I can't think of anyone who benefits from all the state schools having half-term on the same week.

It's easy to see who would benefit from staggered half terms: parents, as places they want to go would be less liable to be booked up and there would be less congestion getting there, the holiday industry as they would get three weeks of trade at higher prices instead of just one, commerce as every working parent isn't trying to take the same week as holiday, residents of cities, as they would get three weeks of reduced congestion instead of one. It looks a bit of a no-brainer, yet the powers that be insist on keeping half term to one week. Am I missing something?

Thursday, 31 October 2013

Half Term Week

Posted by

Bayard

at

21:25

8

comments

![]()

Hugo Chavez's face appears in subway tunnel!

Sticking with the Sesame Street theme;

In news that will have every suburban, sofa socialist mumbling briefly with whatever passes for glee in their #grimdark world, and simultaneously sending the wannabe Aristo, office junior, conservatives of the world running to ConservativeOfficeJunior-AristoWannabeForum.com to spaff hot faux rage into the interwebs;

President Nicolas Maduro said on Wednesday the workers in a subway tunnel saw the image of Hugo Chavez come and go, and he showed a photo of the alleged visage in a rally in Caracas.

"Look at the figure, a face. This picture was taken by the workers," he said, smiling. "Chavez is everywhere."

Maduro, was handpicked by the ailing Chavez to run for president upon his death, said during the election campaign in April that he had seen the populist leader incarnated as "a little bird."

So, should you be digging the garden this week or hanging around the UN you might be lucky enough to suffer a spectral visitation from the cheeky human rights abusing scamp Hugey Chavez.

Posted by

SumoKing

at

14:00

1 comments

![]()

Labels: Hugo Chavez

Did anybody else forget to post their "Happy Halloween" cards?

Posted by

Mark Wadsworth

at

12:40

0

comments

![]()

I wish they'd make up their minds

People explain the Coriolis effect using the analogy of a roundabout e.g. Dr Helen Czerski.

So objects or wind moving in a straight line in the northern hemisphere will curve slightly to the right, good stuff, I understand that. Now, if you are constantly turning to the right, then looked at from above you are moving clockwise, are you not?

But we know that hurricanes, tornados and the trade winds move anti-clockwise, so something has got lost in translation here.

What is even more irritating is that the supposed experts cheerfully explain that winds turn to the right and then in the next breath say that this is why hurricanes etc turn anti-clockwise. Do these people just learn stuff parrot-fashion without ever wondering whether it actually makes sense?

----------------------

UPDATE: Thanks for all your suggestions. View From The Solent emailed me a link to this explanation, which seems reasonably scientific, plausible, and easy to picture:

Storms in the northern hemisphere always circle counterclockwise, or to the left. Storms in the south turn clockwise, to the right. This consistent motion is due to the Coriolis Effect, and yet it if it is, why don't the storms circle to the right?

The mechanics of this are best understood when walked through physically. You'll need some object to mark a spot on the floor, and if possible, a friend. Put a book or a plate or some object down on the floor a few feet away from you. This is a low pressure system. A low pressure system is created when air is heated enough to lift upwards, creating a relative vacuum below. Higher pressure air from around the system rushes in to fill the vacuum. That's you.

We'll pretend that you're in the northern hemisphere. This means the earth turns to the left under you, and your course appears to be diverted to the right. The low pressure system is pulling you in. Take a slow step towards the low pressure system, and have your friend pull on your right sleeve. If you're alone, imagine that someone is turning you sharply to the right. If you've done it correctly, you'll be a little closer to the low pressure system, but you'll have turned to the right, so the system will be on your left.

That low pressure system is still pulling you, so take turn and take another step towards it. Again your friend, imaginary or real, is tugging your right sleeve, turning you to the right. Repeat this step a few times and you'll notice that you're circling the low pressure system in a counterclockwise fashion.

The way that the Coriolis Effect in the northern hemisphere makes objects, including winds, veer to the right of their targets causes them to circle those targets to the left – or counterclockwise. In the southern hemisphere, the way the Coriolis Effect makes objects veer to the left causes them to circle their targets to the right – or clockwise.

Posted by

Mark Wadsworth

at

08:22

25

comments

![]()

Wednesday, 30 October 2013

Wine Shortages

There's a few reports talking about wine shortages, such as this one at the BBC:-

The world is facing a wine shortage, with global consumer demand already significantly outstripping supply, a report has warned.

The research by America's Morgan Stanley financial services firm says demand for wine "exceeded supply by 300m cases in 2012".

...

They say this could be partly explained by "plummeting production" in Europe due to "ongoing vine pull and poor weather".

Well, 2012 was about poor weather, yes. Wine writers aren't too keen on what they've tried of Bordeaux 2012s, where 2010 is considered to be very good indeed.

I'm sure someone is going to start screaming about climate change, even though it seems to have produced some great years, but the point that should be underlined in that article is "vine pull", which Wikipedia explains as:-

Vine pull schemes are programs whereby grape growers receive a financial incentive to pull up their grape vines, a process known as arrachage in French.

in other words, set-aside for wine.

So, there isn't really a crisis in production, more that there's a one-off adjustment to remove subsidised, low-grade wine grapes and have wine grapes sold at market rates. Which is why European production is in decline and New World production is growing. The labour and land costs of someone in Chile are lower than in France.

Posted by

Tim Almond

at

22:48

7

comments

![]()

"Jane Austen banknote portrait 'surgically enhanced', says biographer"

From the BBC:

A Jane Austen biographer has criticised the Bank of England for selecting a "sexed up" portrait of the author for its new £10 note.

Oxford University fellow Dr Paula Byrne said the 1870 image showed the author with Double-D breasts in a low cut dress, both absent in an earlier portrait composed by the novelist's sister Cassandra showing her as rather flat chested and dowdy.

But the Sun's current editor David Dinsmore, who was consulted by the Bank of England, felt it was a good choice. The Hampshire-born writer was chosen to replace Katie Price on the £10 note.

Posted by

Mark Wadsworth

at

13:35

7

comments

![]()

Is power shifting eastwards or westwards?

From Free Critical Thinking:

Financial capitalism and the ruling elites, which control it, have no national loyalty or interest, they move to reap the fattest harvest.

Thus in the 19th century, the British empire was the vehicle for world domination until Britain's demise in the 20th century shifted attention westwards to the USA. Now that America is in decline, focus is shifting eastwards to China.

Nope.

The oldest empires were Asian or Middle Eastern, then came the Egyptians and the Greeks, then the Romans, then the British Empire etc, the centre of power (if by that you mean the capital cities and trading centres such as major ports and harbours) was clearly shifting westwards at a leisurely pace.

Then came the "American century", which had also been colonised from east to west.

The next shift was from America to Japan and possibly Korea in the latter part of the twentieth century, which is clearly another westward shift (across the Pacific - presumably Hawaii was the world centre of power for a few months in 1973).

Those two countries are now also in relative decline and we observe the rise of a massive state-cum-conglomerate trading under the name "The People's Republic of China" run by a nominally Communist Party, which is based on mercantilism, land speculation, political and financial repression, intellectual property theft and most of all, slave labour, which from Japan and Korea's point of view is yet another shift westwards.

So presumably it will be Russia's turn next and give it a century or two, the Europeans and then the British will be top dogs again.

Posted by

Mark Wadsworth

at

11:01

2

comments

![]()

Labels: Geography

A bit like Gibraltar then...

I knew that Spain occupied a couple of small islands off the Moroccan coast, which the Moroccans say should be given (back?) to them.

I didn't realise that Spain actually occupies small enclaves on the Moroccan coast, as explained in this BBC article:

So that's all sorted then.

The next time the Spanish government wants to distract attention from larger issues and demands the return of Gibraltar, we can tell them to hand back Melilla, Perejil, Ceuta and all the other bits and pieces shown on this map and then we'll think about it.

