I was chatting to somebody recently who does hot-dog and coffee stands, beer tents and so on at fairs all over Europe. He told me he was negotiating for a pitch for a hot-dog stand near a tourist attraction in central London, but the rent they were going to charge him was hundreds of thousand pounds a year.

This seemed quite amazing, until we ran through the figures, and agreed if he can sell a thousand hot-dogs or cups of coffee a day, with a gross mark-up of £1 on each one, minus £30,000 for wages and payroll taxes, minus other overheads, he would probably still be left with a fair profit margin after paying the rent.

I didn't ask, but I assume that the pitch he was talking about belongs to the council, in which case they are acting like any other landlord and charging the highest rent they can get away with. But because the rent is a pure site rent, it is more like a licence-to-operate. If you look at it that way, you could say that it is an eighty or ninety per cent tax on his business profits. Maybe it is, but this is further evidence for my generalisation that rents and taxes are ultimately the same thing, or at least that there is a big overlap. The difference is, I suppose, that 'taxes' are paid to the government, and 'rents' are paid to landowners (including cases where the government is the landowner, as in this case).

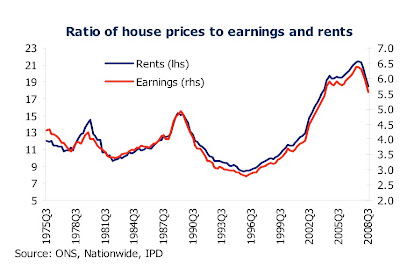

Selling hot-dogs is a nice simple business model, but let's now look at his employees, bearing in mind that unless the wages he pays cover their rent and other living costs, they won't work for him. They have to live somewhere within reasonable commuting distance. As we also know, rents rise (or fall) in line with average wages, or as the Nationwide express it, the house price/wage ratio changes in line with the house price/rent ratio:(click to enlarge): So if business picks up in an area - whether through the wise decisions of the local council, historical accident, a new airport being built or the sudden discovery of natural resources - then of course jobs will be created and wages will go up, but local property owners will benefit disproportionately. If they are landlords (and the first arrivals to take up the new jobs will of necessity be tenants, as they move the fastest), they will put up their rents; if they are home-owners, even if they have no direct income from the new industry, their homes will go up in value; if they are local farmers, they are now much more likely to get planning permission for new homes and make a windfall gain. The real bummer is for those tenants whose wages don't increase (because they have no involvement with the new growth industry) who see their rents rise as well - they are paying 'tax' on somebody else's income.

So if business picks up in an area - whether through the wise decisions of the local council, historical accident, a new airport being built or the sudden discovery of natural resources - then of course jobs will be created and wages will go up, but local property owners will benefit disproportionately. If they are landlords (and the first arrivals to take up the new jobs will of necessity be tenants, as they move the fastest), they will put up their rents; if they are home-owners, even if they have no direct income from the new industry, their homes will go up in value; if they are local farmers, they are now much more likely to get planning permission for new homes and make a windfall gain. The real bummer is for those tenants whose wages don't increase (because they have no involvement with the new growth industry) who see their rents rise as well - they are paying 'tax' on somebody else's income.

So 'rents' (on land and location values, as distinct from a fair return on the capital value of actual bricks and mortar) are just privatised taxes, really. And taxes are just the 'rent' that the government charges business for the licence to operate e.g. within the borders of the UK. So if you have a business that is renting its premises, and all its employees are tenants, it is paying two separate layers - taxes and rents.

The above may all seem blindingly obvious, once you think about it, but there seems to me to be only one reasonable conclusion that you can draw from it all ...

Saturday, 31 January 2009

A hot-dog vendor speaks

Posted by

Mark Wadsworth

at

20:30

9

comments

![]()

Labels: Land Value Tax, Rents, Ricardo's Law of Rent

"Nationalise private schools plans"

OK, the headline hams it up a bit, but it just goes to show why proper lefties love recessions - it gives them an excuse to go round nationalising, subsidising and regulating stuff, thus keeping everything permanently frozen in the whatever poor condition it happens to be in, thus locking us in to a permanent state of recession.

As to the issue of private schools, all I can say is "vouchers", that way many more, possibly most, parents would be able to afford it.

Posted by

Mark Wadsworth

at

10:53

2

comments

![]()

Labels: Education, Nationalisation, Vouchers

"Starlings perform aerial ballet"

This video is really cool. The soundtrack is rubbish though.

Posted by

Mark Wadsworth

at

10:48

1 comments

![]()

Friday, 30 January 2009

Shabbat shalom

Friday Evening Thought Number One:

Anon left the following comment in response to these poll results:

I am now approaching the end of my productive career, but that's OK, because I own the house outright, nobody can turn me out of it, and I can look forward - if that's the right phrase - to ending my days living here in peace. My modest pension will do OK for living expenses.

And now you want me to hand over to the state every year an arbitrary, unpredictable, but probably increasing percentage of an arbitrary "value" (which can only be some official's guess, since the house is unique and I'm not selling - until I'm forced to, to pay the tax)? A value over which I have no control and which will probably increase in numerical terms as the state debauches the currency. My modest pension, of course, will not rise in line with that debauchment, since I didn't used to work for said State. I'm screwed, aren't I?

OK, let's take a step back here. None but the most rabid faux-libertarians object to businesses and workers paying pensions towards those no longer able to work. Anon doesn't appear to be complaining about businesses or workers having to "hand over to the state every year an arbitrary, unpredictable, but probably increasing percentage of [turnover, incomes and profits]" to fund, inter alia, those pensions. But in turn, many people in the UK aged forty or under can't afford to buy; or could only afford to buy a home that is nowhere near big to raise a family; or may now be saddled with negative equity and thus prevented from 'trading up' to a larger property once prices have bottomed out.

Is it really morally unacceptable for such redistribution to go in both directions? Firstly from businesses and workers to those no longer able to work; but also by levying a modest charge - say one per cent of current market values per annum* - from those who own land and property (standing at a huge gain if owned for more than two decades because of artificial scarcity of building land) to those who have been priced out?

-------------------------------------------------

If that's too deep, here's Friday Evening Thought Number Two. Does this count as evidence of Global Cooling?

* Remembering that I have always said that a progressive property tax or land value tax could and should replace all existing property or wealth related taxes, such as Council Tax, Stamp Duty Land Tax, Inheritance Tax etc on an approximately fiscally neutral basis such that there would be few winners or losers; and further that pensioners would be allowed to 'roll up' the tax to be repaid out of their estates and, in case Sobers is reading, that farmland would be exempted as a quid pro quo for scrapping agricultural land subsidies.

Posted by

Mark Wadsworth

at

19:07

22

comments

![]()

Labels: Global cooling, Paris Hilton, Pensions, Progressive Property Tax, Taxation, Tits, Welfare reform

Be careful what you wish for ...

Via Socialist Appeal:

URGENT: Two workers killed while defending the occupied Mitsubitshi factory

In the afternoon of Wednesday, January 29, two workers were killed by police ... The workers killed are Pedro Suarez from the Mitsubishi factory and José Marcano from nearby auto parts factory Macusa. They were killed when regional police of Anzoategui was attempting to evict hundreds of workers who had been occupying the Mitsubitshi (MMC) factory.

Now, guess in which hell-hole of a South American dictatorship this happened...

Highlight between the dotted lines for the answer:

---------------------------------

Yup, that Socialist Paradise Venezuela.

---------------------------------

Posted by

Mark Wadsworth

at

16:29

2

comments

![]()

Labels: crime, Dictatorships, Hugo Chavez, Police state, Trade Unions, Venezuela

Learning the lessons of The Great Depression

It appears to be broadly agreed that one of the things that deepened and lengthened The Great Depression was protectionism, in particular by the USA, although I am sure many other countries were just as guilty.

It's good to see that they've learned that lesson ... oh, sorry, I meant forgotten.

