(This is all old hat to Lola, but it's worth restating the case for general consideration)

1. Let's imagine we are advising a tax-exempt, long term investor who wants to get into the (more or less untaxed) residential market (a pension fund or insurance company, for sake of argument), they have acquired/are thinking of acquiring empty Site 1 shown on this plan. Three neighbouring sites were used to build four semi-detached houses and two neighbouring sites were used to build blocks of ten flats. The white bits are roads and pavements. We are pretty confident that the local council will be happy to grant us planning permission for either four semi-detached houses or a block of ten flats:

So off we toddle to local estate agents and builders, and establish the following facts:

- it costs £75,000 to have a semi-detached house built, so £300,000 for four.

- it costs £500,000 to have a block of ten flats built.

- rents for flats are sixty per cent as much as rents for semi-detached houses, therefore, the gross rental income from ten flats is one-and-a-half times as much as the gross total rent from four houses.

We eagerly report back that it's much better to have the block of flats built... or is it?

The top dog at the investor's residential division says that they are happy to invest in land for a paltry return of 2%, because that is risk-free and always beats inflation but that there is a higher hurdle rate for construction costs - they have to show at least a 7% return.

So before he can make a decision on what to build or whether to build at all, he needs to know how much rent you can get for a house (the lower-risk option), and this is what swings the decision. If houses can only be rented out for £4,000 a year, then it is best to leave the site vacant; if houses can be rented out for £6,000 a year, then building houses is worth doing and building flats is marginal; if houses can be rented out for £8,000 a year, then building flats is the better option (better option is bold underlined):

2. So far so good.

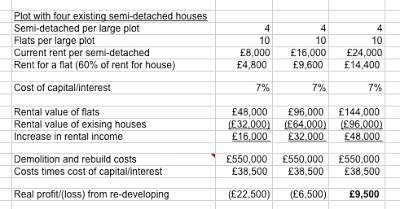

It turns out that houses rent for £8,000 and flats for £4,800 so building the block of flats is the better option. The same investor has now acquired/is thinking of acquiring Site 2 across the road, which has four houses on it with sitting tenants paying market rent, and again asks us for advice:

We check our earlier workings and report back that building flats is the better option... or is it?

The top dog explains to us that this time we have to do a marginal calculation. The rental income from the four existing houses is money in the bank; we have to compare the additional rental income you can get from the flats with the cost of demolishing the four houses, getting the planning, getting rid of the sitting tenants (call it £50,000) and building the flats (£500,000, as above). So if houses rent for £8,000 a year each, the extra £16,000 income you can get from the flats is less than the required return on construction costs of £38,500. Even if the houses rent for double that amount, £16,000 each per year, it is not worth doing.

It is only if Site 2 is in a very high rent area and the houses rent for £24,000 each and flats for £14,400 each that it is (just about) worth knocking down the houses and building a block of flats:

3. Bonus round: would the optimum decision be any different if we had full-on LVT on residential land?

No of course not.

With Site 1:

- if houses rent for only £4,000 a year, the LVT is £zero.

- if houses rent for £6,000 a year, the optimum use is four houses, so the LVT would be [just under] £3,000 a year for the site. So houses are worth building, flats aren't.

- if houses rent for £8,000 a year each and flats for £4,800 each, the optimum use for the site is flats and the LVT is [just under] £13,000 a year. So flats are worth building, the houses aren't.

With Site 2:

- if houses rent for £8,000 or £16,000 a year, the extra rental income (most of which would flow to the council as higher LVT) is less than the required return on investment (£38,500) so investor and council taken together would be worse off by re-developing. The investor doesn't even bother applying for change of planning permission.

- if houses rent for £24,000 each, the extra rental income earned by re-developing (£48,000 a year) is marginally more than the required return on construction costs (£38,500), so investor and council between them would be better off (and people looking for flats would be better off) if the houses were replaced with flats.

But the LVT would go up by £34,000 a year, so the developer would end up £24,500 a year worse off by developing. So the investor/developer is in a good bargaining position with the council and can ask for a cash contribution towards the building costs of (say) £400,000.

As a result of this, the investor/developer's extra income per year is £48,000, his extra cost of capital is £10,500 [7% x [£550,000 minus £400,000]] and his extra LVT is £34,000. He ends up £3,500 a year better off. In return for the £400,000 cash contribution, the council receives £34,000 extra LVT and gets its money back within twelve years. Or instead of making a cash contribution to tip a marginal decision in the right direction, the council could exempt the site from LVT for four years from the date that the last tenant leaves the existing houses, or something like that.

Inconvenient Failures

9 hours ago

2 comments:

Zoning.

BE

BE, zoning is still a kind of planning restriction and doesn't change the underlying economics of what to build or to replace.

Post a Comment