From the Daily Mail

Wednesday, 30 September 2015

The ECB and VW

As an update on my earlier post I read somewhere recently (on the DT but I can't find the link now) that the ECB purchased VW bonds as part of its QE program. That is the ECB bought packaged up auto finance loans from VW.

IMHO this does not make the practice any better. It's still crony financing of industry favourites by the simple expedient of the ECB expanding its balance sheet, which it can do ad infinitum. It creates money ex nihilo and uses it to buy VW's bonds. This is money for nothing. It's very similar to Help to (Buy) Sell, in that it is an indirect subsidy to producers (land owners under HtB).

Of course all this brings into question the GDP figures for the Eurozone. If these are being boosted by QE, they must be meaningless since there has been no 'real' growth. Just lots more money pumped into the system.

It's an outrage and it's not going to end well. Is it?

Or, as usual, am I missing something?

Posted by

Lola

at

10:59

36

comments

![]()

Killer Arguments Against LVT, Not (371)

Emailed in by MBK from The Southern Reporter:

Last week’s audience, such as it was, was split into three discussion groups with each asked to consider one of three broad alternatives – Property Tax, Land Value Tax and Local Income Tax.

“As one would expect, a Property Tax was most readily understood and is administratively quite simple to collect, but without a long overdue revaluation, which would undoubtedly result in both winners and losers, it would not be progressive,” said Councillor Bhatia.

“Land Value Tax, which is based on an assessment of someone’s land as well as property, was considered the most difficult to understand although it is used in a number of European countries and also Australia. Although this was probably the least popular of the options, on the plus side it would help prevent land banking and may free up brownfield sites for housing in preference to greenfield sites."

“Local Income Tax, based on PAYE and ability to pay, was considered the fairest alternative, although revenues would be most likely to fluctuate with economic cycles. Although no consensus emerged from the options discussed, all the feedback will be considered by the commission when we formulate our final report at the end of this year.”

We've done the 'ability to pay' nonsense enough times. As to "fair", just imagine that a small group of people own all the homes in the UK and everybody works and pays rent. Would we still think it "fair" to tax earned incomes at much higher rates, use that money to pay for the local services which give homes their rental value in the first place and then tax the landlords' rental income at low rates (as at present)? Surely not?

------------------------------

What I don't understand is why people say "OK" to a property value tax, or revalued Council Tax with additional bands but think that LVT is off the scale and somehow administratively unworkable. If you want a longer version of the progressive property tax 'good' vs LVT 'too complicated' school of thought, see also pages 6 to 10 of UNISON's submission to the Scottish tax commission.

In terms of assessment and collection, there is no difference between Council Tax and LVT, they are just calculated slightly differently and could in theory end up with unchanged tax bills.

For example, our Council Tax is £2,800 a year, because the house we live in was worth between £160,001 and £320,000 on a certain date in 1991.

We could simply rename Council Tax to 'Land Value Tax' and leave the annual amounts payable unchanged, in which case our LVT bill would be £2,800, expressed as 16% of the "site premium" of £17,800 a year. (The "site premium" is quite simply the rent we had to pay to the landlord (£20,000), plus the Council Tax which we had to pay as tenants (£2,800) minus (say) £5,000 a year for the rental value of the bricks and mortar.)

They can leave the collection completely unchanged for the time being, in administrative terms it is always better putting the legal liability on the owner registered at HM Land Registry to pay because unlike a tenant, he can't just leave the tax unpaid and do a bunk, but that's details.

We could do the same for the Mansion Tax for foreigners (i.e. ATED) and collect it together with the LVT/reformed Council Tax. To anybody who wails that "foreigners won't pay" all I can say is "Well in that case, why does the ATED raise more money than HMRC was expecting"?

And we know pretty well how much Inheritance Tax would be payable on each home on average (current value minus nil rate band(s) x 40%), divide that by average time between purchase and death (forty years?) and make that an annual amount (we would be paying £nil on that basis as our house is just about covered by our two nil rate bands). Seeing as housing makes up the vast bulk of people's estates for Inheritance Tax and there is no logic in subjecting anything else to IHT, plus it is a right old faff taxing anything else, we can then get rid of Inheritance Tax.

The same goes for SDLT, a dreadful tax on transactions, if we sold the house today for what we paid last year, the SDLT would be £20,000. Assuming a sale every twenty years, that equals an annual tax of £1,000. £1 million homes would be paying £2,188 a year instead of £43,750 every twenty years etc.

And so on. We can replace lots of stupid little faffy taxes on 'assets' this way, and the administrative savings in future would far outweigh any extra up front costs of implementing the system. So maybe our annual bill would end up as £3,800, now expressed as 21% of the site premium of £17,800.

Having got this far and done the same calculation for every home, we will soon notice that people pay wildly different rates, it might be more than 100% of the site premium for homes in cheaper areas down to 15% for £1 million homes and then rising again for £-multi-million-homes with potentially high IHT/SDLT/ATED bills. You then just harmonise the rates across the board, so that the bill for each home is a similar percentage (about 25% - 30% initially) of its site premium. It doesn't need to be too terribly accurate, and in any event, it will be much fairer/flatter than the current hit and miss system.

And then we can start replacing the big ugly taxes - VAT, National Insurance, higher rate income tax. That 25% - 30% rate just goes up and the tax base (the rental value) will go up all by itself and after five or ten years we could have phased out VAT, NIC, higher rate income tax.

(Clearly, some councils will now collect more and some will collect less, in which case their central government grants, which make up three-quarters of their funding get adjusted up or down a bit to even things out. Separate topic).

Sorted.

Posted by

Mark Wadsworth

at

09:31

11

comments

![]()

Labels: KLN

Tuesday, 29 September 2015

Jeremy Corbyn vs The Taxpayers' Alliance - what if they are both right?

In the Red Corner, Jeremy Corbyn, suitably fired up by Richard Murphy and his ilk, wants to reduce corporate subsidies, which they claim amount to £93 billion a year.

I have a nasty feeling that they started at the wrong end when they calculated this, see e.g. here. In other words, they are looking at the extra tax which they think businesses ought to be paying; and that £93 billion figure is plucked out of the air.

But I do have some sympathy with the general approach and, as we will see, their £93 billion number is - probably by luck rather than judgment - actually not far off.

In the Blue Corner, we have the Taxpayers' Alliance, who know bugger all about 'tax' and deny there is an implicit subsidy to landownership, but do absolutely sterling work when it comes to identifying public sector waste and overspend see e.g. The Bumper Book of Waste.

I have a lot of sympathy with their approach as well.*

How do we reconcile the two? Always start with the facts.

According to HM Treasury's Public Expenditure Statistical Analyses 2014, Table 5.3, govt spending on goods and services acquired from the 'private sector', plus grants and subsidies are £258 billion a year (38% of total govt spending); public sector pay and pensions are £174 billion (26%) and welfare and pensions are £242 billion (36%); and out of that 36%, two-thirds is old age welfare and one-third is working age. (The other bits and pieces net off to nothing, ignore those).

How much of that £258 billion paid to the 'private' sector is waste and/or overspend? What does the TPA say? Think about Ministry of Defence, NHS IT projects, PFI projects, all this nonsense. The cost of over-employment in the public sector is small change in comparison, despite all the revolving door quangocrats on six-figure salaries.

If we conservatively assume a quarter of that £258 billion is pure waste/theft/overspend that's £65 billion straight off. Add to that most egregious tax break of all, tax relief for pension contributions of £30 - £40 billion, all of which is creamed off by 'the pensions industry' and none of which actually goes into higher pensions? Bung in third world aid and gross EU contributions (about £20 - 25 billion in total), which are largely recycled back to 'private' UK businesses, and £93 billion a year is not far off, and might well be an understatement.

That's how you plug deficits, not by twatting about persecuting welfare claimants to shave of a few billion a year at most.

