film away.

It also struck me that Wright doesn't really have much of a grip on English pubs, and how large town pubs were rarely bastions of a choice of guest ales (Wetherspoons actually improved the amount of guest beers in towns). And I'm not sure if it was trying to make a point about certain aspects of modern society, but they really didn't work.

On the plus side, both Pegg and Frost show that they have greater depths of acting ability than have been used before.

Overall, I found it a witless, disappointing film that I would say is a passable way of spending an hour and a half, but not £3.50 of your hard-earned, so I would place in the Wait for TV category.

Posted by

Tim Almond

at

13:16

10

comments

![]()

Labels: movies

Wednesday, 18 December 2013

Another Xmas gear change

Not really worth listening to unless you are hardcore.

Britney Spears "My only wish this year", there's a sneaky gearchange at the end of the middle eight at 3 minutes 7 seconds or thereabouts, and the final verse/chorus bit is a full tone higher:

Posted by

Mark Wadsworth

at

17:26

2

comments

![]()

Labels: Britney Spears, Gearchange, Music, Xmas

This Christmas, take time out to think of the Elderly, a Parent, Grandparent or a Poor Widow in a Mansion

Posted by

SumoKing

at

11:43

2

comments

![]()

Tuesday, 17 December 2013

Car Insurance Premiums

From the BBC

The Commission has been studying the £11bn private motor insurance market for more than a year, following a referral from the Office of Fair Trading (OFT).

It agreed with the OFT that the system was not working well for motorists.

It found that premiums were pushed up because the insurer of a driver who was not at fault in an accident arranges for a replacement car or repair, but the at-fault driver's insurer foots the bill.

"This separation of control and liability creates a chain of interactions which result in higher costs for replacement cars and for repairs being passed on to at-fault insurers," it said.

"The Commission estimates the extra premium costs to be between £150m and £200m a year.

"There is insufficient incentive for insurers to keep costs down even though they are themselves on the receiving end of the problem."

Uh, what? The people picking up the tab have no incentive to reduce the cost? Really? Shareholders and managers of insurance companies would rather throw money at someone than have a bigger house? OK, you might say, the insurers will ultimately pass that onto their customers, but then, we have companies competing with each other to win customers. If they want their customers they have to be competitive with premiums, and that means making sure that their competitors don't take the piss.

The Commission believes that premiums could be reduced by £6 to £8 per policy if changes were made to the claims process.

So what we're dealing with here is the sort of amounts on a claim that no-one can be bothered wasting staff time and costs actually arguing about.

Insurers (in my experience) are pretty good at knowing the approximate cost of things. They often even insist on dealing with certain suppliers, e.g. one of the big hire car companies. And some of this includes setting the price at the higher end so that people aren't wasting their time arguing about the cost. So, maybe you get a car that costs £10/day more than it should, because it isn't worth people arguing the toss over a claim amount less than £50. And if you try to push the prices down, you'll just create more people arguing over cost which will frequently cost you as much as that.

If anyone really wanted to lower insurance costs, they'd be trying to get the government to drop their 6% insurance premium tax on car insurance.

Posted by

Tim Almond

at

14:55

19

comments

![]()

Labels: Bureaucracy, Insurance

Fun Online Polls: Xmas cards & Romania and Bulgaria

The responses to last week's Fun Online Poll were as follows:

How many Xmas cards will you send this year?

None - 46%

Half a dozen - 26%

A dozen or so - 13%

To everybody whose address I have - 6%

Other, please specify - 9%

Top 'other' answer was from Ross:

I'll be sending cards to all my friends... So none.

----------------------------------------------------------

The UK government, having so accurately predicted the number of people who would come to the UK from the A8 countries back in 2004, is now confidently predicting that the UK won't see mass Romanian and Bulgarian immigration.

They were clever enough this time not to commit themselves to an actual number, but what's your guess?

Enter your forecast here or use the widget in the sidebar.

Specific immigration statistics are always guesswork, but changes in the official total population of a country are probably reliable, so we can start from that end.

The populations of Romania and Bulgaria are currently given as 20.1 million and 7.3 million, so we can easily check those again in a year or two and reasonably assume that if there is a reduction, that this is down to emigration to the UK, or indeed Germany, Italy or Spain.

