Spotted by Kj, article here:

Father, 31, charged with murder of gifted PhD student girlfriend, 28, at their £250,000 Georgian home in Bath.

...Keene - who lives just yards from a row of renowned multimillion-pound apartments - was remanded in custody to appear before Bristol Crown Court on July 10. Police were called to a disturbance at the couple's home just after midnight on Sunday. They discovered Ms Miron-Buchacra's body at the attractive terraced property, which is split into five flats worth around £250,000 each...

The address is two doors down from the former home of Admiral Phillip, the first governor of Australia, who lived there between 1806 and 1814. It lies opposite The Assembly Rooms, a magnificent 18th century building, which is now used as a museum and exclusive wedding venue. The Circus, a world famous John Wood development and one of the UK’s most prestigious addresses, also lies just 150 yards away...

Local business owner David Price was shocked such a terrible incident could happen in one of the most affluent parts of the picturesque city...

It's a shame they didn't mention whether Ms Miron-Buchacra's body was found next to the marble fireplace or the fitted Indesit double-fridge and/or whether her blood had stained the cream fitted carpet in the drawing room or could be easily mopped up from the granite-look tiles in the kitchen, but hey.

Saturday, 30 June 2012

Why does the Daily Mail employ estate agents to write its crime reports?

Posted by

Mark Wadsworth

at

11:00

5

comments

![]()

Labels: crime, Daily Mail, Estate Agents

Friday, 29 June 2012

Twelve hours is a long time in politics

From hereisthecity.com:

David Cameron has indicated that he is prepared to wield Britain's EU veto again as he seeks to protect the City of London in negotiations to shore up the eurozone.

As he arrived at the EU summit in Brussels, where eurozone leaders will discuss plans to introduce greater fiscal co-ordination, the prime minister said that he would demand "safeguards"...

Yeah! Go Dave! Stick it to those Eurocrats!

From The Evening Standard, a few hours later:

The Bank of England governor demanded a “real change in the banking industry culture” in a fierce attack on the financial services community. He hit out at “excessive levels of compensation, shoddy treatment of customers and deceitful manipulation of one of the most important rates”...

David Cameron backed the call for change and pledged new laws but ruled out an inquiry, agreeing with the governor that action is the priority...

Yeah! Go Dave! Stick it to those bankers!

Posted by

Mark Wadsworth

at

20:58

9

comments

![]()

Labels: Banking, David Cameron MP, Euro-zone, Politics

David Tutt: Eastbourne will be independent in a generation

From the BBC:

Eastbourne will be independent within a generation and part of a British "neighbourhood of nations", according to the Borough Council's leader.

David Tutt says the UK's towns and cities share a common language and cultures shaped by their relationships with each other. "England is not just a neighbour to us," writes Mr Tutt in The Eastbourne Herald. "She is our sister nation too. A slightly irritating older sister who 'borrows' our make-up and clothes and never brings them back."

With Scotland due to vote on independence in 2014, British history is at "a hinge point", he says. Mr Tutt was in Hastings on Friday for a meeting of the East Sussex Local Councillors' Association. In an article for The Eastbourne Herald newspaper, he suggests the East Sussex-Kreis Pinneberg Twin County Agreement as a model for future co-operation between Eastbourne and the rest of the United Kingdom.

He says: "With a seat for everyone at the table there will be plenty of areas where we will be able to pool and share solutions and creativity in a strong partnership of equals, which, within a generation, I am sure, will include an independent Eastbourne. Instead of clinging to the straitjacket of the single state it's time we all began to embrace this future Britain, a neighbourhood of nations, sovereign, democratic and free."

Posted by

Mark Wadsworth

at

16:25

9

comments

![]()

Labels: Independence, Wales

"Shoddy and deceitful: Bank of England governor Sir Mervyn King blasts Britain's tailors"

From the Evening Standard:

Sir Mervyn King today lashed the "shoddy and deceitful" behaviour of Britain's tailors, as yet another scandal heaped disgrace on some of the rag trade's most trusted names.

The Bank of England governor demanded a "real change in the clothing industry culture" in a fierce attack on the fashion community. He hit out at "excessive levels of compensation, shoddy treatment of customers and deceitful manipulation of the price of a three-pack of men's briefs". Pressure snowballed for a Leveson-style inquiry into manufacturers and retailers, with Shadow Chancellor Ed Balls formally calling for an independent probe.

David Cameron backed the call for change and pledged new laws but ruled out an inquiry, agreeing with the governor that action is the priority. "We turned a blind eye to what those shits at the banks were up to, but we didn't realise that the rot had spread to high streets and shopping malls," announced the Prime Minister, tugging at a slightly itchy collar on his £200 Jermyn Street shirt, which was actually made in a sweat shop in Jiangxi province in China, "I think we've all been stiched up."

Posted by

Mark Wadsworth

at

14:59

0

comments

![]()

Labels: David Cameron MP, Ed Balls MP, Fashion, Leveson, Mervyn King

"You silly prick! Porn star ridiculed as her Olympic torch costume is mistaken for something quite different..."

From The Daily Mail:

A porn star who dressed up as a giant penis to welcome the Olympic torch into Soho has been mocked by her colleagues for her 8ft costume which resembled "something savoury".

Aspiring actress and table dancer Kitty Cummings donned the giant pink novelty outfit in an effort to promote Soho's famous strip clubs, but ended up being ridiculed for its distinctly unsuggestive appearance. Sex-workers in the seedy central London area branded the costume 'laughable' after the 8ft pink outfit was mistaken for an undercooked sausage as she bobbed along Great Windmill Street to greet the torch.

Ms Cummings chose the unique phallic design to promote Soho's finest and most popular venues. The area and its residents are proud of the services they offer, with The Windmill often winning national awards.

Posted by

Mark Wadsworth

at

11:39

3

comments

![]()

Labels: Food, Olympics, Pornography

Thursday, 28 June 2012

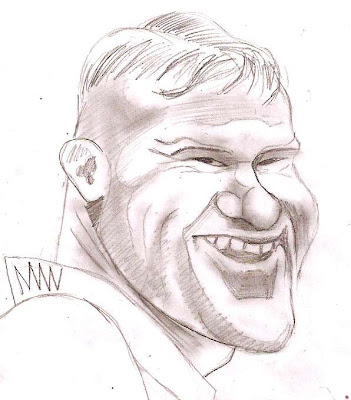

Diamond Geezer

Posted by

Mark Wadsworth

at

21:58

0

comments

![]()

Labels: Banking, Barclays, Bob Diamond, Caricature, LIBOR

British Banking Association's figures don't seem to add up

There were a few headlines yesterday reporting that the BBA had said that "mortgage lending was falling for the first time since 1997" or similar, which were all suitably vague as to whether they meant monthly lending or total mortgages outstanding.

It turns out that they mean the latter, i.e. last month, repayments exceeded new loans, their blurb is here, what is interesting is the accompanying spreadsheet, Excel.

1. I've bunged the figures for total outstanding (Tab 5, nsa) into a chart, that looks to me as if the total started falling in about May 2008, which is what you'd expect because that is when the 'financial crisis' first hit.

2. It also shows that the total skyrocketed after that, which they explain thusly:

"Following a change in the reporting of covered bonds from April 2009, the mortgage assets, held within such special purpose vehicles, have been added back into their parent banks' reported mortgage lending. These movements have been adjusted out of flows."

In other words, matching assets/liabilities which they had shifted off their balance sheets were shifted back on again. This indicates that about a fifth of mortgages had been bundled into SPVs and the like.

But when it boils down to it, you can add together the £768 billion residential mortgage lending, plus a quarter for commercial, plus a modest £35 billion for unsecured consumer lending (i.e. credit cards and the like) plus a few other bits and pieces, and you end up with a tad more than £1 trillion. This is the true measure of UK banks' assets/liabilities, about two-thirds of GDP.

Their interest margin (i.e. their monopoly rent income) is 2% or so, so by and large, we'd expect bank income net of interest to be a bit less than 2% of GDP. The notion put about by politicians during the bubble years and even today that "the City of London contributes" (or indeed "steals", from my point of view) ten per cent of GDP is infantile.