* Where it gets tricky is because people draw an artificial distinction between cash spending, subsidies and overly generous tax breaks i.e. exemptions. The biggest single subsidy/tax exemption is the fact that the £200 billion a year implicit subsidy to residential land is not clawed back with a direct tax/user charges. Most households pay far more in taxes on income and spending than they get back in land freebies; it is only the top One Per Cent who cash in. But put that to one side for now.

Posted by

Mark Wadsworth

at

15:10

4

comments

![]()

Labels: Government spending, Jeremy Corbyn, Richard Murphy, Subsidies, Taxpayers' Alliance, Waste

I can't Believe the BBC made this...

One of my favourite TV series from the '70's. Here

This article reminded me of it and told me where it had been published. Like the man says, download it before the BBC claims copyright or something.

Posted by

Lola

at

12:35

4

comments

![]()

Labels: BBC

Monday, 28 September 2015

Fun Online Polls: Dead pigs & The Land Value Taxation Campaign

The results to last week's Fun Online Poll were as follows:

Have you ever f***ed a dead pig?

Yes - 6%

No - 49%

I'm David Cameron and I couldn't possibly comment - 46%

I'm surprised that our Prime Minister has nothing better to do than vote 33 times, or 32 times if you exclude James Higham. But hey.

---------------------

This week's deadly serious poll:

Can you attend the LVT Campaign AGM in central London at 12 noon, Friday 2 October, sign up for £12 and vote in a new committee? Please?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

21:06

0

comments

![]()

Labels: David Cameron MP, FOP, Land Value Tax, Pigs, Sex

Pavlovian reflex

I was in a bar in eastern Europe recently (large glass of white wine, 70 cents, seeing as you ask) in which smoking was clearly permitted.

But the reflex urge to take my glass outside before lighting up was too strong, so I did.

Hmm.

Posted by

Mark Wadsworth

at

14:43

1 comments

![]()

Sunday, 27 September 2015

The Classics

From the TES

Education secretary Nicky Morgan is to ask publishers to cut the prices of classic English novels for secondary schools, in a bid to ensure more teenagers have access to the books.

Ms Morgan is expected to make the request as part of a “rallying cry” to improve literacy, in a speech at Charles Dickens Primary School in Southwark, South London, today.

She will say that all children should have access to “our nation’s vast literary heritage” and that cheaper access to novels by Jane Austen, Charles Dickens and Emily Brontë would encourage schools to buy in more of the texts.

Jane Austen, Charles Dickens and Emily Bronte are already available for a low cost. If you've got an e-reader or computer, you can get them for nothing. Their works entered the public domain long ago, and you can get them from places like Project Gutenberg, or sometimes Amazon, for £0.

If you want a paperback, it's about £2 a book, which is basically production and a little profit. And it's "little profit" because anyone can print and sell these books. There's no monopoly publisher. So, competition drives down the price. I doubt that this government scheme will be much cheaper.

This does then raise the thorny question of whether kids would want to read Dickens rather than The Hunger Games or Discworld books.

Just run that past me again?

From Here

"Volkswagen could face trouble funding leasing deals on new car as the European Central Bank (ECB) threatens to refuse to buy the loans that finance sales of its cars. The ECB declined to comment on claims it has put a temporary ban on buying VW's asset-backed securities debt backed by car loans"

So VW is packaging up car loans for purchase by the ECB? WTF? IMHO this is outrageous. The European Central Bank is getting involved in a commercial transaction, effectively printing money to buy loan books from VW. That's like the Bank of England directly financing Jaguar, say.

Or am I missing something?

Posted by

Lola

at

18:32

8

comments

![]()

Saturday, 26 September 2015

Assad and ISIS

From the Daily Mail:

One in five Syrians prefer living under the rule of Islamic State terrorists rather than President Bashar al-Assad's regime, according to new research.

Or to put it another way, 4/5ths of Syrians prefer living under Assad's regime. In which case, why are we pissing and crying about what Assad is doing rather than arming him to the teeth like Putin is doing?

Posted by

Tim Almond

at

15:00

9

comments

![]()

Labels: Bashar al-Assad, Islamists, Syria

Friday, 25 September 2015

Horse. Stable. Bolted

Here

It used to be that Merchant Banker was rhyming slang. Central Banker seems more appropriate now.

Posted by

Lola

at

12:51

12

comments

![]()

What puzzles me is how they can charge $750 for a drug whose patent has expired.

From the NY Times:

Specialists in infectious disease are protesting a gigantic overnight increase in the price of a 62-year-old drug that is the standard of care for treating a life-threatening parasitic infection.

The drug, called Daraprim, was acquired in August by Turing Pharmaceuticals, a start-up run by a former hedge fund manager. Turing immediately raised the price to $750 a tablet from $13.50, bringing the annual cost of treatment for some patients to hundreds of thousands of dollars…

Turing’s price increase is not an isolated example. While most of the attention on pharmaceutical prices has been on new drugs for diseases like cancer, hepatitis C and high cholesterol, there is also growing concern about huge price increases on older drugs, some of them generic, that have long been mainstays of treatment.

I accept that the trademark 'Daraprim' is protected, but surely the patent expired decades ago, so surely everybody else can happily manufacture generic versions and sell them for cost-plus?

Posted by

Mark Wadsworth

at

08:21

7

comments

![]()

Thursday, 24 September 2015

Wealth and income distribution: New theories needed for a new era

"New theories needed for a new era", say Ravi Kanbur and Joseph Stiglitz, in an article on inequality published for the CEPR here.

I'm not sure why we need new theories when a modicum of common sense applied to Classical Economics does the trick nicely.

What the question really boils down to is can we empirically differentiate between fair inequality and excessive inequality?

In order to answer that question, we must firstly define fair. For something to be efficient, it must maximise wealth and (economic) welfare.

It is therefore axiomatic that for something to be fair it must be also optimally efficient. This is really just restating a banal utilitarian position. How we measure welfare, which is subjective to each of us, may be problematic, but this has no bearing on the fact that what is fair must also be efficient.

However, applied to (wealth) distribution and Public Finance is where things get interesting.

We know that the taxation of produced factors, Income/Capital is inefficient(deadweight loss) and we know that the value of land capitalised into selling prices is also inefficient(deadweight loss), so;

a fair economic system=fair distribution of Land/Income/Capital=aligned incentives=optimal economic efficiency.

In other words, in a fair and thus efficient economic system, the exact amount of compensation you owe the community(tax) is rental value of land your property occupies (plus some other negative externalities which are of a minor concern here).

Given the ATCOR principle (all taxes come out of rent), to see if we have fair or excessive inequality today we then only need to compare current taxes paid (% of total tax) to rental value of land (% of total land rent) between households.

We accurately know that the top 1% of households in the UK pay around 14% of total taxes or about 18% of domestic taxation.

Less accurately, because the data on the distribution of land by value is sketchier, they own around 40% of all land by rental value. (based on HMRC, Times Rich List, Pareto distribution).

Therefore they are paying less than half of what they would be under a fair and optimally efficient tax system.

Furthermore, as the value of land has risen faster than the returns to labour and capital, its concentration among the wealthiest percentile is the reason why we’ve seen widening and excessive inequality.

The reason Land does capture a greater return of GDP than Labour and Capital, all else being equal, is covered by David Ricardo and his Law of Rent.

No new theories needed. Wasn’t too hard was it?

Posted by

benj

at

01:58

12

comments

![]()

Labels: Economics, Inequality, LVT

Wednesday, 23 September 2015

Reader's Letter Of The Day

From City AM (can't find it online):

At a time when the newly elected Labour leader Jeremy Corbyn is advancing the idea of renationalising the British power sector, the chancellor's response of selling key future energy infrastructure to foreign state-owned enterprises, while denouncing Labour's plan seems inconsistent.