Posted by

Mark Wadsworth

at

08:28

6

comments

![]()

Tuesday, 29 October 2013

As ugly and pointless as the car might be, it's a good advert

And yes, I know that the optical illusions aren't new or original either, but you've got to admit it's well done.

Perversely, the best bit is 18 seconds in when the front wheel of the car just goes behind the corner of the table, which immediately gives the game away. But you know it's an optical illusion and how it's done, so perhaps these infernal smart alecs left it in as a deliberate mistake to trick smart alecs like me into re-watching it to see if the mistake is really there so that I can point it out to others?

Posted by

Mark Wadsworth

at

22:28

2

comments

![]()

Labels: Advertising, Cars, Television

Politicians Salaries: Electric Firms To Turn Up Heat On 'Big 650'

From Sky News

Politicians from Britain's biggest parliament will appear before a panel of electricity company executives today to justify their most recent round of price hikes.

Labour, Conservatives, Lib Dems and SNP have raised bills by an average 11% for this winter.

They all say the market for competitive skills are to blame.

But data from the Office for National Statistics showed that GDP had only risen around 0.8% this quarter.

Posted by

Tim Almond

at

19:42

1 comments

![]()

Labels: Electricity, Hypocrisy, markets, MPs

Cameron talks shite on immigration and education

From The Express (just for a change):

MIGRANTS are flooding to the UK because British youngsters are not "capable" of working in factories, the Prime Minister has said.(1)

Speaking at an apprentice event in Oxford today, David Cameron said migrants from eastern Europe should not be blamed for coming to the UK to fill the void left by under-educated British workers.(2)

But the Conservative leader has been slammed for his "denigration" of British workers by Ukip, while Labour called for Mr Cameron take "positive action" to get more British workers into apprenticeship schemes.(3)

Mr Cameron said:

"You can go to factories in our country where half the people come from Poland, Lithuania or Latvia. You can't blame them, they want to work, they see the jobs, they come over and they do them. But as a country what we ought to be saying is 'No, let's get our education system right (4) so we are producing young people out of our schools and colleges who are fully capable of doing those jobs'."(5)

The welfare system required reform so it "does not pay to be out of work" (6) and immigration needed to be restricted, he added.

"Let's have sensible controls on immigration (7), particularly from outside the EU where we can cap the number of people who come," he said.(8)

Where to begin?

1) The unemployment rates in the three countries he mentions are 9.7%, 17.4% and 9.1% respectively (as against 7.8% for the UK), so it's hardly surprising that the brightest, best and most committed go abroad to look for work and some of them end up here.

But those people are not particularly representative of all Polish, Lithuanian or Latvian people - the lazy ones stay at home and don't work in factories either. If you start with the unemployment figures, you can easily argue that people in those countries are even less suited for "factory work" than we are.

2) Agreed. On a personal level, you can't blame them. The few Poles I've met, I've liked (even though they're a bit racist) and their shops sell a mean pickle.

But we are where we are, and a UK government has to give priority to the interests of existing UK citizens - a few of whom have lost their jobs and many of whom have seen their wages pushed down as a result of immigration (and as a result of high house prices and rents, separate topic).

3) Things have come to a sorry pass when Cameron can be simultaneously and justifiably attacked from right and left.

4) Education is a good thing in and of itself. I have it on good authority that Polish state schools are far better than English ones, so it would not surprise me if Poles are on the whole "well educated" (like the Germans). Doesn't explain their high unemployment rates though, does it?.

5) But how much "education" do you need to work in a factory? You need some innate ability, a bit of on the job training and a lot of commitment. And why do employers prefer the best, brightest and most committed Eastern Europeans to the least employable native Brits? Because they work harder and better for lower pay, is why.

If we improved our education standards so that everybody is at least capable of "factory work" (a desirable aim in itself), what will happen to all the next generation? They will still expect higher wages than the Eastern Europeans, so they still be less likely to be employed in factories.

And if we turn out a generation made up exclusively of scientists, engineers and entrepreneurs, then they will be setting up more factories (hooray) but by definition, they will be employing even more cheap labour from abroad (who would work on the shop floor if they have the skills and qualifications to be the boss?).

Or maybe all these freshly turned out scientists etc would take the opportunity to leave the UK and move to a more business-friendly country not run exclusively by and for landowners (who will do their level best to prevent new factories being built, let alone new housing for all the factory workers).

Analogy - doctors and nurses from poorer countries coming to work in the UK. The UK wastes enough money on so-called health services, but what sort of return do African countries get on training nurses and doctors who promptly bugger off to less sunny climes?

6) It's called a Citizen's Income, Dave. Google it.

7) Of course a policy - whether on immigration or anything else - needs to be "sensible", that is meaningless guff, like "fair". But why does that automatically mean reducing the absolute numbers?

Given the admitted quality of some Eastern European workers, perhaps we'd be better off with more of them (and obviously fewer Somalis who come over here to sponge).

Whether that means more or fewer immigrants in total is neither here nor.

8) Another open goal for UKIP.

Posted by

Mark Wadsworth

at

15:40

17

comments

![]()

Labels: David Cameron MP, Education, Idiots, Immigration, Unemployment

Killer Arguments Against LVT, Not (307)

Lorna Doone at CityWire back in 2011:

Business secretary Vince Cable has hinted that a property tax on expensive homes could be the price high earners have to pay if they want the top rate of tax reduced from 50% to 40%... (1)

Such a switch assumes that owners of valuable properties are all high earners with incomes in excess of £150,000 who would benefit from a reduction in the top rate of tax from 50% to 40%.(2)

This is very far from reality. Some are likely to be pensioners who have seen the value of their property more than double between 1998 and 2007 but are now living on modest incomes. Many would be totally unable to pay the tax.(3)

Assuming the tax was levied at 0.5% a year on properties worth £2 million or more – the LibDem's manifesto proposal – someone with a property valued at £2 million would pay £10,000 property tax a year.(4)

For a person to be better off they would need to be paying tax at 50% on at least £100,000 of earnings – an income of £250,000 a year. These high earners would see the tax on the top £100,000 of income drop from £50,000 to £40,000 – a saving of £10,000 – if the top rate of tax is reduced from 50% to 40%.(5)

1) Good. A tax shift is what the economy needs.

2) Nobody ever made such a stupid assumption. Not everybody who'd like to drive a new BMW can afford to buy one; not everybody who would like to live in an expensive house can afford to do so. LVT is a free market thing - you pays your money and takes your choice, and if the price is set much too high, then government revenues fall.

It's a tax shift. For example, perhaps we will decide in future that tobacco duties should go down (because more smokers = massive savings in old age care costs) but that booze duty should go up (= less drink driving, less drunken fights). Nobody assumes that smokers are all drinkers and break even on this, it is a tax shift from smokers to drinkers with an overall benefit to society.

3) Roll up and pay on death or later sale. Easy.

As it happens, there are dwindling few of such people and it seems idiotic to design a whole tax system around the specific situation of a few marginal cases while making the vast majority considerably worse off.

4) That's not what they proposed, the proposed just taxing the excess of the value above £2 million. So the tax on a £2 million home would be £zero.

5) To be paying £10,000 a year, you'd have to be living in a £4 million home, but even assuming that this is the tax on a £2 million home, how many people in those homes earn more than £250,000 a year (a house price to income ratio of 8 - the average is more like 6)? I would suspect nearly all of them once we have excluded a tiny minority of Poor Widows In Mansions.

So as ever the interests of the "wealth creators" (I use the term loosely) and "land speculators" are diametrically opposed.