Posted by

Mark Wadsworth

at

13:26

1 comments

![]()

Labels: Economics, Free trade, Great Depression, Obama, Protectionism, Recession

Búsquedas profundamente de satisfacción de Google

Posted by

Mark Wadsworth

at

12:30

0

comments

![]()

Labels: Blogging, Bottoms, Serena Williams, Spain

That's strange - the BBC appear to have 'overlooked' this one ...

The BBC doesn't show up on a Google search for "jack straw" saudi donation BBC, but The Telegraph does:

Jack Straw, the Justice Secretary, is facing an inquiry over an allegedly illegal donation to his campaign fund from a company backed by Saudi property developers.

The Electoral Commission has received a complaint over the £2,000 gift from Westminster International Consultants (WIC), a shell company which has never traded in the UK. Electoral law states that MPs must not accept donations from non-trading companies. The money from WIC was paid to the constituency Labour party in Mr Straw's Blackburn seat on the same day it received a £3,000 donation from Lord Taylor, the peer at the centre of the "cash for amendments" row.

Mr Straw could now be forced to pay back the money and apologise to parliament if the Electoral Commission decides he was guilty of breaking the rules. The only donors to the Cabinet minister's 2005 election campaign were Lord Taylor, WIC and a third man, Arif Patel, who runs a clothing firm in Preston. Mr Patel, who donated £2,000, is currently the subject of an ongoing police and customs investigation into an alleged multi-million pound VAT and counterfeit goods fraud...

No doubt the BBC will pick up the story soon ..?

UPDATE My bad, the BBC explained that this was all just an innocent mix-up with cheque books yesterday.

Posted by

Mark Wadsworth

at

10:10

2

comments

![]()

Labels: BBC, Corruption, Electoral Commission, Jack Straw MP, Labour, Nulab

Separated at birth?

Posted by

Mark Wadsworth

at

00:37

2

comments

![]()

Labels: Jo Swinson, Lib Dems, Sarah Teather MP, Tits

Thursday, 29 January 2009

What a difference a year makes ...

Crown has a look at The Nationwide's forecasts for 2007:

Leave comments over at his.

Posted by

Mark Wadsworth

at

21:38

![]()

Labels: house price crash, Nationwide, statistics

Fionnuala: lost in time and space?

The Nationwide's 'Chief Economist' Fionnuala Early has kept us all entertained over the past year with her Time Travel Adventures, whereby each month's house price statistics contained the pat phrase "But house prices are still £x higher than they were y years ago", whereby x was an ever decreasing figure and/or y an ever larger one.

The Nationwide's January figures show that either the time machine has broken down or Fionnuala has simply disappeared into the ether...

Commenting on the figures Martin Gahbauer, Nationwide's Senior Economist, said "The price of a typical house fell by a further 1.3% in January, as the deepening economic recession and financial market turbulence continued to weigh on housing market sentiment and activity. January’s decline leaves the average price of a typical house at £150,501, down 16.6% from 12 months ago. The 3-month on 3-month rate of change, a smoother indicator of the short-term trend in prices, improved for the fourth consecutive month from -4.2% in December to -4.0% in January. However, it is too early to say that this marks the start of a sustained improvement in the short term trend."

Or possibly that it's just too embarassing to admit that the average price - currently given as £150,501 - will be lower than the price of five years earlier (£145,918 in April 2004) by April 2009, assuming that the next three months see prices fall by a further 4%?

Posted by

Mark Wadsworth

at

13:11

7

comments

![]()

Labels: house price crash, Humour, Nationwide, Time travel

Stupid reader's letter of the day

From The FT:

Sir,

What is the similarity between the current financial crisis and a volcano? The answer is the shape of the graph of activity levels leading up to the main event. It shows a long period of deceptive calm followed by a dramatic eruption, up or down, depending on which event is being plotted.

The main interest in both cases is to predict when the big event will happen, and it is clear that with regard to the economy, conventional statistical and economic analyses failed us almost completely. Although many analysts predicted a crisis, nobody correctly predicted the timing*.

As with the volcano, where the relevant metric is the pressure building up out of sight underground, the issue with the economic crisis must have been pressures building up, out of sight, elsewhere in the economy. With the benefit of hindsight, we can now see that we were looking at the wrong variables, as these "underground" metrics were literally invisible**.

A big prize surely awaits the identifier of these pressures and a definitive explanation of why the timing was as it turned out to be. I am surprised that it seems few attempts have been made to probe further than simply blaming irresponsible bankers and sub-prime loans, as these went on for years and do not explain the timing of the crisis.

More serious work is urgently needed by economists and statisticians if they are to remain trusted advisers. Please get to it.

Peter Vos, Littlehampton, West Sussex, UK.

* Er ... Fred Harrison predicted the 1989 and 2007 crashes/recessions many years in advance, see his Moneyweek article from August 2005, for example. As did many other Land Value Taxers, for that matter. Why do you think I sold all my investment properties and my own home in the years leading to December 2007?

** "these 'underground' metrics were literally invisible"? Wot? Rising house and commercial property prices are very well documented and have been constantly in the headlines for the past eight years or so. It's not "underground" that we need to look, it's under our noses. Or under our feet, depending on your point of view.

Posted by

Mark Wadsworth

at

09:57

10

comments

![]()

Labels: Economics, Fred Harrison, Land Value Tax, Recession, statistics

Wednesday, 28 January 2009

Fun Online Poll: Interim results

I have an uphill struggle whichever way I look. According to the FT's coverage of research published by the National Centre for Social Research... "for the first time since 1984, more people wanted taxes and spending ... to be left broadly where they were, rather than seeking an increase... it still showed little support for a big programme of retrenchment. Only 7 per cent favoured cutting taxes and reducing spending on these core areas of the welfare state [health, education and other public services]."

I am certainly among the 7 per cent who'd like to see taxes cut, but there is no need to reduce spending on genuine welfare or public services - we can just cut out the twenty per cent of tax revenues that the government wastes on an army of quangocrats, as Lola explains, but let's put that to one side for the moment.

Government spending has to be met, by and large, out of tax revenues. And the ultimate source of those revenues, or indeed all wealth, is the productive economy, which some try to sub-classify into "enterprise", "labour" or "investment", which is nonsense of course. How those three groups arrange their respective shares is best left to the markets and a tax system that tries to encourage one sub-category at the expense of another is on a hiding to nothing. Taking them as a whole, the tax burden thereon is far too high - even worse, the rates at which different sources of income are taxed range between "acceptable" and "punitive", which gives us yet more distortions.

But because of the British mentality, home-ownership is somehow seen as the ultimate goal, a one-way route to security and wealth, to be taxed as lightly as possible and subsidised wherever possible. This dream is being unveiled, yet again, as a massive Ponzi scheme fuelled by a giant debt bubble and dragging a Depression behind it - one of Fred Harrison's Forgotten Knowns. The mere suggestion that all existing property and wealth related taxes be replaced with a flat rate tax on property values, or even better, site-only location values has earned me a lot of grief, especially from the faux-libertarians (but I suppose I asked for it).

However, every now and then I see light at the end of the tunnel. The results of my Fun Online Poll so far are as follows:

--------------------------------------

For a given level of taxation (the lower the better, obviously), would you prefer:

Low and stable house prices; lower taxes on incomes; and a steadily growing economy? - 87%

Wildly fluctuating house prices; higher taxes on incomes; and a boom-bubble-bust economy? - 13%

--------------------------------------

Maybe it's an inter-generational thing? An average tenant would always prefer higher property taxes and lower taxes on income/production, because although this does not reduce his total rent (it might even increase it slightly), it sure as heck increases his net income. The same goes for a potential first time buyer. As we know, interest rate changes do not benefit or hurt the potential FTB, because he is competing with other FTB's with similar budget constraints. All gains/losses from interest rate cuts/increases accrue directly to existing mortgage borrowers and especially vendors.

Similarly, a replacement tax that averages out at 1.5% of total property values would act like a higher interest rate, that's all - the vendor loses out (unless he was going to buy himself a new house with the proceeds); the FTB benefits (lower mortgage costs and a reduction in other taxes) and existing home-owners are largely indifferent to the change (on a cash flow basis). By how many per cent are typical SVR's going to increase over the next decade? I have no idea, but an increase of 1.5% cannot be ruled out.