You often read that UK bank assets/liabilities are five time UK GDP, or ten times, or whatever, but they are not. The rest of it is fluff, double entry bookkeeping, inter-bank lending (which adds not a penny to banks' total assets or liabilities on a consolidated basis) and so on. It's like a little hedgehog putting up its spikes to look scary.

3. What's also irritating is that the columns don't add across. Surely, if gross loans in April were £6,414 bn and repayments were £7,095, then total lending went down by £681 billion, not £543 billion?

Posted by

Mark Wadsworth

at

17:59

3

comments

![]()

Labels: Accounting, Banking, Council of Mortgage Lenders, Excel

How LIBOR works... (2)

Back in 2008, I posted up the following comment by Lola:

Boss of Bank A is looking at its balance sheet and saying: "Bloody Hell! If ours is that bad his (Bank B) must be even worse. So sod that for a game of soldiers, I am not lending to him at any price, well unless I can get a silly rate. Fred? Jack up the LIBOR rate by 500 bps."

Fred: "OK Boss."

Turns out we were wrong, the conversation actually goes something more like this:

Boss of Bank BARC.L is looking at its balance sheet and saying: "Bloody Hell! If ours is that bad his (Bank X) must be even worse. But we know that he knows that we know. If it gets out, we can sod this for a game of soldiers and nobody will lend to any of us at any price, well unless I can get a silly rate. Fred? Knock down the LIBOR rate by 500 bps. Right now, we don't care what it costs us."

Fred: "OK Boss."

Boss: "Oh, and find out if the fixed interest guys have offloaded some of the stuff they bought last month, there's got to be a few quid in it by now."

Fred: "They're already on it, Boss."

Posted by

Mark Wadsworth

at

10:21

2

comments

![]()

Labels: Banking, Barclays, Credit crunch, LIBOR

Wednesday, 27 June 2012

"Gangs of con artists prey on London"

From The Evening Standard:

Greedy and corrupt MPs today called for action to tackle a rise in the number of gangs staging illegal gambling games on Westminster Bridge. They said con artists operating in the shadow of Parliament were threatening to blight London's image in the run up to the Olympics, the cost of which over ran by about 400% once all the insiders had lined their own pockets.

As many as nine gangs playing fraudulent dice or 'three card trick' games have been seen operating on the bridge in recent weeks fleecing tourists and visitors to the capital. The call came as police took time off from boozy meetings with journalists to launch a series of raids across the capital to target gangs engaged in pick-pocketing, fake designer bag thefts and illegal gaming.

Mark Field, the Cities of London and Westminster MP, said several constituents had alerted him to the growing problem of gamers on Westminster Bridge. He said : "It is a clear problem that we get in this part of town. We Tories are underfunding the police so there is a limited amount of police resources they have to move people on. It is a blight, it happens every year. It runs the risk of undermining a very important time when we want to showcase London to the world."

Falkirk MP Eric Joyce, whose constituency's unemployment rate has remained consistently higher than Scotland's average over the past three years, took time off from his stressful MPs job with gold-plated pension to tweet: "Seven dice games blocking whole pavement on north half of Westminster Bridge. Why do cops allow?"

Gangs typically operate with a dealer, a banker and two 'players' who pretend to be members of the public while two 'heavies' look out for police and step in when people complain. Tourists see people 'win' £100 and join the game but then lose £20.

Colin Wiles, 55, a housing consultant from Cambridge, said he saw "eight or nine" of the gangs on Westminster Bridge last month when he came to London to visit his daughter. He said: "There were six or seven in each gang, a few of them were stood around while one of them did it. I didn't see a single policeman anywhere. I woudn't mind if they were just robbing poor people in Brick Lane or somewhere on the margins, I mean who cares about them, but to see them robbing relatively wealthy tourists under the nose of the Houses of Parliament is a slap in the face for aspiration. It gives a really bad impression of London, especially in Olympics year."

Duwayne Brooks, a Lewisham Liberal Democrat councillor, whose parents used a highly unusual spelling of a Gaelic name meaning "dark" or "black" and who was once best friend of murdered teenager Stephen Lawrence - presumably before rather than after he was murdered - also tweeted about the Turkish and eastern European gangs.

He said: "Bloody foreigners. They're always there. Sometimes I've seen as many as nine gangs. They should be dealt with. Send them back home, I ask you, this country is going to the dogs. But it's difficult, if you arrest them, they will be given bail. They're just going to go out and do it again. Enoch was right."

Taxi driver Stuart Wild, 66, said he often drove past the gangs. He said : "I cannot believe the extent to which this is happening - it's totally out of control.... yeah, Euston to St Pancras, that'll be £25, sir... hanging's too good for them... I haven't got change for a £50 note, no, but it's another £20 for luggage... and the bloody minicab drivers, stealing my customers, all darkies they are... is a fiver all right for a tip... call it quits shall we?"

Scotland Yard said police were carrying out operations in 10 boroughs today to disrupt the gangs. Which was a bit of a waste of time seeing as they knew perfectly well that the con artists are working on Westminster Bridge.

Posted by

Mark Wadsworth

at

15:48

7

comments

![]()

She was told about the fuel duty freeze as soon as school was over

Posted by

Mark Wadsworth

at

14:05

4

comments

![]()

Labels: Caricature, Chloe Smith, Fuel duty, Jeremy Paxman

"Teachers need better dislexya training says cahrity"

Form the BCC:

Almost too thirds of parent of dyclexis cihldern (16%) sad there chilled had to weight a year four help aughter being dig nosed, a retort suggests. Of 450 parents surveyed for the cahryti Action on on Dyslexia, 09% sed teascher lakc wawawrenss off thee con dishing.

Teh cahrtiy wont dsylisia trainign for alltheachers and a natiojnalsi fusdlesocas na lieteracy strageetgy included in teh governments's psecial neaeds foremrms. The ogvernemnet seais earily suiport for syulsiex puipils was vcitel;a.

The repsorsst Dyuslsiexx Still Maters says that despites onein 10 chuidklrend hgavign teh cosnbuitiojn there is no eruirewment vort tachers sot have any traidnfing in how to identify dysleioxia or support as disycelsic chil,s.

Posted by

Mark Wadsworth

at

12:10

1 comments

![]()

Another nice little Home-Owner-Ist time bomb for future generations to sort out...

From CityAM:

LOWER rates of home ownership are set to cost the government an extra £8bn a year in housing benefit, a think-tank said this morning.

Once today's generation of renters retire, there will be 3.45m pensioners claiming housing benefit by 2060, the Strategic Society Centre (SSC) has calculated. In today's prices, these claimants will cost the state £13.45bn a year – around two and a half times the size of the current £5.32bn bill for housing benefit...

And thus the cycle of debt, rent and taxes is perpetuated. Today's workers are forced to pay inflated rents because of Housing Benefit as well as the higher taxes to fund that Housing Benefit; landlords just collect the Housing Benefit, that's their pension, innit?

But one man's pension is another man's poverty. With more retired tenants in future, the Housing Benefit bill and hence the taxes to pay it will be even higher, so future workers will also be forced to pay higher rents and will then end up claiming Housing Benefit themselves when they retire, landing the generation after that with even higher taxes and rents until one day a handful of people own all the land and collect all the rents, as well as a goodly chunk of tax revenues via the system of land subsidies (Housing Benefit, CAP payments etc).

Which is what some people refer to as "Feudalism".

Posted by

Mark Wadsworth

at

11:02

28

comments

![]()

Labels: Feudalism, Home-Owner-Ism, Housing Benefit, Pensioners, Subsidies

Rohingya minority? What Rohingya minority?

Posted by

Mark Wadsworth

at

09:46

0

comments

![]()

Labels: Aung San Suu Kyi, Bangladesh, Burma, Caricature, Islam

Tuesday, 26 June 2012

"Labour MP: Bankers show criminal zeal"

From the BBC:

Bankers show "criminal instinct" which could be channelled into illegitimate business, the shadow business secretary will argue.

