From the Blue-Yellow Corner: Councils in England will be allowed to keep the business rates they collect rather than paying them into Treasury coffers, under new government plans.

Deputy PM Nick Clegg said councils had no financial incentive to boost growth and prosperity in their areas. But he said changes would be "fair" and poorer areas would not get less money than they do under the current system. Business rates are charged on most non-domestic premises, including warehouses shops, offices, pubs and factories.

This is a very good idea, as I explained when The Morbidly Obese one suggested it back in March (it was of course in the UKIP manifesto as well, and I should know because I wrote those bits).

From the Red Corner: Caroline Flint MP, Labour's Shadow Secretary of State for Communities and Local Government, responding to Nick Clegg's speech at the LGA Conference, said:

"Nick Clegg must explain how he intends to localise business rates without pulling the rug from beneath the finances of councils in Britain's most deprived areas. If business rates were completely localised, Westminster Council would gain over a billion pounds*, the City of London would gain half a billion, but many other areas would lose hundreds of millions in vital funding."

That's the easy bit.

Remember that local councils get (say) 75% of their funding from Whitehall and 25% from Council Tax, so keeping it 'fair' is quite simple; on Day One of the transition, each council's central grant is reduced by the amount of Business Rates it could or should be collecting and in future years, the grant is kept constant and it's up to the council to collect as much in Business Rates as possible (any further 'equalisation' makes a mockery of the whole thing, of course).

--------------------------------

So far so good.

What former Housing Minister Ms Flint overlooks is that her successor-but-one, John Healy applied the same good logic to social housing receipts (please read my crash course for an overview of the topic) as the current lot apply to Business Rates, and proposed that instead of councils collecting rents and handing over the proceeds to Whitehall, only for Whitehall to hand it back to pay for the running costs, he would simply allow councils to keep their own rents and pay their own running costs.

So we could do the same exercise with social rents - deduct the amount which councils could or should be collecting in rents and deduct the notional running costs to arrive at a net figure**, which they also knock off each council's current grant and then it's up to each council to maximise rental income/minimise running costs.

As it happens, Council Tax, total (potential) rental income from council housing and Business Rates are of the same order of magnitude - about £25 billion a year each, which would mean that local councils are about 75% self-funded - and all out of taxes and rents on or from land and buildings. If we then doubled Council Tax we could reduce the central grants to more or less nothing and we'd be half way there.

* City of Westminster is a special case, its annual expenditure appears to be about £1 billion a year anyway, in other words to keep things even on day one, if it were allowed to keep all Business Rates receipts (£1.1 billion, as it happens) its theoretical central grant would be negative, so in future it would then have to hand over a net figure to Whitehall, or even better to Transport for London.

** Whether you count 'Housing Benefit' as a reduction in income or as an expense is a separate topic (at present, it's an expense to one government department the DWP and income for another branch of government, local councils), but as far as I am concerned, they might as well scrap it completely and leave it up to local councils to charge below-market rents if they so choose but at their own cost.

Thursday, 30 June 2011

Simple answer to a stupid question

Posted by

Mark Wadsworth

at

17:37

9

comments

![]()

Labels: Accounting, Business Rates, Caroline Flint, John Healey, Nick Clegg, Obesity, Social housing

No wonder the NHS is in a mess

It might be because they teach them nothing at medical school. From The Daily Mail:

Smoking in your car is more damaging to health than breathing in exhaust fumes, a leading doctor has claimed. Douglas Noble, a British Medical Association public health expert, made the claim as his colleagues called for tougher tobacco and alcohol controls...

London-based Dr Noble said: "In cars, particle concentrations are 27 times higher than in a smoker's home and 20 times higher than in a pub, in the days when you could smoke in public places. (1) It would be safer to have your exhaust pipe on the inside of your car than smoke cigarettes (2) in terms of fine particular matter released. A ban would protect pregnant women and children."

1) AFAIAA, there is no general ban on 'smoking in public places', just in enclosed public spaces, although the Buckinghamshire Bansturbulary is working on that one as well.

2) Ahem.

Posted by

Mark Wadsworth

at

11:35

9

comments

![]()

Labels: Bansturbation, Cars, Fuckwits, NHS, Smoking, Suicide

Robbing the young: Now official government policy.

From The Daily Mail:

The Governor of the Bank of England Sir Mervyn King has suggested that interest rates would not rise until it was certain the economy was growing and there had been a drop in unemployment... (1)

Sir Mervyn also indicated yesterday that a large cash injection directly into the economy to boost asset prices(2) and spending (3) was possible.

1) That's clearly not a major concern, they could achieve this by scrapping regulations and National Minimum Wage, leaving EU, reducing taxes on output (i.e. VAT), employment (Employer's NIC) and profits. They just increased all those taxes and they keep piling on new regulations.

3) This government is keeping up levels of government spending, but six months ago it increased the rate of VAT to 20%, which has resulted in a corresponding number of retailers going bust. The rule of thumb that 1% on VAT = 100,000 more unemployed still appears to apply. So 'boosting spending' is clearly not on their list of priorities.

So that leaves...

2) 'Asset prices'. I doubt they care too much about the gold price; I suspect they'd prefer it if oil and food prices went down, so that leaves quoted shares and housing - two asset classes where price rises are seen as A Good Thing.

And who loses out from higher share or house prices (unless that is merely a reflection of higher profits or higher rental values)? Young people who end up vastly overpaying for somewhere to live, or who get far worse value for money when their pension fund buys shares.

Even more bizarrely, unemployment hits younger people hardest and this lot intend to increase the taxes on those who've been to University via these higher tuition fees which are clawed back out of their future earnings. So it's a downward spiral.

Even worse, you can't assume that the winners from all this must be Baby Boomers or pensioners generally (as they also need somewhere to live); although they make some gains, most of the extra goes into the pockets of bankers, middlemen, pensions industry, people in 'the City' and so on.

I really don't understand why young people stand for it, to be honest. And older people are jsut being bribed with a slightly larger slice of a much smaller pie.

Posted by

Mark Wadsworth

at

09:53

13

comments

![]()

Labels: Bank of England, Home-Owner-Ism, House prices, Inflation, Interest rates, Mervyn King

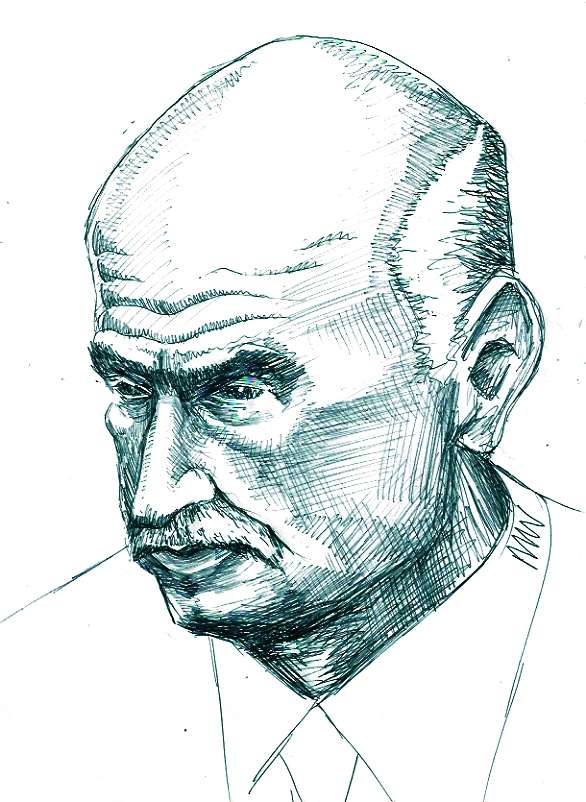

Ah well. At least the caricaturists aren't on strike...

Posted by

Mark Wadsworth

at

09:23

2

comments

![]()

Labels: Caricature, Education, Michael Gove MP, Public sector employees, Public sector pensions, Strike, Trade Unions

Yes, I know it's been done before...

Posted by

Mark Wadsworth

at

07:15

0

comments

![]()

Labels: EU, Government spending, Greece, Hypocrisy, Waste

Wednesday, 29 June 2011

Short Lists

Mike W aced the last one - the three most famous admirals ending in "-itz" are of course Tirp, Dön and Nim.