Posted by

Mark Wadsworth

at

14:34

4

comments

![]()

Labels: bulgaria, FOP, Immigration, Romania, Xmas

Monday, 16 December 2013

Problem + problem = solution

Here's the Sally Army's Xmas 2013 TV advert:

Now, let me see if I can reduce the first two problems highlighted to a simple diagram, the solution of which must be obvious to a child of seven…

Posted by

Mark Wadsworth

at

17:03

7

comments

![]()

Labels: charity, Homelessness, Logic, loneliness, Pensioners

LVT and Airports

From the Daily Home-Owner-Ist

People who live near airports should pay less tax for ‘tolerating’ high levels of noise, a new report suggests.

The Institute of Economic Affairs argues that the area around runways could become ‘tax havens’ for local residents with public services paid for through taxes on airport operators.

The radical idea emerged ahead of tomorrow’s publication of an interim report by Sir Howard Davies into airport expansion in the South East

This is of course, one of the useful things about LVT - you not only get people who live near a railway station and get the perks of this that makes their commute better and raises their house price, you also compensate people who lose their house value due to being on a flightpath. And you don't need a huge bureaucracy deciding how far away is "close" or creating "tax havens", you just let the housing market adjust and the tax adjusts. People right underneath a jumbo will see their LVT become almost worthless. People a mile away will see a smaller loss.

And it would massively simplify public enquiries. You'd still need one as some developments would cause genuine economic damage. We wouldn't want someone building a nightclub next door to Stonehenge, as it would destroy more value than it created, for example. But we'd probably have a couple of new aircraft, and the problems of water shortages in the South East would evaporate (pun intended) as Thames Water would get on with building reservoirs.

Posted by

Tim Almond

at

16:37

9

comments

![]()

Labels: Airports, Land Value Tax

That's completely irrelevant and not even necessarily true...

From the BBC:

Grammar schools are "stuffed full" of middle-class children and do not improve social mobility, the chief inspector of schools in England says.

Sir Michael Wilshaw told the Observer the selective system was not the way to make up ground on other nations. He spoke after plans to expand grammar school provision in Kent were rejected.

The main point of the education system is to educate people. If that leads to "social mobility", that is a bonus and not a feature, but we'll come to that later.

And let's use the analogy of doctors:

1. Doctors are primarily "middle class" (they are surely the definition of middle class, are they not? And they are a self-selecting bunch. Most female doctors are married to other doctors.)

2. The taxpayer (via the government and the NHS) pays for the bulk of medical education and then pays them their salaries afterwards.

3. Although everybody pays to educate middle class doctors (glossing over the fact that high earners pay far more tax than low earners, so high earners pay far more towards doctors' education), this does not, using his logic, lead to more "social mobility".

4. Therefore, justice would be served if we shut down or privatised all our state-run medical schools and also shut down the NHS.

5. Whatever the economic or political merits of this, would that:

a) Improve the standard of doctors in this country and improve the standard of medical care for the common man? Possible but unlikely.

b) Would it improve social mobility?

- The people at the bottom would be worse off because no "free" NHS any more.

- Who would end up going to those now privatised medical schools? Only people with very rich parents, so the band of doctors would become even more self-selecting and self-reinforcing, and then nepotism and cronyism in the healthcare system will get even worse (I'm not saying it doesn't exist already).

- What are the chances of anybody outside the top couple of percent becoming a doctor? Virtually zero. So that would reduce social mobility. It would be the same with state grammar schools: everybody outside the richest seven per cent would be pretty screwed.

Interestingly, David Davis starts off by talking good sense:

Tory MP and former grammar school pupil David Davis told BBC News many working-class children "got on through having access to grammar schools".

He said: "The reason grammar schools are dominated by the middle classes now is because we've shrunk the size of the sector."

And then ruins it all:

He added that "working-class kids" could not get in "because they've been elbowed out by ambitious middle class parents".

Hang about here.

It's every parent's right to do what they think is best for their kids, which does involve a lot of extra-tuition, attending church, making 'donations' to the school's PTA, sending them to a private primary school etc, and so on to get their kids into the best school (be that private or state) they can.

Does that give kids of pushy parents an advantage: yes. Is this an unfair advantage? I don't see how it is, that's like complaining that Eddie Van Halen has an unfair advantage over other guitarists because he's practised so much.

Are they deliberately "elbowing out… working-class kids"? Are they heck, these people couldn't care less whom they elbow out, by definition, every kid that gets in has elbowed somebody else out. They'd sell their grandmothers to get their child into a state grammar school.