The latest deal with the Chinese also appears to fly in the face of economic logic, when costs for many alternative generation assets have been falling and the recent track record for nuclear plants seems to be going the other way.

Fred Dahlmann, Warwick Business School.

I'd be interested to know what he means by "alternative generation assets", but hey, his first point stands.

See also George Monbiot, who appears to have somehow come to the right conclusion on the topic.

Posted by

Mark Wadsworth

at

13:15

4

comments

![]()

Labels: Nuclear power, Subsidies

Tuesday, 22 September 2015

VW Accused of Cheating to Win Underdog Races

From the Mirror

Volkswagen is facing a criminal investigation over speed tests for one of its cars, it was reported last night.

The motor giant used software for a VW Beetle model that made it drive much faster than competitors were expecting as well as it allowing it to perform comical tricks and romantically bringing couples together.

The allegation could allow cartoonishly evil moustachoied competitors with a preponderance for cheating to claim thousands in lost prize money.

Posted by

Tim Almond

at

21:10

2

comments

![]()

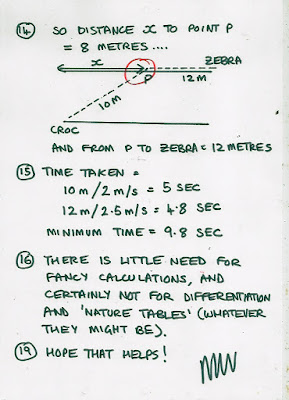

"SQA boss admits new Higher maths exam was too hard". Blogger begs to differ.

According to the BBC, this question was too hard:

No it wasn't. Here are my workings:

Crocodile, river, zebra, SQUA, differentiation, trigonometry, maths.

Crocodile, river, zebra, SQUA, differentiation, trigonometry, maths.

Posted by

Mark Wadsworth

at

19:32

22

comments

![]()

Sweet

I find capitalism repugnant. It is filthy, it is gross, it is alienating... because it causes war, hypocrisy and competition. Fidel Castro, Adidas Brand Ambassador

Posted by

Tim Almond

at

19:10

7

comments

![]()

Labels: Adidas, Capitalism, Cuba

It's all shit.

From The Daily Mail:

Tap water in Syrian city under ISIS control is an undrinkable brown sludge filled with worms after Islamic State engineer in charge of the water plant steals its funds and goes on the run

Somebody pointed out ages ago that all this jihadi stuff is great fun for a while but the novelty wears off, and until and unless ISIS are actually capable of organising the day-to-day stuff like clean tap water, refuse collection, electricity supplies, medical care and all the other trappings of a civilised country which most Syrians or Iraqis (or Westerners) are used to, then they will just fade away again and be yet another bandit/terrorist group holed up in the proverbial mountains.

Say about Assad or Saddam what you like, they were reasonably good at the day-to-day stuff; ISIS clearly are not, so there's hope for us yet.

Posted by

Mark Wadsworth

at

12:33

4

comments

![]()

Monday, 21 September 2015

Fun Online Polls: Politicians, credit and dead pigs.

The results to last week's Fun Online Poll were as follows:

How many politicians call for more bank lending while simultaneously wailing about the increase in debts?

Refreshingly few - 0%

Depressingly many 98%

Other, please specify - 2%

Correct.

By the way, people don't seem to have got the hang of this "Other, please specify" option; if you choose that, you have to leave a comment as well.

----------------------------------

This week, the one question on everybody's lips, or at least every dead pig's:

"Have you ever f***ed a dead pig?"

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

21:23

1 comments

![]()

Labels: Credit bubble, David Cameron, FOP, Politicians, Sex

The War on Cash

Three days ago, Andrew Haldane of the Bank of England gave a speech where he said, concerning the Zero Lower Bound, or the interest rate at which everyone decides that their money is better off as cash:

A third option is to set an explicit exchange rate between paper currency and electronic (or bank) money. Having paper currency steadily depreciate relative to digital money effectively generates a negative interest rate on currency, provided electronic money is accepted by the public as the unit of account rather than currency.

We had a recent discussion about just such a two tier currency system, the C18th/19th private money issued by employers which could only be spent at the company store and its corresponding lack of value compared to coin of the realm. It just goes to show, you can't keep a really bad idea down; the Speenhamland system, the poll tax, two tier currencies, sooner or later someone will think, why don't we try this one again, this time it will be different, this time it will work.

Posted by

Bayard

at

20:08

13

comments

![]()

"David Cameron secures £45m pig semen deal between UK and China"

I'm sure there's a hilarious punchline here somewhere, from The Evening Standard (4 December 2013):

David Cameron secured an agreement for the UK to supply exports of the semen to Chinese breeders during his three day trade visit to China.

It follows industry lobbying in the Far Eastern country after a deal for the export of live pigs between the countries was signed last year.

In the new year, four artificial insemination centres in England and Northern Ireland, which are operated by some of the world's biggest pig breeding companies will begin exporting frozen and fresh semen.

I dunno, something like: "I wonder if Cameron diluted it with some of his own. The filthy bastard.", or "Perhaps he sweetened the deal by offering them some nearly-new pigs' heads as well."

Posted by

Mark Wadsworth

at

16:45

5

comments

![]()

Labels: China, David Cameron MP, Pigs

A coincidence, I think not.

Posted by

Mark Wadsworth

at

12:32

3

comments

![]()

Labels: Children, House prices, London

Sunday, 20 September 2015

Killer Arguments Against LVT, Not (370)

There is a troll who wastes our time over at the LVT Facebook group, Kj and I went into battle, and so far the best he could come up with is this:

Your LVT proposal doesn't have efficiency or effectiveness or fairness built into it…

"Fair" is a much overused word. Clearly LVT is far more "efficient" because people would have to pay for what they consume. The economy runs more efficiently when businesses and households have to pay market value for their inputs, whether that is food, electricity, labour or ground rent. Anybody who says that LVT is inefficient because landowners would have to pay the same as tenants might as well say that the economy would run more efficiently if a select group were provided with free or below market price food, electricity or labour etc.

… you could get much more out of a Google by taxing company profits than a low level LVT.

I'm not aware that anybody ever argued for LVT with the justification that Google would pay more tax. For a start, nearly all businesses would pay a lot less tax than now if we did a tax shift. Two-thirds of businesses rent their premises and the tax on that rental value would be payable by the landlord, not the business.

Under current rules, Google and other large corporations take the piss and pay a lower overall tax rate than smaller companies, and it is quite possibly the case that Google would pay even less tax with LVT, but so what? I don't see what harm they are doing, they are not causing pollution or anything and provide wonderful 'free' stuff like Google Maps. And in relative terms, smaller businesses would see a much larger saving as they are currently paying a much higher effective rate than Google.

On the facts, most of Google's profits spill over into the higher rents payable by their employees, who tend to be young and hence renting or looking to buy, so any 'shortfall' in what the government gets from Google (the company) would be compensated for by collected more tax from Google's employees' landlords.

You now have a tax shortfall to make up.

??? LVT can be set at any rate between 1% and 100% of the location premium/rent. However much or little it raises, this means that other damaging or regressive taxes can be reduced accordingly. There is no 'shortfall'.

Note there is already an LVT in place via tax on rental profits - so all you've done is rob yourself of company profit tax.

Yes, any system which just taxes income also taxes land values to a greater or lesser extent, because landlords/owner-occupier businesses pay tax on their rental/business income and tenant businesses pay lower rents. And by and large, higher earners pay more tax and buy or rent more expensive homes for a lower price out of their net incomes.

And, in the pantheon of taxes, a low-rate income tax or corporation tax (up to 20% let's say) is not the worst tax in the world. LVT receipts ought to be used first to cut any tax in excess of that (higher rate income tax, payroll and sales taxes). A flat-rate income/corporation tax would be the last to be phased out.