Right. Our next Short List is "Countries which have never devalued their currency; 'restructured' or defaulted on their national debt; taken a bridging loan from the IMF; accepted soft loans/grants under Lend/Lease, Marshall Plan, or from World Bank or EU; received overseas aid; nationalised foreign-owned assets etc."

Posted by

Mark Wadsworth

at

18:41

13

comments

![]()

Labels: Central banking, Finance, Lists, Warfare

They've not thought this one through either.

Spotted by DNAse in The Grauniad:

... as of Friday, the state government of New South Wales will pay residents A$7,000 (£4,500) to leave [Sydney]. It's part of a new scheme to boost the population and economy of country areas.

"Regional NSW is a great place to live, work and raise a family – these $7,000 grants will provide extra assistance," said the NSW deputy premier, Andrew Stoner.

The one-off grants to move to country areas will be payable to individuals or families provided they sell their Sydney home and buy one in the country. The country home must be worth less than $600,000 (£390,000), something that won't be hard in most rural areas. It will cost the taxpayer up to $47m (£30m) a year.

As much as boosting regional areas, the scheme is also about making Sydney more liveable. The city's population is 4.5m and predicted to grow by 40% over the next 30 years, putting unprecedented pressure on infrastructure and housing.

The immediate point is that this is a subsidy to rural land values - the price of a country home will merely go up by $7,000 because yer ex-Sydney household has $7,000 more to spend. And of course, it's only Sydney homeowners who get the bribe if they move, not Sydney tenants, so indirectly it must be a subsidy to Sydney homeowners as well.

But why encourage people in Sydney to sell their houses? How does this get the population down - won't they sell their houses to, er, somebody who wants to move to Sydney?

Slapping Sydney homeowners with Land Value Tax would be a much more sensible way of going about things - such a tax tends to increase the population, of course (because small households will be replaced with larger households who are more able to share the cost), but they expect the population to increase anyway, so why not cash in?

This gives the government the money to pay for infrastructure improvements in Sydney, if appropriate, or they can spend the money on making the countryside a more attractive place to live, or paying for resettlement grants or a Rural Citizen's Basic Income or something.

Posted by

Mark Wadsworth

at

12:57

6

comments

![]()

Labels: Australia, Idiots, Land Value Tax, Land values, Subsidies, Unintended conseqences

They've not thought this one through.

Spotted by JuliaM at the BBC:

Cows that have grazed next to the Thames under a 200-year tradition are to be enclosed in a paddock at weekends and holidays because of safety fears...

A spokeswoman for the National Trust said: "Following a vicious attack by a dog on the cows on Petersham Meadows on the 2 May, we have been monitoring the cows for signs of distress and defensive behaviour towards dogs. There were two occurrences recently when the cows did chase after dogs. We have to balance the safety of the public with the well-being of the cows, so we sought further advice and in consultation with the farmer and other stakeholders, we have decided to use temporary fencing at weekends, bank holidays and busy times during school holidays, to create a buffer between the cows and the public walking their dogs."

Er... cattle can jump over walls and fences if they are so minded:

One

Two

Three

Four

Five

Posted by

Mark Wadsworth

at

11:28

4

comments

![]()

Labels: Animals, Cows, Elfin Safety

"Udder chaos"

Splendid bit of reporting of a splendid cow-related event in The Daily Mail*:

The reisdents of the usually quiet street are used to having sheep straying on their gardens - but said the cow invasion is the final straw. Ann Ingram, who was woken by the mooing, said, 'It used to be sheep, and that's bad enough, but cows are a whole different kettle of fish.

* Spotted by View From The Solent.

Posted by

Mark Wadsworth

at

11:03

1 comments

![]()

Cheryl Cole's serial cheat love rat [etc] ex-husband

Posted by

Mark Wadsworth

at

08:03

4

comments

![]()

Labels: Ashley Cole, Caricature, Cheryl Cole, Football, Marriage

Tuesday, 28 June 2011

Killer Arguments Against LVT, Not (138)

Just for fun, let's do the Poor Widow Bogey again. Inane comment plucked at random from this ostensibly Lib Dem blog (one of those Lib Dems who never read their own manifesto) regarding the Scottish Green Party's modest proposal to replace Council Tax with something akin to Domestic Rates in Northern Ireland:

Single pensioners will be hit hard: a “retired person living alone in a big house…would be allowed to put payment off by amortising the cost and securing it against the house value”. So, money that they would have now to pay for things that they need to make their lives independent and comfortable would be handed over in tax instead?

Bonus points for completely confusing the concept of 'allowing people to defer payments' with the concept of 'making them pay up front', but getting back to the topic, in practical terms, the easiest ways to sidestep the Poor Widow Bogey are to simply exempt pensioners' main residences; allow them to defer; or collect all the extra tax and then dish it out again by doubling the Citizen's Pension (i.e. pensioners in big houses subsidise pensioners in flats) or any combination thereof.

The more fundamental point is to teach people to stop looking at the population horizontally (i.e. with pensioners, middle aged and young people as separate groups) but to look at it vertically - i.e. you and your living ancestors and descendants are one vertical slice.

a) Seeing as the LVT (and other bits and pieces of taxation) I proposed would raise approximately as much as current taxes (we could eliminate the annual deficit by cutting corporatist subsidies and quangocrat salaries by a mere third), then by and large, the total tax payable by any vertical slice will be exactly the same as it is now.

b) It may be that a larger chunk is legally due by the older members (if they are land 'owners') but a correspondingly smaller chunk is due by middle aged members, and the younger members end up paying nothing or even paying negative tax.

c) So in ninety-nine cases out of a hundred, if any Poor Widow In A Mansion is 'forced' to down size, that wasn't actually the government doing the 'forcing', it was her middle aged and younger descendants. Nobody is nicking their 'inheritance' at all - they are getting it up front in annual instalments (tax cuts) and if they want to give it back to the older generations, they are free to do so.

Twat points to the first Homey or Faux Lib who leaves a comment saying: "Ah, but what if every member of that family - from young to old - happens to be on a low income but lives in a very valuable home which they bought decades ago for £10,000?"

Posted by

Mark Wadsworth

at

19:14

28

comments

![]()

Labels: Blogging, KLN, Land Value Tax, Lib Dems, Pensioners

Peter Mandelson on top form

The Prince of Darkness tries to beat his own record for 'most factual and logical inaccuracies in one article' in today's FT:

Strike One: We [the EU] are attempting to reconfigure the largest economic space in the world since the United States of America was created.

When the first former colonies declared themselves independent and began coalescing into a new country, they accounted for a tiny fraction of the global economy. Even by today's standards, the size of the economies of all the EU member states is larger than that of the USA (I think - it's certainly one and a half times as many people).

Strike Two: But the fact that is rarely mentioned in this debate is that it is a choice between bailing out these states, or bailing out the German, as well as other, banks that are their creditors.

Nope. The choice is between extending further loans to Greece or just allowing it to cancel some of its debts (with infinite shades of grey in between). Funnily enough, the Statists (nominally left wing) prefer the former and free-market types (nominally right wing) prefer the latter. And by bailing out Greece we automatically bail out the banks - that is the same thing.

Strike Three: ... the “lifting” of the economies of Greece, Spain, Portugal and Ireland over the past decade was driven by what was demonstrably an unsustainable credit-driven boom. A boom that lessened the pressure on these economies to address underlying structural issues, while lack of adequate financial regulation facilitated the recycling of financial surpluses in the form of imprudent lending in Ireland and the southern member states.

I'm sure there's a country to which exactly the same applies which he's deliberately missed off the list - possibly because he and his mates ran it for thirteen years?

Strike Four: The writer is a former UK business secretary and EU trade commissioner.

That's NewSpeak for "The writer currently receives various annual payments from the EU, and will receive an annual index-linked pension of £31,000 at age 65, provided he continues to promote the cause of the EU"

Posted by

Mark Wadsworth

at

14:16

2

comments

![]()

Labels: Corruption, EU, EU pensions, FT, Lies, Peter Mandelson

Something is spot-on in the state of Denmark

Allister Heath's editorial in today's City AM explains how they are sorting out the banks in Denmark.

I'm not cutting and pasting the highlights because it is worth reading in full, all 568 words.