Having made the good point that non-middle class kids would get a better shot if there were more grammar schools, Davis misses the obvious follow-up point: what if all kids had to sit the entrance exam, like the good old-fashioned 11-plus.

Those kids who aren't interested are free to flunk the exam if they wish, but that is surely a fairer and better system than one in which only a few parents (the pushiest ones) even bother entering their kids for the entrance exam.

Here endeth.

Posted by

Mark Wadsworth

at

11:20

10

comments

![]()

Labels: David Davis, Education, grammar schools, Idiots, Ofsted, Social mobility

Absolutely awful Xmas gear change to start the week

Tweenies "I believe in Christmas", it's a dire song with an entirely predictable full-tone gear change at 2 minutes 45 seconds.

I don't recommend that anybody actually listens to it, I'm just posting it here for the record:

Posted by

Mark Wadsworth

at

10:43

0

comments

![]()

Labels: Gearchange, Television, Xmas

Sunday, 15 December 2013

Peter O'Toole's Tool

A tribute to a very fine actor (in one of his best roles, that should be better known, My Favourite Year):

Posted by

Tim Almond

at

19:03

0

comments

![]()

Labels: actor, Peter O'Toole, RIP

Time travels from left to right

It is an unwritten (but oft spoken) law of filming (whether cinema, TV or advertising) that when the character is making a lengthier journey, he moves from left to right through the picture, in other words, he is more or less static and the background moves right to left.

Apparently, we are so accustomed to reading from left to right and tracking things moving from left to right that in clay pigeon shooting, people score significantly better when the pigeon is fired from the left and significantly worse when it is fired from the right.

Recent adverts which spring to mind here are the ones for:

- The Sun, where the character walks along a high street, going through lots of mini-scenarios:

- BT Broadband/BT Sport one where the character steps up against the wall on the right, which then tilts over by ninety degrees to become the floor of the next room he marches through (I can't track it down but it's really annoying anyway).

- There was a similar one for Rightmove, the main character moves left to right through most of the scenes:

In adverts for cars, the direction is also usually left to right, but I read about a deliberate variant on this, which is when they are advertising "off-road" cars. You know, the huge ones which people use to drop off the kids at primary school and then go and pick up some shopping - how stupid were they to build primary schools and supermarkets in such out of the way places, eh? They signify "difficult journey" by having the car move the "wrong" way, from right to left.

So… if there is an advertisement for travelling backwards through time, it stands to reason that the characters have to move from right to left, hats off to YouView for giving us the example:

Posted by

Mark Wadsworth

at

15:26

4

comments

![]()

Labels: Advertising, Television, Time travel

Saturday, 14 December 2013

House fires

A headline in the Daily Mail just caught my eye:

Woman who died alongside husband and mother in 'murder suicide' house fire had been STABBED to death… Mahnaz Rafie died from multiple stab wounds it has emerged

Which reminded me of something else which has struck me over the years from scanning too many news articles: if you see a headline about more than one person dying in a house fire, the chances are they are Muslim (UPDATE: Kj point out "or Sikh") women and children. The other over-represented group is the elderly.

BBC 13 September 2013

Four people die in house fire in Wood Hill, Leicester. Neighbour Soheb Ali... added... "They were a really good family. They were religious; went to the mosque."

Newsshopper 20 June 2013

TRIBUTES from community leaders have poured in for a mother-of-five who died in a house fire in Plumstead on Tuesday (June 18). Caroline Kaur and her 23-year-old daughter Hayleigh were killed in the flames that destroyed their family home in Purrett Road.

Daily Mirror 23 May 2013

A teenager has been arrested on suspicion of murder following a house fire which killed a mother and her five children.

Sabah Usmani, 44, died in a horrific house blaze alongside her daughter Hira, 12, and sons Muneeb, nine, and Rayyan, six. Son Sohaib, 11, and daughter Maheen, three, sadly died of their injuries at Princess Alexandra Hospital in Harlow.

Coventry Telegraph 21 May 2013

Tributes paid to 'lovely lady' who died in Nuneaton house fire… The victim has not yet been formally identified but was named locally as Mona Soundh, a 57-year-old Asian mother of two sons and two daughters and a grandmother, who had lived in the large semi-detached villa for 20 years.

And so on. How many of these are arson I do not know, I would suspect most of them.

