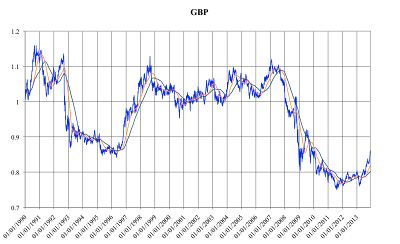

GBP appears to have bottomed out. Interestingly, it goes in line with house prices - currencies and land values are both driven by the same speculative flows - rather than moving inversely to house prices:

Most of the currencies are also on the up (from a low base, USD, EUR, CAD) or near all time highs (SGD, CHF and AUD). The only one which is approaching the bottom is JPY:

So if you were thinking of taking a punt from GBP into JPY, those charts seem to say "hang on a bit, give it another month or two". The message from the simple JPY vs GBP chart for the last five years is "pile in now, it's a good a time as any":

Cover Me! 'The Man Who Sold The World'

1 hour ago

12 comments:

February March still on track.

Intra-fiat currency speculation is amusing. But, it is also instructive to plot all those currencies against gold - gold being the ultimate universal money.

JH, explain?

L, gold is not "money", it is a physical commodity which for some reason people like to speculate in.

MW - wrt, anything at all will do as money as long as everyone accepts it and it can store value over time. Gold has always worked as 'money'.

I think of the speculation in gold the other way around. People speculate in money (aka 'currencies') by moving in and out of gold.

Personally, from watching what has been going on over the last few years, it seems possible that we, i.e. the world, are/is reverting to using gold as the money 'standard'.

But it is instructive look at stuff priced in gold over time. A few factoids stand out. f'rinstance, the oil price although more volatile than the gold price is broadly consistent over time in gold. Whereas all currencies have declined in value (price?) against gold in roughly the same amount as the oil price has increased in them.

L, yes, the price of gold as a commodity has been reasonably stable over the centuries in terms of purchasing power parity.

But the supposed stupendous returns are not as high as people imagine as gold does not pay interest or dividends.

MW. Re your second para. Absolutely. And I think that that is a Good Thing.

But, if you deposit gold in a bank and that bank wants to lend it out then it and you will require that someone pays you and it, some rent for the use of the gold - at a rate that represents the bank and your perception of the riskiness of the loan. You may lend 10 ozs. for a year on the basis that you get 11 ozs. back in 12 months.

So gold is not directly wealth creating. The wealth creation - and the divis - happen when an entrepreneur brings togther the factors of production and makes a profit.

So no-one holds gold as an 'investment'. It is held as liquidity aka 'money'.

In the old Swiss private bank asset management model they, the Swiss, would recommend that 10% of any portfolio should be held in gold. The balance, in income producing investments like shares, bonds and property. And, FYI our portfolios are arranged in this way for clients that have the resources. We are engaged in defending clients from two great evils, inflation and taxation. The former is reasonably easy to deal with the latter, not.

L, if you lend somebody gold and expect to be repaid in gold, then it has become "money". You can denominate a debt in anything you like, sterling, Euro, dollar, gold, hours of work, fresh eggs, "money" has been created out of thin air (unlike the hours of work, ounces of gold or fresh eggs, which can't be so created).

The amount of debt which you will be repaid depends on the borrower's ability to pay, not the value of gold (hours of work, fresh eggs).

If the price of gold doubles or trebles, then your borrower will probably not be able to repay in full.

If the price of gold falls, then your borrower has made a one-off deflationary gain at your expense.

MW. No, that's not what I was getting at.

Para 1. Correct. That's exactly what gold has become (is already?) And the other things you menation can also be money is the parties to an exchange so choose.

But if gold IS the 'money' then its price will not rise or fall. You are assuming that the gold will be switched into another 'money', which I am not.

Whatever way you look at it gold (in your own phrase) is the historic 'tried and tested' money, along with, to a lesser extent, silver. This was money with intrisic value.

Intriguingly various people also made copper 'money' (tokens) that could be used as money without any intrisic value but were held as promises that would be honoured by the issuer.

You just have to stop thinking of Gold only as a commodity and appreciate its global acceptance as 'money' (among its other uses - heat shielding for space craft for example).

L: "if gold IS the 'money' then its price will not rise or fall"

If there were no such thing as loans or credit, then probably.

But a system of "money" where payables and receivables are denominated in units of gold is still "money", you can still have fiat currencies, credit bubbles, government deficits, reckless lending/borrowing, land price bubbles etc.

We've always had land price bubbles, even though at the time we had the Gold Standard.

So while this system might be good against inflation in the RPI sense of the word, inflation is not something inevitable which just happens, it is something engineered deliberately by governments in particular on behalf of the Homeys.

Well, not exactly, no.

Your post assumes no change in banking rules. You and I know that FRB (as currently mandated) is an inflation machine - inflation being the unwarranted expansion of money and credit by the central bank/gummint/commercial banks all in league with one another.

Also making gold money - or rather bowing to the inevitable - pure fiat money must die.

AFAIAA the 1844 Bank Charter act tried to stabilise the FRB system of its day, but although it nationalised bank notes and stopped them being issued on an FRB basis by commercial banks , it did not stop chequeing accounts, which are a form of money, operating on an FRB basis. A further result of this act was to place all 'money' in the hands of the B of E which although it paid lip service to the gold standard did no such thing and was eventually found out by WW1.

Of course there will be loans and credit - but as long as they are backed by gold (or whatever) and banking is reformed along Douglas Carswell's proposed lines then we should end up with sound money.

I think that this is all of a piece with LVT and CI. To make those work - and to control government - we must also have sound money.

And I agree that gummint engineers inflation to help homeys and itself.

L: "Of course there will be loans and credit - but as long as they are backed by gold…"

Well that was my earlier point.

If you lend me x ounces of gold (to spend, invest, whatever) and I spend, invest those ounces, your only security is my ability and willingness to repay you - the physical gold is long gone, the value of the loan (from your point of view) is entirely down to my efforts/honesty and not the value of the ounces of gold you lent me.

MW Correct! And that 'risk' is reflected in the return the bank and I require.

But assuming that gold is 'money' - i.e. the currency in use - then the borrower (assuming a business loan) will be making sales and receiving gold in payment. Ideally he will be making enough to pay us back.

If the loan was to a consumer he ought to be confident that he has sufficient income coming in from elsewhere to pay us back.

The thing about gold as currency it stops stone dead the ability of governments to inflate. Or it makes it very difficult for them to do so.

Post a Comment