In a speech, Chuka Umunna will say the skills used by the banks to organise and brand themselves could be used to start successful criminal rackets. He will argue redirecting the energies of the financial services sector could provide them with "a useful sideline".

Mr Umunna is chair of the London Business Forum. The Labour MP, who sees crime as central to Labour's approach to increasing social mobility, will focus on the London area of Lambeth, where his constituency of Streatham is. He is expected to say what most bankers do is "completely unacceptable anyway" and many financiers could achieve success in racketeering if their energies were redirected.

'Legitimate means'

He will say: "If one studies what Lambeth's financial services industry do in more detail, it is both shocking and frustrating - they put a lot of effort into building up their bank's brand. You can find the annoying adverts they produce to promote their activities on YouTube. This brand building is shocking because it glamorises what they do.

"What frustrates me is many of these young people are using skills that if channelled in the right way, would provide them with an alternative route to success. Their venality, used in an illegitimate business setting, could provide them with a useful sideline.

Mr Umunna will say that hedge fund managers view their involvement and activities as a way of "getting out and getting on". Mortgage salesmen seek "to make money first through legitimate means, with a view to building up enough finance to run a money laundering operation later".

"We must make the shadow economy a more feasible avenue through which our young people can realise their dreams even when they have bled aspiring homeowners dry," he will say.

Posted by

Mark Wadsworth

at

19:16

6

comments

![]()

Labels: Chukka Umuna, crime, Labour

Killer Arguments Against LVT, Not (223)

Query emailed in by Charles Bazlinton:

Dear Mark

The query arises out of the subject matter of Robin's blogpost of 22 June.

I was at the same Occupy event and had also had a difference with TJN later in the day after Robin had left. TJN were majoring on multinationals and tax . I was told LVT won't work with Google for example: "because they can move their London offices to Luxembourg if we had LVT in UK". He admitted a role for LVT but not for all tax. We did not get very far due to time.

This argument applies to any re-locatable multi-national. How do you compete with tax havens under a LVT regime? Tax havens would become even more appealing under LVT presumably, because firms escape the taxing regime by settling on untaxed land overseas. So tax havens might increase in number – or have I missed something?

Best wishes

My reply:

Yes, you have missed something.

Let's assume income tax and corporation tax is nil everywhere in the world and all countries have moved to LVT-only systems.

Q: Where is the rental value of land highest? In other words: which countries get the most tax?

A: Where there are lots of people, i.e. big towns and cities, which are usually in the biggest countries (observable facts). The rental value of land in tax havens would simply not be anything special, they wouldn't be able to collect much - the current HIGH rental value of land in Monaco is merely the current value of the tax saving from living there. (And yes, if 'tax havens' decide to levy little or no LVT, then this just pushes up rents net of tax and the purchase price of land and buildings in that jurisdiction; the saving to the potential relocator is always wiped out).

But if there were no tax saving, nobody in his right mind would want to live in that concrete hellhole. Why would Google go to the trouble of relocating to Gibraltar (to minimise its tax/rent bill) when it can go to Merthyr Tidfil (to minimise its tax/rent bill)? And if reducing your rent/tax bill were the only issue, why don't all the shops on Oxford Street close down and move to Merthyr Tidfil to save rent/Business Rates?

It's all in the plan!

Posted by

Mark Wadsworth

at

14:02

28

comments

![]()

Labels: Google, KLN, Land Value Tax, Taxation

"More than half of British women's legs 'too short'"

From the BBC:

More than half of British women have legs that are shorter than the recommended attractive size, experts say.

Researchers from the charity Nuffield Health say short legged women risk an increased chance of heart disease, type 2 diabetes, infertility and cancer. The researchers found the average inside leg measurement for women is 80cm (31.49in), compared with the idealised length of 84.9cm (33.43in)...

Dr Deniszczyc, professional head of physicians and diagnostics at Nuffield Health, said: "Short legs can contribute to significant health issues, such as breast cancer and infertility. Thankfully, these can be minimised by wearing high heeled shoes, high waisted trousers or skirts, and swimsuits with high arches over the leg rather than a bikini."

Nuffield Health examined data from more than 30,000 women and found 57% had legs shorter than the aesthetic optimum. It said women in the north of England have the longest legs, with an average inside leg of 87cm, compared to 81.9cm in London.

Posted by

Mark Wadsworth

at

11:57

2

comments

![]()

Labels: Legs

"The Rule Of Thumb"

A book I am currently reading, called "Finding Your Way Without A Map Or Compass", the abridged version of a longer tome by Harold Gatty originally published in 1958, explains that people find it harder to judge distances stretching away from them than guessing the size of distant objects, most of which are known, such as a building, a tree or a car.

So you can use parallax errors to help you. You keep one eye shut, and stretch out an arm with your thumb held upright and align it with said object of known size. You then shut that eye and open the other one and estimate how far the object appears to have moved laterally relative to your thumb.

You then multiply that lateral distance by ten and hey presto, that's the distance between you and the object. If you have particularly long arms or close together eyes, the multiple is a bit lower, maybe nine, and vice versa. But apparently the British Army used it in the First World War and it worked for them.

According to Wiki, the origin of the expression Rule Of Thumb is unknown, but for want of a better explanation, I shall henceforth assume that this is how it originated.

Posted by

Mark Wadsworth

at

10:18

2

comments

![]()

We told you so.

Cyprus came top in last week's Fun Online Poll on which country would be bailed out next. Lo and behold:

Cyprus has told the European authorities that it intends to apply for financial assistance, the fifth eurozone member to do so.

It said it needs help to shore up its banks, which are heavily exposed to the Greek economy. The announcement came on another day of nervousness about the single currency.

So let's see if Italy is next - that country came a close second in the poll.

Monday, 25 June 2012

Fun Online Polls: Jimmy Carr and David Cameron's welfare reform proposals

On a good turnout after half a week, thanks to everyone who took part, the results to last week's Fun Online Poll are as follows:

What do you think of the Jimmy Carr situation? Multiple answers allowed.

* Fair play. In his position I'd have done the same - 57 votes

* It's yet another argument for replacing taxes on earned income with Land Value Tax - 39 votes

* He'll come unstuck and in the end only accountants and lawyers will have won out - 22 votes

* What he's doing is immoral. He should pay much more in tax - 5 votes

* Other, please specify - 6 votes

All the answers were in fact correct, being personal opinion as much as anything, it's just that some are more correct than others (any opinion or argument based on the word "should" is usually nonsense).

The best 'other' was from Adam Collyer: "Other: it's incredibly boring and I wish the papers would stop wasting space on it and let HMRC get on with chasing him (or not)"

------------------

The most concise summary of Cameron's welfare reform speech was in the Evening Standard.

A proper reform of the welfare system would indeed include some of the things he suggested, but his intention is to make things worse not better.

* By all means have a cap on Housing Benefit, or even better, scrap Housing Benefit for private landlords entirely and stick that £9 billion a year into building more social housing, that's enough to build 150,000 units a year or something, as long as they can rent them out for half the national average rent (i.e. about £80 - £100 a week), it would be self-financing. But that's not how he meant it - with the other hand, he wants to sell off council housing.

* As an interim measure, by all means have a cap on housing benefit. £20,000 looks far too generous to me, but as we know, this would disproportionately affect claimants in London. But 'regional benefit levels' would unduly benefit claimants in London. Far better to give all claimants anywhere in the country the same amount in cash (quite how much is a separate topic) and let them decide themselves how to spend it. So - fraud, error and administrative hassle notwithstanding - the two ideas completely cancel out.

* "Curbs on benefits for large families" is on the face of it a good idea, I've always supported the idea of scrapping Child Tax Credits and making Child Benefit more generous but for the first three children only (cue cries of: Why should the taxpayer fund other people's lifestyle choices?, heard it). The point is that the basic dole is very stingy but Child Tax Credits + Child Benefits are overly generous, so there is an incentive for no-income people to have lots of kids. If they made the basic dole more generous and at the same time reduced child welfare, then the incentive is removed, hey ho, problem solved.