But once somebody is "on the ladder", that's it - they go over to The Dark Side. Their next instinct is to pull up the ladder - and all major political parties pander to this. The result is a shift in taxation from property back to incomes/production; this leads to a one-off increase in capital property values and the illusion of wealth, but without any real increase is the 'enjoyment value' that people get from their homes. More invidiously, the increase in taxes on the productive economy acts as a slight drag on the economy, which, as the Labour experiment showed, can be masked for a decade by the illusion of wealth that rising house prices bring.

Here endeth.

Posted by

Mark Wadsworth

at

21:00

12

comments

![]()

Labels: Economics, Land Value Tax, Simplification, Taxation

"Boosting credit"

The government is now seriously considering lending people money (directly or indirectly) they don't have to buy cars they don't need (presumably to impress people they don't like).

The key phrase is here: "Business Secretary Lord Mandelson said work to boost credit had begun ..."

*sigh*

You can't just go round 'boosting credit'. You have to imagine the economy as a series of ever smaller concentric circles, or a cone built up therewith:

1. The biggest circle is "the economy" i.e. people specialising and exchanging goods and services. This happens in the most straitened circumstances, e.g. smuggling and black market during wartime, even when there's no 'confidence' or trust in your counter-party, basically a barter economy.

2. Once things settle down, there is a smaller circle called "trust" or "confidence" where people exchange goods and services on tick, or for "credit" or a tradesman takes on an apprentice and trains him up - this wouldn't happen without a reasonable degree of faith in the future - that the customer pays up or that the investment in the apprentice pays off.

3. To oil the wheels of barter economy, we have another smaller circle, this fine thing called 'money', a measure of (relative) value, a medium of exchange and a store of value. It is a way of measuring the trust that we have in each other, or indeed the soundness of the money itself. If I agree to mow your lawn (a service worth £10) on the promise that you'll baby sit my kids next week (another service also worth £10) that is a form of "money" - it measures our relative indebtedness to each other. Whether you give me a tenner this week and I give you it back next week is irrelevant.

4. The next smaller circle within "money" is "money deposited with banks" which banks lend out to homebuyers and businesses to be repaid out of their future income. The depositor has to trust the banks; the banks have to trust the borrower; and the borrower has to have faith in his own future earnings capacity

5. Within the tiny circle "money deposited with banks" there is an even smaller circle called "money lent to borrowers" and so on.

6. Right in the middle of all this is a minuscule circle called "numbers on bits of paper" which have precious little to do with anything, this teeny tiny sub-sub-sub-circle represents a tiny tip of the giant cone called "the economy"

Mucking about with numbers on bits of paper achieves nothing if the bigger circles (the economy, trust, confidence etc) are shrinking. Giving people government-backed loans to buy cars just ain't going to work. Most car companies have been offering cars on credit at low interest rates for years, that all worked fine as long as people were still labouring under the illusion that the economy was doing fine, but not now and not for the foreseeable future. The only thing that might get those cars shifted is massive price cuts, maybe 50% off list price or something.

It's like standing in your front room, blowing up a balloon and expecting your whole house to expand as a result. It doesn't - it just takes air out of your living room and into the balloon. If your house is collapsing, it won't make any difference.

*/sigh*

Posted by

Mark Wadsworth

at

15:43

14

comments

![]()

Labels: Cars, Economics, Finance, Fuckwits, Peter Mandelson, Subsidies

Fakecharity, Blulabour miss the point

The BBC informs us that Childcare fees continue to rise. "Many parents in Britain are paying in excess of £8,000 a year for a full-time nursery place, a survey suggests", which is probably factually correct.

What strikes me is that £8,000 (which is on the high side, see comment from Beverley Hughes, below) is more than typical school fees at better-value private schools. So, if parents can afford to pay for nursery places, is it unreasonable to assume that most of them could also afford to pay for private schools?

As I have discussed before, there are loads of overlapping schemes to subsidise nursery care, which average out at about £70 per child per week (which is what makes nursery places affordable for most). To save all the admin and faff and distortions, I think they should be replaced with flat rate vouchers of £70 per child per week, but hey.

To summarise, the vouchers system 'works' for private nurseries (although with flat rate vouchers it would work much better). The obvious conclusion is that we could replace the whole State education system with vouchers as well - £3,500 per child per year seems a good place to start, which would halve the cost to the taxpayer - the education budget plus Teachers' Pensions is about £70 billion and there are ten million school age kids in the UK. That's a handsome £1,000 tax cut for each taxpayer, so a working couple would have £2,000 a year extra to pay towards the cost of nurseries or school places.

That's how we see things on Planet Wadsworth.

-------------------------------------------------------

But what does the BBC do? They turn straight to fakecharity number 327279 The Daycare Trust. Their spokeswoman spouts the inevitable:

"It is crucial that parents claim all the help they are entitled to, and that the government increase the free childcare entitlement to include all two-years-olds. The current review of tax credits should increase the maximum proportion of childcare costs the poorest parents can claim from 80% to 100%."

A quick glance at Note 3 to their accounts shows that they receive £600,000 a year from The Department for Children, Schools and Families for 'Policy, research and other projects'. They can get their policies for free from this 'blog. What do they do with the rest of it?

------------------------------------------------------

Bizarrely, Nulabour Children's Minister Beverley Hughes seems to more up to speed than her Blulabour counterpart.

Beverly Hughes points out "the survey was based on parents requiring 50 hours of childcare all year round for under-fives, which was "more than most parents take up or want" [and] the survey did not acknowledge the tax credit system for working parents or childcare vouchers offered through employers. The early years grants, available for children in the term after their third birthday, was also ignored...".

You might expect Blulabour to favour vouchers, but no, they just want more complications and more means-testing ....

Shadow families minister Maria Miller said: "The government must do more to make sure more families who are eligible for childcare support through the tax credit system actually receive it. At the moment, the system is overly complicated and that means only one in four families who are eligible are actually claiming the credit."

------------------------------------------------------

UPDATE. Re NC's comment that regulations are driving up prices. Nulab love regulations as it creates jobs for The Righteous. There's very little need for this of course - when you choose a school or a nursery, you talk mainly to other parents about experiences they've had - as long as your child sets off happily and comes back happily, the nursery is probably doing the right thing. Further, if a nursery were involved in some gross negligence, it would be all over the newspapers and people would take their children elsewhere, so simple information sharing makes most regulations unnecesary.

But the real force for increasing regulation is economics. The nursery cartel likes subsidies of course, because it enables them to put up prices. However, in the absence of barriers to entry/restrictions on supply, these super-profits would be competed away by new entrants. So for existing murseries to benefit disproportionately, they need subsidies AND barriers to entry, which they cunningly dress up as being "for the chi-i-ildren".

Posted by

Mark Wadsworth

at

11:13

16

comments

![]()

Labels: Commonsense, Economics, Fuel vouchers, Nurseries, Quangocracy, Subsidies

Tuesday, 27 January 2009

Set the controls for the heart of the sun!

I reckon that this is the week that a recession was finally tipped over - quite wilfully - into a Depression. Replacing a lunatic corporatist US President with a lunatic socialist/protectionist US President would have been bad enough, but the last straw is the bail-out for UK car manufacturers.

This story contains just about everything I've ever railed against:

1. "The package includes a scheme to unlock £1.3bn of loans from Europe for car manufacturers and major suppliers."

It's not from 'Europe', it's from the European Investment Bank, an arm of the EU. I'm a Ukipper, 'nuff said.

2. "... the government would also guarantee up to £1bn of further loans."

That's a hiding to nothing, as I explained here.

3. But shadow business secretary Ken Clarke said the European loans were announced last year and called the whole package "pretty small beer ... I'm slightly disappointed..." the Tories had suggested loan guarantees for the finance arms of car companies in November. "Here we are months later and during that time sales of cars in this country have dropped by half whilst the government dithers," he told MPs.

And he said on the "key subject" of getting people who could afford it credit to buy cars - the government had only said it was "looking at steps" to address it.