Which leads us onto a more recent pathetic attempt at a KLN by Nigel Green of The DeVere Group, who are of course financial and land speculators, so not in any way a vested interest:

By a miracle of Homey non-logic, he conflates the two opposing groups - wealth creators and land speculators and pretends that their interests are aligned:

Apart from the philosophical arguments for and against taxing to death the leaders of industry, entrepreneurs and those who have become successful, there are some very obvious practical concerns (especially in the currently febrile housing market) in attaching a definite and unchanging value to a property... (6)

The other practical consideration is that some people, especially in the London area, might have lived in their property for 30 years or more and find that its value has increased so dramatically that they would be facing a tax bill that they have no way of paying.(7)

6) He waffles on about how difficult it is to value land. As a land speculator himself, he must know that it is very easy. And establishing the "site premium" of housing and most non-specialised commercial land and buildings (i.e. the excess of actual or potential rental income over actual running costs, averaged out over similar buildings in each area) is even easier than that.

That site premium is the upper limit for LVT, as long as the actual tax is no more than that (and the Lib Dems' proposed Mansion Tax is a lot, lot, less) then no harm done. If some miserable sod wants to argue that his house is worth £3 million instead of £4 million, then fine, all we need to do is adjust the official (and admittedly arbitrary) tax rate up slightly to arrive at the same tax bill.

7) Roll up, roll up! Come and see the fun of the fair!

So whose side is he on? The "wealth creators" or the "land speculators"? Or has he convinced himself that he has become wealthy, therefore he must have "created wealth"?

Posted by

Mark Wadsworth

at

13:07

4

comments

![]()

Labels: KLN

Sesame Street: Homelamb (Homeland Parody)

Posted by

SumoKing

at

11:58

0

comments

![]()

Labels: Afghanistan, muppets

Those annoying Lloyds adverts

See write up of "Moving Out" here, which is infuriating/patronising enough, but even worse is the small boy whose parents used to live with his grandparents (not clear whether on mother's or father's side) who can buy a house (in which the small boy is later born and grows up) because "The bank lent them some money".

No the bank did not lend them any money at all, quite the opposite:

1. If you lend somebody money, you are foregoing a consumption opportunity, for the time being at least. It's up to you whether you want to charge interest or not, how much you can get depends entirely on what the borrower is willing and able to pay and/or how much you want to get.

When banks grant mortgages they simultaneously take deposits and are not foregoing consumption opportunities, they are increasing their consumption opportunities by charging more interest on the loan than they take on the deposit.

2. Where does that "money" come from?

a) The bank is just a middleman who splits the zero (with a vested interest in high house prices as this means more lending and deposit taking).

b) It doesn't come from the vendor, because he never had that money, he had a house which he magically turns into a deposit. He can withdraw that money in future and spend it on something else (to which more below).

c) So actually, the "money" comes from the purchasers. They are the ones who go out to work, transform their labour into wealth for which they receive wages or salary, and they devote a large chunk of that into mortgage repayments, which flow via the bank (which takes its cut) back to the vendor. So they are the ones foregoing consumption opportunities!

3. The true position in 2(c) is not materially different to that small boy's parents renting a home (where they can still have sex and bring up kids etc). If they take out an interest-only mortgage, they are renting the money instead of renting the house, is all.

4. "Ah!" cry the Homeys, "But they have paid for the capital value of the house, they are building up their own capital by paying off the mortgage, this is a form of saving etc etc."

Nope, that supposed "capital value" is merely the estimated cost/value of all the future rent which they would have to pay, whether that is for a term of years (a lease) or to theoretically to infinity (a freehold). And borrowing is clearly not "saving" and neither is paying rent or interest - those make you poorer in the long run, not richer.

5. "Ah but…" cry the Homeys, "That house will go up in value, so they are getting richer etc etc."

Well yes and no, all it means is that the next purchaser in a few decades' time will be even poorer. It is no net addition to wealth, unlike proper capitalism and investment.

6. Finally, seeing as there is only a marginal difference between renting and buying with a mortgage in financial terms from the purchaser's point of view, why is it different for the current owner?

Answer: it isn't.

a) Superficially, if the current owner decides to rent out the house, he has to make do with £1,000 a month rental income minus voids and costs etc, and he can't spend any more than what he takes.

b) But if he sells, he is credited with a one-off deposit of £200,000, which he can withdraw and spend all in one fell swoop or just leave it in the bank and hopefully get a bit of interest (his share of the rent of interest that the bank is collecting).

c) However, what the bank is doing here is dealing with the admin hassle side of collecting the rent/interest (fair enough) and spreading the risk.

The banks has thousands or millions of mortgage borrowers, 99% of whom will be paying their mortgage every month, so that's £x million coming in every month, and on average, its depositors will be withdrawing rather less than £x million every month.

d) A large enough group of landlords could do exactly the same thing. If you only have two or three homes, there is a small but real risk that in any month, no rent will come in at all or that costs will exceed income.

But if thousands of landlords clubbed together and agreed that all the rents go into one account and all costs are paid from that account with each landlord entitled to his appropriate share of the whole, then those landlords would be in much the same position as depositors.

So £z million comes in as rent, £y million goes out as costs, leaving a maximum of £x million which can be withdrawn every month. Some landlords/depositors will withdraw their share each month, other will be happy to roll up their share and yet others will withdraw in advance, i.e. they contribute a home generating £10,000 net income every year and immediately withdraw £200,000 to splash out, knowing that they will only be able to withdraw very little in future.

e) The counter example is a really small bank, which only has two or three mortgage borrowers and one large depositor. It does not matter what it says on his bank statement, he cannot withdraw more than what the borrowers pay in each month. The risk spreading is not something that banks inherently do, they can only do it because of averaging out a few bad debts over a large number of depositors.

Just sayin', is all.

Posted by

Mark Wadsworth

at

11:04

19

comments

![]()

Labels: Banking, Lloyds TSB

Monday, 28 October 2013

Fun Online Polls: Plebgate & The Velvet Underground

The results to last week's Fun Online Poll are as follows:

Plebgate: Who is lying?

Andrew Mitchell - 2%

The police - 36%

Probably both - 60%

What is "Plegbate"? - 2%

A good turnout, thanks to everybody who took part. Glad to see I'm with the majority on this one.

------------------------------------

Everybody has turned out in force to sing the praises of Lou Reed (1942 - 2013), and rather irritatingly, the BBC kept playing Perfect Day which was a relatively unknown Lou Reed song (and deservedly so) until they brought out that ghastly everybody-join-in version for Children In Need. Playing a quarter of an hour of Sister Ray would have been a lot funnier and more to the point.

But his solo albums were pretty inconsequential as a whole, the good ones were the Velvet Underground albums, of which most people only know the first one.

So that's this week's Fun Online Poll: "Apart from The Velvet Underground & Nico, which are your favourite Velvet Underground albums?"

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

20:55

3

comments

![]()

Labels: Andrew Mitchell, BBC, Death, FOP, Music, Velvet Underground

"British man, 28, made MBE after hacking into computer systems of US army, Nasa and other federal agencies"

From The Daily Mail:

A British man has been made a Member of the British Empire after showing true British grit and determination and hacking into the computer systems of the US army, Nasa and other federal agencies.

The 28-year-old, named as Lauri Love from Suffolk, was presented with the award by officers from the National Crime Agency (NCA) under the Computer Misuse Act (CMA). He has been invited to join a specialist team with Gary McKinnon at GCHQ from next February.

Showing the bulldog spirit of Bletchley Park during World War II, Love and his partners stole information about government employees, including military service members, by hacking into government networks and leaving behind 'back doors'.

NCA spokesman Andy Archibald said:

"These American fuckers think they can eavesdrop on all their so-called allies with impunity.

"This award is the culmination of close joint working by the NCA, Police Scotland and our international partners in identifying and honouring UK citizens who are going to give those fuckers a taste of their own medicine.

"Cyber-criminals like the NSA should be aware that no matter where in the world you commit cyber crime, even from remote places, you can and will be identified and held accountable for your actions.