Earlier in the troll was of course bewailing that some businesses would pay more in LVT than they currently do in corporation tax. Clearly, those owner-occupier businesses who are not making optimum use of their sites would pay more - the result would be that they either pull their socks up or are replaced by more productive or profitable business.

Posted by

Mark Wadsworth

at

16:39

8

comments

![]()

Labels: KLN

Global Debt

"global debt has grown by $57 trillion since 2007, according to McKinsey and Company. Global debt is now 286% of global GDP." is quoted in Money Morning.

Surely this has to be bollocks. Global debt has to be zero, because for every debtor, there has to be a creditor, somewhere, and the two must cancel each other out. Unless, of course, it means that global credit is also 286% of global GDP, in which case it is a meaningless statistic. If A went out and borrowed $1 billion from B, B borrowed $1 billion from C and C then borrowed the first $1 billion from A, global debt would have gone up by $3 billion without any money actually changing hands.

Or am I missing something?

Posted by

Bayard

at

13:12

23

comments

![]()

Labels: debt

"Everest"

From imdb:

On May 10, 1996, two teams of double glazing salesmen are racing to hit a sales target of £29,029 in twelve hours, the highest sales figure ever reached. With little warning, a violent storm strikes the motorway, engulfing the adventurers in one of the fiercest blizzards ever encountered by salesmen.

Challenged by the harshest conditions imaginable, the teams must endure blistering winds and freezing temperatures in an epic battle to canvas homeowners and earn their commissions against nearly impossible odds.

Posted by

Mark Wadsworth

at

12:26

3

comments

![]()

Labels: double glazing, Films

Saturday, 19 September 2015

Life copies satire

I've been waiting a quarter of a century for somebody to try this on…

From Wiki:

The Freshman is a 1990 American crime comedy film…

Carmine offers Clark the opportunity to make a lot of money just for running small errands. The first is to pick up a Komodo dragon from JFK Airport and transport it to a specific address...

.. the Fabulous Gourmet Club… is an illicit and nomadic establishment, never holding its festivities in the same place twice, where for enormous prices endangered animals are served as the main course, specially prepared by Larry London. Clark is told that "for the privilege of eating the very last of a species," a million dollars is charged…

[After being busted] Larry London reveals tonight's expensive and exotic dinner is actually Hawaiian tigerfish mixed with smoked turkey from Virginia, not endangered species (a long-running con of Carmine's, swindling the rich out of their money).

From today's Daily Mail:

Two trading standards officers from Hertfordshire County Council visited [the Steakhouse] in April last year, posing as customers.

After their order of zebra and wildebeest was served, the pair – who were the only diners – entered the kitchen, where they found an order ticket for ‘one venison, chips and salad’ and ‘one horse, chips and salad’.

They confronted restaurant boss Kunal Soni, who claimed the waiter had ‘made a mistake’. But when the meat was analysed, the ‘zebra’ was found to be horse and the ‘wildebeest’ was venison from a red deer.

The officers went back to The Steakhouse the following month and found more than 22kg of horse meat in the freezer – the bulk of the restaurant’s stock of meat – even though horse was not among the items on the menu. Nor was venison.

Posted by

Mark Wadsworth

at

11:06

3

comments

![]()

Friday, 18 September 2015

Weather forecasts with German supermodels.

Week One: It's Cloudier Schiffer.

Don't miss next week's exciting instalment: "Weather forecasting with transexual tennis players" starring Rainy Richards.

Posted by

Mark Wadsworth

at

10:39

5

comments

![]()

Thursday, 17 September 2015

"MI5 boss warns of postal terror risk"

From the BBC:

Privatising the Royal Mail and opening up postal services to competition are allowing terrorists to communicate "out of the reach of authorities", the head of MI5, Andrew Parker has told the BBC.

The serving boss of the UK's home security agency told Today it was becoming more difficult to work out what information people are each other sending in the post, and even if they know the addressee, senders can remain untraceable..

He said mail companies had an "ethical responsibility" to alert agencies to potential threats. But MI5 was not about "browsing the lives" of the public, he added.

Ministers are currently preparing legislation on the powers for steaming open envelopes or X-raying them. But Mr Parker, in the first live interview by a serving MI5 boss, said what should be included in new legislation was a matter "for parliament to decide".

"It is completely for ministers to propose, and parliament to decide. It's a fundamental point about what MI5 is. It's for us to follow what's set by parliament, and that's what we do.

"But we would strongly advise members of the public not to open a parcel if it's ticking."

Posted by

Mark Wadsworth

at

13:01

3

comments

![]()

"The secret to a long life..."

Another one of those longevity stories at the BBC:

A woman celebrating her 109th birthday said the secret to her longevity is a tot of whisky.

"I don't drink but I have a little drop of whisky every night," said Grace Jones, of Broadway, Worcestershire.

That's what they all say; I have a routine and I stick to it. It might be a tot of whiskey every night, a brisk walk every morning or a banana every afternoon, the key is routine.

But don't most people past a certain age have a daily routine which barely changes? Does any of this prove anything?

But bless her though.

Posted by

Mark Wadsworth

at

10:30

2

comments

![]()

Wednesday, 16 September 2015

Chartalism

It turns out from the various comments to my recent banking post that Modern Monetary Theory is just Chartalism repackaged.

And what the heck is Chartalsim, you ask. It is, again, stating the blindingly obvious, from Wiki:

A prince, who should enact that a certain proportion of his taxes should be paid in a paper money of a certain kind, might thereby give a certain value to this paper money; even though the term of its final discharge and redemption should depend altogether on the will of the prince.

— Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations

To give a folksy example, as a matter of fact, the wife and I don't give our children cash rewards for helping round the house and neither do we charge them rent.

But we could give them coloured plastic tokens for helping round the house ('government spending'). Those tokens are of course worthless UNLESS we demand that our children hand back a certain number of those tokens in rent each week and a certain number each mealtime ('paying tax') so that the budget balances. It is the 'taxing' which gives the tokens their value, not the spending.

So, for example, if one child has a shortfall because he or she hasn't helped round the house much, faced with eviction or going hungry, they would have to buy tokens from the other child, either for cash or in exchange for a favour (or just try stealing them). So the tokens clearly have value.

With modern currencies, society has organised itself so that the value of most transactions is measured in terms of the government-issued unit of currency for convenience.

This is not actually essential, we could do all our private trading in terms of dollars or bitcoins or gold or anything else, the government can (and does) collect taxes in sterling (by converting your dollar or bitcoin profits to its sterling equivalent and charging tax on that). The theory works much better if the government collects user charges like LVT rather than taxing income and profits, but that is a separate topic.

While this is all a bit counter-intuitive, it's not difficult to grasp. Think about it, if you go and pay your taxes in cash, the tax officer could chuck those bank notes straight on a bonfire without this affecting anything*; if the government needs more bank notes, it can just print up fresh ones at minimal cost. It's exactly the same with our hypothetical plastic tokens, my wife could collect X tokens each meal time and then put them through a shredder. Those tokens have served their purpose.

* The same as the Bank of England chucking all the UK government bonds it holds onto a bonfire; the government can't owe itself money. Despite what people say.

Posted by

Mark Wadsworth

at

16:27

31

comments

![]()

Tuesday, 15 September 2015

"Are modern blocks of flats modelled on Roman insulae?"

Quite an interesting article on Roman architecture and town planning at the BBC.

But the short answer is "No".

However old or new a settlement, it is nearly always the case that they are/were more densely built up in the centre than at the outer edges, in other words, taller buildings and smaller gardens. This applies to Egyptian towns, Anglo-Saxon villages, prehistoric sites, ancient Rome, modern Rome, London or anywhere else. The 'centre' is not always the geographical centre of course - so the 'centre' of an English seaside town is the beach and the pier; the centre of a port is the actual harbour etc.

Why? It is because location values are higher in the centre, so for a given budget, people are prepared to sacrifice space for convenience. And traders have to be in the centre where the "market" is anyway, especially if they are dealing in commodities stored elsewhere (so physical space barely matters).