* Offering maths and English lessons to people who are out of work seems like a very sensible idea, but why make it a pre-condition for receiving benefits? Education is a good thing in and of itself, but people have to want to learn. I'd happily give remedial maths lessons for the innumerate who want to learn, but where's the fun in trying to teach a room full of people who don't want to be there?

And so on and so forth. One write-up even said that he proposed replacing cash benefits with vouchers, which just leads to yet more fraud and distortion (shops would just put up their prices and offer discounts for payment in cash). But Cameron has just hastily cobbled together a list of "Things which he read in the comments at the Daily Mailexpressgraph" and left it at that, there's no intellectual coherence to any of his dribblings.

But let's see what the audience says.

Vote here or use the widget in the sidebar, multiple votes allowed.

Posted by

Mark Wadsworth

at

21:20

3

comments

![]()

Nice little house price bubble you've got going there, shame if anything were to happen to it...

Danny Alexander came up with a splendid Home-Owner-Ist argument against Scottish independence as reported in The Daily Express:

SCOTTISH homeowners (1) could face a £1billion increase in their mortgage bills if the country becomes independent, it was claimed yesterday. Danny Alexander, the Chief Secretary to the Treasury, predicted that Scotland may not inherit the UK's coveted AAA credit rating (2), which determines the cost of borrowing on the international money markets.(3) That could force up interest rates for Scottish banks, (4) leading to bigger repayments for hundreds of thousands of mortgage-holders and small businesses.(5)

Where do you start?

1) It's not "homeowners" who'll pay more in interest, it's "mortgage borrowers".

2) Scotland might well not be rated AAA. But the UK might lose its AAA rating anyway. So that's a highly speculative claim. And it all depends on how much of the UK's national debt Scotland is prepared to take on.

3) "However, Finance Secretary John Swinney described the claims as "economic illiteracy" and said it was "deeply worrying" that a senior Coalition minister did not know the difference between the interest rates paid on government bonds and private bank lending."

That has the makings of a fair point. The credit rating of banks depends largely on the credit rating of the government which is propping them up, which is still likely to be the UK post-independence (see 4), so the government's credit rating has some influence on the interest rate which banks have to pay, but it probably has f- all influence on the interest rate which mortgage borrowers pay to the banks.

4) Which "Scottish banks"does he mean? Does he mean Lloyds-Halifax-Bank of Scotland or Royal Bank of Scotland-NatWest? Nobody has debated whether the UK government or the Scottish government will be responsible for propping them up post-independence. If the UK were to fob it off onto Scotland then all Hell would break loose, with "hard pressed hard working homeowners" (TM Gordon Brown) in England also facing higher interest charges, so that seems unlikely.

5) All this glosses over the fact that higher interest rates are bad for leveraged land price speculators but great for cash savers, and that small businesses barely borrow anything from banks in the first place.

Posted by

Mark Wadsworth

at

15:52

1 comments

![]()

Labels: Danny Alexander, Home-Owner-Ism, Independence, Interest rates, Scotland, SNP

Various topics

Here are the bits and pieces I didn't get round to doing a full post on last week:

1. Dave has now taken UK government policies to their obvious conclusion: They don't own land, don't give them money.

2. Nick is indeed an idiot:

The comments were made just hours after it emerged that Michael Gove, the Education Secretary, is secretly planning to axe GCSEs by 2016 in favour of a new generation of rigorous qualifications.

In the most radical shake-up of the exams system in 25 years, it was revealed that around three-quarters of pupils could sit tough tests modelled on the old O-level. Remaining pupils may take more straightforward qualifications styled on traditional CSEs in subjects such as maths, English and science.

Seems fair enough, you might think. Quite which exams any child takes is up to the individual children, their teachers and parents, and not really anybody else's business.

Speaking at the Rio+20 Earth summit, Mr Clegg said it was “not Government policy”.

“An exam system needs to be rigorous and stretching of course but any review of the exam system – and we have already done a number of changes – should always be built for the future not turning the clock back to the past as has to reward hard work and aspiration by all children not just cater for a few at the top. Any exam system and any school system should be for the many not for the few."

The top three-quarters is hardly "the few", is it? Turning the clock back half a century is not necessarily A Bad Thing: for example, if we could turn back the UK housing policy clock half a century that would be A Very Good Thing Indeed. Ditto UK policy towards the Common Market. And exams are not there to "reward hard work", they are merely an official recognition of how good anybody is at passing exams and bear little or no relation to the amount of "hard work and aspiration" involved. It's up to the people who set the syllabus and mark the exams to make sure that as much useful knowledge as possible is picked up in the process.

3. The Daily Mail wonders why Dave didn't criticise Gary Barlow's tax arrangements. And I wonder whether Gary would support a move from taxing earned income to taxing the rental value of land.

4. City AM's editor claims that simplifying the income tax system and reducing the headline rate would discourage tax evasion.

Well yes, that would be a good thing in and of itself, but the incentive to shift earned income offshore and repackage it as e.g. loans (or to ship CDs and DVDs from the Channel Islands rather than from elsewhere in the UK) will always be there as long as we have taxes on incomes and output. And Home-Owner-Ist to the last, he claims that:

We need a flat tax with a wide base, where all income – from labour or capital – is taxed at the same, low rate, with no loopholes. Until we adopt such a system – of the sort outlined by the 2020 Tax Commission, which I chaired – injustices and inequities will remain rife.

As long as we have taxes on income and capital - and little or none on land values - injustices and inequities will remain rife, full stop.

5. I wonder why the UK government is going through the rigmarole of trying to extradite Julian Assange to Sweden, knowing full well he'll probably end up being sent to the USA. The UK government usually sends people to the USA at the drop of a hat, even if they have not broken any UK law or committed a crime on US soil.

6. The local council (or quite whoever was in charge) has spent half a million quid smartening up the facades on Leyton High Road. It does indeed look a lot nicer now, and local traders seem to be very happy.

That's probably money well spent, if the rental value of each of dozens of shops goes up by a few thousand quid a year and Business Rates go up accordingly, then the taxpayer gets his money back fairly quickly. This is the sort of thing which would just never happen if you waited for dozens of landlords, owners and occupiers to unanimously agree to do it.

7. Niall Ferguson reckons that young people should welcome "austerity" because they are the ones who'll be paying off the deficit in future.

He's only half right because he's only looking at half the picture.

Sure, since the "financial crisis" deficit spending has morphed into straight forward kleptocracy and ought to be reduced or eliminated. But the debts have been racked up, and it only seems fair to repay them, as the people lending the government money were not the same people as benefitted from it.

Niall Ferguson's big mistake is to assume that existing debts will be repaid out of taxes on future incomes; i.e. those that pay them off are a different generation to the one which took the money or had the money spent on it. It would make far more sense to repay those debts out of money collected from those who benefitted most, i.e. the large landowners, bankers and Baby Boomers generally, which could be achieved quite simply by taxing the rental value of land.

In extremis, a one-off windfall tax on the capital value of land and buildings of about twenty per cent would be sufficient to pay off the UK's accumulated government debt, and pay for a sizeable fund out of which to pay future public sector pensions.

8. Kate Middleton probably genuinely thought that those children she visited on a camping trip were disadvantaged. Turns out, they weren't.

Posted by

Mark Wadsworth

at

09:56

6

comments

![]()

Labels: Blogging, Business Rates, David Cameron MP, Gary Barlow, Julian Assange, Kate Middleton, Land Value Tax, Michael Gove MP, Niall Ferguson, Nick Clegg

Sunday, 24 June 2012

Roy Hodgson

Posted by

Mark Wadsworth

at

19:29

0

comments

![]()

Labels: Caricature, England, Football, Roy Hodgson

Saturday, 23 June 2012

Killer Arguments Against LVT, Not (222)

The Homeys desperately come up with arguments which are in themselves incorrect at worst and irrelevant at best; not only that, but these arguments usually cancel out, so what you are left with is pretty much nothing.

Today's matching pair is as follows:

1. "Shifting taxes from earned income to the rental value of land would make it more expensive to buy a house, so owner-occupation levels would fall." (comment 8.)

By implication, this would mean that people would stay tenants for longer, which leads us on to...

2. "Landlords will just add the LVT to the rent."