Nulabour, Blulabour - can't we at least have the choice between a Big Government party which wants to nationalise everything and a small government party which doesn't? As I said before Xmas, "each party promises something more generous than whatever it was that the other party just promised, at the moment, government guarantees for such lending are top of the agenda." When I suggested that instead of just trying to prop up the housing market, why not do new car sales, I was being ironic, FFS.

4. He said the measures would boost the industry and lay "the foundations of its reinvention for a low carbon future". They include ... another £1bn in loans to fund investment in green-friendly vehicles. Regional development agencies and the Technology Strategy Board are to be invited to bring forward new research and development programmes into cleaner engines, lighter cars and "plug-in hybrids".

Ah, nice to see a couple of quangoes jumping on board. Again, as I said at point 5 here "Once The Quangocracy and The Righteous realise all this, they will ask 'Why should the banks lend money to young Arthur Simmonds with his climate-change-causing-car repair workshop? We think that the banks should lend to The Malcolm and Cressida Ethical Living Awareness Project.' That way lies chaos."

5. ... he said there would be "no blank cheque" and any schemes supported had to provide jobs, develop new technology and processes for the long term and provide value for money.

There, there dear. I'm sure that's what they said when the nationalised the constituent parts of British Leyland.

6. "Unite general secretary Derek Simpson told the BBC he was pleased the government had made a start in helping the car industry but questioned whether the loans would be enough."

That's another euphemism that annoys me - 'helping' instead of 'giving money to'. And The Unholy Trinity of trade unions, government and rent-seekers are gathering ...

7. "Friends of the Earth welcomed the announcement but said more needed to be done to make sure the car industry was building cars that used less fuel - and providing incentives for people to buy them."

Hurrah! Not just quangoes, but a fake charity (TM Devil's Kitchen) jumping on board.

Let's just do a bit of rough arithmetic. Prior to the downturn, people replaced their cars every ten years. About 30% of total pollution relates to the manufacture of a new car and the disposal of the old one, and 70% to petrol/diesel use. So that's 30 pollution-units ('PUs') to replace, and 7 PUs to run it per year (total one hundred PUs). In a downturn (like now) you could quite reasonably expect cars to be run for twenty years, not ten. So over the next ten years, that creates 70 PUs. If we are forced to replace a car, cost 30 PUs, the number of PUs emitted over the next ten years would have to be rather less than 4 per year if there is to be any reduction in PUs, or if your current car does 28 mpg, your new car would have to do at least 40 mpg for the next ten years for there to be an overall reduction. It is quite conceivable that Friends of The Earth are indirectly sponsored by European car manufacturers who make such economical cars, is it not?

8. Finally, isn't this all about preventing job losses? As this fine Readers' letter of the day pointed out ...

It doesn't take an econometric model to conclude that transferring wealth from the productive to the unproductive sector results in a negative-sum game. For every 10,000 jobs saved in the car industry, it is likely that 20,000 to 30,000 jobs will be destroyed in the sectors that are forced to pay for the bail-out.

Specifically, those jobs will be lost - or never created - in car repair workshops up and down the land who would have kept our motors going for twenty rather than ten years. If and when car manufacturing picks up, then they'd have a ready pool of skills, and so on, back and forth.

Posted by

Mark Wadsworth

at

21:04

14

comments

![]()

Labels: Bastards, Cars, Economics, EU, Friends of the Earth, Global cooling, Maths, Peter Mandelson, Quangocracy, Subsidies, Trade Unions, Waste

Enviro-Nazis of the week

'Unstoppable' climate change will last 1,000 years

Hmm. Where have I heard that before ..?

Posted by

Mark Wadsworth

at

16:37

9

comments

![]()

Labels: Fascists, Global cooling

Non-existent problem, misleading headline, made up statistics, biased reporting, fake charities ...

This article in The Metro has got the lot...

Cheap booze blamed as alcohol deaths double in 18 years

Non-existent problem, misleading headline? Check! As the article explains, "The rapid rise in deaths which can be directly attributed to drinking too much has levelled out since the early 1990s but levels are still higher than they were just less than two decades ago, researchers have found."

"The average death rate for men has rocketed from 9.1 per 100,000 people in 1991 to 18.1 in 2007 while the female rate has risen from 5.0 per 100,000 to 8.7."

Biased reporting? Check! As the article explains "In 2007 8,724 people died as a result of alcohol, fewer than in 2006 but more than the 4,144 in 1991." So out of over half a million deaths per year in the UK, a bit more than one per cent are alcohol-related.

" ... more than a third of adults drank more than the recommended daily alcohol limit in the week before they were interviewed for the ONS General Household Survey 2007."

Made up statistics? Check! What they omit to mention is that a third of adults had drunk more than the (ridiculously low) daily limit ... on one occasion in the previous week.

"Don Shenker, Chief Executive of Alcohol Concern, said ... Alison Rogers, Chief Executive of the British Liver Trust said ..."

Fake charities? Check! I've covered Alcohol Concern before (click label for details), The BLT* is new to me, yup, it's fake charity number 298858.

From page 8 of their annual report ...

"Over the past year, we have started to build a better income stream from the pharmaceutical industry, but had a very disappointing response from the alcohol industry, with the admirable exception of Diageo who gave us £7,500 for our Alcohol and liver disease publication, but who otherwise point us to the Drinkaware Trust**. The Drinkaware Trust gave us just £1,800 in the year.

News from the Department of Health (DH) was bleak in that our grant requests for around £250,000 of support for work on alcohol, blood borne viruses and cancer translated into an offer of £18,000..."

That's a downright lie of course. Note 3 on page 18 says:

"Two Department of Health Section 64 grants are receivable: £40,000 for core activities and £50,000 restricted for the purpose of running the hepatitis C and liver disease helpline."

* Cue Dearieme with the "Bacon, lettuce, tomato" joke.

** Oh God, it just never stops - The Drinkaware Trust is fake charity number 1094586.

Posted by

Mark Wadsworth

at

11:54

0

comments

![]()

Labels: Alcohol, Alcohol Concern, Bansturbation, British Liver Trust, Quangocracy, statistics

Comment of the day

Worried Londonder: Surely it's not that cold!

Posted by

Mark Wadsworth

at

10:43

1 comments

![]()

Labels: Global cooling, Humour

Monday, 26 January 2009

Fun Online Poll: Indecisive

On a high turnout of over four hundred votes in a day, there's no clear overall picture. I also forgot to include the cop-out answer "Never! House prices only ever go up!" which might invalidate the results to the question...

By when will the Nationwide's UK average house price index have fallen below its level of five years earlier?

Results:

March 2009 - 23%

April 2009 - 23%

May 2009 - 19%

June 2009 - 12%

July 2009 - 23%

FWIW, my money's on April 2009.

This week's Fun Online Poll Why do turkeys keep voting for Xmas?

Posted by

Mark Wadsworth

at

22:55

0

comments

![]()

Labels: house price crash, Taxation

What can possibly go wrong? (2)

Obnoxio assesses the impact of The EU Council Decision of 20 January 2009 on the establishment of the European Criminal Records Information System (ECRIS) in application of Article 11 of Framework Decision 2008/…/JHA*

* I hope this isn't a spoof or something.

Posted by

Mark Wadsworth

at

17:04

39

comments

![]()

Labels: Authoritarianism, crime, Data protection, EU, Surveillance society, Totalitarianism

What can possibly go wrong?

From The Metro:

400,000 to access children's data

Posted by

Mark Wadsworth

at

15:15

4

comments

![]()

Labels: Data protection, Surveillance society

You can't lose what you no longer have

I have explained often enough that the banks can only be fixed via debt-for-equity swaps (and not by throwing good taxpayers' money after bad aka 'bail out'), whether explicit or implicit, e.g. here.

Detractors say that this would be robbing bondholders, which is nonsense of course - it's a free market solution. You've got to remember that bondholders have already lost a lot of money via the lousy investment decisions of the banks that raised money this way. As ever, 'the markets' have already predicted the likely losses to date, as the FT explains:

The selling pressure [on bank bonds] began to increase late last week as bank stocks started to tumble, but it was not until Tuesday’s meeting between banks, investors, the Treasury, the Bank of England and the Financial Services Authority failed to produce any guidance that the rout really got under way.