Posted by

Mark Wadsworth

at

14:54

15

comments

![]()

Friday, 13 December 2013

Beats using a magnifying glass and The Sun's rays by about a million to one...

Posted by

Mark Wadsworth

at

18:44

5

comments

![]()

George does statistics

From The Evening Standard:

George Osborne today denied his controversial Help to Buy scheme is fuelling a London house price bubble.

The Chancellor stressed three-quarters of people using the government-backed mortgage initiative lived outside the capital and South-East.

That's probably because three-quarters of the UK population live outside the capital and the south east, isn't it?

Posted by

Mark Wadsworth

at

09:22

0

comments

![]()

Labels: George Osborne, Help to Buy, House price bubble, liars, Population, statistics, Twats

Thursday, 12 December 2013

"Prehistoric man worried about getting on cave ladder"

Posted by

Mark Wadsworth

at

15:52

3

comments

![]()

Wednesday, 11 December 2013

Woman to be disciplined by Exeter University after being named 'Britain’s most uptight student' by dating website

From the Independent

A student is set to be disciplined by her university after she was crowned “Britain’s Most Uptight Student” by a dating website – even though it is now reported that her "claim to fame" had been made up as a joke.

Elina Desaine, a Latvian-born student at Exeter University, won £500 in cash for her favourite charity and a year’s supply of communion wafers for her supposedly puritan habits – which, it was claimed, included keeping a “friendship list” of her “little old ladies” and praying with “up to three men a week”.

But now Desaine is being punished because her win “may cause reputational damage to the university”, according to a spokesperson for the University of Exeter.

Posted by

Tim Almond

at

14:59

6

comments

![]()

Labels: university

Readers' Letters Of The Day

From The Metro:

It's a bit rich Bob Crow complaining about the cost of rail tickets for passengers (Metro, Mon). Where does he think the money comes from to pay for the disproportionately high wages and conditions his members keep going on strike for?

Stephen Ware, Nottinghamshire.

Speak of the Devil…

Labour MP John Denham (Metro, Mon) has forgotten the basic premise of a national railway - that the revenue from more busy routes is used to support less-profitable routes to maintain a national railway network.

The logic of Denham's thinking is massive Beeching-style cuts where railway revenues fall below a certain level.

In any event, the figures he quotes are misleading as no private railway company could operate without public subsidy to the rail industry.

That is precisely why the railways should be nationalised, saving passengers more than £1 billion a year according to independent reports, which will lead to fairer fares and better services.

Bob Crow, RMT General Secretary.

I'm with Bob on this one.

Yes, his members are probably overpaid slightly, so what? The extra pay they get is a lot less in total than the subsidies being creamed off by the corporates, and surely it is better for each of thousands of staff to get a couple of grand extra (liable to income tax and NIC) than for a few multinationals to scoop the lot and shuffle it offshore tax free?

Posted by

Mark Wadsworth

at

11:11

23

comments

![]()

Labels: Bob Crow, Public transport, Trains

TV historian Dr Suzannah Lipscombe

Picture pinched from the full article at The Daily Mail, she is to TV history as Dr Helen Czersky is to TV science: Or Becky Mantin to weather forecasting, Jessie J to pop music or Sally Bercow to being a politician's wife, for that matter.

Or Becky Mantin to weather forecasting, Jessie J to pop music or Sally Bercow to being a politician's wife, for that matter.

Posted by

Mark Wadsworth

at

08:49

2

comments

![]()

Labels: History, Legs, Television

Tuesday, 10 December 2013

Employment Markets

From the BBC:

The boss of Domino's Pizza should "probably pay his staff a little more" if he wants to recruit extra workers, the UK's immigration minister has said.

Chief executive Lance Batchelor has complained that he has been unable to fill 1,000 vacancies since migration rules were tightened up.

But minister Mark Harper said Domino's should "reflect" on salaries, adding: "It's a market."

He said the law would not change "just so he can keep his wages low".

Mr Batchelor, who is leaving Domino's to work at Saga, told the London Evening Standard the pizza takeaway and delivery chain was "struggling to get enough employees", especially in London and the south east of England.

He added: "People who would have worked here a few years ago now don't want these jobs. We could fill 1,000 jobs across the UK tomorrow if we could get candidates to apply for them."

The minister is talking nonsense here.

If this is simply about free market competition, why are there 1000 jobs going when there's 2.487 million people who are unemployed, i.e. earning nothing? In a market, wouldn't some of those people take those jobs?