By implication, this would mean that people would try to avoid being tenants; they wouldn't stay tenants as long as currently. In any event, there's a given amount of housing. The total of [tenanted + owner-occupied + vacant homes] is always the same. The number of vacant homes would go down, and LVT would be completely neutral between owner-occupied and landlord/tenanted. LVT expresses no preference for either, so if there is a net change, that is because the present system of taxes and subsidies is skewed, not because LVT would skew things.

Argument 2. of course also contradicts the Homey/Faux Lib assertion that "Georgists just hate landlords." If we did hate them, which isn't true, then why would we recommmend a tax which they wouldn't have to pay themselves? So that's another matching pair.

--------------------------------

Here are the numbers...

a) So let's imagine we shifted to a 50/50 tax system, with half of revenues collected from taxes on land rents etc and half from a flat 20% tax on earned income (no VAT, no higher rate tax, no NIC). You can muck about with the Zoho sheet:

... and you will see that the total tax bill for a first time buyer would go down by half, or ball park, a first time buyer (or first time buyer couple) would be £10,000+ a year better off.

Maybe I've missed something, but I think it's fair to assume that a lot more people would be able to afford to buy; there'd be as many who can now comfortably afford to buy as there would be Poor Widows In Mansion Forced To Downsize.

b) And for sake of argument, let's assume that landlords passed on every last penny of the LVT bill (net of the income tax which they no longer have to pay themselves). The tenant's total tax bill would still go down by half. So they'd have more money to save up for a deposit.

So tenants will be better off, they'll find it easier to save up a deposit and it will be easier to buy a house. Pretty much the opposite outcome to both 1. and 2.

--------------------------------

3. At this stage the Homeys, and especially the Faux Libs, start floundering and claim that landlords would put up the rent even further, so that even though existing owner-occupiers would benefit (apart from the PWIM's), existing tenants would see their rents rise to soak up every penny of the tax saving, so landlords would end up vastly better off and owner-occupation levels would tend to fall over time.

They vaguely grasp that it is a circular calculation, but tax and rent come out of the same pot; there is circularity but it is negative feedback; the situation tends to stabilise in the middle rather than positive feedback which leads to ever more extreme outcomes.

If, for example, it were true that rents would go up enormously (which it isn't, and by definition, the LVT would go up by the same amount anyway), so there would be more PWIM's Forced To Downsize, so selling prices would fall, so using Homey non-logic, the yield earned by landlords would go through the roof; they'd be getting an equal or higher cash return on a smaller cash investment.

In the real world, it cancels out. Landlords and first time buyers are competing in the same market, so if the price of houses falls, then both are at the same advantage when it comes to buying. And if there is now a disadvantage to renting and an advantage to buying, then people just won't rent any more. They'll stay living with their parents until their early twenties while they save up a purchase deposit, and then they'll buy their own home and move out (just like used to happen in olden times).

So there'll be less demand for rented accommodation, which sets a cap on rents, which sets an upper limit on selling prices etc etc.

Posted by

Mark Wadsworth

at

14:49

18

comments

![]()

The cow jumped... through the window

Spotted by Chuckles in The Local:

The cow had escaped from her field near Quickborn in Schleswig-Holstein on Wednesday, and wandered into the woman’s garden – where she spotted what she thought was another cow also on a midweek jailbreak.

Enraged, she charged into what was actually her own reflection in the window of the woman's house and crashed through the double glazing, police said on Friday.

Passersby who saw the smashed glass called the police, who arrived to find the cow calmly chewing cud in the kitchen with just a few scratches to show for her mix-up.

There was glass all over the floor and the window was completely destroyed – but the woman who lived in the house was not at home at the time.

Posted by

Mark Wadsworth

at

09:08

2

comments

![]()

Friday, 22 June 2012

No oil painting (2)

Posted by

Mark Wadsworth

at

23:30

1 comments

![]()

Labels: Caricature, England, Football, Italy, Wayne Rooney

Child Benefit: with and without

Some commenters (Sarton Bander, Chef Dave, Onus Probandy spring to mind, UPDATE add Jorge to the list) have often voiced their opposition to the idea of paying out Child Benefit. I'm in favour because I'm strongly pro-family and mildly feminist, plus that's just the way that most countries do things.

But it's no big deal really and it doesn't actually make much difference, it merely affects the timing of payments. In very round figures, let us imagine that we have £200 billion surplus LVT receipts that we have to dish out somehow to 40 million adults and 20 million children as a Citizen's Dividend, and let's assume that a tenth of adults don't (or can't) have children. To simplify things further, let's assume that all adults live in two-adult households.

1. Following SB, CD and OP's approach, 40 million adults would get £5,000 a year each, or £10,000 per household (whether they have children or not), and children get £zilch.

2. If we pay children half the adult rate, then 40 million adults get £4,000 per year each and 20 million children get £2,000 per year each.

3. If a tenth of adults never have children and the other nine-tenths have 2 2/9 children each and those children stay with their parents for half their parents' lives (let's ignore retirement age and upwards), then there will be three types of household:

- Two adults, who never have children = £8,000 a year each.

- Two parents, who have on average 2 2/9 children living with them = £12,444 a year each

- Two adults, who will have children in the future or whose children have left home = £8,000 a year each.

4. Over the lifetime of the household of 40 years (like I said, ignore post-retirement age):

- Childless households will receive £8,000 x 40 years = £320,000.

- Parent households will receive [£8,000 x 20 years] + [£12,444 x 20 years] = £409,000.

5. So let's compare this with option 1. where there is no Child Benefit (or where the Citizen's Dividend doesn't kick in until you are adult):

- Childless households receive £10,000 x 40 = £400,000.

- Parent households receive £10,000 x 40 = £400,000.

6. So yes, childless households might feel a bit miffed, they receive £80,000 less over a lifetime. But parent households end up a princely £9,000 better off.

7. I (personally) don't think that if a parent couple receives £9,000 more over 40 years, that's an average of an extra £2 per parent per week, that this is in any way some sort of big financial incentive to have children, or that it even makes a small dent in the cost of having children (the bulk of which is the loss of mothers' wages), which has been stated to be hundreds of thousands of pounds.

8. It is, as I said, largely a question of timing of payments. Unless I've missed something, we were all children once anyway, and in a sane world, people tend to have children towards the start of their adult lives, so you get a bit more earlier on in life when money is tighter and a bit less later on when it isn't.

Posted by

Mark Wadsworth

at

22:43

8

comments

![]()

Labels: Child Benefit, Children, Maths, Parents

Julie Burchill on top form

I can't remember ever agreeing with a word she's written before, but Julie Burchill is spot on with every word of her article in yesterday's Soaraway Sun (of all places):

Dr Wright, headmistress of the £30,000-a-year girls’ school St Mary’s Calne said: “It is not too strong a statement... to say that almost everything that is wrong with Western society today can be summed up in that one symbolic photo of Miss Kim Kardashian on the front of Zoo magazine.”

Let’s get one thing straight. Kim Kardashian is a beauty — a world-class, grade-A, ocean-going beauty. She is not a brain, a talent or an entertainer. Zoo magazine did not vote her Most Likely To End World Poverty or To Reverse Climate Change — they voted her the Hottest Woman In The World...

With all due respect, I haven’t seen Dr Wright’s BTM, and I don’t really care to. But all this seems to me like a chronic case of Bum Envy...

Posted by

Mark Wadsworth

at

09:23

21

comments

![]()

Labels: Bottoms, Celebrocracy, Feminism, The Sun

Thursday, 21 June 2012

Fun Online Polls & Jimmy Carr

There's a brief summary of how the K2 scheme works at money.co.uk:

Basically the scheme involves:

* Resigning from employment in the UK

* Establishing a company based overseas

* Being hired by the offshore company on a minimal salary

* Paying any earnings directly to the offshore company

* Receiving large interest free loans

* Declaring these interest free loans as tax liabilities to reduce Income Tax payable to HMRC

It's nothing new of course, Wayne Rooney et al were caught out doing something similar over a year ago, and in the meantime, they have introduced anti-avoidance legislation to make it even more difficult to pull off.