Posted by

Mark Wadsworth

at

13:23

8

comments

![]()

Labels: Banking, Commonsense, Debt for equity swaps, Denmark, Shakespeare

The Joys Of Supply And Demand

From Commodity Online:

Global gold production is projected to exceed 2.6 thousand metric tons by next year, according to GIA.

In its global report on gold mining stocks, Global Industry Analysts Inc said production is being primarily driven by increasing gold prices, which are improving the economic viability of hitherto unviable resources*, and technologies...

Gold supply is a mix of mined gold, central bank supply, and scrap recovery. About two-thirds of global gold supply is met from mined gold. In 2009, mine production broke away from a trend of decreasing production that began in 2006.

For comparison, the total amount of physical gold held above ground is estimated to be about 80,000 tons (that's what they said on that Dispatches programme on Channel 4 yesterday, other sources say it's a bit more than that), so annual new production of 2,600 tonnes is pretty heroic (it's enough to increase physical supply by over 3% a year - if only the housing market were as responsive!).

Just for fun, let's divide 80,000 tons by world population of 6.8 billion, that's enough for about 12 grams each, i.e. about £400's worth at today's prices. That would do for coinage, jewellery, but not much more than that. We can't all magically stick our life savings into gold.

* Resources = stuff that is physically there, whether it's economically viable profitable to mine it or not. Reserves = resources which are worth mining. So the amount of reserves can go up and down rapidly; the amount of resources is fixed.

Posted by

Mark Wadsworth

at

10:18

16

comments

![]()

Labels: Economics, Gold, Maths, Speculation

Making the punishment fit the crime

From The Metro:

A teenage recluse accused of helping to launch a cyber attack on the website of Britain’s security services has been bailed – on condition he stays in his house...

Ryan Cleary, who has reportedly not left the family home for the past four years owing to his agoraphobia, was ordered to observe a curfew between 9pm and 7am.

The 19-year-old will also have to wear an electronic security tag and can only leave the house if he is accompanied by a parent.

Monday, 27 June 2011

Fun Online Polls: Police database and Cheryl Cole

On an OK turnout (thanks to everybody who took part) the results to last week's Fun Online Poll are as follows:

Do you think you are on the UK police database?

Yes, as a victim of crime - 15%

Yes, as a criminal - 12%

Yes, both as criminal and as victim - 12%

I don't think so - 49%

Other, please specify - 11%

So that's only about half who reckon they won't be on it, rather less than the official estimate that three-quarters of us won't be on it, which gave rise to mucho shock-horror headlines just over a week ago.

----------------------------

Another shock-horror story which caught my eye was in the weekend's red tops, see e.g. Daily Mirror: "Ashley Cole is to jet back to the UK for a reunion with ex-wife Cheryl so they can discuss their future together. The Chelsea star is due back from his US holiday next week and his number one priority is to meet Cheryl and try to convince her to take him back. And friends of the former X Factor judge say she is considering giving the serial love cheat another chance."

So that's this week's Fun Online Poll: Should Cheryl Cole go back to her serial cheat love rat overpaid prima donna ex-husband?

Vote here or use the widget in the sidebar. I based the spelling on back issues of VIZ and the online English to Geordie translator, don't blame me if it's not perfect.

Posted by

Mark Wadsworth

at

21:13

1 comments

![]()

Labels: Cheryl Cole, crime, Football, FOP, Marriage, Surveillance society, Television

FREEDOM IS SLAVERY, POVERTY IS WEALTH

The Daily Express takes a leaf out of 1984:

This morning they called for lower interest rates:

An 11 per cent increase in sales reflects the enormous benefits to the economy of our record low interest rates, a point that should not be lost on the Bank of England.

A property-owning middle class has been one of the foundations on which our economic success over the past 30 years has been built. Those who urge that interest rates should go up would do well to reflect on the damage it would cause to home-owners and businesses.

Ho hum, that's their opinion. But yesterday they were arguing exactly the opposite when they offered their readers the keys to unlocking letting's rewards:

WITH first-time buyers continuing to struggle to get a mortgage and the number of properties to rent in high demand it’s no wonder the market is booming.

New figures from LSL Property Services show the average asking price for rents reached a record high of £696 in May after four successive months of rises, while the National Landlords Association (NLA) suggests as many as one in five households will rent privately before the end of this decade...

I suppose the only way to square this apparent contradiction is to assume that they envisage a world where the 'middle class' own all the housing and the 'working class' pay rent, which doesn't seem like a 'property owning democracy' to me - I though that democracy means that everybody has an equal say, which applied to land must means that everybody has an equal share - which could only be achieved with a Georgist tax/redistribution system.

And I know it's easy to make fun of The Daily Express, but this kind of Home-Owner-Ist DoubleSpeak is widespread. Remember: if you own a real asset like a TV or a car or if you have valuable experience or qualifications, you are no worse off if others also have such assets*, but there's only an advantage to 'owning' land if there are others who are excluded - or else there'd be nobody forced to buy or rent your land from you, natch, and land would have no value.

So land 'wealth' can only exist if there is an equal and opposite land 'poverty, and land 'ownership' is a zero-sum game at best and a negative sum game in practice.

* if the roads get too crowded, we can build more roads; and provided we have the right mix of experience and qualifications, we are all better off

Posted by

Mark Wadsworth

at

15:01

21

comments

![]()

Labels: 1984, Citizens Income, Daily Express, Doublespeak, Home-Owner-Ism, Hypocrisy, Land Value Tax, Logic, Propaganda, Rents

Reader's Letter Of The Day

From today's FT:

Sir,

Greece can’t be allowed to fail – to save French and German commercial banks. But a failure has to be engineered in a way that saves commercial banks from having to pay out on the credit default swaps insurance for which they have already taken large premiums. Tails really do wag dogs.

Keith Wallace, London EC2, UK .

Sunday, 26 June 2011

Harry Potter's Home-Owner-Ist Uncle Vernon

From page 32 of the paperback edition of Harry Potter and the Deathly Hallows:

"According to you", Vernon Dursley said now, resuming his pacing up and down the living room, "we -Petunia, Dudley and I - are in danger. From - from -"

"Some of 'my lot', right", said Harry.

"Well, I don't believe it, " repeated Uncle Vernon, coming to a halt in front of Harry again. "I was awake half the night thinking it all over, and I believe it's a plot to get the house."

"The house?" repeated Harry. "What house?"

"This house!" shrieked Uncle Vernon, the vein in his forehead starting to pulse. "Our house! House prices are sky-rocketing round here! You want us out of the way and then you're going to do a bit of hocus-pocus and before we know it the deeds will be in your name and- "

"Are you out of your mind?" demanded Harry. "A plot to get this house? Are you actually as stupid as you look?"

"Don't you dare-!" squealed Aunt Petunia, but again, Vernon waved her down; slights on his personal appearance were, it seemed, as nothing to the danger he had spotted.

"Just in case you'd forgotten", said Harry [playing the Home-Owner-Ist trump card], "I've already got a house. My godfather left me one. So why would I want this one? All the happy memories?"

Posted by

Mark Wadsworth

at

17:37

3

comments

![]()

Labels: Harry Potter, Home-Owner-Ism

The Daily Mail outlines the advantages of Land Value Tax

From The Daily Mail (our new weekend paper of choice as it has the best weekly TV guide):

Take a short trip on the metro to [Athens'] cooler northern suburbs, and you will find an enclave of staggering opulence. Here, in the suburb of Kifissia, amid clean, tree-lined streets full of designer boutiques and car showrooms selling luxury marques such as Porsche and Ferrari, live some of the richest men and women in the world...

One of the reasons [the inhabitants] are so rich is that rather than paying millions in tax to the Greek state, as they rightfully should, many of these residents are living entirely tax-free. Along street after street of opulent mansions and villas, surrounded by high walls and with their own pools, most of the millionaires living here are, officially, virtually paupers.