"Unless you are a Yank, in which case we will politely turn a blind eye but get our petty revenge by refusing to meekly hand over UK-based hackers and giving them a gong instead."

Posted by

Mark Wadsworth

at

16:55

0

comments

![]()

"EastEnder's Game"

From imdb.com and Wiki:

In the near future, a hostile alien race led by Grant and Phil Mitchell attacks Albert Square, in East London and takes over the Queen Victoria pub.

The plot is built around the idea of relationships, strong families and the legendary heroics of International Fleet Commander Mazer Rackham, with each character having a place in the community.

In preparation for the next attack, the highly esteemed Colonel Hyrum Graff moulds the entire community into a family of sorts, prey to upsets and conflict, but pulling together in times of trouble, such as when there is the threat of annihilation by a technologically superior alien species.

The International Military are training only the best minds from Beale and Fowler families, consisting of Pauline Fowler, her husband Arthur Fowler and teenage daughter Michelle Fowler. Mark Fowler, a shy but strategically brilliant young leader, is recruited to join the élite.

Arriving at Battle School, Pauline's twin brother Pete Beale, his wife Kathy Beale and their teenage son Ian Beale quickly and easily master increasingly difficult challenges and simulations, winning respect amongst their peers for their full English breakfasts.

Mark Fowler is soon ordained by Graff as the military's next great hope, resulting in his promotion to running a stall in the market. Once there, he's trained by Mazer Rackham himself to lead his fellow stall holders into an epic battle with the Mitchells that will determine the future of Earth and save the human race, while Sanjay minds the stall.

Posted by

Mark Wadsworth

at

11:59

3

comments

![]()

Labels: Films, Television

"Pirates' Britney fears"

From The Metro:

BRITNEY SPEARS is being used as a secret weapon... to scare off Somali pirates. Her hits are blasted out to deter kidnap attacks, merchant navy officer Rachel Evans revealed.

Second Officer Evans, who works on supertankers off the east coast of Africa, said:

"Her songs were chosen by the security team because they thought pirates would hate them most. These guys can't stand Western culture or music, making Britney's hits perfect."

... Steven Jones, of the Security Association for the Maritime Industry, said:

"Pirates will go to any lengths to avoid or try to overcome the music.

"Though I'd imagine using Justin Bieber would be against the Geneva Convention."

Posted by

Mark Wadsworth

at

10:19

0

comments

![]()

Labels: Britney Spears, Music, Pirates, Somalia

Sunday, 27 October 2013

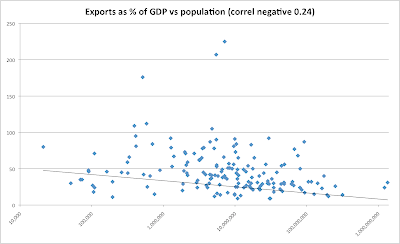

The ratio of exports to population, GDP and per capita income

A throwaway phrase which many people use is that "Great Britain is a great trading nation", but on closer inspection, how true is this any more?

I downloaded all available figures for populations and GDP from the CIA Factbook and exports-to-GDp ratios from the World Bank (that last one is hours of fun), bunged them into Excel and created some charts.

All horizontal axes are logarithmic. The coefficient of correlation for exports-to-GDP is negative 0.13 if you use absolute figures and positive 0.04 if you use logarithms, so to all intents and purposes, this is zero.

Unsurprisingly, there is a slight negative correlation between population size and exports - if you have a large population then there will be a much wider range of producers and consumers in the same country, but if you have a smaller population, you tend to specialise in fewer things, so if you are world leader in bananas or oil or anything else, you have to export most of your output to be able to buy stuff which other people produce cheaper or better than you.

Similarly, there is a fairly high positive correlation between per capita income and exports - the richest people/countries are those who specialise, which in turn drives exports; and people/countries who export more are probably richer (chicken and egg).

And how does the UK score?

It's only fair to compare like-with-like, so I sorted the data three ways, in terms of descending population; per capita income; and GDP, and then compared the UK's exports with the next three countries above and below it in the rankings. The UK scored distant fourth, distant fifth and distant second equal respectively. Which hardly makes us a "great trading nation" any more.

The figures for the six countries with exports-to-GDP ratios over 100% are misleading as they include a lot of purely paper exports which are matched by equal and opposite paper imports, i.e. trades are booked through those usually small countries for tax, regulatory or subsidy reasons (lack of the first two and/or lots of the last) without anything physically actually happening there, i.e. the factory in PR China ships the goods direct from mainland China to elsewhere in the world but the Hong Kong intermediaries book it as a purchase and sale. These six countries are Hong Kong 'Special Administrative Region', Singapore, Luxembourg, Macao 'Special Administrative Region', The Maldives and Republic of Ireland.

So now we know.

Posted by

Mark Wadsworth

at

13:15

0

comments

![]()

Labels: Economics, Exports, Free trade, Population, statistics

Saturday, 26 October 2013

TomTato

The BBC wrote about somebody who had successfully grafted a tomato plant onto potatoes, so you can get two crops from one space.

Bit of a problem though:

"It has been very difficult to achieve because the tomato stem and the potato stem have to be the same thickness for the graft to work," he said...

The firm said the plants last for one season and by the time the tomatoes are ready for picking, the potatoes can be dug up.

Well a fat lot of good that is then, if they only last one season. The extra hassle of the trial and error grafting them is probably not worth those few extra potatoes/tomatoes.

But this reminds us that tomatoes and potatoes are from the same plant family and are native to Central/South America, so sooner or later, they'll be able to splice the DNA together and make plants which will grow again and again or from seeds. (You'd have to be careful which up you plant the seeds though, if you put them in the wrong way up, you'll get potato flowers growing on tomato roots, which is worse than useless.)

The list of useful plants in that family is very long:

Perhaps the most economically important genus of the family is Solanum, which contains the potato (Solanum tuberosum, in fact, another common name of the family is the "potato family"), the tomato (Solanum lycopersicum), and the aubergine or eggplant (Solanum melongena). Another important genus Capsicum produce both chilli peppers and bell peppers...

Nicotiana contains, among other species, the plant that produces tobacco.

So in a perfect world, you'd have a plant which produces potatoes under the ground and tomatoes above it, with leaves which you can dry and smoke. Result!

Other useful plants which are native to Central/South America, although not in the same family, are cocoa/chocolate and coca.

Which all makes me think that life in Europe must have been pretty grim until they started importing these plants/products a few hundred years ago.

Europe/the Middle East actually only has one major useful native plant, wheat (and rye, barley and so on), which you need to make beer and pizzas.

The other plant which make life worth living is from Ethiopia (coffee), which is a bit closer to home, but they didn't even work out how to make it until a few hundred years ago.

Posted by

Mark Wadsworth

at

09:37

16

comments

![]()

Labels: Food, Smoking, south america

Market Towns

From the BBC

The places with highest levels of life satisfaction tend to be larger than a small town but smaller than a city.

The happiest places of all, it turns out, are larger rural or market towns.

The government analysis suggests some of the benefits of market town living be "designed into" other communities. Among the official advice to ministers is the delivery of public services in ways which meet people's needs for social contact - fewer call centres, more real people, perhaps - creating thriving high streets and promoting volunteering.

Above all, it seems, the secret of market towns' high well-being levels is their sense of distinct identity, community spirit and perfect size - small enough for people to feel included but large enough to remain private.

To which the simple answer to all of that is: correlation is not the same as causation.

If you went back 30 or 40 years, market towns were often poorer than the big town nearby. People left them and crappy jobs to go and work in modern jobs in towns. In the early part of the 20th century, those that lacked a railway line were often very poor.

Then around the late 70s/early 80s, cars started getting cheap and reliable enough that many people started buying houses in market towns, at first because they were cheap and then as they improved, because they were often more charming. New facilities like late-opening supermarkets and 24 hour garages meant that people could enjoy the benefits of the big towns while living in a rural setting.