Tier one bonds from Royal Bank of Scotland have been hardest hit, falling to less than 10 pence in the pound, but most other UK banks’ outstanding tier one notes now trade at well below half their face value. Most worrying for the market was the performance of the new Lloyds tier one, which began trading on Monday at face value of 100p and have already dropped to just 52p in the pound for the sterling issue with the shortest potential maturity.

OK, 'Tier one' is a technical term for those bonds that rank second-to-last in the order of priority of repayment, just above share capital, but a debt-for-equity swap that gave them shares worth 10p or 52p in the £1 respectively would merely be recognising market realities.

Posted by

Mark Wadsworth

at

14:00

0

comments

![]()

Labels: Credit crunch, Debt for equity swaps, Finance

Readers' letters of the day

From The FT:

Sir,

On a recent visit to the Babylon exhibition at the British Museum my elderly mother and I were stopped by a Metropolitan Police community support officer, who demanded my identity, home address and other personal details. The officer warned that I could not refuse to provide this information, according to section 44 of the Terrorism Act 2000.

I asked the reason for this "stop and account". She told me it was to deter potential terrorists near an “iconic target”. I wonder how the names and addresses of middle-aged males accompanying their mothers to the museum would help the west win the war on terror.

Prof. Alfredo Saad Filho, University of London, London, UK.

And from The Metro:

Would it be possible to provide free sick bags with future copies of Metro? Mainly because if I have to endure yet another grovelling, adoring and sycophantic article or letter concerning how supremely wonderful, handsome, awe-inspiring and all round God-like Barack Obama is, I will be in real danger of emptying my breakfast on to the good people riding my train.

It's time to get a grip, everyone.

Oliver, London, UK.

Posted by

Mark Wadsworth

at

10:13

7

comments

![]()

Labels: Authoritarianism, Obama, Police state, Surveillance society, Terrorism

Sunday, 25 January 2009

Fun Online Poll: By when will the Nationwide's UK average house price index have fallen below its level of five years earlier?

As background, The Nationwide reported that the average UK house price in December 2008 was £153,048.

Over the period March to July 2004, it rose from £142,584 to £154,299. I can't wait for the first headline reporting that "House prices are now lower than they were five years ago", but can we guess correctly when that will happen?

Cast your vote here.

Oops, with the benefit of hindsight, I should have added the cop-out option "Never! House prices only go up!". Ah well.

Posted by

Mark Wadsworth

at

21:13

6

comments

![]()

Labels: house price crash, Humour, Maths, statistics

Fun Online Poll Results: Who's your favourite celebrity Kate?

The outright winner with 36% of the votes was "Never heard of any of them".

In honourable second place with 21% of the votes was Kate Beckinsale, whose Dad was on telly in the 1970s and who has starred in few sort-of-OK-ish films. She looks like this:

Also rans:

Kate Moss - 14%

Kate Winslett - 13%

Kate Silverton - 7%

Kate Hudson - 4%

Kate Middleton - 3%

Kate Perry - 3%

This week's Fun Online Poll - By when will the Nationwide's UK average house price index have fallen below its level of five years earlier?

Posted by

Mark Wadsworth

at

16:54

1 comments

![]()

Labels: Films, Kate Beckinsale

"Revealed: Labour lords change laws for cash"

This article in The Sunday Times is well worth a read. It does what it says on the tin.

Via Christina Speight.

Posted by

Mark Wadsworth

at

09:26

2

comments

![]()

Labels: Corruption, Labour

Saturday, 24 January 2009

How come he's allowed to say this? (2)

Relatively right-wing economist Patrick Minford came up with his own suggestions for a flat-tax system a few years ago. As a simplification campaigner, there was a lot I liked about this. What stands out are these bits...

---------------------------

A UK flat tax on consumption would bring the imputed rent on owner-occupied housing into the tax base and would allow the standard rate of income tax to be cut cautiously to a 15% flat tax rate ...

There will plainly be an immediate loss of revenue from the cut in the top rate from 40% to the standard rate of 22%. According to the standard 2005/6 tax ready reckoner, the cost of this would be £21 billion, about 2% of GDP... However there would be large offsetting gains in revenue from bringing imputed owner-occupied housing into the tax base...

In politics there is a well-respected principle: for any reform to succeed, there should as few losers as possible. The overall cut in taxation proposed here implies an absence of any major class of losers – the vast majority of those who lose from paying tax on owner-occupied housing ... will benefit more from the cuts in tax rates. However inevitably there will be some individuals for whom there is a serious loss; notably anyone (probably retired) who has a valuable house (bought out of taxed income) but with a small current income. To avoid injustice to these people, an indefinite transitional provision is proposed ...

---------------------------

Many minor technical quibbles aside, how is this any different to what I say? A low flat tax on incomes/production is better than what we've got, that goes without saying.

He suggested extending the flat tax on "the imputed rent of owner-occupied housing" (which mathematically amounts to around 1.5% per annum on the value of owner-occupied housing) in order to a) broaden the base and hence reduce the rate and b) to avoid the accusation that it was a 'rich giveaway'.

I have often suggested replacing all existing property and wealth-related taxes with a flat property value tax or land value tax that mathematically amounts to around 1.5% per annum on the value of owner-occupied housing, with a roll-up option for pensioners, obviously.

Answers on a postcard...

Posted by

Mark Wadsworth

at

16:11

5

comments

![]()

Labels: Flat Tax, Land Value Tax, Simplification

How come he's allowed to say this? (1)

The Goblin King has given us yet more evidence, were it needed, of his complete lack of grasp of economics, history or anything else with this outburst:

"Every recession in the last 60 years in Britain has been caused by inflation, domestically generated, caused by wages getting out of control on some occasions, by interest rates having to rise," Mr Brown told BBC Radio 4's Today programme, "This is a completely different type of event, as everyone recognises. This results from a global banking crisis. So America's already in recession. Germany's been in recession for some time. The euro area is in recession. It's a global financial crisis caused by irresponsible lending practices."

Nope, it's much simpler than that. In the UK we have house price booms (with the corresponding illusion of wealth and economic growth) followed by inevitable house price busts (with the corresponding recession, where we realise it was all built on sand). Where it's different this time is that this was a global credit bubble and a global property price bubble (rather than specific to the UK), er, a bit like 1929...

I've said this before, on ConHome (point 2 here), on this 'blog and to anybody else who cares to listen. Countless others have said it before me, Ricardo, the Austrian School, you name it.

To cap it all, if The Goblin King is correct that inflation causes recessions (rather than being a symptom of something else), why on earth is he now insisting that printing money, aka 'quantitative easing', will fix anything?

Posted by

Mark Wadsworth

at

11:52

8

comments

![]()

Labels: Credit crunch, Economics, Gordon Brown, house price crash, Quantitative easing, The Goblin King

Friday, 23 January 2009

"1.5m cheated out of minimum wage"

From The Metro:

More than 1.5 million workers are being "cheated" out of the national minimum wage by dishonest employers, with hairdressers, hotel and bar staff most likely to suffer, according to new research.

The TUC said workers across the country are still taking home less than the legal minimum wage because of rogue employers who were paying below the adult rate of £5.73 an hour...

Woah! Hold it right there!

People on income support or jobseeker's allowance who work a few hours a week have a "take home pay" of precisely £0.00 as their benefits are reduced by £1 for every £1 earned.

If they work enough hours at £5.73 an hour to qualify for Working Tax Credits, their "take home pay" is £1.72, because 31% gets taken away as tax and 39% in WTC withdrawal.

Why do the lefties never mention this?

The DWP's TBMT (Table 1.1 b) shows that a single person over 25 who earns £185 per week pays roughly the same in PAYE as he or she can claim in WTC.