How so? Simple: they are allowed to state their own earnings for tax purposes, figures which are rarely challenged. (1) And rich Greeks take full advantage. Astonishingly, only 5,000 people in a country of 12 million admit to earning more than £90,000 a year — a salary that would not be enough to buy a garden shed in Kifissia... (2)

With Greek President George Papandreou calling for a crackdown on these tax dodgers — who are believed to cost the economy as much as £40bn a year (3) — he is now resorting to bizarre means to identify the cheats. After issuing warnings last year, government officials say he is set to deploy helicopter snoopers, along with scrutiny of Google Earth satellite pictures, to show who has a swimming pool in the northern suburbs — an indicator, officials say, of the owner’s wealth.

Officially, just over 300 Kifissia residents admitted to having a pool. The true figure is believed to be 20,000. There is even a boom in sales of tarpaulins to cover pools and make them invisible to the aerial tax inspectors. (4) ‘The most popular and effective measure used by owners is to camouflage their pool with a khaki military mesh to make it look like natural undergrowth,’ says Vasilis Logothetis, director of a major swimming pool construction company. ‘That way, neither helicopters nor Google Earth can spot them.’(5)

But faced with the threat of a crackdown, money is now pouring out of the country into overseas tax havens such as Liechtenstein, the Bahamas and Cyprus. (6)

1) Yes, getting people to declare their incomes honestly is difficult, and even if they did, a tax on incomes still has huge dead weight costs...

2) ... but working out the value of land that people own is relatively simple.

3) The DM confuse 'cost to the economy' with 'the government collecting less in tax than you'd expect' and use the "s" word, but hey.

4) They haven't learned the lessons of the Window Tax. It's entirely unnecessary to know exactly what is built on any plot of land to work out the location value of the land to within a tolerable margin of error (certainly by Greek standards), it doesn't matter whether an individual house has a swimming pool or not (and if you wish to make swimming pool owners pay more in tax, then it's easier to slap a tax on mains water usage).

5) Most pictures on Google Earth are several years old, it's too late to try and camouflage your swimming pool now.

6) So what? A lot of that money will come flowing back to pay the LVT bills, won't it? And if not, the Greek can recover the tax arrears by selling off the plots of non-payers or renting them out. Which, coincidentally is more or less the opposite of their plan to sell off even more state-owned land.

But no doubt, all these millionaires will manage to track down a Poor Widow or two to use as a human shield: surely it's far more important to allow them to live out their days in peace than try to plug the budget deficit or anything?

Posted by

Mark Wadsworth

at

13:07

6

comments

![]()

Labels: Daily Mail, Greece, Land Value Tax, Should, Taxation

The Ultimate Elvis Presley Tribute Act

From the NME:

A man has been found dead in a portable toilet in the VIP backstage area of Glastonbury festival this morning (June 26)...

Saturday, 25 June 2011

"We will rock you"

I took Her Indoors to see this musical for an early birthday present, and although I despise musicals in general and don't particularly like the music of Queen in particular, I must admit it was quite a pleasant experience.

Two points to note:

1. For some reason, they have done their best to airbrush Queen's bass player John Deacon out of history.

2. Unlike 'British' films or 'British' theatre productions (the quality of which is inversely proportional to the amount of subsidies they get), musicals do not get a penny in subsidies, but somehow, these theatres are more or less sold out, week after week and year after year, despite their high ticket prices (£60 for the front rows appears to be normal). If popularity or profitability is a measure of quality, then they beat 'Briitsh' films and 'British' theatre hands down. People flock from all over the world to see them, which in turn is good for our balance of trade and hotels in London etc.

Short Lists

Picking up where I left off two months ago, the three cheap consumables with Land Value Tax connexions are:

1. The Henry George 5 cent cigar (had his face on the packet) ;

2. "Big President" Sun Yat Sen cigarettes sold in packs of 16 in China now;

3. Tsingtao lager from former German land tax enclave on Chinese coast.

-------------------

This week's short list: Three famous admirals whose name ended with "- itz".

Posted by

Mark Wadsworth

at

10:57

6

comments

![]()

Labels: Alcohol, China, Germany, Land Value Tax, Smoking, USA, Warfare

Friday, 24 June 2011

A solution looking for a problem...

Here's the solution:  This would solve the following problems:

This would solve the following problems:

1. The sun shining in the players' eyes.

2. Play having to be stopped every time it rains at Wimbledon.*

3. Those rather unsporting double-handed shots.

4. There's not enough space for advertising logos on a tennis racquet.

5. The players will have something to hide behind if they are sulking after losing a game, or if they wish to mouth swear words at their opponent.

Any more ideas?

* Apparently they've gone for the rather more expensive option on Centre Court.

Posted by

Mark Wadsworth

at

20:17

11

comments

![]()

Labels: Serena Williams, Sport, Weather

The Poor Widow Bogey played out of turn

Spotted by SW in The Daily Mail:

"A 'supertax' on thousands of homes is being demanded by the Liberal Democrats as the price of agreeing to scrap the 50p top rate of income tax... The Lib Dems are thought to be proposing that capital gains tax – which is currently paid only on profits from the sale of second homes – should be levied on profits from first homes that are worth more than £1million.

The Lib Dems are thought to be proposing that capital gains tax – which is currently paid only on profits from the sale of second homes – should be levied on profits from first homes that are worth more than £1million... Around 250,000 homes would be above the £1million threshold, though some are occupied by families without a high income, including pensioners."

On an international note, they have such a tax in the USA: capital gains on your main residence in excess of $500,000 are taxable. And on a reformist note, they are shelving an idea for A Good Tax (annual tax of 0.5% or 1% tax on the value of very expensive houses above a certain threshold) with A Bad Tax (capital gains tax, which discourages efficient allocation of housing, however expensive), but at least they want to get rid of A Really Bad Tax (the 50p income tax rate), so fair play.

Assuming that the article explains the tax correctly (and The Daily Mail are usually pretty reliable on actual facts, it's the spin which is wrong), then the design of the tax seems a bit haphazard; if you bought for £100,000 a couple of decades ago and sell for £1 million you pay nothing, but if you buy for £1m last year and sell for £1.1 million today, you pay £18,000 or £28,000, which seems illogical to say the least.

The point is that the Home-Owner-Ists are so conditioned to slap down what they believe to be their trump card, The Poor Widow Bogey, the minute that anybody suggests increasing the tax on residential land and buildings a bit, that they'll play it even in the middle of a game of Monopoly.

Whatever the merits or demerits of such a tax, it is not due until and unless a home is actually sold, so by definition, the vendor will always have more than £1 million proceeds sloshing around, even after paying the tax, why on earth do the Home-Owner-Ists think they can start bleating about ability to pay? The tax is not going to be collected out of people's old age pensions or anything, is it?

Posted by

Mark Wadsworth

at

16:46

1 comments

![]()

Labels: Home-Owner-Ism, Income Tax, Land Value Tax, Lib Dems, Poor Widow Bogey

Negative interest rates = privately collected wealth tax

From yesterday's City AM:

IF you owe a lot of money to your bank, it’s time to rejoice. There is now almost no chance of interest rates going up this year. The Bank of England’s monetary policy committee voted 7-2 to keep rates on hold; and given the arguments and worries about growth expressed by the majority of the members it would be foolish to bet on a rate rise any time soon...

It is fair to assume that prices will rise by 5-6 per cent this year: for someone with a £200,000 mortgage, that is equivalent to a gift of £10,000-£12,000... People with big mortgages and low interest rates are gaining immensely, at least if they are prepared to weather the downturn in house prices; people facing ever-higher rents are being hammered.

Savers are even bigger losers and are directly paying for the gains being made by those with large debts. Interest rates on savings products are miserably small and capital is being depleted. As ever, inflation is transferring wealth from those with savings to those with debt. The poor and those on fixed incomes are being hit the hardest and retail sales are under intense pressure.

The UK government is doing its best to fulfil its core rôle, which is to keep house prices as high as possible, which they achieve in collusion with the banks by having interest rates lower than the rate of inflation, so borrowers (primarily home-owners or landlords) are getting richer at the expense of savers (as well as at the expense of first time buyers and tenants).

The government could make this transfer explicit by allowing interest rates to rise, levying a five per cent annual tax on deposits and then paying the money over to homeowners or landlords (or cutting out the middleman and using the wealth tax to finance scrapping Council Tax and Stamp Duty Land Tax), but they don't want to do this as it would tend to give the game away - so they do it by the back door.

But the economic effect is exactly the same - negative interest rates (i.e. when inflation is 5% but a saver only earns 1% interest) are a wealth tax on deposits and a cash subsidy to home owners and landlords.