So, that's where the rich often live now. In Ascot rather than Bracknell, in Alderley Edge rather than Manchester, in Warwick rather than Coventry.

Which is why you can't "design" market towns into main towns. Market towns don't have the unemployment problems or crime problems of large cities because the underclass can't get to live there. Someone in a house that loses their job for a long time will move somewhere cheaper.

As for "fewer call centres", what the hell? Call centres exist because they're efficient. Yes, it might not be as nice as walking into an insurance broker's office but people voted with their feet over that and chose the likes of Direct Line.

Posted by

Tim Almond

at

00:58

7

comments

![]()

Labels: FBRIs, government, towns

Friday, 25 October 2013

Private Property/Public Good. Discuss

I have been pondering the private property rights / public good argument, and I need your help.

Overall, a lot of things might be improved if private property rights were respected. For example it would be reasonable for a houswife to take action against a nearby power station operator if his plant produced contaminants that dirtied her clean washing on the line. His pollution invades her private property and ruins her enjoyment of it, so she could reasonably request that he be made to cease and desist. This would apply whether she was an owner or a tenant.

But, in lots of cases the State pushes something through against local wishes on the basis of the 'public good', which is straightforward denial of property rights. So HS2 for example would be a non-starter, even if it were privately financed. In other words private property rights could frustrate the ambitions of a major undertaking by the use of 'ransom strips' by some landowners.

Or would it? If we had universal LVT would it not be the case that once 99% of the land had been acquired for the track the last 1% would have a very high rental value that would exceed what could be earned by any other use than as a railway. The owner would be forced to sell by the unsustainable LVT imprests?

In fact once the route was published all the landowners along the route would have the same LVT rating. In other words LVT evens things out not only in favour of private property but also enables the construction of large national sized undertakings? The attempt to be the owner of the last ransom strip would not occur. I am making the assumption that large undertakings like a railway are a Good Thing - if privately financed.

(In re an earlier posting, in passing I read somewhere recently that the bulk of the cost of nuclear power stations in the UK is regulation....?)

Posted by

Lola

at

15:27

7

comments

![]()

Labels: Public transport

A Brief History Of Mallorca

From The Rough Guide to Mallorca and Menorca:

Southern Mallorca

Most of Southern Mallorca comprises the island's central plain, Es Pla, a fertile tract surrounded to the west by the mountainous Serra de Tramuntana and to the east by the hilly range that shadows the coast, the Serra de Llevant.

... although it may seem like a sleepy backwater, it was Es Pla that pretty much defined Mallorca until the twentieth century: the majority of the island's inhabitants lived here, it produced enough food to meet almost every domestic requirement, and Palma's gentry were reliant on Es Pla estates for their income...

This situation persisted until the 1960s, when the tourist boom stodd everything on its head and the developers simply bypassed Es Pla to focus on the picturesque coves of the east coast.

Inca and around

In medieval times, one of the few ways to escape the clutches of the island's landowners was to practise a craft and then join the appropriate guild. As early as the fifteenth century, Inca had attracted enough shoemakers to be become the centre of a flourishing shoemaking industry - and so it remains today with Camper's HQ and main factory-warehouse firmly ensconced here.

Posted by

Mark Wadsworth

at

09:26

3

comments

![]()

Thursday, 24 October 2013

Muggers would like to know how much is in your wallet

Carol W emailed me this reader's letter from the FT back in May:

Sir, I read with interest the article “Retailers struggle to account for sales” (April 29), which focused on the continuing dilemma of how retailers report online and in store sales.

It is not only investors and analysts who need more transparency, however. Landlords also have a stake in better understanding where sales are transacted. Transparency benefits both landlords and tenants. If online activity is skewing the picture for like-for-like sales it is also impacting the value of rents...

We will get to the answers eventually. In the meantime, landlords could do worse than adopting a common approach in response to evolving new models of retailing. Ultimately, both retailers and landlords have a vested interest in ensuring that, between us, we maintain vibrant and successful retail destinations across the UK.

Ed Jenkins, Head of UK Retail, Real Estate Investments, Standard Life Investments, Edinburgh.

Posted by

Mark Wadsworth

at

09:13

9

comments

![]()

Labels: Rent seeking, Retail

Wednesday, 23 October 2013

Munich

A line from "Highwire" by The Rolling Stones is "Another Munich we just can't afford, we're sending in the 82nd Airborne"

From the context, I assume they are referring to Munich's first claim to notoriety, The Munich Agreement of 1938, which "is widely regarded as a failed act of appeasement toward Germany."

The next claim is the Munich Air Disaster of 1958 in which seven Manchester United players and sixteen other people were killed.

Spielberg directed a film called Munich a few years ago, which is about The Munich Massacre, which was "an attack during the 1972 Summer Olympics in Munich, West Germany on 11 members of the Israeli Olympic team, who were taken hostage and eventually killed, along with a German police officer, by the Palestinian group Black September.

I'm not aware of anything nasty happening there since, but let's keep our fingers crossed.

Tuesday, 22 October 2013

Intergenerational risk and banking...

The Rt Hon John Redwood MP has been busy "considering the house price conundrum", explaining "why we have to live with high house prices", and even lecturing us "let's avoid a battle of the generations". For today's thought experiment, we can conflate all three posts as follows:

For every new buyer suffering from the high price, there is a seller who may be trading down, taking a profit or benefitting from an inheritance, who should have more money to spend. We need to see more housing transactions. They generate income for those involved, and usually lead on to work for builders, decorators, home improvers, furniture suppliers and the like. [The baby bulgers] children ... will come to inherit the wealth their parents have built up. They are already giving them money for deposits on homes.

Background

Let us consider two couples. Couple A are 65 years old, retired, live in a 3 bed house the estate agent values at £100,000 and have paid off their mortgage. Couple B, their son and daughter-in-law, are 30, and working and living with couple A. They've scraped together £10k in savings when the Chancellor Help to Buy comes along. Couple B decide to take the plunge and buy their home from couple A, who will continue to live in it whilst using the £100k to help provide an income in their retirement. Couple B will put £5k down and spend £5k on professional fees and decorating.

Balance sheets before

Couple A

Assets: £100,000 house

Liabilities: None

Couple B

Assets: £10,000

Liabilities: None

Balance sheets after

Couple A

Assets: £100,000 cash

Liabilities: None

Couple B

Assets: £100,000 house

Liabilities: £95,000 mortgage

Income statements before and after

Let us assume the banks are paying 3% per annum interest and lending at 5%. Couple A's income has increased by £3,000 a year. Couple B's income has decreased by £4,450 a year. The banks earnings have increased by £1,550 and that's assuming the £5k spent on fees and decorating just circulates as cash.

What's the overall effect?

Apart from the obvious, Couple A are long sterling and sterling interest rates and sterling, while couple B are short the same trade. Talk about generational conflict! Provided couple B can keep paying couple A, through a banking system creaming off 2% per annum, they can all keep living in their home!!!

What would be a more sensible thing to do?

Drawing up a legally binding mortgage contract, secured on a property, is actually quite simple. In our simple example, all sorts of intergenerational conflict (and care home fees and taxes) could be avoided by Couple A selling to Couple B on a 25 year fixed rate. Of course most transactions aren't kept in the family and UK consumers pay the banking system to intermediate that risk, and when it goes wrong UK taxpayers prop it up.

And the point is?

The September MPC Minutes stated:

Since the spring, and after several years of stasis, activity in the housing market had been picking up and, on the basis of recent indicators, gaining momentum. Although still well below pre-crisis norms, monthly mortgage approvals had increased by almost a third over the past year ... Increased housing market activity had the potential to support dwellings investment and spending on associated services, thereby boosting growth overall. And some rise in prices might provide a modest fillip to consumer spending and investment if, for example, the increase in collateral values helped to relax households’ and small businesses’ credit constraints.