What is the point?*

Here's an idea: how about reducing the income withdrawal rate for income support to the same as the basic rate of PAYE (31%). It then wouldn't be tapered to nil until you reached weekly earnings of £194. There'd be no need for a separate system of means-testing either, as claimants would just be given a BR tax code, i.e. no personal allowance. That way we wouldn't need all the faff of WTC - it could just be scrapped. And for those not claiming benefits, why not give them a personal allowance of £185 or £194 a week as well, which is just under £10,000 a year?

So even if their boss cut a few corners and paid only £4 an hour, the true "take home pay" for income support claimants would be £2.76 per hour (better than what they've got now and without the faff) and for non-claimants, take home pay would be £4 an hour, a shade more than £5.73 minus PAYE.

* BQ answers that in the comments.

Posted by

Mark Wadsworth

at

17:14

5

comments

![]()

Labels: Brendan Barber, Citizens Income, Economics, Fuckwits, liars, TUC, Welfare reform

Readers' letters of the day

From The FT:

Sir, It is indeed a paradox that the Church feels the need for professional investment advice (Letters, January 21), since this is the one area where even an atheist might well believe that decisions are best left in the hands of God.

Investment at random for a large fund offers full diversification, has very low costs and protects against the sort of expert knowledge and skill which led professionals to invest with Bernard Madoff.

M.R. Weale, London, UK

And, from The Metro:

I believe the bonuses being paid to Northern Rock staff are a good idea. They are necessary to recruit, retain and motivate the right calibre of staff to ensure that NR is profitable and can therefore repay the loans made by taxpayers.

PS I'm not a NR employee.

J Fisher, Hertfordshire, UK.

A Times article puts this in perspective - gross bonuses approx. £9 million, post-tax cost approx £5 million; "The payments were being made because the bank had more than met its target of repaying 25 per cent of the £26.9 billion lent to it last year by the Government, a Rock spokeswoman said. In fact, £15.4 billion had been repaid." Paying out £5 million in return for speeding up repayments to the tune of £9 billion seems like a good deal to me. I suppose it would be nice if there were some sort of cap so that the bonuses do not unduly reward the senior people who created the mess in the first place, but hey.

Posted by

Mark Wadsworth

at

10:05

13

comments

![]()

Labels: Bonus culture, Investing, Northern Rock, Religion

Thursday, 22 January 2009

Fixin' the banks - made simple

Instead of explaining the book-keeping entries, the finer details of the Companies Act, TUPE regulations and capital adequacy ratios, I'll try explaining it with pictures.

1. First up is the current situation: on its 'assets' side, a typical bank has good, reliable borrowers, who can easily repay the interest and repayments out of ordinary income or profits and where the assets on which the loan is secured are double the amount of the loan ... all the way down to wacky investments in US sub-prime mortgages that have been endlessly sliced and diced and where the recoverable amount is a fraction of what the bank paid for it. On the 'liabilities' side, deposits have to be repaid in full (morally rather than legally, but there is a taxpayer-guarantee of the first £50,000 per borrower) and shareholders rank last, there is no legal obligation to pay them anything, they just get what's left after everybody else has been paid off. I've ignored fixed assets (branch offices, telephones, computers) as their value is minuscule in the scheme of things.

2. Then you snip off the top bit from the bottom bit roughly where the dashed line is - whether that is by (1) depositors and good borrowers simply transferring their business to a new bank; (2) a corporate demerger; (3) a sale of trade and assets (like the transfer of Bradford & Bingley's deposits, branch offices and employees to Santander, that seems to have gone without a hitch) or even (4) massive write down of the worthless loans (shaded dark grey) combined with a radical debt-for-equity swap (and subsequent reduction in share capital) is neither here nor there.

3. The top bit then becomes a new Good Bank, which looks a heck of a lot like a well-run building society used to do - they borrow spare cash from people with a bit of spare cash and lend it out to sensible borrowers at sensible income multiples and demand at least a 25% deposit, or corresponding security from a business.

4. Unless you have gone for option (4) (write down of assets and debt for equity swap etc), then you also end up with Bad Bank. This bank is a 'closed fund' - it makes no new mortgage advances but collects as much as it can from existing borrowers who aren't able to remortgage elsewhere and dishes out the receipts between the original shareholders and the bondholders of the bank we started off with until there's nothing left.

5. And there's not a penny of taxpayers' money involved, no nationalisation, nothing. Capitalism is about risk and reward - there were reckless lenders and reckless borrowers, who should share the losses, I don't see why ordinary depositors, sensible borrrowers or the taxpayer should get dragged into this.

Posted by

Mark Wadsworth

at

22:33

19

comments

![]()

Labels: Banking, Credit crunch, Debt for equity swaps, Simplification

Early 19th Century British “Environmentalism”

Lengthy but well worth a read, especially the section on David Ricardo: "The interest of the landlord is always opposed to that of the consumer and the manufacturer." (1821).

From the introduction: Environmentalism is the social movement of the "landed interest" – an interest parallel to that of neither business nor labour. "Environmentalism" is readily identifiable in early 19th century Britain. This essay draws from the best-known writings of the era’s three most influential intellectuals for a portrait of an anti-democratic, anti-liberal social movement based in the aristocracy but claiming to represent the masses; a movement permeated with the ideas of over-population theorist T. Malthus; a movement benefitting from restricting land supply and suffering from advancing agricultural technology; that fought a cultural civil war using literary Romanticism and monkish asceticism; that was militantly protectionist regarding agriculture; that constrained industrial progress and spread fear of catastrophe.

Via Peter Risdon:

Posted by

Mark Wadsworth

at

13:27

0

comments

![]()

Labels: David Ricardo, Global cooling, Land Value Tax, NIMBYs

Deliberately misleading headline of the day

"A third drink over daily limit", blares the BBC, who caveat this in the very first paragraph with "...at least one day a week".

Fake charity Alcohol Concern make their inevitable fatuous comments, of course.

Posted by

Mark Wadsworth

at

11:07

3

comments

![]()

Labels: Alcohol, Alcohol Concern, Bansturbation, BBC, liars, statistics

Wednesday, 21 January 2009

... and then they came for the disgruntled constituents ...

A while back, Hazel Bleurgh said that the knives were out for the 'bloggers, and unless I am mistaken, she compared them disparagingly to "people who write to their local newspaper".

They've gone one better now - you can't even risk writing to your MP to complain about the fact that ... er ... your MP might be raided for being in possession of letters complaining about this.

H/t OH (and many others, of course).

Posted by

Mark Wadsworth

at

21:37

4

comments

![]()

Labels: Authoritarianism, Censorship, Daniel Kawczynski MP, Hazel Blears MP, Surveillance society

Gratuitous "wardrobe malfunction" post

Posted by

Mark Wadsworth

at

19:22

4

comments

![]()

Labels: Ekaterina Rubleva, Ice skater, Tits

... and then they came for the anglers ...

Article 47, EU Common Fisheries Policy:

Monitoring of Recreational Fisheries

a, Recreational fisheries on a vessel in Community waters on a stock subject to a multiannual plan shall be subject to an authorisation for that vessel issued by the flag Member State.

b, Catches in recreational fisheries on stocks subject to a multiannual plan shall be registered by the flag Member State.

c, Catches of species subject to a multiannual plan by recreational fisheries shall be counted against the relevant quotas of the flag Member State. The Member States concerned shall establish a share from such quotas to be used exclusively for the purpose of recreational fisheries.

d, The marketing of catches from a recreational fishery shall be prohibited except for philanthropic purposes.

UKIP have set up a petition against this lunacy, sign here.

Posted by

Mark Wadsworth

at

16:22

5

comments

![]()

Labels: Authoritarianism, Bansturbation, EU, Fisheries, UKIP

Personnel Today's "Redundancy Tracker"

Personnel Today have set up a handy list of recent redundancies in the UK, listed by employer, please email mike.berry@rbi.co.uk so that he can keep it updated.

Christina Speight, who emailed me this, reckoned that there were 3,000-odd public sector jobs cuts, out of "Total employees made redundant since September 2008: 81,294".

Seeing as 'only' one-in-four people work for the State, that means a private sector worker is about nine times as likely to lose his or her job as one in the bloated public sector. Plus, the public sector is created new jobs far faster than it scraps old ones.