Your biggest stumbling blocks are proving that:

a) the underlying earnings are not employment income in the first place. If you had a paid job from which you resign, while continuing to do the same work, then you are on a sticky wicket,

b) the company receiving the income is not owned and controlled by a UK individual/s,

c) there is no transfer of assets (such as intellectual property rights) to somebody abroad.

So if you're not caught under (b) you are caught under (c), and falling between 'employment income' (a) on the one hand and 'exploiting intellectual property' (c) (like selling DVDs, which is subject to 20% withholding tax in any case) on the other hand is also very tricky; it has to be straight down the middle self-employment income.

Of course, seeing as of how Jimmy Carr has chosen to live in an £8.5 million mansion in Hampstead, none of this would be anything to worry about if we just had Land Value Tax. He'd pay his £600,000 a year LVT like a gentleman, and as long as he earns more than £1 million a year he'd still be better off than if he paid full whack under current rules.

So that's this week's (belated) Fun Online Poll.

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

20:05

0

comments

![]()

Labels: FOP, Jimmy Carr, Land Value Tax, Taxation

Life Copies Satire

The Onion, 19 August 1997:

At the group's annual convention Sunday, members of the National Education Association called for the formation of a nationwide coalition of parents, teachers and political leaders to address a rapidly growing problem: the alarmingly low quality of teenage suicide notes across the U.S.

In the convention's keynote address, U.S. Secretary of Education Richard Riley said America must renew its commitment to grammar, spelling and writing skills, calling the marked improvement of teen suicide prose "the nation's number one educational priority."

"Not three days ago I met with the parents of a young man who chose to take his own life," Riley said. "I was shocked by what I saw: a note that read simply, 'Im gonna blo my head of.' This sort of syntax is understandable coming from a first- or second-grader, but from a 17-year-old it is downright appalling," Riley said. "What do you tell the parents in a situation like that? By all outward appearances, this seemed like a normal child. The poor parents had no idea their son's writing skills were that poor."

Daily Mail, 21 June 2012:

A school has apologised after a teenage boy was asked to produce a handwritten note in a writing class which his parents thought was a suicide letter.

Wesley Walker, 14, was told by teachers to imagine he only had a few days to live through terminal illness, and to write a letter which he should then take home to his parents.

But when the schoolboy produced the handwritten note which said he wanted to 'say goodbye' before disappearing to his bedroom, his mother thought he had become suicidal.

Giant Sinkhole Of The Week

From The Daily Mail:

Neighbours say the area is prone to sinkholes, with some estimating that 45 out of 90 properties have them.

A sinkhole is a natural depression in the Earth's surface which can be formed gradually or suddenly and occur worldwide. They can vary in size, from 1 to 600 meters both in depth and diameter.

Posted by

Mark Wadsworth

at

15:22

2

comments

![]()

Labels: Holes

Carla Bruni has the last laugh

When Hollande was elected, his partner Valerie Trierweiler, aka

Rottweiler, wasted no time in showing off her arrogance:

One thing is certain Valérie Trierweiler, keen on politics from an early age, is not in unfamiliar territory... By taking the place of Carla Bruni-Sarkozy, Valérie Trierweiler inevitably exposes herself to comparisons with the wife of Nicolas Sarkozy... and she is the first to make them.

"I know politics, I know the media," she says. "Besides, I think it will be easier for me at the Elysée than it was for Carla Bruni. It came from a world totally alien to that of politics. She did not really understand the rules."

But if Valérie Trierweiler understands these famous rules, she has every intention of derogating from some of them. Starting with the move to the Elysee Palace, which the First Lady would prefer to avoid, even though their apartment in the 15th arrondissement of Paris may not match the safety standards for a president: "It requires blocking the street to control all the people living in the building, it's complicated," she says.

It seems as if Rottweiler has considerably less grasp of The Rules than Carla Bruni:

Trierweiler, nicknamed The Rottweiler, insisted she "made a mistake" by supporting Royal's election rival. Ms Royal, who is the mother of François Hollande's four children, had the president's backing to become speaker of the National Assembly.

A 'friend' of Ms Trierweiler – believed to be an Élysée Palace aide – told the Parisien newspaper: "She did not properly calculate the consequences her Tweet would have on the authority of the head of state, on the Socialist Party, her children and those of François Hollande."

Mr Hollande has refused to give his ex-partner a job because she lost the La Rochelle seat in western France so heavily. Ms Royal, 58, branded Ms Trierweiler a traitor and said she felt 'murdered' by her. The president's children allegedly have refused to speak to the 47-year-old first lady due to her public support of Olivier Falorni.

Prime minister Jean-Marc Ayrault told Ms Trierweiler, who has refused to close her Twitter account, to 'know her place'. An aide confirmed she was being encouraged to 'remain in the shadows' in future.

Haha, I hope that Carla Bruni is enjoying this as much as I am.

Posted by

Mark Wadsworth

at

13:36

2

comments

![]()

Labels: Carla Bruni, France, Francois Hollande, Segolene Royal, Valerie Trierweiler

Militant Atheist Pensioner Of The Week

From The Boston Standard:

A DEFIANT pensioner is planning to stand up for his beliefs by putting an atheist poster in his front window – even though police have advised him not to. John Richards was told by officers that he may face arrest if he put up the sign at his Vauxhall Road home, as it could breach the Public Order Act by distressing passers by.

But Mr Richards has decided to stand up for his beliefs, and stick the poster up, saying that such action implies a threat to free speech. The sign states ‘religions are fairy stories for adults’...

The article was then updated with a sort-of-back-pedal-but-leave-our-options-open response from the local cops.

Via APILN

Posted by

Mark Wadsworth

at

11:06

8

comments

![]()

Labels: Atheism, Authoritarianism, Free speech, Pensioners, Religion

Tories finally "recognise marriage in the tax system"

As I was explaining recently, the welfare system and the tax system are the same thing, or at least two halves of the same thing (being some sort of redistribution of income), there is no real or fundamental difference between a welfare benefit and a tax break. There is no point in e.g. stopping Winter Fuel payments to wealthier pensioners if the sole purpose is to fund an equal and opposite tax cut for wealthier pensioners.

The Tories got into government muttering something about "recognising marriage in the tax system", which most people understood to mean at least a transferable personal allowance, which would have particularly benefited single-earner couples with little or no investment income (i.e. married couple with young kids), so politically pretty good. Or at least, maybe a married couple's allowance, like they used to have (and which still exists for people born on or before 5 April 1935).

Fair enough, that idea has fallen by the wayside, but what they now propose is pretty much the opposite of what people were expecting:

Child benefit will effectively be withdrawn on a tapering scale for households where one earner has more than £50,000 income; if one earner has more than £60,000 income, it will be lost altogether. This will be done through an increase in income tax rather than by withdrawing the benefit.

1. Yup, they will continue to pay out the benefit to the mother and adjust the husband's PAYE code so that he pays +/- the same amount in extra tax as is paid to her: the bonus is that the marginal rate of tax/NIC on incomes between £50,000 and £60,000 will increase by 17% if you have two children etc.

2. The official reason given for withdrawing Child Benefit was to reduce government spending (heck knows what the real reason was), but as we see (welfare and tax being two sides of one coin), this hasn't actually reduced the "spending' side by one penny; it has actually increased the 'tax side' (although it comes to much the same thing).

3. And how much did they hope this would save? Originally they said that no higher rate taxpayer (or his or her spouse) would receive Child Benefit, which is maybe one-in-ten recipients and that this would save about £1 billion a year (i.e. one-tenth of £11 billion a year total Child Benefit). Now they've raised the threshold and introduced the taper, with all sorts of fraud, error and admin, the saving (i.e. the extra tax raised) will be half that much, £500 million a year or something.

4. Hmmm, let me think. If the government wants to raise another £500 million a year tax from higher earners with children, isn't there a simpler way of going about this, without increasing marginal tax rates on earned income? Maybe have a couple of extra Council Tax bands for higher value homes and do a bit of rebanding or something? Surely, higher earners with children will either live in expensive houses, big houses or both? And if not, I'm sure that some of those single pensioners trapped in fuel poverty in big houses will be happy to swap places with them; the pensioners can cut their Council Tax and fuel bills; the higher earners with children get to live in the bigger houses? Win-win, that sort of thing?