This all gives use some insight into how the establishment thinks. The more debt we all take out against their our houses the better. The more house prices go up, the more equity we will have to borrow against, the more we will spend to keep things ticking and the more of our incomes we can all pay in rent to the bankers. The more intergenerational interest rate risk we can all take on while we're at it.

But I'd be very surprised if the likes of MP's and MPC folk and other members of the governing classes had missed the trick of buying and selling direct to each other. I mean, Peter Mandleson didn't did he?

Posted by

Steven_L

at

16:30

4

comments

![]()

Labels: Banking

Land banking

According to the Local Government Association, the total number of plots of land with residential planning permission is 400,000.

The land bankers (i.e. the large house building companies) bleat that they need to have a couple of years' supply in hand because it is so difficult to get planning permission. At current rates of 100,000 new homes per year that's enough for four years and I do wonder whether they also buy up four years' worth of bricks, timber and pipes.

But in their accounts they tell a different story, from Taylor Woodrow (link below) page 7:

Our landbank is an investment portfolio which is critical to our success and underpins the future performance of our business. We have continued to enhance the quality of our short term landbank by actively managing our portfolio: taking advantage of the attractive opportunities we are currently seeing at this point in the cycle and continuously adding value to our existing landbank.

But land with planning is only part of it. Let's take the top five house builders from here and look at how much land they own on which they hope to get planning permission aka "strategic land".

They publish the following figures in their annual accounts with varying degrees of fine detail:

Barratts

18,536 plots with planning, value £1,047m

11,400 acres strategic land = 59,800 plots, value £1,080m

Sales 13,663

Taylor Wimpey

65,409 plots with planning

Strategic land = 100,340 plots

Total value £2,051m

Sales 10,886

Persimmon

Landbank 68,200 plots, which they say is "6.9 years of output at current levels of supply"

Total value £1,496m

Sales 9,903

Berkeley

25,685 plots with planning, value £861m.

Strategic land = 10,000 plots, value £310m

Sales 3,712

Bellway

17,636 plots with detailed planning,

13,500 plots "in the pipeline" i.e. will get planning very soon.

Long term land holdings 2,800 acres

Total value £853m

Sales 5,226

That means that these five builders have got enough land for 400,000 homes and the total cost/value of that is £7,000 million.

In their last accounts year, they sold 43,390 homes, so overall, that looks like nine years' worth of land to me.

So yes, they are land banking and they make no secret about it in their accounts.

Posted by

Mark Wadsworth

at

09:26

3

comments

![]()

Labels: Construction, Speculation, statistics

Monday, 21 October 2013

Double Bubble

9th October 2013

He said: "I can tell you, first of all, that energy prices doubled under Labour, electricity prices went up by 50 per cent. And let me say this to you - there is one thing governments can't control and that is the international wholesale price of gas.

21st October 2013

David Cameron hailed the nuclear project as "brilliant news" for Britain, calling it a "landmark in our economic growth plan".

But the Government has come under fire for guaranteeing to pay £92.50 per megawatt hour of electricity produced - a so-called "strike price" double the current market rate.

Posted by

Tim Almond

at

21:09

18

comments

![]()

Labels: Electricity, LibLabCon, nuclear

Attractive Adult Woman accuses Dead Adult Man of Trying it On, Breaking No Law

From the Daily Mail:

Amanda Holden has revealed how Jimmy Savile made lewd comments suggesting he wanted to 'give her one' when she was a teenager being treated in hospital.

The TV personality, 42, was just 19 when she met Savile at Leeds General Infirmary while she was being treated for a cut finger.

She told how the shamed Top Of The Pops presenter made a string of 'lame' jokes before offering to give her a gynaecological problem.

Ian B on Tim Worstall's blog comments is convinced that there's a campaign to raise the age of consent to 18, and it's journalists saying "just 19" that's part of that. You push the idea that 19 is a vulnerable age, and well, of course 17 is ridiculous.

But I have to wonder... when did we start infantilising young adults, and why?

When I was a lad, I had a shop job at 15. You now have to have staff CRB checked if you have such a staff member. I was learning to drive at 17, which various groups seem to want to change. We're going to have even more kids at school until they're 18, even though it's a waste of time. No-one took the drinking age too seriously - we certainly didn't have ID card schemes in pubs, which meant that 16 year olds got served.

Fun Online Polls: Harry Potter films & Plebgate

The results to last week's Fun Online Poll, on an unsurprisingly low turnout were as follows:

Which is your favourite Harry Potter film?

Philosopher's Stone 9%

Chamber of Secrets 4%

Prisoner of Azkaban 11%

Goblet of Fire 0%

Order of The Phoenix 0%

Half Blood Prince 0%

Deathly Hallows - Part 1 4%

Deathly Hallows - Part 2 5%

I've never seen any of them 68%

By a slim margin, people liked "Prisoner of Azkaban" best, which also happens to be my favourite, it's the best-made film in terms of conveying the story from the book with a lot of background colour without getting too distracted by sub-plots or random scenes.

It's also interesting that the first three films got the most votes, I suppose people got bored after that apart from a small hard core who saw it through to the bitter end and then liked those best.

---------------------------------------------------

The Plebgate affair drags on, without anybody caring any more:

A transcript of the meeting showed that, while he admitted swearing, Mr Mitchell denied using the word "pleb" or insulting the police.

I'm not sure if it's possibly to swear at somebody without insulting them, I've never got away with it.

But on the basis of no information whatsoever, let's settle the matter with a Trial By Internet.

Vote here or use the widget in the sidebar.

Posted by

Mark Wadsworth

at

08:49

4

comments

![]()

Labels: Andrew Mitchell, Films, Harry Potter, liars, Policing

Saturday, 19 October 2013

"How the railways will tear up rural England"

From The Telegraph, 20 July 1813:

More than 1,000 of Britain’s most important wildlife habitats and dozens of ancient woodlands will be directly affected by the proposals to lay down 8,000 miles of track between England's towns and cities.

Official documents also disclose that tens of thousands of acres of valuable farm land - already scarred beyond recognition with canals and cart tracks - will be lost and more than 1,000 buildings are to be demolished.

Conservationists and other campaigners reacted angrily to the figures, which were buried in a mass of Railway Acts passed without fanfare by Parliament.

They are the fullest assessment of the environmental impact of the newfangled 'steam locomotives'. Until now only the impact of the first railway using these contraptions, from Pen-y-darren ironworks to Abercynon, had been fully detailed.

The railways are backed by both Houses of Parliament, with Lord Liverpool, the Prime Minister, and other senior Cabinet ministers arguing that railways suitable for steam locomotives will transform Britain’s “economic geography”.

Posted by

Mark Wadsworth

at

15:44

7

comments

![]()

Friday, 18 October 2013

Friday Night Gearchanges

Aretha Franklin, "Think" (from the film "The Blue Jasmine Brothers"), up a semi-tone at 1 min 2 seconds and 2 min 4 seconds:

Posted by

Mark Wadsworth

at

18:54

0

comments

![]()

Labels: Music

"Mixed communities"

Let's take another glimpse into the swirling maelstrom of Homey platitudes and identify a few more which cancel each other out.

From some official DCLG research:

... the rationale for mixed communities is that substantial diversification of housing type and tenure, combined with improvements to facilities, services and opportunities will both improve life chances for disadvantaged residents and attract new wealthier residents.

This will lead to a new dynamic including increased land values and a better-functioning housing market, reducing overall concentrations of deprivation.

Lower income residents will benefit from increased resources and social interaction with better-off residents. Neighbourhoods will thus be less reliant on repeated 'regeneration'.

That's the theory (the research goes on to say that there is no actual real life evidence of such results being achieved), and this is one of the reasons/excuses given for flogging off the council housing at undervalue to those who could afford it:

The 'mixed tenure' policy with greatest impact on individuals and neighbourhoods to date has been the Right to Buy, with two million homes sold, against fewer than 100,000 for all the other low cost home ownership initiatives combined.