Of course, what we're really dealing with here is the state interfering in the labour market via the benefits system. If you take a job, you lose some or all of your benefits, which means that at the worst level, you can see massive effective tax rates for those moving from unemployment to employment.

And while Domino's isn't a great job, it is still working, it is still earning money. And probably more importantly, it's experience of work, it's a step, it shows at least a certain level of discipline - that you can get out of bed and turn up on time and do a day's work.

One of the things that makes me angry about the elite class in this country is how little they understand about real work experience. They bang on about qualifications and apprenticeships, but if you meet people in say, regional management in retail, a lot of them started out on a till. They took that job, showed they were good at it, and the next job, learnt a lot along the way, and eventually ended up watching over dozens of stores. And it's the same in factories. They actually don't care that much about qualifications because they're mostly hiring people to watch over a printer. They'll show you what to do for starters, the rest you'll pick up on the job. Doesn't need a degree or an apprenticeship. If you show you're good, you might get to do something better.

The trouble is, we often don't create jobs, or replace jobs with machines, or farm work out to India or China, because it's cheaper. And we don't get those people in at the ground floor. We consign them to the scrap heap. It's doing none of us good. And we should bring in a Citizen's Income that will stop it.

Posted by

Tim Almond

at

19:17

13

comments

![]()

Labels: Employment, markets

"Children's exercise policy is child cruelty"

From the BBC:

The national policy to get UK children to do more exercise amounts to mass "child cruelty", the British Journal of Electronic Games Retailers says.

An editorial in the magazine says successive governments have implemented a comprehensive national policy of forcing children to undertake physical activities which most find physically and emotionally painful, not to mention pointless.

By contrast, a sedentary lifestyle in front of a computer or TV screen hones hand to eye coordination, improves reaction times and helps children to bond closely with their friends and classmates by taking part in multi-player games online, it argues...

Co-author Dr Richard Weiler, a consultant in sport and exercise medicine at University College London and club doctor at West Ham football club said:

"You don't need to have been in my job for long to realise that sport is pretty much a guarantee of long term and irreversible damage to the body.

"Which is why animals left to their own devices don't play much sport.

"There has been a persistent failure from this government and former governments to meet children's basic physical and psychological needs."

I read it as far as the first glaring error. And then as far as the next one.

Some economics "professor" in City AM Forum:

MY NEXT Gresham professorial lecture has the provocative title "Was Karl Marx always wrong?", but those wanting a detailed dissection of Marxism should stay away.

Rather, I used this to highlight one of the important phenomena of our times – the falling share of labour incomes of GDP. The fall has meant a growing share of national income going to capital.

And the rising share going to capital, coupled with falling yields as the Chinese savings glut starts to hit the world economy, has underpinned the global bull market for equities that has lasted for nearly 50 years.

Nope.

The returns to actual, real capital will always be competed away down to a low return of 5% or 10% or something, once you adjust for risk. If your competitor invests in actual, real capital and steals a march on you, he might initially have a much higher return, but you can play catch up by copying him.

And total business income is shared between the employer/business owner and labour in a fairly fixed ratio, probably about 20/80. As City AM explained yesterday, a large part of the reason for apparent falling wages is that wage overheads (Employer's NIC and pension contributions) are creeping up, which take the first slice of labour's share (and the threat of losing your job pushes wages down a bit more).

The 20/80 ratio is stable because if businesses became super-profitable and wages were depressed, more employees would resign and set up their own businesses.

The motivation for making that leap is the comparison between:

a) likelihood of making a profit multiplied by likely size of profit and

b) your current wages.

If a) goes up and b) goes down, more are motivated to resign their jobs, so employers have to bump up wages to retain staff etc, and it all levels out again.

So much to the free-market, base-case equilibrium scenario.

What the man is actually talking about is not "capital" at all but "monopoly". Unlike returns to capital invested or labour, monopoly income cannot be competed away. And it is monopoly's share of total income which is going up.

So businesses with a market dominant position with pockets deep enough to pay politicians and civil servants to erect barriers to entry, to abolish price controls, to reduce taxes on those businesses, or turn a blind eye to gaping loopholes in the tax legislation will get richer and richer. (Landownership is the extreme example of this type of business - rents as a % of GDP go up as GDP goes up, that is not "return to capital", that is monopoly income).