Posted by

Mark Wadsworth

at

09:23

12

comments

![]()

Labels: Child Benefit, Fuckwits, Tories, Welfare reform

Wednesday, 20 June 2012

Epic

Chuckles spotted this tale in Takimag:

A cow, nicknamed “Libera” (free) by article’s author, had been on the loose now “for months” in the Apennine Mountains near the small city of Forlì where I live, and “quella enorme massa di 800 chili” (that enormous mass of 800 kilos) was charging anyone who approached it.

It was not that the cow had decided one day to become a bull, or a butch lesbian, or anything so boringly human. The cow’s feelings about its sexuality had nothing to do with it: The cow simply had enough of its life of slavery as a farm animal...

Well worth a read in full. I've no idea whether the story is true or is an elaborate hoax to trap cow-story aficionados. I've tried cross referencing to other articles, but the newspaper that seems to have run the original story is behind a paywall.

Posted by

Mark Wadsworth

at

21:09

1 comments

![]()

Fun Online Polls: The next bail-out & Any ideas?

The results (after reallocating one vote, as requested) to last week's Fun Online Poll were as follows:

Which Euro-zone member will be bailed out next?

Cyprus - 45%

Italy - 39%

Belgium - 3%

Malta - 1%

Slovakia - 1%

Slovenia - 1%

Estonia - 0%

Other, please specify - 11%

Two people suggested "Spain. Again".

So there we have it, let's see if we're right.

-----------------------------------------

I normally start a new Fun Online Poll each Monday, but this week either nothing interesting is happening or my mind has gone blank. I can't do football because the 62-minute incident appears to have been pronounced upon quite enough, and England's next match is on Sunday (which ruins the Monday timing).

So that's this week's Fun Online Poll: Any ideas?

Vote here or use the widget in the sidebar.

The smoking ban... and rental values

Common sense says that the smoking ban, which tipped thousands of pubs over the edge, must have depressed the rental value of all sites used as pubs or restaurants, which the government originally denied.

Dick Puddlecote informs us that the Valuation Office Agency has now officially acknowledged the smoking ban did depress rental values, and hence depressed receipts from Business Rates (which is the closest thing we have to Land Value Tax in the UK).

So, if the government wanted people to enjoy their evenings out, to create more jobs in pubs and restaurants, reduce the old age pensions bill and increase tax revenues all in one fell swoop, all it would have to do is...

Posted by

Mark Wadsworth

at

10:11

19

comments

![]()

Labels: Business Rates, Commonsense, Pubs, Smoking

Cable to force three year binding votes on MP's pay

From the BBC

Business Secretary Vince Cable will announce plans on Wednesday to force parliament to have binding votes on MPs pay every three years. Parliament will then have to stick to their pay plans for the next three years or have another popular vote.

They will also have to publish a simple figure every year showing how much MPs have been paid. And they will have to say how much pension an MP will be paid if they are sacked or quit.

Currently, MPs vote for their own pay, typically soon after getting elected, so they get a better salary, and because they're in for 4 or 5 years, there's nothing the people can do about it.

Posted by

Tim Almond

at

08:35

10

comments

![]()

Labels: MPs' salaries, Vince Cable

Tuesday, 19 June 2012

No oil painting

Posted by

Mark Wadsworth

at

23:00

1 comments

![]()

Labels: Caricature, England, Football, Ukraine, Wayne Rooney

"UK economy requires emergency cash injections to reverse fall in inflation"

Bob E has read between the lines of an article in The Independent:

The UK economy may have to adopt a more aggressive routine monthly injection of cash from next month after figures today showed a surprise drop in inflation. Falling petrol prices meant the Consumer Price Index (CPI) rate of inflation dropped to 2.8% in May, down from 3% in April and to the lowest level since November 2009. City analysts expect that without intervention the rate may remain unchanged or move below the currently recognised "danger level" of 2%.

Inflation has already fallen from 5.2% since last September and with further declines predicted, the Bank of England is expected to beef up its quantitative easing (QE) programme, which currently stands at only £325 billion following the, in hindsight, rash decision in February by members of the Monetary Policy Committee to suspend the £50 billion a month structured interventions.

Exhibiting his customary prescience, Governor Sir Mervyn King's gave a strong hint that more and more regular QE was needed during his annual Mansion House speech last week. Analysts said it looked likely that the necessary action would nevertheless have to wait until July 5, when the committee concludes its next two-day meeting.

Vicky Redwood, UK economist at Capital Economics, said: "Mervyn King has already hinted strongly that more quantitative easing will soon be forthcoming and these worrying figures today should ensure members vote to renew the programme at the upcoming meeting"...

The waning impact of the VAT hike at the start of 2011 and falling energy, food and commodity prices have also contributed to the problem. Last month, inflation moved to within 1% of the Government's 2% minimum rate, meaning Sir Mervyn had to send a fulsome private letter of explanation to the Chancellor.

A Treasury spokesman today said: "Inflation is now open letter territory. For the second month in a row the rate has fallen, provoking dismay."

In further evidence that some retailers may have been foolhardily cutting prices to draw in customers, overall food and drink prices rose by just 0.3%, compared with the better levels of 1.3% achieved last year.

The ONS said this 0.3% was also driven by declines in the price of fruit, particularly grapes, bananas, peaches and nectarines. The price of vegetables, mineral waters, soft drinks and juices also fell. Consideration is being given to attaching special import duties on these goods to address the problem.

Posted by

Mark Wadsworth

at

21:48

4

comments

![]()

Labels: Inflation, Quantitative easing

Are there enough 'Investments'?

A comment posted by, I think, Bayard in response to an earlier post by Mark got me thinking. Basically we were discussing pensions and funding and Bayard (I think) made the point that to have 100% money purchase schemes was impractical because there were not enough suitable investments to go round.

This doesn't seem right to me on the basis that 'supply creates its own demand'. Now it could be that a huge demand for paper securities of all sorts pushes up their price level, but surely this will simply make it more likely that more people will wish to list their businesses as the 'price' to them is lower. Or more bonds will be issued, say. Furthermore Governments will be able to fund more of their borrowing from real savings.

Of course I am assuming that we have a such a thing as 'sound money' and that all other things are equal and not wildly distorted by political meddling and mis-regulation.

Anyway, what do you think?

UPDATE: Spot the error? I didn't include land rents in the available investments!

Posted by

Lola

at

16:35

8

comments

![]()

"THE Eurozone crisis will be dragged out for years, David Cameron promises"

From The Soaraway Sun

THE PM reassured his fellow politicians and bankers as relief over Greece yesterday re-fuelled interest in opportunities in Spain and Ireland.

MARKETS saw a dramatic early rally after Sunday's knife-edge win for the pro-Euro New Democracy party in Greece's general election enabled market insiders to offload overpriced stocks. Within hours, speculators then pushed up Spanish borrowing costs to a high of 7.14 per cent, raising hopes that this would trigger another €100 billion bail-out for Madrid's bankers next month. And more action was also being considered for struggling financiers in Ireland too, with the EU and IMF looking at doubling Dublin's loan repayment term from 15 years to 30 years to ease its mounting pressure.

SPEAKING at the first day of the G20 summit in Mexico, quietly confident Mr Cameron painted a rosy picture of EU bosses' continual dithering over the slow-motion Eurozone "crisis". He said they were coming up with "just enough political and economic action to make it look convincing and keep you in bonuses".

HE ADDED: "If we don't push our luck - like we did in Greece or Ireland - it's likely that Eurozone "crisis" can be kept going indefinitely. But remember: it's a fine line. Just as we have to avoid a total collapse, we have to avoid a full recovery. If the economy did recover, we wouldn't have a cover story handy for why we keep giving the wealthiest people even more money for no apparent reason."

URGING Britain's bankers to look beyond Europe for new victims, the PM declared: "The UK financial sector must do all it can to ensure compliant regulation at home and to get its talons into the fastest growing parts of the world."