The Homeys continue to ignore real life evidence that the policy does not achieve its stated aim and they insist that the "mixed community" is a good concept with good outcomes and hence justification for flogging off council houses. Quite how we jumped from "mixed community" to "mixed tenure" is another topic.

Now, in two ever so slightly different contexts, Homeys oppose "mixed communities" with absolute venom:

1. When higher earners, particularly a middle class hate figure like Bob Crow, continue to rent a council house

They are, allegedly, stealing from the taxpayer, depriving low earners of affordable housing etc.

But surely they are is still making that council estate more "mixed" by living there, which is A Good Thing, isn't it? Serving as a positive role model and all that?

Why is it that on Planet Homey, if higher earners bought their council houses and are now living there rent-free, i.e. contributing less back to the taxpayer, then they are not stealing from the taxpayer, they are not depriving a low earner of affordable housing - and they are serving as positive role models as a bonus - but not if they are still renting?

2. When it comes to new construction

The "mixed community" model says that in an area, there should be affordable rented housing for low earners (i.e. council housing) and there should be more expensive privately owned housing for middle and high earners to buy.

But if the council says that x% of a new development has to be affordable housing, or, Heaven forfend, the council just gets on with it and builds some social housing near privately owned housing, then the NIMBYs (the radical wing of the Homey movement) scream blue murder. There is no room at our inn, they shriek, there's no need for it, and we don't want chavscum round our way dragging down the neighbourhood and our lovely house prices.

Conclusion

Thus we can safely say that Homeys do not believe in "mixed communities" except when it suits them (i.e. they don') and in any event, on the facts, the policy does not work.

Posted by

Mark Wadsworth

at

16:16

4

comments

![]()

Labels: Bob Crow, Home-Owner-Ism, Social housing

"Land rents don't exist"

The strange thing is that it is not just the Homeys and Faux Libs who deny that land rents exist, the Commies do it as well.

From the comments in a leftie blog:

Marx is not so much deploying the Smith/Ricardo LVT as criticizing it: abstract average socially necessary labor time is not so much embodied in commodities as extracted/abstracted from them through the system of market exchanges.

But at the same time, surplus-value is generated from the hiring of commodity-labor at "fair" wages, as determined by reproduction costs, and it is the need to reproduce surplus-value to maintain the valorization of capital stocks that is the key dynamic driver of the whole system.

At the same time, neither natural resources lying in the ground, nor capital goods can accrue any value unless activated by labor processes. (Land rents don't exist except within some system of production that deploys labor and capital).

Splendid state of denial there!

Wages are a very high share of any business' total income, usually about four-fifths, the rest is return on capital used in the business, first-mover profits etc. For sure, you can argue that some people are underpaid, no doubt they are, but other people are overpaid, exploiting their own monopoly power etc. There is no such share with land rents - all land rents go to the owner.

It strikes me as pretty hard to envisage a "system of production" that doesn't "deploy labour and capital". That's what "production" is, it's the deployment of labour and capital, and with a bit of luck, the value of the outputs is more than the cost/value of the inputs.

(Even if it is value-detroying, it is still "production" i.e. British Leyland were "producing" cars right up to the bitter end.)

And as soon as you have a system of production, you have land rents.

Whether that system of production is hunter-gathering or sitting in a swanky city centre office making important sounding phone calls and shoving paper round, it all requires land, so that land has value and that value is rent.

Posted by

Mark Wadsworth

at

14:15

9

comments

![]()

Sucker Bets

I'm a bit of a math geek, and especially a probability geek, so this sort of story interests me:-

I was going to say that nothing is left to chance. But chance is now contemplated, considered and factored. You might be aware of Peter Edwards of Denbighshire, who proudly watched his grandson, Harry Wilson, come on to play for Wales against Belgium in the 87th minute on Tuesday night, thereby winning Edwards £125,000 on the £50 bet he placed when Harry was 18 months old. Finely romantic; old-fashioned, almost. But there are other, increasingly popular parental bets that are more calculating, principally betting on children to do well at A-levels or university.

Graham Sharpe, of William Hill, who paid out on Wilson, says it is now taking around a dozen or so bets like these every week. Ladbrokes says hundreds of parents have bet with it. Algorithms are involved. Odds, for example, on a student with three Bs at A-level getting a first in media studies at Leeds University are 5-1. Be warned, though: Sharpe will want to know some history, following the first bet he ever took, when the boy's headmaster rang up the next day and asked if could put a bet on, too.

I could understand placing a couple of quid on a grandson. Something where the bet is a bit of fun to have with your son. But £50?

Let's break it down: the population of Wales is 3m. So, 1.5m of those are boys. Of those, you'll get maybe 10 new players in a squad each year. So, over the possible playing career, say 150 people will get picked. So, the realistic odds are 10,000/1, and he got 2,500/1. It's already a bad bet, if you're doing it for money. The bookie is already taking 75% of that money. Plus, he tied up £50 for over a decade.

But it gets worse when you consider how many Englishmen who aren't good enough to play for England will fly the daffodil of convenience when it suits them so they can play international football.

"Betting on your kids degree" is even worse. If someone's got to look at your kids A-level results, that actuarial work is going to get factored into the bookie's costs, and therefore your odds.

You really can't beat the bookies. They work out the risk, then factor a margin on for costs and profit. The sports pundit Angus Loughran, aka Statto was declared bankrupt a few years ago, owing debts to a bookie. And he knew far more than most of the population about football betting.

Posted by

Tim Almond

at

11:38

3

comments

![]()

Labels: betting, Football, university, Wales

Global warming vs Global cooling

I watch a lot of documentaries on the telly about all sorts of things in an eclectic/dilletantish, history, archaeology, science, architecture, engineering, religion, statistics, natural disasters, geology etc, and of course I always look for patterns in these things.

(It's what they say inadvertently which is the most interesting, so programmes about economics ignore land values completely, but in the programmes about new transport infrastructure they always mention increases in land values.)

It is also the rule nowadays that wherever possible, a documentary has to mention "climate change" and they usually sneak it in towards the end, saying "Well, this is a lovely coral reef but it won't be hear any more in a few years because the ocean is become more acidic because of man-made climate change" or some such guff (the oceans are becoming less alkaline and not more acidic, for example).

Now, we all know that since the dawn of mankind, there have been temperature fluctuations of quite a few degrees up and down.

We were actually quite well established during the last Ice Age (which ended on 19 July about 10,000 years ago).

For example, the North Sea was so shallow that the bit between Great Britain and the Netherlands was actually dry land and people lived there quite happily. Once things warmed up and the ice started melting, the North Sea filled up quite quickly again and they all scarpered and set up camp somewhere else. Others took the opportunity to head up to Siberia and cross over into Alaska.

The periods when temperatures fell abruptly are primarily after large volcano eruptions (or that meteor which hit the Gulf of Mexico) because of all the dust in the atmosphere blocking the sun, but the cause is not so important. And it is in these sudden cold periods that everything goes horribly wrong, crops fail, diseases spread, lots of people die etc. Or there are mass extinctions after extreme events.

To sum up, humans are quite good at adapting to quite sudden rises in temperature, this has always been the case and there's no reason to assume that this won't hold in future. But we are rubbish at adapting to sudden falls in temperature.

Ergo, even if the Warmenist predictions are correct (and they aren't), then this is not really a problem, what we ought to be more wary of and be working out contingency plans for are sudden falls in temperature.

Just sayin', is all.

Posted by

Mark Wadsworth

at

10:56

3

comments

![]()

Labels: Global cooling, global warming

Thursday, 17 October 2013

"British Gas urges customers to ditch David Cameron after he hikes taxes by more than 10%"

From The Evening Standard:

Struggling London families were dealt a huge blow two years ago when the Conservative-led government increased taxes on output and employment by 10.6 per cent.