Posted by

Mark Wadsworth

at

14:15

8

comments

![]()

Labels: Home-Owner-Ism, Inflation, Interest rates, Rents, Taxation

One-sided economics (post script)

Further to my earlier post...

Of course, while corporation tax is the most reviled tax among authoritarian right-wingers, authoritarians on left, right or middle go along with the myths that VAT is a 'tax on consumption' or that Employer's NIC is a 'contribution towards employees' welfare'.

If you sit down with a pencil and paper you will realise that VAT or Employer's NIC are far, far, worse than corporation tax in terms of discouraging re-investment, employment or economic growth:

Company A has found a nice niche market and coasts along with turnover of £1.2 million and a wage bill of £600,000. It has to hand over £200,000 in VAT (being the sum total of its own VAT bill which it pays to HMRC and the additional input VAT it pays to suppliers, which they in turn hand over to HMRC) and £82,800 Employer's NIC (13.8% x £600,000, ignoring the amounts which fall below primary threshold). That leaves it will profits chargeable to corporation tax of £317,200, liable at 21% plus a bit, call it £67,000 corporation tax, total tax bill £350,000, post-tax profits £250,000.

Company B is very similar, but management decide to re-invest £280,000 of its profits in the business by taking on a load of new employees to do market research, product development, marketing etc.

Its VAT bill of £200,000 remains unchanged.

its Employer's NIC payments go up to £121,440.

Its corporation tax bill goes down to +/- nothing (taxable profits are £317,200 minus £280,000 extra wages, minus £39,000 extra Employer's NIC = +/- nothing, 21% x +/- nothing = +/- nothing).

And the company/its shareholder have spent £250,000 but their employees are only £190,000 better off (because while corporation tax is only 21% for most companies, the marginal rate of basic rate income tax + Employees' NIC is 32%). So that's another £60,000 down the tax toilet as a result of the decision to take on more employees and try to expand the business.

------------------------------------------

So tell me, of the three taxes, VAT, Employer's NIC and corporation tax, which discourage re-investment the most?

in absolute terms, it's VAT, in relative terms its Employer's NIC and in behavioural terms, corporation tax actually encourages re-investment. And the fact that corporation tax is at a lower rate than basic rate income tax + Employees' NIC doesn't exactly help matters - far better to have a flat rate on tax on everything.

Posted by

Mark Wadsworth

at

11:07

13

comments

![]()

Labels: Corporation tax, Employer's National Insurance, Taxation, VAT

One-sided Economics by people who don't know as much as they pretend they do

From a reader's letter in yesterday's Times (it's a very old fashioned organisation so they don't put their stuff online):

Mr Cameron... should look at taxing profits which stay in companies and are re-invested in markets and products differently from those that are paid in dividends and buy backs..."

Bob Bishoff, Managing Partner, SCCO International

OK, here's a crash course in calculating corporation tax for people who have better things to do than making their "clients more valuable by providing solutions to the key management issues of Strategy and Structure."

1. You calculate the company's profits under normal accounting rules.

2. In arriving at the company's profits under normal accounting rules you DEDUCT amounts that are spent on market research, R&D, product development, staff training, machinery, advertising etc (unless you are an idiot and don't deduct them).

3. Therefore, by definition, that part of a company's income which is re-invested in the business is excluded from accounting profits because it's not profit - it's an expense.

4. There's then a bit of tomfoolery with add-backs and deductions, timing differences etc blah blah, which even out in the grander scheme of things to arrive at taxable profits (overall, taxable profits are much the same as accounting profits, sometimes higher, sometimes lower).

5. You multiply taxable profits by the corporation tax rate and that's your corporation tax bill.

6. Therefore, only a complete moron would accuse the government of taxing re-invested profits at too high a rate, because the government does not tax re-invested profits at all because amounts re-invested in the business do not count as profits in the first place!!

Twat points to the first person to leave a comment saying that "But a company doesn't get tax relief for money it spends on land and buildings". Firstly, if you are a tenant you get a full deduction for the rents you pay; secondly, if you buy land and buildings, you still get a tax deduction for the interest you pay on the loan; and finally although you can't claim much in the way of capital allowances any more, IBAs having been phased out, there is very little tax on the increase in value of the land and buildings, so fair's fair.

Posted by

Mark Wadsworth

at

09:07

9

comments

![]()

Labels: Corporation tax, Fuckwits, Idiots, Should, Stupidity, Twats

Thursday, 23 June 2011

Norman Baker's slow return to sanity

From The Evening Standard:

Appearing at the Commons transport committee, the Liberal Democrat was highlighting how his department was seeking to axe unnecessary and ancient legislation.

He told MPs: "I think there is an offence of furious driving which only applies to taxi drivers because they used to be Hackney Carriage drivers, from about 1847. I must admit I have not seen any taxi drivers driving furiously; they drive rather slowly in my experience, to keep the clock ticking over."

Posted by

Mark Wadsworth

at

21:58

9

comments

![]()

Labels: London, Norman Baker, Taxi driver

NIMBYs Of The Week

Spotted by Joseph Takagi in The Augusta Chronicle:

An Evans neighborhood association has blocked a group that was prepared to build a home free of charge for a local veteran who was injured in Afghanistan. The homebuilding group, Homes for Our Troops, says Knob Hill Property Owners Association approved the home's design June 2 but reversed its decision in a later meeting....

Homes for Our Troops worked for four months with the Knob Hill Property Owners Association to get the design approved, according to John Gonsalves, [HfoT's] founder. But at an association meeting, members said the 2,700-square-foot home was too small and neighbors thought it would bring property values down, Gonsalves said. A cease-and-desist order was issued as the site was being prepared last week.

"We've done everything they've asked. For them to do this at the last minute is very disturbing," he said. "I don't think there's a community in America that shouldn't embrace this family after what they've sacrificed. No one deserves it more."

But owners association member Tom Rogers said Homes for Our Troops did not do everything asked of it. The group did not have written approval from the association's architectural review board, but negotiated through e-mail only.

"What's important to understand is the family already lives here. They're a great family. We have no qualms with them," Rogers said. "The problem is, that street down there has 5,000-square-foot homes all the way up and down the street there. ... It just doesn't fit. That's the whole issue."

Gonsalves said his team checked association documents, which do recommend that at least 2,700-square-foot houses be built, but Rogers said homeowners in that section built much larger homes.

"We want to protect our homes that we worked hard to achieve, and we want everyone to be treated equally," Rogers said. "These people will have to go through the same process as everyone else did."

Posted by

Mark Wadsworth

at

13:38

6

comments

![]()

Labels: Afghanistan, NIMBYs, US, USA

Pensions myths and other assorted stupidity

Exhibit One, from The Daily Mail:

The number of private sector workers with a company pension has fallen to its lowest level since the Fifties. Of the total private sector workforce of 23.1million, only 3.3million – a paltry 14 per cent – are in a company scheme. This contrasts starkly with the public sector, where almost nine in ten will receive a gold-plated pension. (1)

Joanne Segars, chief executive of the National Association of Pension Funds, warned that Britain’s ageing society is on ‘a collision course with its own retirement’ as it fails to save enough. (2)

The basic state pension is currently worth a little over £100 a week, (3) although many are not eligible to claim the full amount. The typical public sector worker enjoys a pension of £7,841 a year, or about £150 a week. (4) If a private sector worker happens to be in the minority that gets a company pension, the average payout is about £1,300 a year – just £25 a week.

1) I'll return to these factoids in points (5) and (7) below.

2) Vested interest, irrelevant.

3) Lie. There's been an outbreak of commonsense, and the current government is going to replace a whole mish-mash of taxpayer-funded old age pensions and benefits with a flat rate Citizen's Pension of about £150, as well as harmonising pension age for men and women. Which is what I was recommending all along.

4) Aha! The magic figure of £150 a week again. If the government plays its cards right, what it could do is follow through my proposals to their logical conclusion and treat public sector pensions as just another taxpayer-funded pension, i.e. you get the higher of [whatever your weekly taxpayer funded income would have been under the existing rules] and £150 a week, which would be an enormous cost saving without allowing too many people to end up in poverty.