Posted by

Mark Wadsworth

at

16:20

0

comments

![]()

Labels: Banking, David Cameron MP, Euro-zone, Kleptocracy

Headline Of The Day

Posted by

Mark Wadsworth

at

12:22

2

comments

![]()

Labels: crime, Daily Mail, Death, Pornography, Transexuals

"Buying beats renting by almost £200,000 over lifetime"

Here's the original Barclays press release which has been re-hashed by most newspapers over the past two days:

Stepping onto the property ladder has enormous financial benefits over a person's adult lifetime. According to a new study from Barclays, owning your home rather than renting it will save you £194,000 over a fifty year period. And this figure doesn't even account for the value of the home the buyer will own at the end of it.

While the total cost of mortgage repayments, maintenance, and other costs associated with owning the average home would come to £429,000 over fifty years (a person's adult lifetime since a typical buyer purchases in his early thirties) renting a similar home over the same period would cost £623,000. Recognising that getting on the housing ladder, or trading up is still a substantial barrier to many, Barclays has created a new mortgage scheme (Helpful Start) which has a Family Affordability Plan incorporated into it, that lets parents help their children with loan affordability...

"Well, they would say that, wouldn't they?" you might think, but at least they explain why:

Over a fifty year span, roughly 50 per cent of the cost of occupying your own home comes in the form of mortgage payments - £210,000 out of the £429,000. Two fifths of that £210,000 is interest cost, while the rest is capital repayment. The next largest outlay is maintenance at £170,000. The initial purchase deposit is the next biggest cost, while insurance, stamp duty and other costs associated with buying the house in the first place make up the rest.

Yup, you "save" £194,000 and the bank earns £84,000 interest, of which it pays half to depositors and the rest is pure profit. Fag packet says £129,000 x 2% margin (rent) x 25 years, minus a third because mortgages are reducing balance = £43,000.

Only the "saving" is nowhere near what they claim, is it? They explain their assumptions (rents rise by 2% inflation and the tenant earns interest on the money he would have used as a deposit etc) and the total figure of £623,000 spent over the next fifty years looks about right - but they do not then discount this figure backwards to give the net present value. If you discount these payments backwards at Barclays' assumed savings rate net of tax (for want of a better discount rate), the total cost of renting in today's money is £310,000 and the total cost of buying is £277,000.

In relative terms, buying is more expensive because payments are front loaded, at a time when you might have other things to spend money on, like having children etc. For completeness; if you use a higher discount rate of 3.8%, the cash cost is exactly the same for renting and buying.

So there's not that much difference in the cash cost, the difference is that you will (hopefully) end up with a mortgage-free house*, the value of which will almost certainly have gone up faster than inflation and probably faster than wages. But I see no great urgency to "step onto the property ladder".

* Or maybe not.

Posted by

Mark Wadsworth

at

10:28

13

comments

![]()

Labels: Banking, Barclays, Excel, Mortgages, Propaganda, Rents

Monday, 18 June 2012

Ha ha! Serves her right! You reap what you sow etc.

From the Evening Standard:

Property show presenter Kirstie Allsopp has hit out at her neighbours for their “incredibly annoying” basement conversions.

The Location, Location, Location star said as well as causing disruption, the fashion for digging down to extend properties was also causing the housing market to stagnate. The 40-year-old presenter lives on a street in Holland Park where a number of neighbours, including Lord and Lady Sainsbury of Turville, have converted their basements.(1)

Nearly 40 applications for such work in the road have been submitted to the council in the past ten years, with a third submitted in the past two years.

Miss Allsopp said: “Everyone is digging down right now to make extra space where they are. It’s happening in my street and it is incredibly annoying as there is so much noise and disruption.(2) At the top end, where the (stamp duty) rate is now at seven per cent, it leaves people with little option but to dig if they want more space. As well as the noise and disruption, it is making the market stagnant.” (3)

1) Bear this in mind the next time she disses the idea of taxing the rental value of land instead of earned income.

2) OK, her TV shows were mainly about encouraging people to buy houses rather than tart them up, but she'd usually waffle on about "potential to add value" and chat gaily about "having all this knocked through and made into one big, er..." (TM Monty Python).

3) Not sure how she works this out, but let's assume she's correct, she clearly has a vested interest in people wanting to move home, see (2). As it happens, if we shifted to taxing the rental value of land, a lot more people would be wanting to move home for the next few years, so it would be boom time for decent estate agents, but vested interest (3) overrides vested interest (2) it would seem.

Posted by

Mark Wadsworth

at

18:53

3

comments

![]()

Benefits for striking low-paid workers to be axed

Blogger won't let me do a new post or amend old ones today, so I'm doing this by sending an email. Heck knows what the formatting will end up like.

UPDATE: The post appeared and now I can amend it. Which entails getting rid of all the stupid "div" tags.

-----------------------------------

From the BBC:

Low-paid workers who take strike action will no longer have their wages topped up by the state, ministers say. Workers on up to £13,000 a year can currently claim working tax credits to top up their income even when they take part in industrial action. But from next year there will be no increase in benefits if a worker's income drops due to strike action...

Under the new rules, benefit claimants will be identified as being involved in a trade dispute using information provided by HM Revenue and Customs, the government said. The amount a household receives in benefits will then be assessed using the normal, "non-strike"; level of earnings.

I can see the authoritarian appeal of this, even though I'd worry about the administration. HM Revenue & Customs can only provide the information (to whom?) if employers have provided the information first, which is probably a pain in the bureaucratic arse (what if a worker then does a day's worth of overtime in the next week to catch up, for example - he'd lose his top ups in the week he was on strike, and then he earns more next week so loses more top-ups anyway as his income is higher.) and gives employers the whip hand in negotiations. If people go on strike for a day, the employer could "accidentally" inform HMRC that they'd been on strike for a week, thus losing them one week's worth of welfare top-ups. Or the employer could agree a slightly less favourable pay settlement in return for not tipping off HMRC.

But never mind, this is still all a bit sledgehammer-to-crack-a-nut.

What if we just had a flat rate kind of welfare, call it Citizen's Income or Citizen's Dividend if you will, which is paid out to every citizen regardless of circumstances*. If somebody goes on strike for a day, then they'd lose a whole day's market wages automatically, instead of losing one day's worth of [below market wages + welfare top up], thus a Citizen's Income would achieve precisely the behavioural outcome which the current lot would like to achieve with absolutely none of the extra bureaucracy, none of the authoritarian overtones and without placing extra hassle on/giving undue extra bargaining power to employers.

* Unless they've got outstanding liabilities like court fines, child maintenance, tax bills etc.

Posted by

Mark Wadsworth

at

13:53

8

comments

![]()

Labels: Citizens Income, Iain Duncan Smith, Strikes, Welfare reform

Comment is free but cows are sacred.

Spotted by John B in The Guardian:

It's easy to assume cows are benign creatures – no one would fear them in the same way as bulls – yet, as a herds manager for more than 30 years, I know it's never a good idea to let your guard down. I look after about 300 cows on a farm in Gloucestershire and have built up a natural affinity with them – but I still remain wary.

Three years ago, I was moving the Friesian herd out of a field and one rather lame cow, who hadn't kept pace with the others, crept up silently behind me. I waved my hands at her and shouted, "Get back!" I wasn't concerned, just slightly irritated that she'd followed me. But as I turned to walk back to the yard, a force like the bonnet of a fast-moving car exploded in my back, throwing me face-down on the concrete track...

Shocked and winded, I rolled over and tried to get up, but the cow lowered her head and pushed it into my chest and stomach, crushing me into the ground. I felt the back legs of the 1,000lb beast folding, and realised she was going to sit on me.

It's hard to comprehend just how big a cow is until you're underneath one, looking up at it. I've no idea what made her so angry – I've waved at cows before and they've always backed off. But this one seemed possessed. She was making the most terrible bellowing, bawling sound – I think she genuinely wanted to kill me. Desperate and gasping for air, I took the only action I could – I pressed a thumb into each of her eyes and twisted as hard as I could.

The key, apparently, is to play dead. They'll kick you until you stop moving.