The bombshell from Britain's biggest government reduced disposable incomes of an average household by nearly £1,000 and sent their annual total tax bill spiralling to a record £20,000 a year...

The VAT and National Insurance rises, which came into force in 2010, did not trigger a storm of protest and consumer groups did not accuse the Liberal-Conservative coalition of delivering a "big, nasty" shock to taxpayers that will force thousands to make a "heat or eat" choice over the winter.

British Gas chairman Sir Roger Carr today said the tax rises were "disappointing" and urged people to try to save money by switching governments.

Shadow energy secretary Caroline Flint said: "People are too feeble to stand up to the government. Britain's tax and welfare system is not working for ordinary families and businesses.

"Heck knows how we keep getting away with it."

Posted by

Mark Wadsworth

at

22:17

8

comments

![]()

Labels: British Gas, Caroline Flint, David Cameron MP, Taxation

The Fifth Estate Element

From imdb.com and imdb.com:

In the twenty-third century, the universe is threatened by evil. The only hope for mankind is WikiLeaks founder Julian Assange (Benedict Cumberbatch) and his colleague Daniel Domscheit-Berg (Daniel Brühl), who come to Earth every five thousand years to become underground watchdogs of the privileged and powerful

On a shoestring, they create a platform with the four elements: Fire, Water, Earth and Air. Their Mondoshawan spacecraft allows whistle-blowers to anonymously leak covert data, shining a light on the dark recesses of government secrets and corporate crimes

Soon, they are breaking more hard news than the world's most legendary media organizations combined but they are destroyed by the evil Mangalores.

However, a team of scientists use the DNA of their remains to gain access to the biggest trove of confidential intelligence documents in U.S. history and to rebuild the perfect being called Leeloo (Milla Jovovich). She escapes from the laboratory and stumbles upon the taxi driver and former elite commando major Korben Dallas (Bruce Willis).

They end up battling each other and a defining question of our time: what are the costs of keeping secrets in a free society and what are the costs of retrieving the stones?

Posted by

Mark Wadsworth

at

14:25

0

comments

![]()

Labels: Films

I blame the parents.

As a general principle, I'm all in favour of the "free schools" idea, vouchers for education and so on. It's all experimentation and some experiments will fail, but without experimentation, you'll never find out what works and what doesn't.

A common objection or misgiving, which I share, is that the Islamists will hijack the scheme and set up taxpayer-funded madrassas. Well of course they will, these people have no shame and we now have an interesting live example of exactly this happening.

The Statists of course use this as a Killer Argument Against the whole system, i.e. throwing the Christian baby out with the Islamist bathwater.

Speaking in Parliament earlier, shadow education secretary Tristram Hunt said the Ofsted report was a "devastating blow to the education secretary's flagship policy".

He said: "It reveals that pupils have been failed on every possible measure and parents will want to know why the education secretary has allowed this to happen."

He described the government's free school programme as a "dangerous free-for-all".

Surely it's not too difficult to simply refuse them a licence or funding in the first place? I mean, we, the Great British taxpayers, will never all exactly agree on what constitutes a "school" and what doesn't, there are legitimate differences of opinion but only a small minority would consider that Islamist shit hole to be a "school" in any meaningful sense of the word.

But really, my final point/question is this: there is clearly demand for places at such schools, but what sort of fuckwit parent wants to send their children to a school like this in the first place? Do they hate their children that much? It's absolutely beyond me.

Posted by

Mark Wadsworth

at

13:03

23

comments

![]()

Well, duh!

From the day before yesterday's Metro:

It's pouring with rain and we're all huddled together in the shelter when somebody despite the sign, lights up and fills our throats and noses with smoke. Why? Dot.

From today's Metro:

Dot, surely everyone knows that lighting a cigarette at a stop makes the bus arrive much faster? Archie.

I think he meant "sooner" rather than "faster" but his point stands.

Posted by

Mark Wadsworth

at

09:58

0

comments

![]()

Labels: Logic, Public transport, Smoking

Wednesday, 16 October 2013

Home-Owner-Ists merrily jumbling legal and economic concepts

They'll pick and choose whatever suits them:

People who rent out their council homes to make money could be locked up for two years under new laws which come into force today. For the first time, sub-letting a council property is now a criminal offence with fraudsters also facing hefty fines.

OK, council and Housing Association tenancy agreements say that you are not allowed to sub-let; but so do most private tenancy agreements.

A private tenant has little incentive to sub-let because there's no money in it. If you are paying market rent and sub-let for market rent, there's no profit in it and a lot of hassle for you. Clearly, if a private tenant sub-lets, that is a civil offence and the landlord can terminate the agreement and evict the original tenant.

The Homeys then decide that council tenancies are a special case, and say that sub-letting is a criminal offence, which is a purely legal concept as there is no real crime involved, but hey, their gaff, their rules. The reason social tenants like sub-letting is because they can pocket the difference between the low social rent (about £80 a week) and the private rent (about £160 a week on average across the UK, call it £250 a week in London).

But the naughty social tenant's £170 a week (£9,000 a year) pure profit is no actual or legal cost to the taxpayer, he is getting the £80 a week official rent whatever happens, it is purely an economic or notional cost, i.e. in economic terms, you can view the £170 as a notional loss to the taxpayer of the rent he could be collecting.

Ministers are clamping down on the practice after discovering it costs the taxpayer £1.8 billion a year and clogs up desperately needed social housing.

When they say "it costs the taxpayer £1.8 billion a year", this is purely a notional cost, i.e. let's say that five percent of social housing is sub-let = 200,000 units @ £9,000 = £1.8 billion.

That notional cost is the same whether sub-letting is legal or illegal, it makes no difference. Notional costs are an economic concept, not a legal one.

But seeing as we have merrily segued from legal to economic concepts, what is the cost to the taxpayer of all the social housing which Thatcher and Blair sold off for cheap over the last thirty years? Average private rents across the UK are £160 a week and the taxpayer is losing all of that = £8,000 a year.

That's 1.5 million units @ £8,000 = £12 billion a year.

Hmmm, what's the larger cost to the taxpayer - £3.6 billion or £12 billion?

"Ah, but..." squeal the Homeys, "If you bought your council house, albeit at a huge discount, then it's yours to do with as you please. If people rent out their old ex-council house, that's not a cost to the taxpayer."

It's not necessarily an actual cost, no - but neither is [illegal] sub-letting of council housing, we established that.

But of course it is still a notional cost, and one four or five times as large.

-----------------------------------------------

For a rich seam of Homey DoubleThink, I refer you to Bill Quango's post.

He makes the perfectly sensible point that the majority of the council houses which were sold off are still occupied by the family had always lived there and then bought it. Seeing as they would have stayed in the house either way, that sale has no net effect on availability of social housing.

Fair enough.

But then he merrily throws in a classic bit of Home-Owner-Ism:

The idea was not to give tenants a house and then build another one for some else. It was to remove people from state dependency for their property and, as a bonus, turn socialists into capitalists through asset transfers.

We've heard this crap so many times that many people actually believe it, but it crumbles apart under closer scrutiny.

How on earth does making people pay some rent every week, even if it only £80 mean "state dependency"? Why does it make them less dependent if you effectively give them that house for free?

In my simple world view, if the state gives people stuff for free then that is truly "state dependency". If the state charges market rates, or at least some sort of contribution towards costs, like social rents, prescription charges, or charging for dentists, then those people are forced to be a little more self-reliant i.e. less dependent on the state than people who get things for free.

Our successful right-to-buyer is in the happy position of paying no rent, having paid off the laughably small mortgage years ago. So he has to be slightly less self-reliant than the tenant next door who is paying £80 a week which at least covers the costs and maintenance etc.