Exhibit Two, from The Guardian:

Lord Hutton of Furness will warn of a "serious" risk of a mass exodus from the local government pension scheme – which is funded and has 3.5 million members – if contributions are raised too high and no other compensation is provided... (5)

Ministers have acknowledged the risk of the welfare system being left to pick up the pieces (6) after a mass opt-out from public sector pensions.

5) If the employee contributions are set 'too low' relative to potential benefits, then everybody will opt in; if nearly all public sector employees who are eligible (not all of them are) opt in, then clearly the employee contributions are much 'too low'. I'd guess that if half opt in and half opt out, then the terms are 'about right'.

6) What 'welfare system'? Why do authoritarians on left and right constantly wail on about "encouraging people to save to ease the burden on the welfare state"? Are they completely stupid, badly informed, lazy or corrupt?

If everybody gets their Citizen's Pension (or existing State Pension + public sector pension) then we don't need any more welfare on top of that, do we? The total cost of the Citizen's Pension would be about £75 billion a year (i.e five per cent of GDP, seems fair enough) as against the cost of tax/NIC breaks for private pensions saving of about £43 billion and implied taxpayer subsidy to unfunded public sector pensions of about £30 billion.

Out of these two items of expenditure, which do you think does more to alleviate poverty in old age? And for comparison, the entire cost of the other old-age related benefits (primarily Pensions Credit and Council Tax Benefit) is only about £20 billion a year, it's chicken feed, so this is spending a pound to save a penny.

Exhibit Three, from The Telegraph:

The funding gap faced by local government pension schemes in England has grown to £71.5bn, (7) new research has revealed, despite a rally in equity markets boosting returns on investments.

7) Remember that this is like a 'funded' (i.e. slightly underfunded) company pension scheme, local governments actually take the contributions and invest them in stuff. The article suggests that we can increase the £71.5 billion by £10 or £15 billion, call it £80 billion all in. Right. £80 billion deficit divided by about 4 million members is a shortfall of about £20,000 each.

Compare and contrast with pension schemes in the private sector, which had a deficit of about £148 billion a year ago and £79 billion now (from here). Take a mid figure of £114 billion and divide by 3.3 million (from (1) above), gives you a deficit per member of £34,000.

So local government is doing pretty well, by comparison.

No doubt some mal-informed commenter will mention 'Gordon Brown's pensions raid', which, as much as I enjoy(ed) Brown-bashing, is yet another stupid myth.

---------------------------------

Please note: unfunded civil services schemes are a completely different topic, these are pure and utter complete fraud and extortion.

Posted by

Mark Wadsworth

at

07:30

25

comments

![]()

Labels: Citizens Pension, Iain Duncan Smith, John Hutton MP, Pensions

Wednesday, 22 June 2011

First they reduce your sentence by half and then they reduce it by a third instead and call it 'tough on crime'.

Posted by

Mark Wadsworth

at

20:35

11

comments

![]()

Labels: Caricature, crime, Judges, Ken Clarke, Maths, Prisons

More Banking Blackmail Fun

The Daily Mail merrily repeats a story which is patently untrue:

Britain could be hit with losses of up to £366 billion from the collapse of the Greek economy, it has emerged. Ministers had claimed that British banks have 'only' £2.5 billion of exposure to Greek government debt, while the Bank of England says the potential losses would be just £8 billion.

But experts last night said that UK financial institutions are in far more danger than previously thought, because banks are tied up in complicated derivatives and insurance deals. They warned that if Greece defaults on its debts the crisis could cause a series of dominoes to fall, with Portugal, Spain and Ireland heading to the wall in turn...

Ho hum.

The nominal value of all these side bets may well be £336 or £366 billion (the headline and the contents of the article are not consistent), they may well be £3,360 billion or £3,360 quadzillion, but it's still nothing to worry about. As I've said before, beyond a certain level, it's not proper money any more, it's just numbers on bits of paper:

1. These banks and financial institutions have all made bets with each other, it is a zero sum game, so even if some banks end up losing a total of £336 billion, other banks will win £336 billion - and I'd assume that most banks have inadvertently made each-way bets because different departments can and do take opposite positions.

2. The total amount that any bank can lose is capped at its total net assets; I guesstimated the total net assets of UK banks (i.e. shares + bonds) at £873 billion last time I looked, so absolute worst case, UK banks have only bet with non-UK banks and they lose every single bet, shareholders and bondholders would lose just under half their capital.

3. Commonsense tells us that if you have assets worth £10,000 and foolishly enter into a £1 million bet which you lose, the maximum you can lose (and the maximum amount which the other person can win) is £10,000, which whittles that £336 billion down even further.

4. Let's say that Big Bank and Small Bank have entered into such a bet and Big Bank wins - the most extreme outcome is that Small Bank loses everything and, having nothing left to offer, is taken over by Big Bank lock, stock and barrel. So along comes the Monopolies & Mergers Competition and splits them up again, big deal.

Another day, another reckless throw of the dice (44)

From the BBC:

"A London council is to help families get on the housing ladder by offering tenants and first-time buyers £50,000 deposits. Wandsworth councillors will discuss plans to set up a special "deposit fund" to help low-income families...

The council is to lobby Government for the financial freedom to create a "deposit pool" funded from the sale of council housing and future development. Initially, interest-free deposits of up to £50,000 would be repaid back into the fund once the property was eventually sold."

I refuse to believe that a council could, collectively, be so stupid as to imagine that this will help those whom it is supposed to help and assume that this is downright corruption, i.e. maybe a lot of the councillors own buy-to-let flats in the area and they want to be able to sell them at a high a price as possible.

What this council cheerfully overlooks is that it is a f-ing council!

If the council gives somebody an interest-free loan, repayable when the home is sold, then it is effectively part-owner of that home but is not charging rent for it and is bearing a lot of the risk of the value falling. That's about the worst position you could be in.

Alternatively, for £50,000 they can build a whole flat or maybe a small house and own it outright. Sure, land is expensive round there, but it's actually only land with planning permission which is expensive. Land without planning permission is pretty cheap wherever it is. And the council is in charge of granting planning permission, so it can give itself planning permission for free. Problem solved.

Posted by

Mark Wadsworth

at

07:32

7

comments

![]()

Labels: Corruption, Council Housing, House price bubble, London, Waste

Tuesday, 21 June 2011

Greek Traffic Light Fun

If you fast forward to 1 min 33 seconds into this clip, the reporter says that workers at a power plant in Greece went on strike, which "left large parts of the mainland with no electricity [cut to picture of traffic lights which are clearly off] and throwing traffic into chaos".

Problem is, the traffic in the background is flowing smoothly - I don't know whether traffic slows even more smoothly than this in Greece when the lights are 'working', of course - but turning off the traffic lights doesn't appear to have made things noticeably worse.

Posted by

Mark Wadsworth

at

22:48

3

comments

![]()

Labels: Cars, Electricity, Greece, Traffic lights

Ponzi Scheme Fun

Somebody from Castle Trust left a comment on a post from yesterday and an email exchange ensued. I asked whether I could publish their response on my blog and they agreed.

They said: "Castle Trust uses the returns from Partnership Mortgages to pay HouSA investors returns greater than the Halifax House Price Index" [Their website states: "Income HouSAs provide a fixed quarterly income as well as giving you full access to house price returns" which I think is pretty crystal clear]

I responded: "I'm now even more puzzled - your website says that the borrower doesn't pay anything until the house is sold or 25 years later, so how will you pay a fixed quarterly income to investors? Where does this money come from? New investors?"

They responded: "Castle Trust will keep 20% of all investments through HouSAs in cash to meet our shorter term obligations and use the balance of 80% to lend as Partnership Mortgages. Castle Trust will then use the proceeds from Partnership Mortgages as they are redeemed to fund the returns due on HouSA investments."

Ahem. From Wiki:

A Ponzi scheme is a fraudulent investment operation that pays returns to separate investors, not from any actual profit earned by the organization, but from their own money or money paid by subsequent investors.

Ah well. I suppose the fact that "Its seven part-time directors include... former Financial Services Authority chairman Sir Callum McCarthy" means they won't have too many problems getting this scheme authorised.

---------------------------------

UPDATE, Jack C at HPC recommends the following further reading:

Mortgage Strategy: Is Castle Trust shared equity deal too good to be true?