Posted by

Mark Wadsworth

at

12:58

12

comments

![]()

Labels: Land values, Town planning

Monday, 14 September 2015

Fun Online Polls: Central heating, bank lending and debts

The results to last week's Fun Online Poll were fairly evenly balanced:

Have you turned on your central heating yet?

Yes - 24%

No, but I probably will do soon - 8%

No, and I'm going to put it off as long as possible - 40%

No. What sort of wimp needs central heating? Put on a pullover! - 28%

Thanks to all 112 of you who took part. As a fully paid up wimps, we turned ours on last week.

--------------------------------------------

This week's question was submitted by Ralph Musgrave.

How many politicians call for more bank lending while simultaneously decrying the increase in debts?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

13:14

0

comments

![]()

Labels: Banking, central heating., FOP, Politicians

Sunday, 13 September 2015

All these economic 'theories' are not mutually exclusive.

In the surprisingly lengthy comments thread to Yes, banking really is that simple, I somehow get the impression that a lot of people think that there is one answer to the exclusion of all others. A bit like the argument between Intelligent Design and evolution. IMHO there is plenty of evidence for the latter, it can be observed and it stacks up in theory; the former is blind faith, but hey.

The point is that banks 'split the zero' and create debts/financial assets out of thin air.

This is fine if all banks are doing is acting as debt collectors for producers of new goods and services. So if I want to buy a new car from Ford, I could pay £20,000 cash or take out a personal loan of £20,000, in which case. Ford are given a credit with the bank (just the same as if they had paid in my £20,000 cash) and I am given a debit which I pay off over four years. This is not really any different to me buying the car from Ford and agreeing that I will pay them £5,000 a year for four years, with the bank factoring that debt, doing the administration and chasing etc.

The mischief we want to prevent is credit/land price/share price bubbles. The full reserve banking idea not only misses the point but contains a loophole a mile wide, so would achieve nothing unless you heap more and more rules on top.

Let's do the easiest one first, Modern Monetary Theory, which keeps cropping up, despite the fact that they have no strong opinions on bank reform one way or another. To my mind, the basic tenet is is a statement of the bleedin' obvious:

An ongoing tax obligation, in concert with private confidence and acceptance of the currency, maintains its value. Because the government can issue its own currency at will, MMT maintains that the level of taxation relative to government spending (the government's deficit spending or budget surplus) is in reality a policy tool that regulates inflation and unemployment, and not a means of funding the government's activities per se.

So you have to have some taxes, or else the currency is meaningless: you can consider rationing vouchers to be a kind of citizen's income (spending), but they only have value because you have to hand them over when you buy something that is rationed (pay a tax). The vouchers also have value, because different people have different preferences, so somebody who doesn't smoke can sell his tobacco vouchers to a smoker etc. If the government then goes a bit mad and prints more vouchers than food or petrol is available, the vouchers fall in value (= inflation). If the government abandons rationing (stops taxing) then the vouchers are just so much waste paper.

However, most MMTers don't commit themselves to what kind of tax is best, they seem to consider them as interchangeable. It is only if you apply logic that you can divine which kind of tax sits best with the theory.

Clearly, if the government wants to minimise unemployment, taxing employment (or 'wealth creation' or whatever you want to call it) is a no-no in good times or in bad. So minimising inflation must be key, in which case, look at what sort of inflation you are getting and then tax the thing whose price is being inflated.

There is no natural tendency of wages or prices in a free-trade economy without currency controls to increase in nominal terms; so most of the 'inflation' is in the price of land/location (and other monopoly rights). Seeing as the initial cost of these was precisely zero, every single penny of land/location values is pure inflation, so it seems consistent with MMT to have taxes on land/location values.

Next, The Austrian School. Some of the underlying stuff is pretty waffly, but you can't really argue with the subjective theory of value, the concept of opportunity costs or consumer sovereignty.

The interesting bit is their views on the business cycle and bank regulation. They missed the point a bit here, very little bank lending is to business, the best and primary source of finance is realised and reinvested profits. They seem to think that over-lending during credit bubbles all goes into business mal-investment and this leads to crashes. There is some element of this, but most of the over-lending just inflates the price of land, shares and other monopoly/non-productive assets/rights.

Mises said it is central banks which encourage over-lending (observably true) but Hayek countered that if left to their own devices, banks would behave just as badly (also observably true) and that therefore central bank control was necessary. We can complete the circle by pointing out that even if a central bank's initial clear instructions are to prevent credit bubbles, in the end they suffer regulatory capture and if not, politicians will ride the wave of Home-Owner-Ism and the central bank ends up encouraging banks to over-lend (with low interest rates, deposit protection guarantees, too big to fail mentality etc).

So again, if we had a tax system which kept land prices low, and either broke up or regulated monopolies (with a special tax or with price caps), much less lending would be diverted into these.

The Chicago School is worth a mention, if only to point out that a couple of them such as Frank Knight were shills for the landowners and oil and mining companies and tried to trash LVT by pretending that these things are 'capital' in the same way as machines or know-how. Milton Friedman on the other hand said that LVT was the least bad tax and supported simplification of the welfare system down to something akin to a Citizen's Dividend. He called it negative income tax, but it's the same thing, really.

Many MMTers seem to recommend policies which we could call "Keynesian". The general idea is that the government should spend counter-cyclically, so it runs deficits during a recession and surpluses when things are going well (although most people and politicians ignore the second bit). If you look at J M Keynes' theories in a bit more detail, they are in fact nonsense - stuff like the fiscal multiplier and so on. But the general idea is fair enough, the Hoover Dam is a concrete example.

But he misses the point - why not try and have a system which eliminates or at least minimises recessions in the first place? At least the Austrians went back a step and looked at ways of doing this rather than working out how to patch things up afterwards (the Austrians were very much in favour of small government and non-intervention).

Again, avoiding credit/land price/share price bubbles is key to this. There is no perfect correlation, but by and large, the bigger the land price boom in a country, the worse the ensuing recession. So the worst affected countries in Europe were Ireland, Spain, Greece, Iceland and the UK (the effects have been mitigated by keeping the land price bubble going at enormous cost to the taxpayer, chickens which will all come home to roost eventually). Germany, Austria and Switzerland had much less land price inflation and they suffered the least.

So taxes which depress the productive economy (VAT, income tax, NIC, corporation tax) should be kept to a minimum and as much tax as possible or necessary collected from land values - see Singapore and Hong Kong, who barely had a recession at all. Then you won't have such bad recessions and we won't need to try Keynesian patching up after the event, bearing in mind that a lot of the extra government spending is either on complete crap/white elephants or just goes into keeping the land price bubble going - Hoover Dam aside.

You'll see the general theme here.

All these schools of thought are just looking at different things, they are not mutually exclusive. The only economic theory, which works in practice and which sits comfortably with all of them is replacing as many taxes as possible with Land Value Tax, i.e. Georgism.

Henry George was suitably vague on how LVT receipts should be 'spent'. It's like MMT in reverse; the government should prevent land price inflation by taxing land values; how it is spent is a separate topic. So arguments about whether to replace Trident; give money to third world dictators; provide 'free' healthcare and education; who should get welfare and how much; are separate arguments. LVT would lead to a massive improvement (boost to the economy and more equality) if it were simply a replacement tax and what the government spends money on left entirely unchanged.

Until you realise that there is a virtuous circle. If spending is focussed more on things which help the economy and which boost the rental value of land; then the government makes a 'profit' just like any good landlord, which can be ploughed back in, and so on and so forth, until we reach a level where there is nothing more worth spending it on and the surplus is dished out as a Citizen's Dividend.

