I was chatting to somebody recently who does hot-dog and coffee stands, beer tents and so on at fairs all over Europe. He told me he was negotiating for a pitch for a hot-dog stand near a tourist attraction in central London, but the rent they were going to charge him was hundreds of thousand pounds a year.

This seemed quite amazing, until we ran through the figures, and agreed if he can sell a thousand hot-dogs or cups of coffee a day, with a gross mark-up of £1 on each one, minus £30,000 for wages and payroll taxes, minus other overheads, he would probably still be left with a fair profit margin after paying the rent.

I didn't ask, but I assume that the pitch he was talking about belongs to the council, in which case they are acting like any other landlord and charging the highest rent they can get away with. But because the rent is a pure site rent, it is more like a licence-to-operate. If you look at it that way, you could say that it is an eighty or ninety per cent tax on his business profits. Maybe it is, but this is further evidence for my generalisation that rents and taxes are ultimately the same thing, or at least that there is a big overlap. The difference is, I suppose, that 'taxes' are paid to the government, and 'rents' are paid to landowners (including cases where the government is the landowner, as in this case).

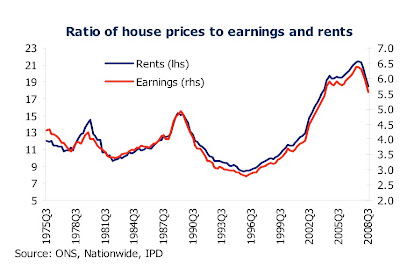

Selling hot-dogs is a nice simple business model, but let's now look at his employees, bearing in mind that unless the wages he pays cover their rent and other living costs, they won't work for him. They have to live somewhere within reasonable commuting distance. As we also know, rents rise (or fall) in line with average wages, or as the Nationwide express it, the house price/wage ratio changes in line with the house price/rent ratio:(click to enlarge): So if business picks up in an area - whether through the wise decisions of the local council, historical accident, a new airport being built or the sudden discovery of natural resources - then of course jobs will be created and wages will go up, but local property owners will benefit disproportionately. If they are landlords (and the first arrivals to take up the new jobs will of necessity be tenants, as they move the fastest), they will put up their rents; if they are home-owners, even if they have no direct income from the new industry, their homes will go up in value; if they are local farmers, they are now much more likely to get planning permission for new homes and make a windfall gain. The real bummer is for those tenants whose wages don't increase (because they have no involvement with the new growth industry) who see their rents rise as well - they are paying 'tax' on somebody else's income.

So if business picks up in an area - whether through the wise decisions of the local council, historical accident, a new airport being built or the sudden discovery of natural resources - then of course jobs will be created and wages will go up, but local property owners will benefit disproportionately. If they are landlords (and the first arrivals to take up the new jobs will of necessity be tenants, as they move the fastest), they will put up their rents; if they are home-owners, even if they have no direct income from the new industry, their homes will go up in value; if they are local farmers, they are now much more likely to get planning permission for new homes and make a windfall gain. The real bummer is for those tenants whose wages don't increase (because they have no involvement with the new growth industry) who see their rents rise as well - they are paying 'tax' on somebody else's income.

So 'rents' (on land and location values, as distinct from a fair return on the capital value of actual bricks and mortar) are just privatised taxes, really. And taxes are just the 'rent' that the government charges business for the licence to operate e.g. within the borders of the UK. So if you have a business that is renting its premises, and all its employees are tenants, it is paying two separate layers - taxes and rents.

The above may all seem blindingly obvious, once you think about it, but there seems to me to be only one reasonable conclusion that you can draw from it all ...

Saturday, 31 January 2009

A hot-dog vendor speaks

My latest blogpost: A hot-dog vendor speaksTweet this!

Posted by

Mark Wadsworth

at

20:30

![]()

Labels: Land Value Tax, Rents, Ricardo's Law of Rent

Subscribe to:

Post Comments (Atom)

9 comments:

The pitch should be auctioned.

It is being auctioned.

Good article.

Very well done.

Perhaps the effect we're talking about here only happens in the long-term? Perhaps the short-term effect of taxing land value would force landlords to put up rents... and only then would it gravitate towards its natural equilibrium? This could explain many economists' opposition or dismissal of LVT?

It suggests that to be implemented, it should start very low indeed, and then only gradually be increased in order to see the effects? Otherwise it would have a painful birth.

Yes, that's right - I'm plugging the SLP yet again :P

He should be worrying about Local Councils using their licensing powers to insist that 'mobile' fast food vendors provide 'healthy alternatives' such as toffu burgers and fresh fruit even if they do not appeal to the market that he is attempting to serve.

" Oi Kylie, before we grab a taxi back to your place, burp, let's a lentil pie and a litre of orange juice "

Middle of last summer I was cycling round richmond park and fancied a drink, I started looking for an ice cream van. I used to live locally and there there used to be one on every gate, but I went past every gate, not a single van.

I spotted one outside on the road and while buying asked him where they had all gone, turns out they wanted high tens of thousands for a pitch in the park, so he setup on the road for free.

A service killed by greed.

In the Emirates it seems the rule is for a "local" to have to sponsor your business, for which he takes a share. At first I thought it was a kind of sharecropper extortion kind of thing, until I thought about it.

In the UK many taxes are not related to what you make. There are fixed poundage business rates, rents, vehicle excise duties, insurance tax on statutory insurance premiums, and a raft of others. The odds are stacked more against a new start because of the number of taxes they have to front up. The new business gets little from the state in return for his contribution.

Perhaps the Arab system is better after all.

You really do hate property owners, don't you?

Certainly I do not. I have owned several in my life and intend to start buying again when prices bottom out. As the average property owner is also a wealth creator, for them it's six of one, half a dozen of the other.

Good post. The council always charge at below market rents. i.e. subsidise. It varies a lot depending on how much we want to keep the peace. 10-25% I hate it.

I sit on the planning ctte, not boasting, just that I see this Q arise all the time, when the poorer tenants ask for an even bigger subsidy. They shouldn't really be there and the place should go at market rate.

In the end I suppose it all balances out. Shit I'm sounding like an accountant now. More scotch...

Post a Comment