Money Marketing: Four major lenders will not lend to Castle Trust borrowers

Posted by

Mark Wadsworth

at

18:32

5

comments

![]()

Labels: castle trust, Fraud, FSA, House price bubble, Investing

Greek bail-out nonsense: suddenly we're all experts!

The MSM is full of apocalyptic visions of why we are doomed if we bail out Greece again and doomed if we don't, largely dreamed up by people who have little clue about banking and finance and so on.

As far as I can see, there isn't much to worry about if we allow Greece to default, leave the Euro-zone etc. History is littered with similar examples, no two cases are ever exactly the same, but as a general rule, the country concerned usually devalues, dusts itself off and is back to normal after a year or two.

A few recent examples are:

1980s Latin American debt crisis

1990 German debt waiver

1992 Black Wednesday

mid-1990s Argentine debt restructuring

1997 Asian financial crisis

1998 Russian Financial Crisis

2008 Icelandic banking collapse (compare the favourable outcome here with the complete and utter mess that the O'Irish made of it).

There have been plenty of instances where a currency has devalued by twenty or thirty per cent in the space of weeks or months (which to a foreign debt holder is tantamount to a twenty or thirty per cent default), sometimes it bounces back, sometimes it doesn't, sometimes it leads to inflation, sometimes it doesn't.

Never forget that the sum total of all the money in the world is always precisely zero, because for every financial asset there is a financial liability, and beyond a certain level of abstraction and on supra-national scale, money really just is numbers on bits of paper, it's not real money any more (as Nick Leeson once said). It's the pretending that these numbers mean anything which causes the damage.

As a silly example, sometimes a tramp asks you if he can "borrow" a pound; if you hand over a quid and say "Keep the change", all is well with the world. What would be stupid is taking him at his word and then trying to track him down asking for your money back.

I won't bore you further with why this is so, but take it from me, it just is.

Posted by

Mark Wadsworth

at

15:39

23

comments

![]()

Labels: Banking, Commonsense, Greece, History

Newspeak or Weasel Words

There are phrases and words used by the financial services regulatory bureaucrats which infuriate me.

'Mis-selling' for example. This is nonsense as no-one can be forced to buy anything. Buying is voluntary therefore nothing can be 'mis-sold'. Especially if one of the cornerstones of English law is adhered to - caveat emptor.

The FSA et al have some other dillies:

'Consumer detriment' - eh? Product A costs more than Product B which you failed to buy, so you've suffered detriment even if no-one was aware that product B existed.

'Treating Customers Fairly' - Here 'fairly' is used to replace 'equitably' - as in fair and just.

'Retail distribution review'. Distribution of what? Review of what?

'Retail Mediation Activity Monitoring' - well, we do that but what it is that we do we don't know as none of the questions are answerable. I am sure that there are more.

Do you know any? And are they 'weasel words' or are they 'Newspeak'?

Posted by

Lola

at

14:32

7

comments

![]()

Another "deer smashes through window" story*

From The Daily Mail:

The Colonial Baptist Church in Cary, North Carolina, may want to look into updating its security system after a deer broke through a glass door and tore through the house of worship. Security cameras caught the deer pushing his way though an unguarded entrance, before taking the grand tour...

The deer proceeded to charge though the halls of the crowded church, leaving children - who were forced to dodge the sprinting animal - terrified and scrambling for the exits. A trio of brave men followed behind the unwanted guest as he nosed through a few rooms in what resembled a classic skit on the Benny Hill show."

Previous episodes here and here.

* OK, glass door, window, what's the big difference?

Monday, 20 June 2011

Jennifer Lopez' nip slip on Wetten Dass

Posted by

Mark Wadsworth

at

21:52

0

comments

![]()

Labels: Germany, Jennifer Lopez, Television, Tits

My Big Fat Greek Finance Minister

Posted by

Mark Wadsworth

at

20:58

2

comments

![]()

Labels: Caricature, ECB, Evangelos Venizelos, Finance, Greece, IMF

Same day, another reckless throw of the dice (43)

From the DCLG website:

Grant Shapps said: "With 80 per cent of young first-time buyers depending on parental help, I am determined that we pull out all the stops to help those who want to take their first steps onto the property ladder.

"FirstBuy will do just that - a Government-backed scheme making £500 million available to offer a valuable alternative to the Bank of Mum and Dad. Over the next two years, this will help as many as 10,000 people in England to get that much-needed deposit together and realise their dreams of owning their own home.

"And because this help will be available on newly-built properties, it will also offer a much-needed boost to our housebuilding industry, supporting thousands of jobs across the country."

Stewart Baseley, executive chairman of the Housebuilders Federation, said: "Firstbuy will help first time buyers, boost economic growth and provide a vital shot in the arm for the house-building industry. Our members have reacted decisively to support FirstBuy and recognise the scheme is an important first step."

Or, they could just stop trying to prop up house prices and let young people get on the ladder without being saddled with extra debts of £50,000? That would be good for the taxpayer, good for the first time buyer and good for the economy. It would, of course, be bad for existing home owners, land owners and banks... ah, right.

And no, propping up house prices and underwriting the value of home-builders' land banks does NOT boost economic growth, in case you were wondering.

Posted by

Mark Wadsworth

at

16:49

15

comments

![]()

Labels: Corruption, Grant Shapps MP, Home-Owner-Ism, House price bubble, Idiots, Subsidies, Waste

Cow attacks: This professor claims to be an expert?!?

From the Des Moines Register:

A rural Urbana woman died after a cow attacked her while she was feeding her animals, leaving people baffled.

"It's pretty unusual for a cow to become aggressive," said Terry Engelken, an associate professor at Iowa State University's College of Veterinary Medicine. "We have a few instances of (cow attacks) across the country every year - but it's uncommon. For it to result in a fatality is very uncommon."

I also wonder why the URL includes the word "SPORT", it's only a sport from the cows' point of view.

Fun Online Polls: Your favourite "Fi" and the police database

The lead kept changing in last week's Fun Online Poll (which is unusual) but the final results are:

Which is your favourite "Fi"? (multiple answers allowed)

Sci-Fi - 47 votes

WiFi - 25 votes

Hi-Fi - 21 votes

Other, please speciFi - 13 votes

Which is ironic really, as WiFi would have been considered Sci-Fi until a decade or two ago, and Hi-Fi would have been considered Sci-Fi until forty or fifty years ago (not to mention MP3 players). Will we be just as blasé about teleportation devices in a century's time?

--------------------------------------------------

According to last week's Telegraph, "The personal details of 15 million people, a quarter of the population of Britain, will be held on a new police database which will include information about victims of crime, it has emerged.

The Police National Database, which will be launched by ministers next week, will hold the records up to six million apparently innocent people, including every victim of sexual assault and domestic violence... According to official figures a total of 9.2 million people in the UK have criminal records, which means the new database will hold information about up to six million people who have not committed an offence.

So that's this week's Fun Online Poll: "Do you think you are on the UK police database?"

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

13:46

0

comments

![]()

Horse attack

From the BBC:

A woman has died after a horse hitched to a carriage bolted and crashed into spectators at an event in Bury St Edmunds, Suffolk...

St Edmundsbury Borough Council Chief Executive Jeff Rivers said health and safety officers were investigating... Mr Rivers said:

"Unfortunately one of the horses, that wasn't actually being used at that time, was being held by a member of staff. But something happened so the horse took fright, bolted, went round the circuit it had traditionally done when it was giving rides, and then broke away from that and crashed right down the middle avenue where most people were."

Posted by

Mark Wadsworth

at

11:27

0

comments

![]()

Labels: Animals, Death, Elfin Safety, Horse riding

Another day, another reckless throw of the dice (42)

From The Daily Express:

EX-cabinet minister Lord Deben, formerly John Gummer, is among the directors of a new investment and mortgage business promising “to breathe new life into the housing market”.

Newly formed Castle Trust will offer investors the chance to make returns based on house prices. Funds raised will provide householders with loans known as a “partnership mortgage” of 20 per cent of their home’s value. They will not make monthly repayments but after a set period must repay the loan plus 40 per cent of any rise in value. Castle’s key backer is the US private equity firm JC Flowers.