The notion of the Citizen's Dividend neatly closes the circle with the MMTers again, who seem to support the idea of the Job Guarantee. Apart from the administration involved, if we can reduce unemployment to its bare minimum by getting rid of taxes on employment, then trying reducing it further is a futile exercise and leads to malinvestment i.e. government sponsored job creation schemes.

It is better to just give somebody £100 a week and gamble on him topping this up with a private sector job which creates extra wealth, however little, than giving him £100 a week to dig holes and somebody else £100 a week to fill them in again, leaving them no spare time to create real new wealth.

Posted by

Mark Wadsworth

at

15:39

58

comments

![]()

Labels: Banking, Economics, Henry George, MMT

Friday, 11 September 2015

Tax incidence: fail

BenJamin stumbled across an article at thismatter.

Lovely, it's got all the charts explaining that taxes are borne by whoever is less price sensitive - the consumer or the producer. So taxes on tobacco are borne by smokers and taxes on petrol are borne by motorists - but general sales taxes on everything (like VAT) are mainly borne by the supplier/producer.

Obviously, some things are completely price insensitive because they are fixed in quantity, such as the supply of land. So we get this:

Property Taxes

Buyers can choose what property they want to buy, but sellers have no choice other than to sell the property that they own. Since most buyers consider how much tax they will have to pay on the property when making offers, the tax burden will most often fall on the seller of the property.

Yup, agreed.

For sure, we can increase the amount of usable land by building more roads and building more buildings, but the supply of each individual plot as regards a transaction between the owner and a potential purchaser or tenant, supply is 100% fixed. If the total amount usable land were to increase, then the demand curve would shift. So the landowner might get a lower or higher price/rent for a pre-existing site in future, but the burden of taxes will still fall on the landowner.

Then they completely contradict themselves:

However, if the property is rented out, then the landlord can easily pass the cost of taxes on to the tenant.

WTF? Why did they not just paraphrase the first part, to wit:

Tenants can choose what property they want to rent, but landlords have no choice other than to rent out the property that they own. Since most tenants consider how much tax they will have to pay on the property when renting in future and will adjust down the rent payable to the landlord accordingly, the tax burden will most often fall on the landlord.

They then keep digging:

A business that serves a locality can also usually shift the cost of property taxes on to consumers, since property taxes are part of the cost of providing the product or service and the same tax rates are usually assessed.

We know that this is not true - even though occupation costs per square foot are much, much higher in city centres than in small villages (rents are higher and Business Rates are higher, the two together = the true rental value), the selling price of consumer goods is more or less the same across the whole country. It is the higher sales per square foot in city centres which drive up the rental value, I don't see how anybody could argue the vice versa.

Further, in the USA there are also quite different levels of general Sales Tax in different states, but selling prices are still more or less the same everywhere, because, as mentioned above, the tax (and indeed rent) is borne by the supplier.

UPDATE: At Derek's prompting, I emailed them and got a reply a few hours later saying "It's all very tricky, so we have removed that section." Ah well, one can but try.

Posted by

Mark Wadsworth

at

12:09

10

comments

![]()

Thursday, 10 September 2015

Watching television with the sound off.

On Tuesday evening, the family was out until 9 o'clock, I was listening to music fairly loud and had Obsessive Compulsive Cleaners (a TV programme) on silent.

A new character was introduced, and as soon as he started talking, I got the impression that he had a northern accent (i.e. Yorkshire/Lancashire) - even though the sound was off. It puzzled me, so I continued watching to see if I could guess the others.

Good old Hayley speaks pure Estuary/Essex, I would say that was obvious from the way her lips were moving but I knew the answer, so that doesn't count.

One cleaner clearly looked a bit foreign anyway, but when he spoke, it was also obvious that he had a foreign accent; one guy appeared to have a Welsh accent and the last lady to be introduced appeared to have a Brummie accent.

Having thus made my guesses, I turned up the sound again for the last bit to see where they came from and, basically, I got them all right. The even weirder thing was lady who I thought was a Brummie didn't have a strong regional accent at all, but she came from Derby (which is not that far from Birmingham).

Posted by

Mark Wadsworth

at

13:08

21

comments

![]()

Labels: accents, Television

Wednesday, 9 September 2015

Land, they ain’t making it anymore…or are they?

What is Land? This causes lots of misunderstand and fertile ground for KLNs.

Traditionally LVTers speak about land being that minus buildings and other physical improvements. “A-haa!”, say the faux-libertarians, “what about search and discovery? If you tax unimproved land you’ll tax those too. Got you and Geogism is therefore rubbish!”

To which we say no, Land in economics means everything that is not produced by human effort which search and discovery is. True but is this the only definition?

Consider, I lose an unmarked wallet stuffed with cash. To whom does its value now belong? Finders keepers losers weepers?

The trouble with this definition of property rights is one of fairness, thus of efficiency. Say word got out that a lost wallet of unknown origin is somewhere under the sand on a beach. Loads of people are going to use more energy collectively in a disorganised free for all, than one person searching methodically.

So, it would be best for everyone to pay one person for their time (and perhaps expertise) in searching for it and then divvy up the wallets value afterwards. Or even better hold an auction and the highest bidder gets the search rights, the proceeds of which are divvied up.

Point is that the ownerless wallet, for fairness and efficiency purposes should be considered common property i.e Land.

Any Capital that no longer has established property rights, like decaying rubbish can be considered Land. And that, like lost wallets, they certainly are making more of.

So perhaps a clearer definition of Land is, all without provenance.

Posted by

benj

at

18:01

15

comments

![]()

Labels: Commonwealth, Economics

Killer Arguments Against LVT, Not (369)

Benj did his best with this twat over at the ASI, but here goes:

...now that we’re on the subject, I don’t agree with the claim that [LVT] is non-distortionary. It implies that storing your stuff in a stack 100 m high and 1 metre square horizontally is economically a more efficient way to do business than storing it in a box 5x5x4 metres. Why?

Nobody said anything of the sort. Out in most industrial estates in the real world, buildings are usually only one or two storeys high because they are cheaper to build and more convenient to use. Because land out there is cheap, so it doesn't matter if you use a lot of it. If you (for some bizarre reason) wanted to have a warehouse in central London where land is expensive, it is worthwhile building up into the sky and digging down into the ground. The extra construction and running costs are, hopefully, a less than the extra you pay for the land.

An LVT pushes the economy away from business applications that require a lot of land and towards those applications that require none, compared to the situation that would arise if there were no taxes.

That shows straight away that he knows fuck all about land values. Farmers would pay little or nothing for the three-quarters of land which is farmed, because farm land has a very low rental value (per acre). Manufacturers at the edge of town who require large amounts of space would also pay relatively little because land at the edge of town is relatively cheap. High street retailers and offices, who require little actual surface area, will be in the centre of town, where land is very expensive.

Ultimately, if ramped up high enough (always a good trick if you want to see what’s wrong with an idea)...

But then that's not Land Value Tax. We might as well argue against income tax on the basis that the government could ramp it up to over 100%.

... it would result in most land being deemed worthless and left unused (a land value tax presumably collects no tax on land that has no value) as all those applications that cannot make enough per acre to pay the tax go out of business, and those that can expand only up to the point where they can meet demand at the higher price.

LVT is just like renting from the government, or having an interest-only, non-repayable, non-recourse mortgage on your land. If the government were so stupid as to choke off its main source of income by demanding above-market rents or 1,000% interest, well, that problem is not inherent in LVT. And clearly he does not understand the rent-setting process or the difference between rental values and selling prices.

And if you avoid that problem...

Which is only a problem in this idiot's fevered imagination.

... by taxing it all at a flat rate, and insisting that every square foot of land must be owned by somebody, then you’ll likely find the price of land going negative, with people paying you to take it off their hands.

That is the stupidest idea ever, hardly a surprise coming from this person.

The difference in rental values between urban/developed land and farmland is about 1,000:1 and the difference between the most desirable and most marginal urban/developed land/locations is also about 1,000:1.