Posted by

Mark Wadsworth

at

13:57

8

comments

![]()

Labels: Great Depression, Public sector employees, Recession

Reader's letter of the day

From The FT:

Sir,

E.G. Nisbet (Letters, January 19) may wish to ponder why his (heavily subsidised) rail journey would cost him more than four times a comparable flight (after paying air passenger duty to the exchequer). His musings might lead him to conclude that one reason is the very expensive infrastructure (tracks and signalling) required to maintain the rail service; by comparison air traffic control and a couple of miles of track in the form of runways come pretty cheaply.

He might also reflect that this disproportionate use of resources, including the energy required to maintain the rail “system”, is one reason that the purported environmental benefits of rail might not be all they seem.

David Starkie, London, UK.

Which brings me back to a fundamental question: the knee jerk reaction of Greenies and NIMBYs is to prefer rail over air travel. Ignoring the practicalities that within conurbations rail or Tube is clearly the best form of transport, as is air travel over long distances, if we assume that 'CO2 emissions" is a relevant 'cost', has anybody ever done a full CO2 cost comparison between rail and air travel for a medium length journey over (say) 200 miles?

You'd have to include CO2 created in smelting steel for the actual rails and the heavy carriages, generating the electricity to power the trains and light the stations etc; and compare that with the CO2 emissions created in building the airport, manufacturing the much lighter aeroplanes as well as CO2 emitted by the jet engines. Focusing on that very last bit of the calculation on only one side of the comparison is meaningless.

Until I see such a calculation I am not convinced either way.

Posted by

Mark Wadsworth

at

09:59

26

comments

![]()

Labels: Airlines, Global cooling, Public transport, Science

Tuesday, 20 January 2009

Quangista of the week

From The Evening Standard:

A SENIOR Scotland Yard officer is to quit for a Home Office post which will see him collect a combined £200,000-a-year pay and pension package. Deputy Assistant Commissioner Alf Hitchcock, 49, is to retire from the Metropolitan Police, gaining an £80,000 pension, then immediately start work as deputy chief constable of a quango at an estimated £120,000 a year.

His new role will see him take charge of part of the National Policing Improvement Agency where he will "mentor" potential chief constables. The senior officer's package, which will entitle him to another pension when he retires, will far exceed the pay of the officers he is mentoring.

Mr Hitchcock said it was a "one-off" job and told how he had been put off applying for promoted posts because of the pay. "Chief executives of councils usually earn far more than chief constables in charge of policing entire counties," he said... [Oh, so that's all right then]

... Peter Smyth, chairman of the Metropolitan Police Federation which represents more than 30,000 officers, said the public would be "shocked" by the news. He said: "I'm not sure this is the best use of public money. Common sense says this isn't right." It comes after thousands of officers have been forced to take second jobs to supplement their wages. Other officers who have retired and immediately gone into other policing roles include the chief constable of the British Transport Police, Ian Johnston, and his deputy Andy Trotter. They left Scotland Yard and joined the BTP, which is not under Home Office control, entitling them to the "double hat" windfall.

Posted by

Mark Wadsworth

at

19:40

12

comments

![]()

Labels: Alf Hitchcock, Commonsense, Policing, Quangocracy, Waste

"Pollution is the solution: Official"

Well, according to the BBC at least:

Since the 1970s, European temperatures have risen by about half-a-degree Celsius per decade. This warming rate is faster than the global mean change (roughly equal to 0.18C per decade) and the trend averaged over all the Earth's land (roughly equal to 0.27C per decade) during the same period.

The regional climate models used by scientists have failed to simulate the European experience, say Vautard and colleagues; and they point to legislation that has cleaned up Europe's air as the probable cause.

This has limited the presence of the tiny particles, or aerosols, in the atmosphere which help trigger the low-visibility phenomena. With fewer fogs, mists and haze, more of the Sun's energy has been reaching the surface, leading to a rise a rise in temperatures, they tell Nature Geoscience.

The team's analysis suggests the clearer air's contribution to the background warming trend may have been about 10-20% across Europe as a whole; and in Eastern Europe specifically, it may have been as much as 50%.

*sigh*

It seems I shall have to abandon my narrow prejudices that cleaner air, better visibility for drivers and a balmier climate are Good Things.

*/sigh*

Posted by

Mark Wadsworth

at

14:18

4

comments

![]()

Labels: BBC, Doublethink, Global cooling, Pollution, Science

Reader's letter of the day

From The FT:

Sir, I see Richard Lambert, director-general of the CBI employers’ organisation, insists that taxpayers should bail out ailing companies (Taxpayers must plug the big companies’ credit gap, January 16). The questions I want to ask him are:

* Is he in any way related to the same CBI whose members never tire of complaining about high tax rates?

* Who, if anybody, should bail out the small- and medium-sized companies?

Dipak Ghosh, Economics Department, Stirling University, Stirling, UK.

Posted by

Mark Wadsworth

at

12:33

0

comments

![]()

Why a debt-for-equity swap WILL work

NVM alerts me to an article entitled Insolvent Banks: Why a Debt-for-Equity Swap Won't Work.

The author has at least used the real life example of Citigroup, which appears to be deeply in the mire. He points out that if assets were written down by 20% (a reasonable guess), not only would all bonds have to be converted to equity, but (1) some ordinary deposits as well, which would of course trigger a run on the bank, and (2) a lot of those bonds represent money invested by the government on the taxpayers' behalf, so the taxpayer still has to take a loss on the chin.

Problem (1) has only arisen because banks were allowed to move away from the good old-fashioned model whereby they are financed solely by deposits and share capital/retained profits. This keep a tight lid on the lending side, as funding is by definition restricted to 'spare cash' in the economy, which is of necessity a fairly stable amount.

Problem (2) arises because governments have been steering the wrong course for the past year; once you start bailing out banks, it is difficult to know when to stop - the UK government invested £5 billion in RBS preference shares two months ago and is now about to swap this for equity worth about £0.5 billion.

Be that as it may, and as painful as a debt-for-equity swap may be, it is best to get it done and over with as soon as possible - a year ago would have been better than now, but doing it now is better than letting things drag on for another year. Most governments guarantee ordinary deposits (probably rightly so), but clearly they have been undercharging banks for this implicit insurance and not supervising banks closely enough to minimise the risk that it will have to pay out.

Using the author's figures, and assuming that the government guarantees deposits, there would still be an immediate cost to the taxpayer, but at least the loss would be capped once and for all and The Black Hole would be shut.

I did similar workings on the Bradford & Bingley last September, with a 10% write down and it worked just fine - even with a 20% or 30% write down, that bank would not have to eat in to ordinary deposits, so it all depends on the numbers.

There is another cunning way of doing what is effectively a debt-for-equity swap, and that is the New Bank/Good Bank model.

Just sayin', is all.

Posted by

Mark Wadsworth

at

10:04

0

comments

![]()

Labels: Banking, Citigroup, Commonsense, Debt for equity swaps, Incompetence, Subsidies

Monday, 19 January 2009

Fun Online Poll Results: Excuse me sir, where were you born?

With a day or so to go, the opinions on where Obama was born (opinions and beliefs being far more important than facts nowadays, two can play at that game) on a good turnout of 132 votes (thanks to everybody who voted, as ever) are as follows:

Runaway winner: Planet Krypton (33%)

Leaving that possibility aside, 37% reckoned he was disqualified from being US President:

Mombassa, Kenya (24%)

On an aeroplane from somewhere to somewhere else (4%)

It's irrelevant, he lost US citizenship when he was adopted by an Indonesian (9%)

And only 31% are True Believers:

Kapi'olani Medical Center, Honolulu (13%)

It's irrelevant, he will still Save The World (10%)

Queens Medical Center, Honolulu (7%)

Washington State (1%)

We remember how George W Bush took the shoe-throwing incident with good grace - I look forward to seeing how The Chosen One reacts when the first question at every press conference for the next four years is something along the lines of "Excuse me sir, where were you born?"

To lighten the mood a bit - this week's Fun Online Poll is Who is your favourite celebrity Kate?