Its seven part-time directors include Gummer, former Financial Services Authority chairman Sir Callum McCarthy and former National Consumer Council chairman Dame Deirdre Hutton.

As I commented over at HPC, These people really are gambling on there being people with a lot more money than sense.

Logic says that

A. Any FALL in house prices will be borne 100% by the people who lend the top twenty per cent of the value of the house - if prices fall 20%, then their "deposit" is wiped out, therefore, depending on what probabilities you ascribe to prices rising or falling and if so by how much, they ought to be asking for nearly 100% of any price increases.

B. Then there is the phenomenon that an 80% mortgage costs (say) 4% interest but a 100% mortgage is (say) 7%, so the effective interest rate on that top slice of 20% is actually (say) 19% (formerly known as Higher Lending Charge). Using a £100,000 house as an example:

£80,000 x 4% = £3,200

£100,000 x 7% = £7,000

By subtraction, the top slice of £20,000 costs £3,800 interest

So we can actually split that 100%/£100,000 loan into a 4% loan for the first £80,000 and a 19% loan on the rest, i.e.

£80,000 x 4% = £3,200

£20,000 x 19% = £3,800

Total mortgage £100,000, total interest = £7,000.

C. Therefore, if you were willing to invest money in this scheme and assumed that there are equal probabilities that house prices go up, stay the same or go down, you ought to be looking for an annual interest of 19%, plus 100% of any increase in house prices, and not be fobbed off with a mere 40% of any price rises (and an unknown fraction of price falls).

For the house on which your investment is secured to cover the whole of the loan, prices would have to be rising by at least 4% a year to cover the £3,800 compound interest in the interim, which pushes the chances of this investment paying off even further into "unlikely" territory.

Posted by

Mark Wadsworth

at

10:17

9

comments

![]()

Labels: castle trust, Fraud, House price bubble, House prices, Interest rates, Investing

Sunday, 19 June 2011

Brian Haw

Didn't make it.

Terrible shame, he's the sort of person who makes me proud to be British.

Posted by

Mark Wadsworth

at

18:06

2

comments

![]()

Labels: Afghanistan, Brian Haw, Cancer, Death, Iraq, Warfare

If you're going to reform pensions, why not go the whole hog?

From The Daily Telegraph*:

Discussions have begun at the Treasury over the move which would see the axing of tax relief currently paid out on pension contributions by people who pay income tax at the higher rates of 40 per cent and 50 per cent. The money saved could go towards cutting the budget deficit or – in what would be a more politically popular decision – be used to provide a significant increase to the value of the basic state pension...

Some Conservative MPs expect the axing of higher-rate relief to be merely the first stage in a more extensive and radical plan which would end up with all tax relief – including on contributions made by people paying the basic 20p rate of income tax – being abolished, saving £22 billion a year in total. Such raids, which could be announced in next year’s Budget, would be greeted with howls of protest by the pensions industry.

However, experts estimate that abolition of all tax relief on pension contributions – except employer rebates which would be likely to be retained – could be used to boost the value of the basic state pension by up to half.

OK, how about this for a plan?

It's not £22 billion, for a start. HMRC's Table 1.5 gives the total cost of income tax relief for pensions contributions and tax exemptions for pension funds as £20.3 billion and relief from Employer's NIC as £7.9 billion. Contracted-out rebates cost £9.5 billion. There's no figure for the 'cost' of relief from Employee's NIC, so let's guess another £6 billion for that, total £43.7 billion.

Let's then split that £43.7 billion into four chunks of £11 billion and see what we could do:

a) Increase the proposed Citizen's Pension by £20 a week.

b) Reduce Employer's NIC's from 12.8% of wages to 10%. Even better, scrap the lower threshold and apply a flat rate of 7% or 8% to all wages.

c) HMRC's Table 1.6 tells us that getting rid of the 50% additional rate tax would cost £0.7 billion, and reducing higher rate tax from 40% to 20% (i.e. scrapping higher rate tax) would cost £12.6 billion, but let's factor in some Laffer effects and call it £11 billion as well.

d) Increase the income-tax personal allowance and Employee's NIC threshold by £1,500 a year.

What can possibly go wrong?

* Spotter's Badge MBK.

Posted by

Mark Wadsworth

at

12:18

15

comments

![]()

Labels: Citizens Pension, Pensions, Subsidies, Taxation

Saturday, 18 June 2011

Killer Arguments Against LVT, Not (137)

A good one is to deliberately misunderstand it, argue against what you claim it to be and then resolutely refuse to give ground. Over at a Faisal Islam's Channel 4 economics blog:

adrian clarke: Meg and Carol, I am trying to get my head round this LVT without success. If i start from the end and work back , i will pose some questions...

The tax is based on land values. Who determines those land values? Is all land of an equal value irrespective of its location. Clearly the landlord needs investment within that land to produce an income to pay the tax. If so that tax must be passed on, either in rental or production to meet that payment. How does a farmer, within a rural community pay the same value for land as in one of the large urban conurbation?

To which Carol Wilcox responded "Adrian, your question “Is all land of an equal value irrespective of its location” shows that you have not understood anything about LVT and are therefore not worth debating with. Sorry."

That's the short answer :-) The long answer is that there is a staggering difference between the lowest and highest land/location values in the UK. If you imagine a rental value of one penny per square yard per year to be equivalent to one second in time, then you can picture these differences as follows:

A grouse moor in Scotland - about half a second

Average residential land in England - about three quarters of an hour

Retail premises in Bond Street, London - about a week.

If you can imagine how much longer a week is than half a second (about a million times as long!), then that is roughly how many times as valuable the most expensive location is compared to the cheapest one. That is one of the first things you have to grasp about land values in any developed country.

---------------------------------------------

Workings:

A 9-acre grouse moor in Scotland was bought/sold for £5,000,000 a year or two ago (page 5 of this), that works out at selling price of 11.48 pence per square yard, so the rental value will be five per cent of that, call it half a penny per square yard per year.

You can rent an average semi-detached for about £10,000 a year, an average residential plot is 400 sq yards, so that's 2,500 pence per square yard per year. One hour is 3,600 seconds.

The most expensive rents in England are on Bond Street, about £500 per square foot per year for the ground floor retail premises = 450,000 pence per square yard per year, plus maybe a third as much again for the upper floors = 600,000 pence per square yard per year. A week is 604,800 seconds.

Posted by

Mark Wadsworth

at

19:30

7

comments

![]()

Labels: KLN, Land Value Tax, Land values, Maths

Philip Davies and reported speech

The MSM and various 'charities' are up in arms about the fact that Philip Davies said that the disabled are second class citizens who should work for less than the National Minimum Wage etc etc. blah blah blah.

Only he never said either of those things, did he? Philip Davies simply stood up in Parliament and reported what other people had said to him. His speech is included right at the beginning of this YouTube clip* (it's not in Hansard yet):

It seems highly unlikely to me that Mr Davies would make such a claim if it weren't true, so the whole thing is a storm in a tea cup.

If, for example, an MP were to report that some of his constituents had told him that they would like cannabis to be legalised, or that some of his constituents wanted to "send all the darkies back" (and I'm quite sure that most MPs will have heard just about everything), would that MP then be castigated as a drug fiend or a racist?

Probably he would, and that's the worrying thing. How are you supposed to have a debate if you aren't even allowed to report what voters actually think and say? Whether you agree with those sentiments or not is a separate issue.

* As to the substantive issue, discussed in the rest of the YouTube clip, Philip Davies is completely right of course - there shouldn't be a National Minimum Wage in the first place. If we want to alleviate poverty, then do it via the welfare system, funded out of everybody's taxes, and don't try to fob it off onto individual employers.

Posted by

Mark Wadsworth

at

14:27

10

comments

![]()

Labels: Commonsense, Disability, National Minimum Wage, Philip Davies

Buddy, can you spare me a Euro? Well, about a hundred billion, actually...

Posted by

Mark Wadsworth

at

10:27

6

comments

![]()

Labels: Caricature, ECB, EU, Euro-zone, George Papandreou, Greece, IMF

Friday, 17 June 2011

Air Passenger Duty Fun

There was a nice bit of special pleading by the big airlines in today's papers, see for example The Metro, along the lines of "nobody move or the puppy* gets it!":