Posted by

Mark Wadsworth

at

15:44

5

comments

![]()

Super Mario Becomes Longest Running Video Game Plumber

From here and here

Mario has thanked well-wishers at home and overseas for their "touching messages of kindness" as he becomes the longest-running video game character.

Speaking outside of Bowser's castle, the 30-year-old plumber said the title was "not one to which I have ever aspired".

Mario will have run for 30 years and 2 days.

David Cameron said the jumping on mushrooms he had given was "truly humbling".

Dressed in blue dungarees with his trusty sidekick Yoshi at his side, Mario spoke briefly to the gathered crowds on the day he passes the record set by left bat in Pong.

Posted by

Tim Almond

at

13:54

0

comments

![]()

Labels: monarchy, video games

Full reserve banking - with a massive bloody loophole.

Having hopefully grasped the concept of banks 'splitting the zero', various people have proposed Full Reserve Banking, defined on Wiki as follows:

Full-reserve banking, also known as 100% reserve banking, refers to an alternative to fractional reserve banking in which banks are required to keep the full amount of each depositor's funds in cash, ready for immediate withdrawal on demand. Funds deposited by customers in demand deposit accounts (such as checking accounts) could not be loaned out by the bank because it would be legally required to retain the full deposit to satisfy potential demand for payments.

OK, that makes sense so far, banks would just be keepers and guardians of physical notes and organise transfers between people's current accounts.

Proposals for full reserve banking systems generally do not place such restrictions on deposits that are not payable on demand, for example time deposits or savings accounts.

Exactly, there's your massive bloody loophole which holes the whole thing under the waterline from the word 'go'.

--------------------------------------

So along comes our mortgage borrower, wants to borrow £100.

All the banks need to go back to the good old 'splitting the zero' is to persuade a few current account holders with £100 in the bank (literally) not earning any interest to transfer that money to a 'time deposit' or 'savings account' or 'investment account' (as Positive Money call it, page 8).

The banks then allocate £100 cash to the mortgage borrower, he withdraws it, gives it to his vendor, who puts in back in the bank. Clearly, the money would not physically move, but it's easier to imagine it if it does. And clearly, there is no need for physical money at all, whether the Bank of England gives you a bit of paper or records your cash electronically is neither here nor there.

To make it even easier than that, let us imagine that the original current account holders convert their investment accounts back into current accounts (having been paid a small commission for the few hours that their money was inaccessible), and the vendor converts his current account to an investment account.

At the end of the day, how does the bank's balance sheet look different?

The physical cash is exactly the same, but now they have:

- an additional asset (the mortgage i.e. future payments in from the borrower).

- an additional liability (the vendor's investment account).

The zero has been split and the status quo has been reinstated.

I've tried explaining this to Positive Money and others, but they flatly refuse to accept that there is a massive fucking huge great colossal flaw in their 'full reserve banking' plans which you can actually see from space.

"Oh well, yes, maybe, but we'll think up a few more rules and regulations to prevent banks doing this, yada yada yada."

Top tip: anybody who talks about banking and uses the word 'reserve' or 'reserves' without specifying whether he means on the asset side (i.e. spare physical cash) or on the liability side (retained profits) doesn't know what he is talking about.

Posted by

Mark Wadsworth

at

12:53

9

comments

![]()

Labels: Banking

Which?

The killing by an RAF drone of two UK citizens fighting with ISIS is:

(a) Extra judicial murder of two of its citizens, or

(b) An act of national defence against a real and present danger?

Posted by

Lola

at

10:13

3

comments

![]()

Tuesday, 8 September 2015

Fun Online Polls: Syrian refugees & Central heating

The results to last week's Fun Online Poll - on a good turnout of 102 - were as follows:

You're a Muslim fleeing the war zone in Syria or Iraq. What's the obvious destination?

Safer areas in Syria or Iraq - 20%

A neighbouring Muslim country 25%

A Muslim country which can be reached overland - 19%

North-west Europe, a society quite alien to you, via a highly risky journey across the Mediterranean 36%

Although the general perception is that they are all coming over here, those hundreds of thousands are just the tip of the iceberg and people on the ground are responding pretty much as you would expect.

Graeme left the following comment:

As far as I know, the numbers are:

Total refugees 12m

Refugees displaced within Syria 8m

Refugees in Turkey, Lebanon and Jordan 3.75m

Refugees in Europe 0.25m

Facts which could be used to justify a hardening of the European line: "if fleeing to Turkey etc is good enough for 98% of them, it must be good enough for the other 2%"; or it could be used to justify a softening: "oh, it's only a few of them who actually want to come here".

But these arguments are self-cancelling: if the line hardens, even fewer will try to come here, which then justifies a softening; if the line softens, more will try to come here, which will justify a hardening etc.

--------------------------------

Turning to more topical matters, have you turned on your central heating yet?

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

11:18

2

comments

![]()

Labels: central heating., FOP, Syria

Monday, 7 September 2015

Yes, banking really is that simple.

Link spotted by Lola in the DT comments, from the BoE semi-official blog:

Specifically, whenever a bank makes a new loan to a non-bank customer X, it creates a new loan entry in the name of customer X on the asset side of its balance sheet, and it simultaneously creates a new and equal-sized deposit entry, also in the name of customer X, on the liability side of its balance sheet.

The bank therefore creates its own funding, deposits, through lending. It does so through a pure bookkeeping transaction that involves no real resources, and that acquires its economic significance through the fact that bank deposits are any modern economy’s generally accepted medium of exchange.

You see, there is no mention of 'capital' or 'reserves' or any other such woolly non-scientific concepts. People who talk about these things don't even realise that they can be used to describe both assets or liabilities, depending on the context. Those two words are more or less meaningless. Most people don't realise - or even refuse to accept when told - that a company's share capital is on the liabilities side, not the assets side.

----------------------------------------------

Anyways, those paragraphs remind me a bit of what I posted four years ago:

A far simpler way of explaining banking... is to remind people what happens when you go to the bank to take out a personal loan for (say) £10,000.

Assuming you pass the credit checks etc, the bank creates two accounts for you - a deposit account and a loan account, and it simultaneously credits £10,000 to the deposit account and debits £10,000 from the loan account. No coins and notes change hands, nobody had to deposit money first, nothing, the banks just 'splits the zero'.

This is just how it works. People like Positive Money have their hearts in the right place, but they refuse to accept that this is inevitable, banks will easily be able to circumvent any fancy rule they can dream up.

End of.

Posted by

Mark Wadsworth

at

14:38

80

comments

![]()

Labels: Banking

"At last! British banks are FINALLY lending to small businesses"

From The Daily Mail:

According to Bank of England figures, small and medium-sized businesses received over £1.1billion in net lending from January to the end of June.

Net lending is the amount handed out to firms, minus the amount repaid.

Ho hum. How many small and medium-sized businesses are there? Half a million? That means on average £2,000 each.

From The Council of Mortgage Lenders:

Lending was particularly subdued at the beginning of the year, and was running at lower than expected levels. But in the second quarter it began to gain momentum. Our recently revised forecast predicts gross mortgage lending in 2015 will be £209 billion.

So for every £1 the banks lend to SMEs, they lend £99 to mortgage borrowers.

UPDATE: BFOD points out in the comments that the figures are not necessarily comparable because the former is net lending and the latter is gross lending. But if you look at a breakdown of total UK bank lending, it's about 80% residential mortgages, 10% commercial mortgages and the other 10% is split between credit cards, personal loans and proper SME lending (most of who are tenants).

Posted by

Mark Wadsworth

at

11:18

7

comments

![]()

Labels: banks

Saturday, 5 September 2015

Deadweight loss of excess inequality.

Posted by

benj

at

17:51

19

comments

![]()

Labels: deadweight cost, Economics, Inequality

The End of Working Tax Credits.

