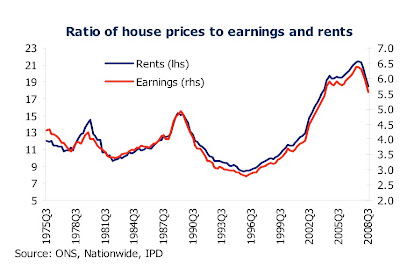

I have explained before that rents are a normal good, in other words they increase (or decrease) in line with wages. I've now found a handy chart to back this up, pinched from the Nationwide's December House Price Survey (click to enlarge): The logic being, if the ratio of prices-to-earnings changes in step with the ratio of prices-to-rents, then earnings and rents must also be moving in line (either up simultaneously or down simultaneously).

The logic being, if the ratio of prices-to-earnings changes in step with the ratio of prices-to-rents, then earnings and rents must also be moving in line (either up simultaneously or down simultaneously).

As it happens, they have fudged the two Y-axes slightly. The ratio of rents to earnings in 1975Q3 was 4.5-to-12 (i.e. average rent was 38% of average earnings) and in 2008Q3 it was 5.5-to-18 (i.e. average rent was 31% of average earnings). Quite why rents fell slightly over this 23-year period is open to debate, and it may well be down to statistical error or a short term thing like the flood of buy-to-let-landlords in the last few years.

Tuesday, 6 January 2009

Wages and rents

My latest blogpost: Wages and rentsTweet this!

Posted by

Mark Wadsworth

at

18:54

![]()

Labels: Economics, House prices, Rents, statistics

Subscribe to:

Post Comments (Atom)

11 comments:

Mark,

Not exactly a shock to a regular, but excellent to see it laid out so plainly, so well done!

I was hoping you'd give me some feedback on my latest "post"?

I saw that yesterday but I had to mull it over a bit before giving a full response.

Thanks for your thoughts!

Because the standard of living has improved due to worldwide economic growth?

Average rents to average earnings = 4.5

Average house price to average earnings 3.5 times (roughly historically)

There's a lot more in your post than meets the eye. Something is 'not quite right' as it were or I am missing something. It is certainly very thought provoking.

L, "Average house price to average earnings 3.5 times (roughly historically)" correct, we have always known this.

But the ratio of prices to rents is the left hand scale! Average rents appear to be (from that table) roughly one third of average earnings*, which sounds 'about right'. I think it's on the high side, but hey.

* Don't forget these are inverse ratios!

Is that earnings after government extortion or before?

AC1, that I do not know, but it does not affect the overall picture.

I have a feeling that Rent Ratios are stable WRT pay minus "deductions".

Mark,

It would be interesting to see interest rates (or actually 1 / interest rates) plotted on that graph.

To me, that graph shows something deeply disturbing: that as wages increase, it is not the recipients of the wages that receive the benefit of economic growth, but is instead, the property owner.

Why should a vast section of society remain on margin living, while others live it up, when it's our whole society that contributes to the economic growth?

PFW, that's a good idea but would involve a lot of work!

As to your second point, exactly, that is the obvious conclusion, which is why proper economists of yore (Smith and Ricardo) reckoned that Land Value Tax was the Least Bad Tax.

Post a Comment