Posted by

Mark Wadsworth

at

19:53

2

comments

![]()

Labels: George W Bush, Humour, liars, Obama

Royal Bank of Scotland shares down 98%!

Compared to two years ago, when they touched 700 pence.

UPDATE: As John Ashton has pointed out in the comments: "RBS has a closing market capitalization of around £5bn. The government plan is to convert £5bn of prefs into 12% of the ordinary shares worth around £600m at close. £5bn into £600m in just one deal. Great stuff!"

Posted by

Mark Wadsworth

at

17:11

8

comments

![]()

Labels: Banking, Credit crunch, Investing, Royal Bank of Scotland

"New plan to boost banks' lending"

Dude, WTF?

Four key points:

On another day of major development for the banking sector, here are the key points of the government's latest announcement:

• Banks will be able to take up government insurance against their expected bad debts

• The Bank of England will be able to buy stakes in companies in all sectors of the economy

• Northern Rock has been given extra time to repay its loans from the government

• The government is increasing its stake in Royal Bank of Scotland (RBS) to nearly 70% from 58%. RBS also said it was set to report a huge loss for 2008, with asset write-downs of up to £20bn.

Wouldn't a more accurate headline be "New plan to boost powers of the state at the taxpayers' expense"?

Posted by

Mark Wadsworth

at

13:19

5

comments

![]()

Labels: Authoritarianism, Banking, Bastards, BBC, Insurance, Taxation, Waste

Reader's letter of the day

From The Metro:

I loved seeing the greenheads crying after the Heathrow expansion got the go-ahead. Given that the smoking ban was brought in against the majority of pub-goers' opinions, I say to all the Heathrow protestors: taste democracy.

Jo Amos, London.

Posted by

Mark Wadsworth

at

12:44

2

comments

![]()

Labels: Airports, Democracy, Global cooling, Heathrow, Smoking

More dubious statistics from the statistics factory

The quango* known as the NSPCC has churned out some more "shock horror (give us more money or else!)" numbers today.

Police recorded more than 50 sexual offences against children every day last year, new figures have shown. There were 20,758 alleged sex crimes involving under-18s reported to officers in England and Wales in 2008, children's charity NSPCC said...

Six times more sex crimes were recorded against girls than against boys. The NSPCC obtained the statistics by making freedom of information requests to all of England and Wales's 43 police forces. All but Greater Manchester Police responded. This is the first time the charity has compiled the figures**.

But the NSPCC says official statistics do not provide a clear picture of how many involved children. It is now calling on the Government to collect and publish annual police data showing the number and ages of victims. The charity also wants these figures to be linked clearly to the number of convictions and other penalties that result from the recorded offences.

* The NSPCC received about £14 million in 'statutory funding' in its last financial year (see Note 3 to the accounts). This is only ten per cent of its total income but a handsome wedge nonetheless.

** If this is the first time, then the figure is meaningless as there is no comparative. Assuming it is accurate, that means that about one-in-five-hundred kids is affected by this each year, which is 20,000 individual tragedies but not much, in the grander scheme of things.

Posted by

Mark Wadsworth

at

10:29

9

comments

![]()

Labels: crime, NSPCC, Quangocracy

Sunday, 18 January 2009

Forever blowing bubbles

I am currently working on a Grand Unified Theory of asset and commodity price bubbles.

I'm not going to give anything away as yet, but I'd be grateful if readers could leave examples of recent price bubbles (let's say the last twenty years) in the comments, as there well may be some that don't fit my current theory and which I may have overlooked - it's difficult to avoid selectively choosing examples that fit the theory, whereas the scientific approach is to look at all the facts first and then test the theory.

Thanks in advance.

Posted by

Mark Wadsworth

at

18:36

33

comments

![]()

Labels: Economics

Fun Online Poll: One day to go!

I personally don't think much of the rule that only 'natural born US citizens' may become US President, as that excludes Arnold Schwarzenegger, but hey, rules is rules and they apply to Obama as well.

Even ignoring the 32% who reckon that he was born on Planet Krypton, 44 people reckoned he doesn't qualify and even among the 36 Obama-believers, opinions are hotly divided - 16 voted for Kapi'olani Medical Center, Honolulu and 8 for Queens Medical Center, Honolulu*. 11 reckoned it doesn't matter as He Will Save The World and 1 voted for Washington State.

I'm going to call this one tomorrow evening - once he's inaugurated on Tuesday, the whole issue will be brushed under the carpet, so please ... place your bets now

* It is amazing that he never bothered to get his story straight, which is a good measure of his sheer unadulterated arrogance.

Posted by

Mark Wadsworth

at

13:42

10

comments

![]()

Labour Party political broadcast

Dick Puddlecote reckons that this is "Quite possibly the best YouTube clip ever":

Wrong. This is:

Posted by

Mark Wadsworth

at

00:36

3

comments

![]()

Labels: Humour, Labour, Music, Propaganda, They're taking the Hobbits to Isengard

Saturday, 17 January 2009

Third runway problem solved (2)

Although I have faith that BAA have done their calculations properly and that the third runway makes economic sense, the idea of knocking down the entire village of Sipson is a bit of a stumbling block.

From The Evening Standard:

... the people who live in Sipson's 700 homes are resigned to losing their fight.

... Campaigner Lynne Davies, 60, a retired florist, said: "I have lived in Sipson for 50 years. My brother-in-law built my house and now we have a Spanish company coming in with compulsory purchase and offering us peanuts*. They have only offered us market value, moving costs and 10 per cent commission when they get planning permission. That's not a good deal. I don't want somebody telling me what to do.

The best way of balancing competing property rights is LVT of course and a parallel tax on the value of the landing slots to compensate those affected by noise, but short of this, what BAA ought to do is buy up ten acres of farmland a few miles down the road and build a carbon copy of Sipson, with the same street names, same houses, only make everything ten per cent bigger and better. The market value of the 700 houses in Sipson may be £200,000 each, but rebuilding them (including drainage, electricity, broadband) etc would be half that. They can even bung in a nicer park, give the pub a bigger beer garden/car park, whatever.

BAA should then invite the entire population of Sipson onto a fleet of coaches, drive them a few miles down the road, ply them with free drinks and offer each resident or property owner a straight swap, new for old. Some will jump at the chance, others will dig their heels in, but hopefully those who like the idea of shifting the whole village, lock and barrel will put pressure on the stick-in-the-muds and commonsense will prevail. BAA could even offer to bung in £50,000 towards everybody's mortgage or something, this would still work out cheaper than paying market value.

Hey presto, problem solved.

Part 1 of this series over at Ross.

* Er, "... market value plus moving costs and ten per cent commission" is not what I'd call peanuts.

Posted by

Mark Wadsworth

at

15:02

12

comments

![]()

Labels: Airports, Commonsense, Heathrow, Planning

Friday, 16 January 2009

Counter-intuitive (3)

Today let's think about subsidies and tariffs, specifically on cars.

In round figures there are twenty million cars on the road in the UK that are on average ten years old, so we were buying two million cars a year. As it happens, we also produce nearly two million cars a year - the UK is only a modest net importer of cars. In a recession, people cut back on major purchases like this first - they cut back on buying houses because prices are falling and because of job insecurity - but modern cars are better built than before, so if we forget the snob value of having a brand new car with an up to date number plate, we could easily move to only scrapping their cars once they were twenty years old, so we'd only buy one million cars a year, i.e sales would fall by half.

For some reason, there is a strong macho streak in politicians which says that earning £1 from exporting manufactured goods - particularly exporting of cars - is somehow better than earning £1 by exporting something else, like wimpy stuff like inwards tourism to the UK, all these foreigners that come to London to see musicals and go shopping, all very girly, despite it's money for old rope. As an aside, since sterling plummeted, the tourism industry in London is already seeing a boost to foreign visitor numbers, and UK holiday-makers are choosing to/being forced to holiday in the UK rather than abroad, which is the same thing in balance-of-payment terms, unlike manufacturing, which takes longer to respond to an increase in demand and is of course facing collapsing demand abroad as well.