From the BBC:

... the income threshold for tax credits is to be reduced from £6,420 to £3,850. So, from April 2016, anyone earning more than £3,850 a year will have their Working Tax Credit reduced more steeply.

Sneaky!

Gordon Brown always used to boast that the Working Tax Credit was worth £x to the individual if he worked 30 hours a week, but that was always a lie - if you worked 30 hours, then your income was so far above the threshold of £6,420, most of that promised £x would be clawed back.

Boy George has just taken this twisted logic to extremes and extended it to the 16 hour credit as well (Gordon Brown and Boy George are very similar in many ways).

So here goes:

After April 2016, you work 16 hours a week, so you are notionally entitled to the basic amount of £1,960.

16 hours x 52 weeks x likely NMW £7.20 = £5,990

That is £2,140 over the £3,850 threshold, so your £1,960 is reduced by 41% of £2,140, i.e. down to £1,082. Under the old rules, you would have kept the full £1,960.

If you are on 30 hours a week, you are notionally entitled to the £810 extra WTC = £2,770

30 x 52 weeks x £7.20 = £11,232

£11,232 - £3,850 = £7,382. £7,382 x 415 = £3,027, so your notional entitlement of £2,770 will be reduced to zero. But you can bet that officially, the 30-hour credit will still exist.

If you earn a bit more than the NMW, about £10 an hour (which is still very low paid), then you get precisely nothing in WTC.

So as shit as the whole Tax Credits system was and is, this just increases overall marginal tax rates i.e. reduces the incentive to get a job. In other words, it makes it even shitter.

H/t @JMchools

Posted by

Mark Wadsworth

at

14:43

2

comments

![]()

Labels: working tax credits

Pretty Girl, Not Too Bright

From the Guardian

Emily Ratajkowski, the model and actor who became famous after starring in the video for Robin Thicke and Pharrell Williams’s controversial hit Blurred Lines in 2013, has called the video the “bane of my existence”.

In an interview with InStyle magazine the model, who has since won roles in Gone Girl and EDM flick We Are Your Friends, said whenever “anyone comes up to me about Blurred Lines, I’m like, ‘Are we seriously talking about a video from three years ago?’”

Posted by

Tim Almond

at

10:24

4

comments

![]()

Friday, 4 September 2015

There's a first and last time for everything.

I found myself in agreement with Richard Littlejohn. Weird feeling, but there you go.

This child's death was tragic but it was not our fault

The father told the Mail that the family were fleeing the war in Syria when the recklessly overloaded rubber dinghy capsized. Miraculously, he survived, although he couldn’t save his wife and two children.

But here’s what puzzles me. They’d been living in Turkey for the past year. So why didn’t he apply for asylum there? After all, surely culturally Syria has more in common with Turkey, another Muslim country, than with Tunbridge Wells or Trondheim.

I had to remind myself that I also agreed with a fair chunk of what Jeremy Corbyn said yesterday on the Sky debate to balance things out. I mean, at least Corbyn was saying something rather than just spewing out Labour-insider politico-gibberish like the other three.

Posted by

Mark Wadsworth

at

15:00

26

comments

![]()

Labels: Jeremy Corbyn, Richard Littlejohn

"Drug deaths in England and Wales reach record levels"

Shock horror from the BBC:

More than 3,300 people died from drug poisoning in 2014 in England and Wales, the highest figure since modern records began in 1993, the Office for National Statistics says...

A Department of Health spokeswoman said: "Although we are seeing fewer people year on year using heroin, in particular young people, any death related to drugs is a tragedy. Our drugs strategy is about helping people get off drugs and stay off them for good, and we will continue to help local authorities give tailored treatment to users."

Hang on one cotton pickin' moment, 3,300 deaths (assuming it to be ballpark accurate and over-reporting and under-reporting net off) is about one per cent of all deaths per year in England and Wales.

So assuming that rather more than one per cent of the population is a fairly regular drug user (the official estimate is 300,000 'opiate and crack cocaine users' plus as many again for other stuff), this means that the chance of a drug user dying is no different to a random person plucked from the population as a whole.

Admittedly, drug users are mainly in the 20 - 40 age bracket, so their chance of dying in any one year is higher than for other 20 - 40 year olds, because the average chance of dying is heavily skewed by old people. But it strikes me that drug users still have a pretty good chance of surviving.

If half a per cent of drug users die each year because of drugs (3,300 out of 640,000, let's say), then the chance of surviving a twenty year drug career is still pretty good i.e. ninety percent (=0.995^20).

Posted by

Mark Wadsworth

at

14:07

4

comments

![]()

Labels: Drugs, Maths, statistics

Thursday, 3 September 2015

Reader's Letter Of The Day

From The Evening Standard. The letter won't be viewable online for a couple of days, because for some reason it is updated two days in arrears, go figure, but here is the original text as submitted:

If Thames Water was allowed to charge what the market would bear, they would enjoy excessive profits of the scale that London developers, home sellers and landlords do now. Surely a compelling case for heavy taxation or regulation of these monopoly profits?

A Land Value Tax would deal with the problem most efficiently but rent controls and a massive council housing building drive would provide some relief for UK renters and homebuyers. We have the shameful honour of the worst value housing in the world, clearly the market is utterly broken.

Joe Momberg, Young Peoples Party

Posted by

Mark Wadsworth

at

21:19

11

comments

![]()

Labels: Land Value Tax, London, Monopoly

Fun with student numbers

From the BBC:

More than a million young people will be enrolling in universities in England and Germany this autumn. But in financial terms their experience couldn't be more different.

In Germany tuition fees have been abolished, while England has the most expensive fees in Europe, with every indication that they are likely to be allowed to nudge even higher...

In Germany, about 27% of young people gain higher education qualifications. In the UK, the comparable figure is 48%. The expansion in university entry in the UK has been one of those changes that has been so big that no one really notices.[wot?]

A report from the Chartered Institute of Personnel and Development last month claimed that more than half of graduates were overqualified for their jobs. In contrast, the institute said that only 10% of German graduates were in non-graduate jobs.

Same old, same old.

In either country, about one-quarter of jobs are "graduate jobs". So nearly all of the one-quarter of Germans who go to uni get graduate jobs; and about half of the one-half of Brits who go to uni get graduate jobs.

--------------------------------------

If you ask me, the German system makes more sense. The cost to the taxpayer ends up much the same whether you send one-quarter to uni for "free" or whether you send one-half to uni and impose a graduate tax aka tuition fees, and this was YPP policy anyway (there is nothing new under the sun).

The article does make the point that has been made here before (probably by The Stigler) that it might still be worthwhile going to uni, because it gives you the edge when applying for a non-graduate job, but this just pushes the problem onto somebody else (the non-graduates looking for non-graduate jobs).

I suppose the Germans can get away with it because their secondary education system is much more egalitarian, so everybody has a fairly equal chance of ending up at uni. If the UK did it, there would be squealing that the reduction in the number of student places disproportionately hits people from state schools.

The counter-argument to that is: so what? Some people get twelve years "free" state primary and secondary education; other people pay for those twelve years out of their own pockets and then get three years' "free" higher education. The former group probably still gets better value for money.

And also because German unemployment is lower, so there is less pressure to mask unemployment figure by getting a million or two young people off the books for three years.

Posted by

Mark Wadsworth

at

15:03

11

comments

![]()

Labels: Commonsense, Germany, jobs, Maths, UK, university

"Oil tankers swing round the Cape to create profit"

Emailed in by MBK from The Times:

It is a treacherous route that mariners thought they had seen the back of when the Suez Canal opened a century and a half ago, but low oil prices have made the trip from Asia to Europe via the Cape of Good Hope more attractive.

As the price of crude was sent lower again yesterday, research from Bloomberg showed that tankers have been making longer voyages to take advantage of market conditions. At least five have gone as far as avoiding the short-cut to Europe via Egypt, a diversion that adds 4,000 miles to the journey...